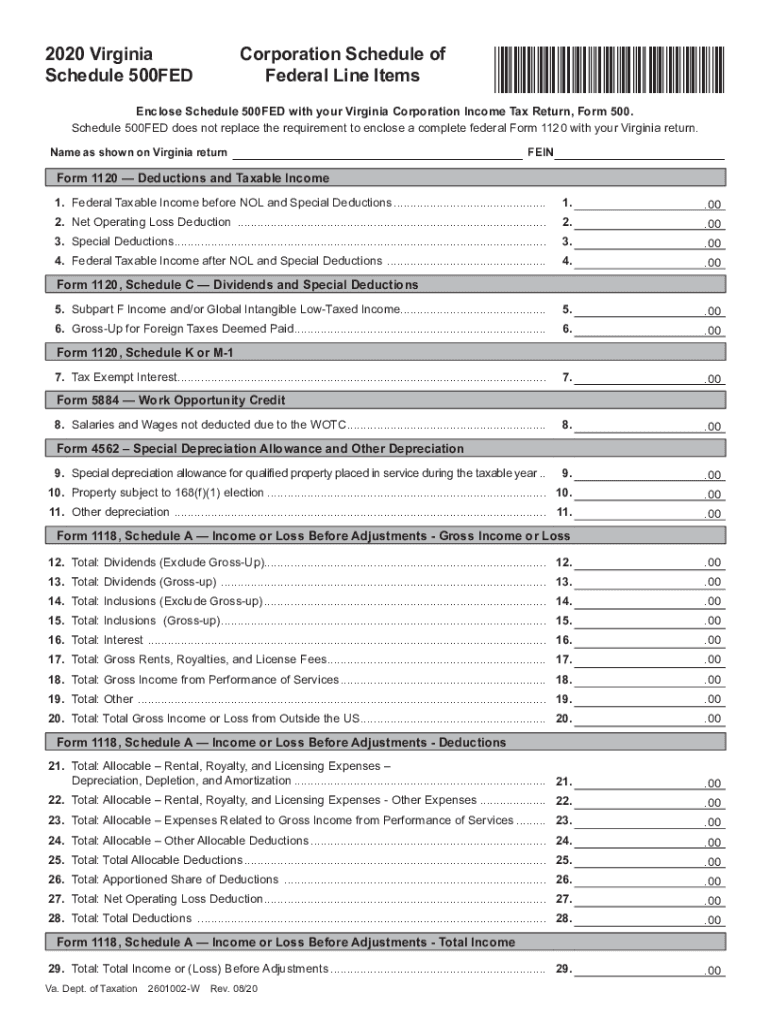

Corporation Schedule of Federal Line Items Virginia Tax 2020

What is the Corporation Schedule of Federal Line Items Virginia Tax

The Corporation Schedule of Federal Line Items is a crucial document for businesses operating in Virginia. This schedule is designed to report specific federal tax items that affect the calculation of Virginia corporate income tax. It includes details about federal taxable income, deductions, and credits that must be accurately reported to ensure compliance with state tax regulations. Understanding this form is essential for corporations to maintain transparency and fulfill their tax obligations.

Steps to Complete the Corporation Schedule of Federal Line Items Virginia Tax

Completing the Corporation Schedule of Federal Line Items involves several key steps:

- Gather necessary financial documents, including federal tax returns and supporting schedules.

- Identify the federal line items relevant to your corporation's income and deductions.

- Accurately transfer the amounts from your federal return to the corresponding lines on the Virginia schedule.

- Ensure all calculations are correct and that any applicable credits are included.

- Review the completed schedule for accuracy before submission.

Filing Deadlines / Important Dates

Corporations must be aware of specific deadlines to avoid penalties. The Corporation Schedule of Federal Line Items is typically due on the fifteenth day of the fourth month following the end of the corporation's fiscal year. For corporations operating on a calendar year, this means the due date is April 15. It is essential to stay informed about any changes to these deadlines, as they can vary based on state regulations or federal tax law updates.

Required Documents

To successfully complete the Corporation Schedule of Federal Line Items, certain documents are necessary:

- Federal corporate tax return (Form 1120 or 1120-S).

- Supporting schedules and statements related to income and deductions.

- Any applicable documentation for tax credits claimed.

- Prior year tax returns for reference, if needed.

Form Submission Methods (Online / Mail / In-Person)

Corporations have several options for submitting the Corporation Schedule of Federal Line Items. The form can be filed electronically through the Virginia Department of Taxation’s online portal, which is a convenient method that allows for faster processing. Alternatively, businesses may choose to mail the completed form to the appropriate tax office. In-person submissions are also accepted at designated tax offices, providing flexibility for corporations based on their preferences.

Penalties for Non-Compliance

Failure to comply with the filing requirements for the Corporation Schedule of Federal Line Items can result in significant penalties. These may include late filing fees, interest on unpaid taxes, and potential audits. It is crucial for corporations to adhere to all deadlines and ensure that the information reported is accurate to avoid these repercussions. Understanding the implications of non-compliance can help businesses maintain good standing with state tax authorities.

Quick guide on how to complete corporation schedule of federal line items virginia tax

Prepare Corporation Schedule Of Federal Line Items Virginia Tax effortlessly on any device

Online document management has gained signNow traction among organizations and individuals alike. It serves as an ideal environmentally friendly substitute for conventional printed and signed documentation, enabling you to easily locate the right form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents quickly without delays. Manage Corporation Schedule Of Federal Line Items Virginia Tax on any device using the airSlate SignNow apps for Android or iOS, and streamline any document-related process today.

