What's New for the Tax Year Marylandtaxes Gov 2022

Understanding VA Form 500

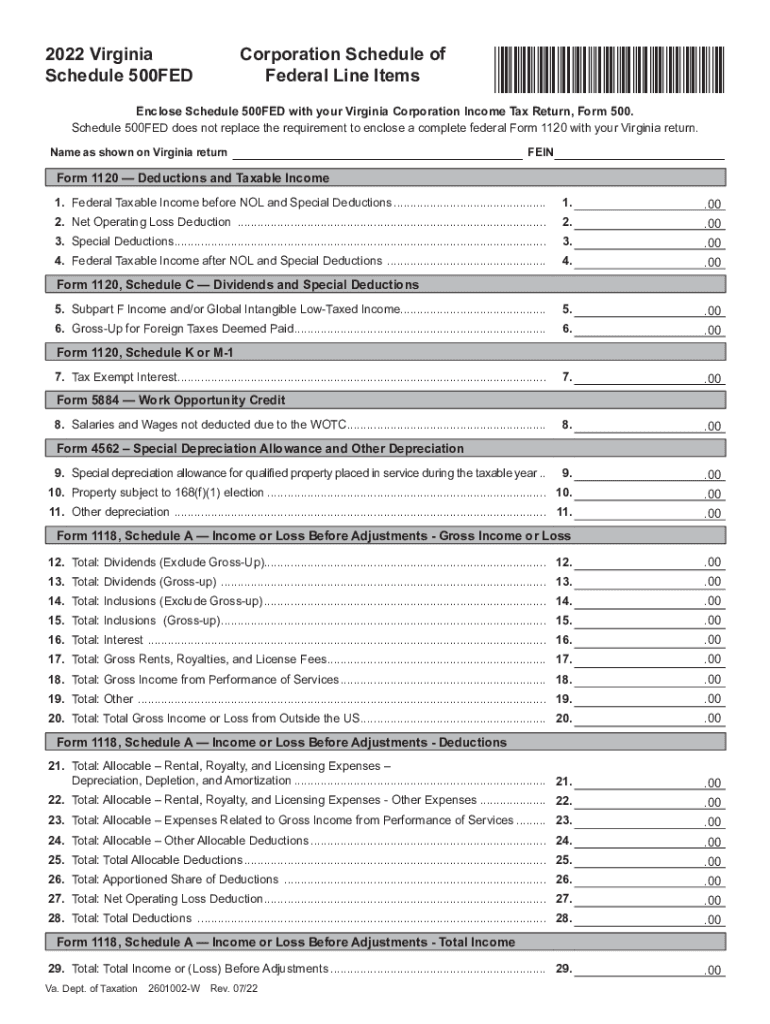

VA Form 500 is a crucial document used by the Virginia Department of Taxation for various tax-related purposes. This form is primarily utilized for filing personal income tax returns in Virginia. It is essential for residents to understand its significance and how to accurately complete it to ensure compliance with state tax regulations. The form collects vital information regarding the taxpayer's income, deductions, and credits, which ultimately determines the tax liability.

Steps to Complete VA Form 500

Completing VA Form 500 involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary documentation, including W-2 forms, 1099s, and any other relevant income statements. Next, fill out your personal information, including your name, address, and Social Security number. Proceed to report your income, making sure to include all sources. After that, calculate your deductions and credits, which can significantly impact your tax liability. Finally, review the completed form for any errors before submitting it to the Virginia Department of Taxation.

Required Documents for VA Form 500

To successfully complete VA Form 500, you will need various documents that provide proof of income and deductions. These include:

- W-2 forms from employers

- 1099 forms for additional income

- Receipts for deductible expenses

- Records of any tax credits claimed

Having these documents ready will streamline the filing process and help ensure that all information reported is accurate.

Filing Deadlines for VA Form 500

It is important to be aware of the filing deadlines for VA Form 500 to avoid penalties. Generally, the form must be submitted by May 1st of each year for the previous tax year. If May 1st falls on a weekend or holiday, the deadline is extended to the next business day. Taxpayers should also consider any extensions that may be available, which can provide additional time for filing.

Legal Use of VA Form 500

VA Form 500 serves as a legally binding document when filed correctly. It is essential for taxpayers to ensure that the information provided is truthful and accurate, as any discrepancies can lead to penalties or audits. The form must be signed by the taxpayer, affirming that the information is complete and correct to the best of their knowledge. Understanding the legal implications of this form is crucial for compliance with Virginia tax laws.

