Interest on Underpayment of Estimated Tax by 2023-2026

What is the Interest On Underpayment Of Estimated Tax

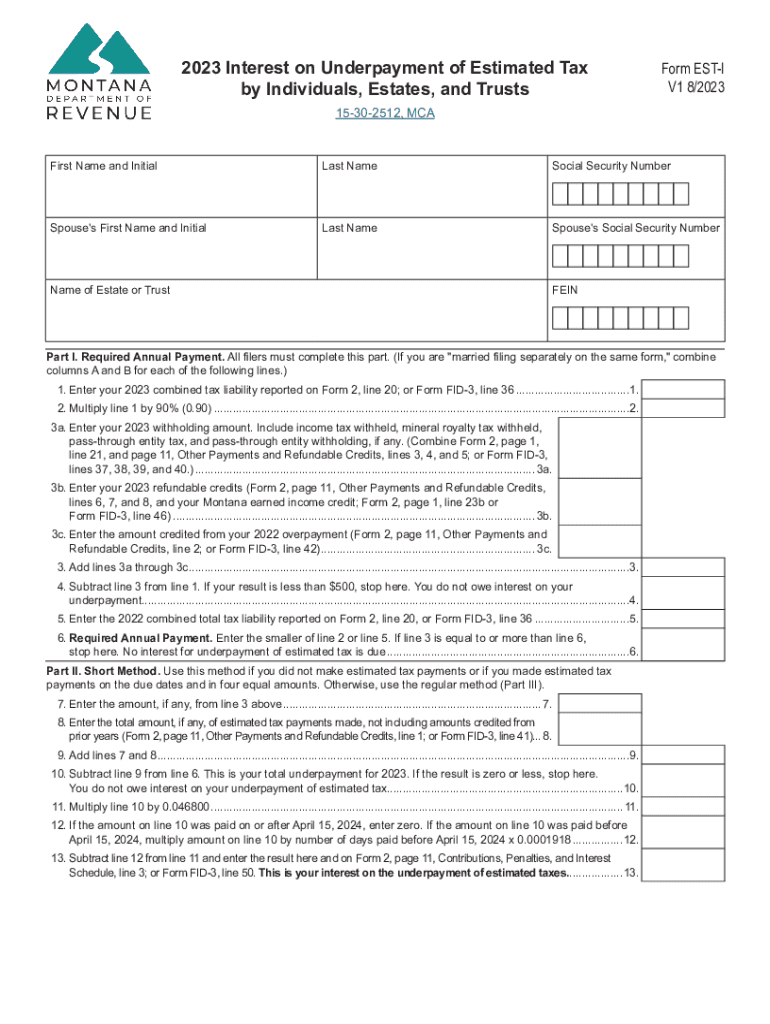

The Interest On Underpayment Of Estimated Tax refers to the interest charged by the Internal Revenue Service (IRS) when taxpayers do not pay enough tax throughout the year. This situation typically arises when individuals or businesses fail to make estimated tax payments or do not withhold enough from their income. The IRS calculates this interest based on the amount owed and the duration of the underpayment. Understanding this interest is crucial for taxpayers to avoid unexpected financial burdens and penalties.

How to use the Interest On Underpayment Of Estimated Tax

To effectively manage the Interest On Underpayment Of Estimated Tax, taxpayers should first determine if they owe any underpayment interest. This involves reviewing their estimated tax payments and comparing them to their total tax liability for the year. If there is a shortfall, taxpayers can calculate the interest owed using IRS guidelines. It's advisable to keep accurate records of all payments and consult IRS publications for specific calculations to ensure compliance.

IRS Guidelines

The IRS provides specific guidelines regarding the Interest On Underpayment Of Estimated Tax. Taxpayers should refer to IRS Publication 505, which outlines the rules for estimated taxes, including how to calculate underpayment interest. The IRS updates interest rates quarterly, which can affect the total amount owed. Staying informed about these guidelines helps taxpayers understand their obligations and avoid penalties.

Filing Deadlines / Important Dates

Filing deadlines for estimated tax payments are crucial for avoiding the Interest On Underpayment Of Estimated Tax. Generally, individuals must make estimated payments quarterly, with specific due dates typically falling on the fifteenth of April, June, September, and January of the following year. Missing these deadlines can result in interest charges and penalties, making it essential for taxpayers to mark their calendars and plan accordingly.

