Desktop Virginia Supported Business Forms 2023-2026

Steps to complete the Virginia Form 500

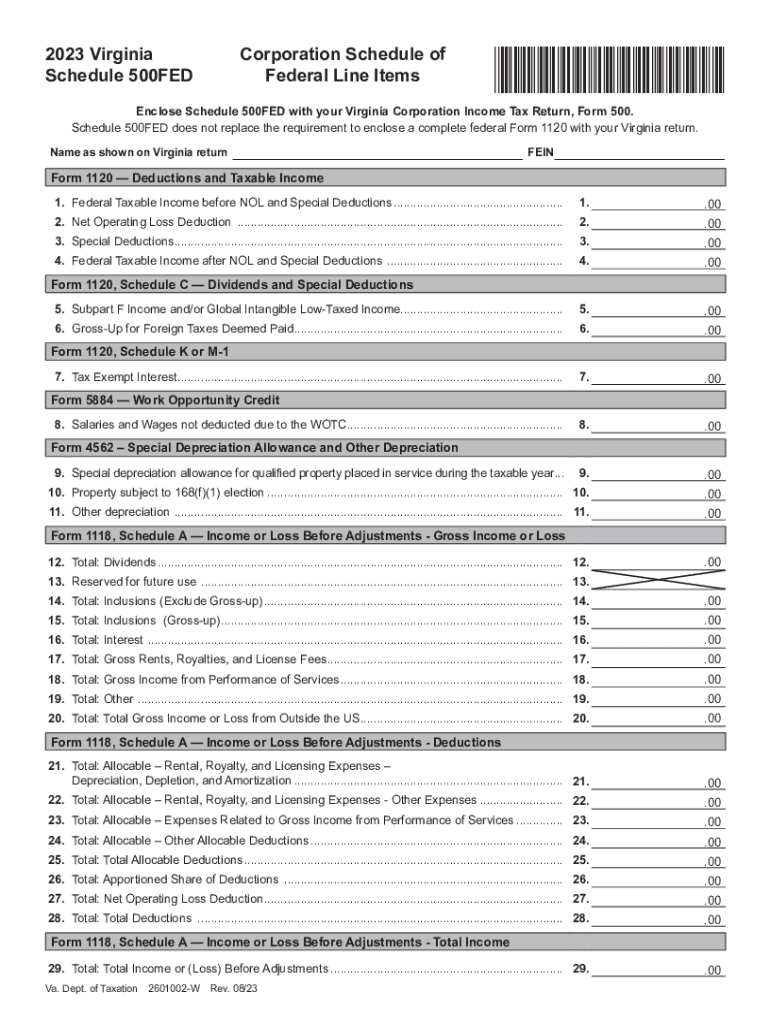

Completing the Virginia Form 500 requires careful attention to detail. Begin by gathering all necessary information, including your identification details, income sources, and any deductions you plan to claim. Ensure you have your Social Security number and any relevant tax documents on hand.

Start filling out the form by entering your personal information in the designated sections. This typically includes your name, address, and filing status. Next, report your total income, which may include wages, interest, and dividends. Be sure to follow the instructions closely to avoid errors.

After entering your income, calculate your deductions. Virginia allows various deductions, so review the guidelines to ensure you claim all eligible amounts. Once you have your total income and deductions, you can calculate your taxable income and the amount of tax owed or refund expected.

Finally, review the completed form for accuracy before submission. Double-check all figures and ensure that all required signatures are included. This will help prevent delays in processing your return.

Filing Deadlines / Important Dates

Understanding the filing deadlines for Virginia Form 500 is crucial for timely submission. Typically, the deadline for filing your Virginia income tax return aligns with the federal tax deadline, which is usually April 15. If this date falls on a weekend or holiday, the deadline may be extended to the next business day.

For those who require additional time, Virginia offers an automatic six-month extension, allowing you to file until October 15. However, it is important to note that this extension applies only to the filing of the return, not the payment of any taxes owed. Ensure any taxes due are paid by the original deadline to avoid penalties and interest.

Required Documents

Before starting the Virginia Form 500, gather all necessary documents to ensure a smooth filing process. Key documents include your W-2 forms from employers, 1099 forms for any freelance or contract work, and records of any other income sources.

Additionally, collect documentation for any deductions you plan to claim, such as receipts for medical expenses, mortgage interest statements, and proof of charitable contributions. Having these documents organized will streamline the completion of your tax return and help prevent errors.

Form Submission Methods

Virginia Form 500 can be submitted through various methods, providing flexibility for taxpayers. The most efficient way to file is electronically through the Virginia Department of Taxation's e-filing system. This method typically results in faster processing times and quicker refunds.

If you prefer to file by mail, ensure you send your completed form to the correct address as specified in the instructions. It is advisable to use a secure mailing method, such as certified mail, to track your submission. In-person filing is also an option at designated tax offices, though this may require an appointment.

Penalties for Non-Compliance

Failure to comply with Virginia tax regulations regarding Form 500 can result in various penalties. If you do not file your return by the deadline, you may incur late filing penalties, which can accumulate over time. Additionally, if you owe taxes and do not pay by the due date, interest will accrue on the unpaid balance.

It is important to be aware of these penalties to avoid unnecessary financial burdens. If you find yourself unable to file on time, consider applying for an extension and ensure that any taxes owed are paid to minimize potential penalties.