How to modify and electronically sign Corporation Schedule Of Federal Line Items Virginia Tax with ease

- Obtain Corporation Schedule Of Federal Line Items Virginia Tax and then click Get Form to commence.

- Utilize the tools we provide to complete your document.

- Emphasize pertinent sections of your files or redact sensitive information using tools that airSlate SignNow offers specifically for this purpose.

- Generate your electronic signature with the Sign feature, which takes mere seconds and holds the same legal validity as a standard ink signature.

- Review all the details and then click the Done button to save your changes.

- Choose your preferred method of sending your form, whether by email, SMS, invitation link, or download it to your computer.

Put aside concerns about lost or misplaced files, tedious document searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your choice. Modify and electronically sign Corporation Schedule Of Federal Line Items Virginia Tax and ensure seamless communication at any point in your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct corporation schedule of federal line items virginia tax

Create this form in 5 minutes!

How to create an eSignature for the corporation schedule of federal line items virginia tax

The way to make an eSignature for your PDF file in the online mode

The way to make an eSignature for your PDF file in Chrome

The way to make an eSignature for putting it on PDFs in Gmail

How to make an electronic signature straight from your smartphone

The way to make an electronic signature for a PDF file on iOS devices

How to make an electronic signature for a PDF document on Android

People also ask

-

What are the basic requirements for completing the virginia form 500 instructions 2020?

To effectively complete the virginia form 500 instructions 2020, you need to gather your income and deduction information, including W-2s and 1099s. Make sure you have all supporting documentation ready to ensure accuracy. This will streamline the process, minimizing errors and discrepancies in your return.

-

How can I file using the virginia form 500 instructions 2020?

You can file your return using the virginia form 500 instructions 2020 either electronically or by mail. Utilizing e-filing can speed up the processing time and is generally more secure. Many software options can assist with electronic filing, making the process easier and efficient.

-

Are there any penalties for late submission of the virginia form 500 instructions 2020?

Yes, if you fail to submit your virginia form 500 instructions 2020 by the due date, you may incur penalties and interest on any unpaid taxes. It’s important to review the submission deadlines carefully to avoid these extra costs. To reduce your risk, consider filing for an extension if needed.

-

What are the benefits of using airSlate SignNow for my virginia form 500 instructions 2020?

Using airSlate SignNow for your virginia form 500 instructions 2020 gives you an efficient platform to eSign and send documents securely. It streamlines the process, reduces paper usage, and saves time. Additionally, the service provides an easy-to-navigate interface suitable for all users.

-

Can airSlate SignNow integrate with other financial software I use for the virginia form 500 instructions 2020?

Yes, airSlate SignNow offers integrations with various accounting and tax software, enhancing your workflow for the virginia form 500 instructions 2020. This allows you to sync data, automate repetitive tasks, and maintain consistency across your documents. Check the compatibility of your software to maximize efficiency.

-

What pricing plans are available for airSlate SignNow when handling the virginia form 500 instructions 2020?

airSlate SignNow offers several pricing plans that cater to different business needs when managing the virginia form 500 instructions 2020. You can choose from individual, business, or enterprise plans depending on your document volume and required features. Each plan provides scalable options for sending and eSigning documents.

-

Is customer support available for questions about the virginia form 500 instructions 2020?

Yes, airSlate SignNow provides comprehensive customer support for users needing assistance with their virginia form 500 instructions 2020. You can access help through live chat, email, or phone, ensuring you can resolve any questions or issues quickly. The support team is knowledgeable about tax document processes.

Get more for Corporation Schedule Of Federal Line Items Virginia Tax

- A series parallel xml multisignature scheme for xml data ijcsns form

- Certification of appointment to a michigan training hospital medicine form

- Internship training affidavit michigan form

- Form csclcd 754 download fillable pdf or fill online

- Final physical therapy form 3 2017 legal revisions final physical therapy form 3 2017 legal revisions

- Fill free fillable nclex score transfer request bureau form

- 1000 hour supervision evaluation form

- Dog amp cat import form aqs 279

Find out other Corporation Schedule Of Federal Line Items Virginia Tax

- eSign Delaware Termination of Employment Worksheet Safe

- Can I eSign New Jersey Job Description Form

- Can I eSign Hawaii Reference Checking Form

- Help Me With eSign Hawaii Acknowledgement Letter

- eSign Rhode Island Deed of Indemnity Template Secure

- eSign Illinois Car Lease Agreement Template Fast

- eSign Delaware Retainer Agreement Template Later

- eSign Arkansas Attorney Approval Simple

- eSign Maine Car Lease Agreement Template Later

- eSign Oregon Limited Power of Attorney Secure

- How Can I eSign Arizona Assignment of Shares

- How To eSign Hawaii Unlimited Power of Attorney

- How To eSign Louisiana Unlimited Power of Attorney

- eSign Oklahoma Unlimited Power of Attorney Now

- How To eSign Oregon Unlimited Power of Attorney

- eSign Hawaii Retainer for Attorney Easy

- How To eSign Texas Retainer for Attorney

- eSign Hawaii Standstill Agreement Computer

- How Can I eSign Texas Standstill Agreement

- How To eSign Hawaii Lease Renewal