Penalties for Non-Compliance

Failure to comply with estimated tax payment requirements can lead to significant penalties. The IRS imposes penalties based on the amount of underpayment and the length of time the payment is overdue. Additionally, interest accrues on any unpaid amounts, compounding the financial impact. Taxpayers should be aware of these penalties to avoid unexpected costs and ensure they meet their tax obligations.

Eligibility Criteria

Eligibility for avoiding the Interest On Underpayment Of Estimated Tax generally depends on a taxpayer's total tax liability and the amount of tax withheld or paid throughout the year. Individuals who expect to owe less than one thousand dollars in tax after subtracting withholding and refundable credits may not need to make estimated payments. Understanding these criteria helps taxpayers assess their situation and determine their payment obligations.

Quick guide on how to complete interest on underpayment of estimated taxby

Effortlessly prepare Interest On Underpayment Of Estimated Tax By on any device

Managing documents online has gained traction among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed forms, as you can access the appropriate template and securely save it online. airSlate SignNow equips you with all the necessary tools to create, edit, and electronically sign your documents swiftly and without interruptions. Manage Interest On Underpayment Of Estimated Tax By on any platform with the airSlate SignNow applications for Android or iOS, and enhance any document-centric process today.

How to edit and electronically sign Interest On Underpayment Of Estimated Tax By effortlessly

- Obtain Interest On Underpayment Of Estimated Tax By and click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize important sections of the documents or mask sensitive information using the tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click the Done button to preserve your modifications.

- Select your preferred method of delivering your form, whether by email, SMS, invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you choose. Edit and electronically sign Interest On Underpayment Of Estimated Tax By and ensure superior communication at every stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct interest on underpayment of estimated taxby

Create this form in 5 minutes!

How to create an eSignature for the interest on underpayment of estimated taxby

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Interest On Underpayment Of Estimated Tax By?

Interest On Underpayment Of Estimated Tax By refers to the interest charged on the unpaid estimated tax due to the IRS. Businesses may incur this charge if they do not pay enough estimated tax throughout the year. Understanding this concept can help you avoid additional financial penalties.

-

How can airSlate SignNow help with tax document management related to Interest On Underpayment Of Estimated Tax By?

airSlate SignNow provides a streamlined solution for managing tax-related documents, ensuring that all necessary forms are signed and submitted on time. This can minimize the risk of issues related to Interest On Underpayment Of Estimated Tax By by simplifying the document workflow and keeping everything organized.

-

What pricing plans does airSlate SignNow offer for managing tax documents?

airSlate SignNow offers several pricing plans tailored to businesses of all sizes. Each plan provides access to essential features for managing your tax documents, which can help you stay compliant and avoid issues like Interest On Underpayment Of Estimated Tax By. Check our website for detailed pricing and features.

-

Can I integrate airSlate SignNow with my existing accounting software?

Yes, airSlate SignNow integrates seamlessly with various accounting and financial software solutions. This integration can help you manage your tax documents more efficiently, ultimately reducing risks associated with Interest On Underpayment Of Estimated Tax By. Syncing data helps ensure that all tax-related information is up to date.

-

What are the benefits of using airSlate SignNow for eSigning tax documents?

Using airSlate SignNow for eSigning tax documents offers numerous benefits, such as faster processing times, secure document storage, and legally binding signatures. These advantages can reduce your exposure to Interest On Underpayment Of Estimated Tax By, as timely document handling is crucial for tax compliance.

-

Is airSlate SignNow user-friendly for individuals unfamiliar with eSigning?

Absolutely! airSlate SignNow is designed with user experience in mind, making it accessible for individuals who may not be familiar with eSigning. This ease of use can be especially beneficial for those managing financial documents related to Interest On Underpayment Of Estimated Tax By.

-

How secure is airSlate SignNow for sensitive tax documents?

airSlate SignNow employs top-tier security measures to protect your sensitive tax documents, including encryption and secure access controls. This level of security is essential for avoiding complications like Interest On Underpayment Of Estimated Tax By. You can trust us to keep your documents safe.

Get more for Interest On Underpayment Of Estimated Tax By

Find out other Interest On Underpayment Of Estimated Tax By

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors