InvestmentNew Jobs Tax Credit PackageOklahoma Department 2020

What is the Investment New Jobs Tax Credit Package Oklahoma Department

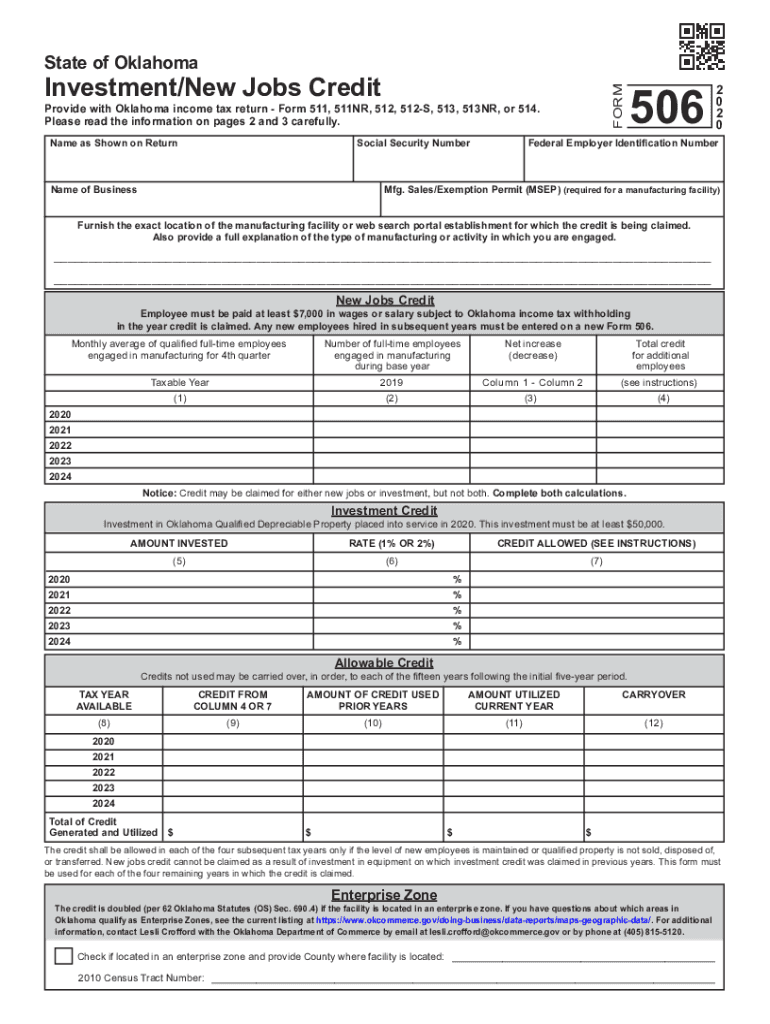

The Investment New Jobs Tax Credit Package offered by the Oklahoma Department is a financial incentive designed to encourage businesses to create new jobs within the state. This program aims to stimulate economic growth by providing tax credits to eligible businesses that meet specific criteria. The primary objective is to foster job creation and investment in Oklahoma, ultimately benefiting the local economy.

Eligibility Criteria for the Investment New Jobs Tax Credit Package Oklahoma Department

To qualify for the Investment New Jobs Tax Credit Package, businesses must meet several eligibility requirements. These typically include:

- Establishing a new business or expanding an existing one in Oklahoma.

- Creating a minimum number of new full-time jobs within a specified timeframe.

- Meeting certain wage and benefit standards for the newly created positions.

- Complying with all applicable state and federal regulations.

It is essential for businesses to review these criteria carefully to ensure they meet the requirements before applying for the tax credit.

Steps to Complete the Investment New Jobs Tax Credit Package Oklahoma Department

Completing the Investment New Jobs Tax Credit Package involves several key steps to ensure proper submission and compliance:

- Gather all necessary documentation, including proof of job creation and investment.

- Fill out the required forms accurately, ensuring all information is complete.

- Submit the completed forms to the Oklahoma Department, either online or via mail.

- Keep copies of all submitted documents for your records.

Following these steps will help streamline the process and facilitate a smoother application experience.

Legal Use of the Investment New Jobs Tax Credit Package Oklahoma Department

The legal framework surrounding the Investment New Jobs Tax Credit Package ensures that businesses comply with state laws while benefiting from the program. Businesses must adhere to the guidelines set forth by the Oklahoma Department, including maintaining accurate records and reporting job creation accurately. Non-compliance with these regulations can lead to penalties or disqualification from receiving the tax credits.

Form Submission Methods for the Investment New Jobs Tax Credit Package Oklahoma Department

Businesses can submit the Investment New Jobs Tax Credit Package through various methods, including:

- Online submission via the Oklahoma Department's official portal.

- Mailing the completed forms to the designated office address.

- In-person submission at local Oklahoma Department offices.

Choosing the appropriate submission method can depend on the specific needs and preferences of the business.

Required Documents for the Investment New Jobs Tax Credit Package Oklahoma Department

When applying for the Investment New Jobs Tax Credit Package, businesses must provide specific documents to support their application. These may include:

- Proof of business registration in Oklahoma.

- Documentation of new job creation, such as employment contracts or payroll records.

- Financial statements demonstrating the investment made by the business.

- Any additional forms required by the Oklahoma Department.

Ensuring that all required documents are included will facilitate a smoother review process.

Quick guide on how to complete investmentnew jobs tax credit packageoklahoma department

Complete InvestmentNew Jobs Tax Credit PackageOklahoma Department seamlessly on any device

Managing documents online has gained signNow popularity among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed paperwork, as you can access the necessary form and securely keep it online. airSlate SignNow provides all the tools required to create, edit, and eSign your documents quickly and without hassle. Manage InvestmentNew Jobs Tax Credit PackageOklahoma Department on any device using airSlate SignNow's Android or iOS applications and streamline any document-related task today.

How to edit and eSign InvestmentNew Jobs Tax Credit PackageOklahoma Department effortlessly

- Find InvestmentNew Jobs Tax Credit PackageOklahoma Department and then click Get Form to begin.

- Use the tools we offer to complete your form.

- Mark relevant sections of the documents or redact sensitive information with features that airSlate SignNow provides specifically for this purpose.

- Create your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and then click the Done button to save your modifications.

- Choose how you would like to send your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, and errors that require reprinting new document copies. airSlate SignNow meets all your document management needs in just a few clicks from your preferred device. Edit and eSign InvestmentNew Jobs Tax Credit PackageOklahoma Department and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct investmentnew jobs tax credit packageoklahoma department

Create this form in 5 minutes!

How to create an eSignature for the investmentnew jobs tax credit packageoklahoma department

How to create an electronic signature for your PDF file online

How to create an electronic signature for your PDF file in Google Chrome

How to make an eSignature for signing PDFs in Gmail

The best way to create an eSignature straight from your mobile device

How to create an electronic signature for a PDF file on iOS

The best way to create an eSignature for a PDF document on Android devices

People also ask

-

What is the Investment New Jobs Tax Credit Package offered by the Oklahoma Department?

The Investment New Jobs Tax Credit Package provided by the Oklahoma Department aims to incentivize businesses to create new jobs in the state. This package offers tax credits based on the number of new employees hired and the amount invested in business expansion, ultimately fostering economic growth.

-

How can airSlate SignNow help businesses applying for the Investment New Jobs Tax Credit Package?

airSlate SignNow streamlines the documentation process necessary for applying for the Investment New Jobs Tax Credit Package. By providing a robust eSigning solution, businesses can easily send and sign essential documents, ensuring compliance and a smoother application experience with the Oklahoma Department.

-

What features does airSlate SignNow offer for managing the Investment New Jobs Tax Credit Package documentation?

airSlate SignNow includes features such as secure document storage, customizable templates, and advanced eSignature capabilities. These tools facilitate the efficient management of all documents related to the Investment New Jobs Tax Credit Package, making it easier to stay organized and compliant.

-

Are there any costs associated with using airSlate SignNow for the Investment New Jobs Tax Credit Package?

Yes, airSlate SignNow offers various pricing plans tailored to different business needs. Each plan is designed to provide a cost-effective solution for businesses looking to manage their applications for the Investment New Jobs Tax Credit Package through efficient document workflows.

-

What are the benefits of using airSlate SignNow for businesses considering the Investment New Jobs Tax Credit Package?

By utilizing airSlate SignNow, businesses can save time and reduce paperwork by digitizing their signing and documentation process for the Investment New Jobs Tax Credit Package. This leads to faster approvals and enables businesses to focus on growth rather than administrative tasks.

-

Can airSlate SignNow integrate with other tools for managing the Investment New Jobs Tax Credit Package?

Absolutely! airSlate SignNow offers seamless integrations with various business tools and applications. This feature allows businesses to connect their existing software with airSlate SignNow, enhancing their workflow for handling the Investment New Jobs Tax Credit Package efficiently.

-

How secure is airSlate SignNow when dealing with sensitive documents related to the Investment New Jobs Tax Credit Package?

Security is a top priority for airSlate SignNow. It utilizes industry-standard encryption and security measures to safeguard all documents, ensuring that sensitive information related to the Investment New Jobs Tax Credit Package is well protected at all times.

Get more for InvestmentNew Jobs Tax Credit PackageOklahoma Department

Find out other InvestmentNew Jobs Tax Credit PackageOklahoma Department

- Sign Colorado Business Operations LLC Operating Agreement Online

- Sign Colorado Business Operations LLC Operating Agreement Myself

- Sign Hawaii Business Operations Warranty Deed Easy

- Sign Idaho Business Operations Resignation Letter Online

- Sign Illinois Business Operations Affidavit Of Heirship Later

- How Do I Sign Kansas Business Operations LLC Operating Agreement

- Sign Kansas Business Operations Emergency Contact Form Easy

- How To Sign Montana Business Operations Warranty Deed

- Sign Nevada Business Operations Emergency Contact Form Simple

- Sign New Hampshire Business Operations Month To Month Lease Later

- Can I Sign New York Business Operations Promissory Note Template

- Sign Oklahoma Business Operations Contract Safe

- Sign Oregon Business Operations LLC Operating Agreement Now

- Sign Utah Business Operations LLC Operating Agreement Computer

- Sign West Virginia Business Operations Rental Lease Agreement Now

- How To Sign Colorado Car Dealer Arbitration Agreement

- Sign Florida Car Dealer Resignation Letter Now

- Sign Georgia Car Dealer Cease And Desist Letter Fast

- Sign Georgia Car Dealer Purchase Order Template Mobile

- Sign Delaware Car Dealer Limited Power Of Attorney Fast