Credits UtahCredits Utah Income TaxesUtah State Tax CommissionCurrent Forms Utah State Tax CommissionCredits Utah

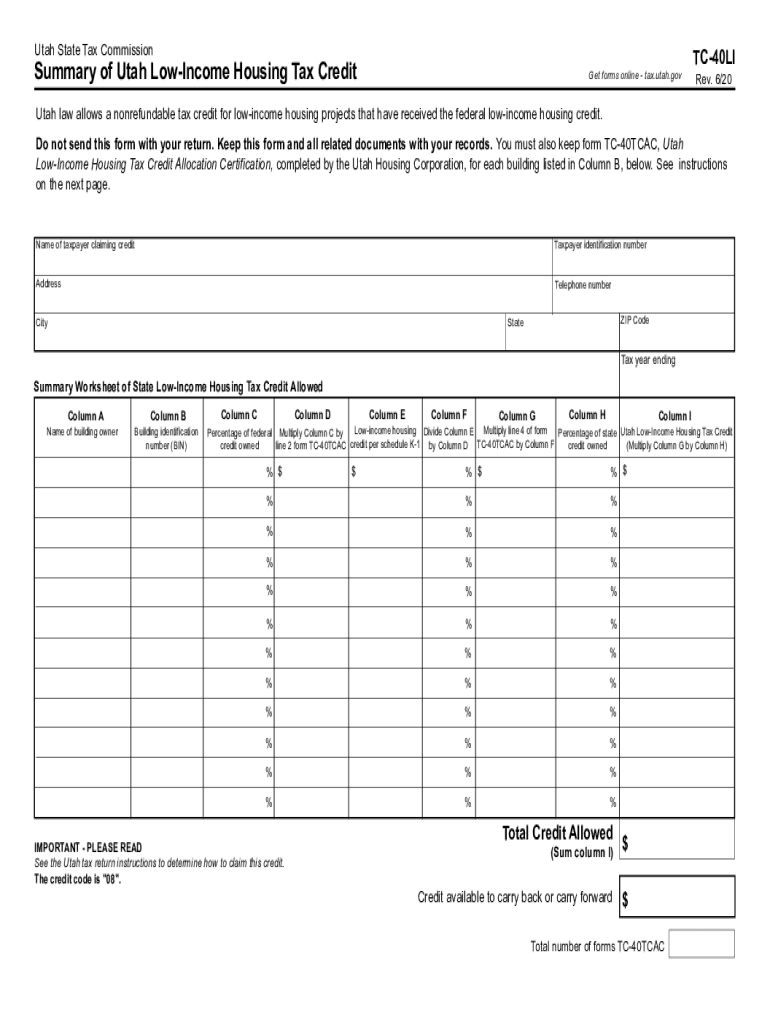

What is the Utah low income housing tax?

The Utah low income housing tax is a program designed to provide financial incentives for the development and rehabilitation of affordable housing in Utah. This tax credit is available to developers who meet specific criteria, allowing them to reduce their state tax liability while contributing to the availability of low-income housing. The program aims to encourage the construction of housing that is accessible to individuals and families with limited income, thereby addressing housing shortages in the state.

Eligibility Criteria for the Utah low income housing tax

To qualify for the Utah low income housing tax, developers must adhere to certain eligibility criteria. These typically include:

- The property must be designated for low-income housing.

- Developers must comply with federal and state regulations regarding affordability.

- Projects must meet specific construction and rehabilitation standards.

- Income limits for tenants must align with state guidelines.

Understanding these criteria is crucial for developers seeking to take advantage of the tax credit and contribute to affordable housing initiatives.

Steps to complete the application for the Utah low income housing tax

Completing the application for the Utah low income housing tax involves several key steps:

- Gather required documentation, including project plans and financial statements.

- Ensure compliance with all eligibility criteria outlined by the Utah State Tax Commission.

- Complete the application form accurately, providing all necessary details about the project.

- Submit the application to the appropriate state department for review.

- Await confirmation and further instructions regarding the approval process.

Following these steps can help streamline the application process and improve the chances of approval.

Required documents for the Utah low income housing tax application

When applying for the Utah low income housing tax, developers must prepare and submit various documents to support their application. These documents may include:

- Detailed project plans and specifications.

- Financial statements demonstrating project viability.

- Evidence of compliance with state and federal housing regulations.

- Tenant income verification forms.

Having these documents ready can facilitate a smoother application process and ensure compliance with all necessary requirements.

Legal use of the Utah low income housing tax

The legal use of the Utah low income housing tax is governed by specific regulations set forth by the Utah State Tax Commission. Developers must ensure that their projects align with these regulations to maintain compliance. This includes adhering to guidelines regarding tenant eligibility, income limits, and the duration of affordability. Failure to comply with these legal requirements can result in penalties or loss of tax credits.

Filing deadlines for the Utah low income housing tax

Filing deadlines for the Utah low income housing tax are critical for developers to keep in mind. Typically, applications must be submitted by a specific date each year to be considered for the upcoming tax year. It is essential to check the Utah State Tax Commission's website or contact their office for the most current deadlines to ensure timely submission and avoid any penalties.