Eligibility Criteria

To file Virginia Form 500, you must meet specific eligibility criteria. Generally, this form is intended for residents of Virginia who have earned income during the tax year. This includes individuals who are full-time residents as well as part-time residents who earned income in Virginia.

Additionally, certain exemptions may apply, such as for individuals with low income or those who qualify for specific tax credits. Review the eligibility guidelines closely to determine if you meet the requirements for filing Form 500.

Quick guide on how to complete desktop virginia supported business forms

Complete Desktop Virginia Supported Business Forms effortlessly on any device

Online document management has gained traction among businesses and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed papers, allowing you to access the necessary forms and securely store them online. airSlate SignNow provides all the tools required to create, modify, and electronically sign your documents swiftly without interruptions. Handle Desktop Virginia Supported Business Forms on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

The easiest way to alter and eSign Desktop Virginia Supported Business Forms seamlessly

- Find Desktop Virginia Supported Business Forms and then click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for this task.

- Generate your signature using the Sign feature, which only takes a few seconds and holds the same legal validity as a conventional wet signature.

- Review all the details and then click the Done button to save your changes.

- Select your preferred method to send your form, whether by email, SMS, invitation link, or download it to your computer.

No more concerns about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Edit and eSign Desktop Virginia Supported Business Forms to guarantee excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct desktop virginia supported business forms

Create this form in 5 minutes!

How to create an eSignature for the desktop virginia supported business forms

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the key updates in the Virginia Form 500 instructions 2023?

The Virginia Form 500 instructions 2023 include important clarifications on eligibility criteria, deductions, and filing deadlines. These updates aim to simplify the filing process for business owners. It is crucial to review the latest instructions to ensure compliance and avoid potential penalties.

-

How can airSlate SignNow assist with filing the Virginia Form 500?

airSlate SignNow streamlines the document signing process, making it easier to collect signatures for your Virginia Form 500. By using our solution, you can ensure all necessary documents are signed and submitted on time. This efficiency can greatly reduce the stress associated with tax filing.

-

Is there a cost associated with using airSlate SignNow for Virginia Form 500 instructions 2023?

Yes, airSlate SignNow offers various pricing plans tailored to different business needs. Our cost-effective solution ensures that you have all the tools necessary for compliant and efficient document management, including the Virginia Form 500 instructions 2023. We aim to provide maximum value while minimizing your operational costs.

-

What features does airSlate SignNow offer that are relevant to the Virginia Form 500?

airSlate SignNow offers key features such as document templates, eSignature capabilities, and real-time tracking, which are highly relevant for filing the Virginia Form 500. These tools help simplify the preparation and approval processes. By utilizing our platform, you can ensure your filings are accurate and up to date with the Virginia Form 500 instructions 2023.

-

Can I integrate airSlate SignNow with other software for filing Virginia Form 500?

Yes, airSlate SignNow seamlessly integrates with various accounting and tax software, enhancing your filing process for the Virginia Form 500. These integrations allow for automatic data syncing and improved workflow efficiency. You can manage your documents and eSignatures in one consolidated platform.

-

What benefits does airSlate SignNow bring for managing the Virginia Form 500?

airSlate SignNow offers several benefits for managing the Virginia Form 500, including automation, enhanced security, and compliance tracking. These features help mitigate risks associated with document management. By utilizing our platform, you ensure that your filings are handled professionally, in line with the Virginia Form 500 instructions 2023.

-

How does airSlate SignNow ensure the security of documents related to Virginia Form 500?

airSlate SignNow employs advanced encryption and security protocols to protect your documents related to the Virginia Form 500. Our platform complies with industry standards to ensure confidentiality and integrity throughout the signing process. This peace of mind allows you to focus on your business rather than worry about document security.

Get more for Desktop Virginia Supported Business Forms

- Guidelines for completing the aimg applicant identity verification form

- Ads reference 303mav certifications assurances representations and other statements of the recipient form

- All online pdf forms in numeric order usps about usps

- Pythonanywhere forums got a proxyerrortunnel connection form

- Request for administrative information request for administrative information

- Fillable online uspsps3602 r templatetxt fax email print form

- Mr1394 form

- Common reporting standard crs self cimb bank form

Find out other Desktop Virginia Supported Business Forms

- eSign California Sublease Agreement Template Safe

- How To eSign Colorado Sublease Agreement Template

- How Do I eSign Colorado Sublease Agreement Template

- eSign Florida Sublease Agreement Template Free

- How Do I eSign Hawaii Lodger Agreement Template

- eSign Arkansas Storage Rental Agreement Now

- How Can I eSign Texas Sublease Agreement Template

- eSign Texas Lodger Agreement Template Free

- eSign Utah Lodger Agreement Template Online

- eSign Hawaii Rent to Own Agreement Mobile

- How To eSignature Colorado Postnuptial Agreement Template

- How Do I eSignature Colorado Postnuptial Agreement Template

- Help Me With eSignature Colorado Postnuptial Agreement Template

- eSignature Illinois Postnuptial Agreement Template Easy

- eSignature Kentucky Postnuptial Agreement Template Computer

- How To eSign California Home Loan Application

- How To eSign Florida Home Loan Application

- eSign Hawaii Home Loan Application Free

- How To eSign Hawaii Home Loan Application

- How To eSign New York Home Loan Application