Form Submission Methods for VA Form 500

Taxpayers have several options for submitting VA Form 500. The form can be filed electronically through the Virginia Department of Taxation's online portal, which is often the quickest method. Alternatively, it can be mailed to the appropriate address provided by the department. In-person submissions are also possible at designated tax offices. Each method has its own processing times, so it is advisable to choose the one that best fits your needs.

Quick guide on how to complete whats new for the tax year marylandtaxesgov

Prepare What's New For The Tax Year Marylandtaxes gov effortlessly on any device

Digital document management has gained popularity among organizations and individuals alike. It offers an excellent eco-conscious substitute for traditional printed and signed papers, as you can acquire the correct format and securely store it online. airSlate SignNow equips you with all the necessary tools to generate, modify, and electronically sign your documents rapidly without delays. Work on What's New For The Tax Year Marylandtaxes gov from any device with airSlate SignNow's Android or iOS applications and simplify any document-based task today.

The easiest way to modify and electronically sign What's New For The Tax Year Marylandtaxes gov with ease

- Locate What's New For The Tax Year Marylandtaxes gov and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight important sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes only seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Select your preferred method to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that require printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from a device of your choice. Modify and electronically sign What's New For The Tax Year Marylandtaxes gov and ensure effective communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct whats new for the tax year marylandtaxesgov

Create this form in 5 minutes!

How to create an eSignature for the whats new for the tax year marylandtaxesgov

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the VA Form 500?

The VA Form 500 is a critical document used by veterans for various benefits applications. Understanding how to complete the VA Form 500 accurately is essential for ensuring timely processing of your claims and requests. airSlate SignNow provides a streamlined platform to fill out and eSign the VA Form 500 easily.

-

How can airSlate SignNow help with the VA Form 500?

airSlate SignNow simplifies the process of completing the VA Form 500 by allowing users to sign electronically and securely. With our platform, you can fill out the form from anywhere, ensuring that you meet all necessary requirements. Plus, you can save time by eliminating the need for printing and scanning.

-

Is there a cost associated with using airSlate SignNow for the VA Form 500?

Yes, airSlate SignNow offers affordable pricing plans that cater to different needs. By using our service for the VA Form 500, you can take advantage of cost-effective solutions that save time and effort in managing your documents. Check our website for the most up-to-date pricing information.

-

What features does airSlate SignNow offer for the VA Form 500?

airSlate SignNow provides a range of features for the VA Form 500, including templates, automated workflows, and secure eSignature capabilities. These features ensure that completing the form is not only efficient but also compliant with legal standards. Explore how our platform can enhance your documentation processes.

-

Can I integrate airSlate SignNow with other applications for the VA Form 500?

Yes, airSlate SignNow integrates seamlessly with various applications to help streamline your workflow related to the VA Form 500. Whether you use CRM systems or document storage services, our easy-to-implement integrations enhance your productivity. Check out our integrations page for a full list of compatible applications.

-

Is the eSignature on the VA Form 500 legally binding?

Absolutely! The eSignature provided by airSlate SignNow on the VA Form 500 is legally binding and complies with electronic signature laws. This means you can confidently submit your completed form without worry. Our platform prioritizes security and compliance, ensuring that your electronic signature is valid.

-

How does airSlate SignNow ensure the security of the VA Form 500?

airSlate SignNow takes security seriously, implementing advanced encryption and authentication measures to protect your data while completing the VA Form 500. We ensure that your personal information and submitted documents are secure and accessible only to authorized users. Trust us to keep your information safe throughout the signing process.

Get more for What's New For The Tax Year Marylandtaxes gov

Find out other What's New For The Tax Year Marylandtaxes gov

- Can I eSign Washington Charity LLC Operating Agreement

- eSign Wyoming Charity Living Will Simple

- eSign Florida Construction Memorandum Of Understanding Easy

- eSign Arkansas Doctors LLC Operating Agreement Free

- eSign Hawaii Construction Lease Agreement Mobile

- Help Me With eSign Hawaii Construction LLC Operating Agreement

- eSign Hawaii Construction Work Order Myself

- eSign Delaware Doctors Quitclaim Deed Free

- eSign Colorado Doctors Operating Agreement Computer

- Help Me With eSign Florida Doctors Lease Termination Letter

- eSign Florida Doctors Lease Termination Letter Myself

- eSign Hawaii Doctors Claim Later

- eSign Idaho Construction Arbitration Agreement Easy

- eSign Iowa Construction Quitclaim Deed Now

- How Do I eSign Iowa Construction Quitclaim Deed

- eSign Louisiana Doctors Letter Of Intent Fast

- eSign Maine Doctors Promissory Note Template Easy

- eSign Kentucky Construction Claim Online

- How Can I eSign Maine Construction Quitclaim Deed

- eSign Colorado Education Promissory Note Template Easy