Quick guide on how to complete credits utahcredits utah income taxesutah state tax commissioncurrent forms utah state tax commissioncredits utah

Complete Credits UtahCredits Utah Income TaxesUtah State Tax CommissionCurrent Forms Utah State Tax CommissionCredits Utah effortlessly on any device

Digital document management has gained popularity among enterprises and individuals. It offers an ideal environmentally-friendly substitute for traditional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools needed to create, modify, and eSign your documents swiftly and without delays. Manage Credits UtahCredits Utah Income TaxesUtah State Tax CommissionCurrent Forms Utah State Tax CommissionCredits Utah on any platform using the airSlate SignNow Android or iOS applications and enhance any document-related process today.

The easiest way to amend and eSign Credits UtahCredits Utah Income TaxesUtah State Tax CommissionCurrent Forms Utah State Tax CommissionCredits Utah without hassle

- Find Credits UtahCredits Utah Income TaxesUtah State Tax CommissionCurrent Forms Utah State Tax CommissionCredits Utah and click Get Form to initiate the process.

- Utilize the tools we provide to complete your form.

- Mark important sections of the documents or redact sensitive information using tools that airSlate SignNow offers specifically for this objective.

- Create your signature with the Sign feature, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review the details and click on the Done button to save your modifications.

- Choose how you wish to submit your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate the hassle of lost or misfiled documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Edit and eSign Credits UtahCredits Utah Income TaxesUtah State Tax CommissionCurrent Forms Utah State Tax CommissionCredits Utah and ensure effective communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the credits utahcredits utah income taxesutah state tax commissioncurrent forms utah state tax commissioncredits utah

The way to make an eSignature for your PDF document online

The way to make an eSignature for your PDF document in Google Chrome

The way to make an electronic signature for signing PDFs in Gmail

How to make an electronic signature straight from your smart phone

The way to make an electronic signature for a PDF document on iOS

How to make an electronic signature for a PDF document on Android OS

People also ask

-

What is the Utah low income housing tax and how does it work?

The Utah low income housing tax is a program designed to incentivize the development of affordable housing in Utah. It provides tax credits to investors who support low-income housing projects, making it easier for developers to finance these essential community resources.

-

How can I benefit from the Utah low income housing tax?

By participating in the Utah low income housing tax program, both developers and investors can benefit financially. Investors receive substantial tax credits, while developers gain access to funding, making it easier to create safe and affordable housing for low-income families.

-

Who is eligible for the Utah low income housing tax credits?

Eligibility for the Utah low income housing tax credits generally includes developers of affordable housing projects that meet specific criteria. These criteria often involve income limits for tenants and project location, ensuring that the tax benefits directly impact those in need.

-

What types of housing are covered by the Utah low income housing tax?

The Utah low income housing tax covers various types of housing developments, including apartments, townhouses, and single-family homes designated for low-income residents. This ensures a diverse range of options for individuals and families seeking affordable living solutions.

-

Are there specific requirements for applying for the Utah low income housing tax?

Yes, there are several requirements to apply for the Utah low income housing tax. Developers must demonstrate that their projects meet the designated affordability criteria and follow state regulations to qualify for the tax credits.

-

What documents are needed to leverage the Utah low income housing tax?

To leverage the Utah low income housing tax, developers typically need to provide comprehensive project documentation, including financial statements, tenant income surveys, and compliance reports indicating adherence to state guidelines.

-

Can airSlate SignNow assist with documents related to Utah low income housing tax?

Absolutely! airSlate SignNow provides a user-friendly platform to easily send and e-sign all necessary documents related to the Utah low income housing tax. This ensures that developers and investors can manage their documentation efficiently, streamlining the application process.

Get more for Credits UtahCredits Utah Income TaxesUtah State Tax CommissionCurrent Forms Utah State Tax CommissionCredits Utah

- Physical therapist application by endorsement state of form

- Internship training affidavit form

- Fis 0407 618 department of insurance and michigan form

- Assumed name certificate forms results for websites listing

- 5 michigan department of licensing and form

- Form csclcd 800 ampquotapplication to register a limited

- Professional counselor license application form

- Bid bonddate bond executed must not be later see form

Find out other Credits UtahCredits Utah Income TaxesUtah State Tax CommissionCurrent Forms Utah State Tax CommissionCredits Utah

- Help Me With eSign Iowa Insurance Living Will

- eSign North Dakota Lawers Quitclaim Deed Easy

- eSign Ohio Lawers Agreement Computer

- eSign North Dakota Lawers Separation Agreement Online

- How To eSign North Dakota Lawers Separation Agreement

- eSign Kansas Insurance Moving Checklist Free

- eSign Louisiana Insurance Promissory Note Template Simple

- eSign Texas Lawers Contract Fast

- eSign Texas Lawers Lease Agreement Free

- eSign Maine Insurance Rental Application Free

- How Can I eSign Maryland Insurance IOU

- eSign Washington Lawers Limited Power Of Attorney Computer

- eSign Wisconsin Lawers LLC Operating Agreement Free

- eSign Alabama Legal Quitclaim Deed Online

- eSign Alaska Legal Contract Safe

- How To eSign Alaska Legal Warranty Deed

- eSign Alaska Legal Cease And Desist Letter Simple

- eSign Arkansas Legal LLC Operating Agreement Simple

- eSign Alabama Life Sciences Residential Lease Agreement Fast

- How To eSign Arkansas Legal Residential Lease Agreement