Form 14039 B SP Rev 5 Business Identity Theft Affidavit Spanish Version 2021-2026

Understanding the Form 14039 B SP Rev 5 Business Identity Theft Affidavit Spanish Version

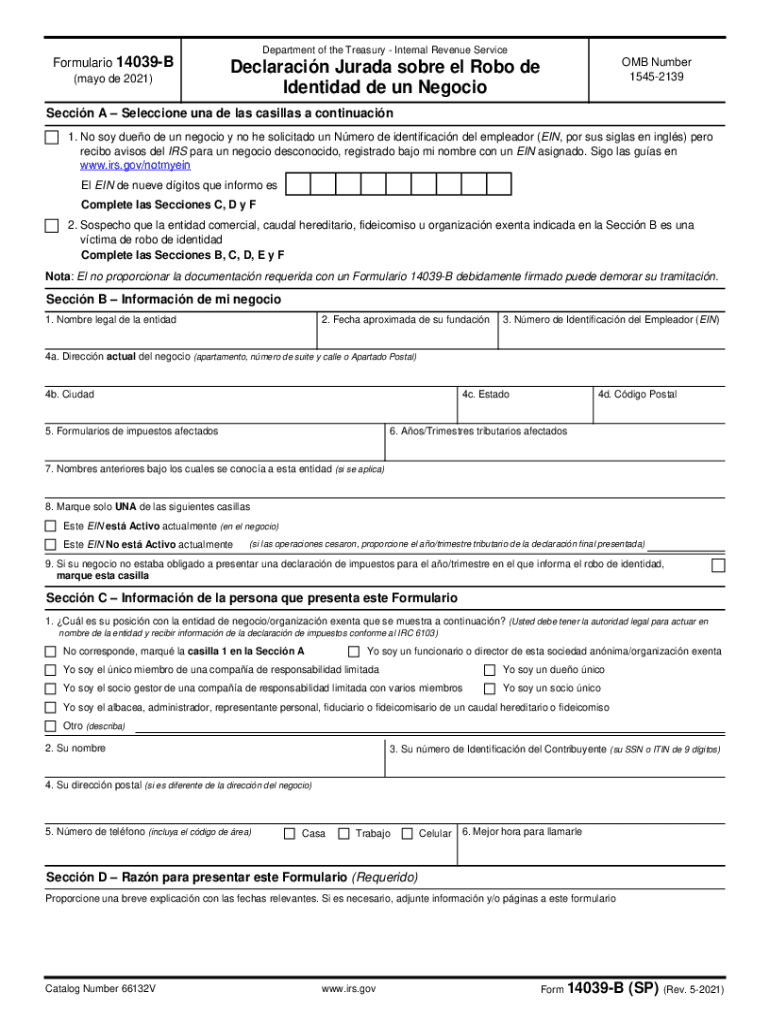

The Form 14039 B SP Rev 5 is officially known as the Business Identity Theft Affidavit in Spanish. This form is essential for businesses that suspect they have been victims of identity theft. It allows business owners to report the fraudulent use of their business identity to the IRS. By completing this form, individuals can help protect their business from potential tax-related issues that may arise due to identity theft. The Spanish version ensures that Spanish-speaking business owners can accurately report their situation and seek assistance from the IRS.

How to Complete the Form 14039 B SP Rev 5

Completing the Form 14039 B SP Rev 5 involves several key steps. First, gather all necessary information about your business, including the business name, Employer Identification Number (EIN), and any relevant details about the identity theft incident. Next, fill out the form by providing accurate information in each section. It is crucial to explain the circumstances of the identity theft clearly. Once completed, review the form for accuracy before submission. This thoroughness helps ensure that the IRS can process your affidavit efficiently.

Required Documents for the Form 14039 B SP Rev 5

When submitting the Form 14039 B SP Rev 5, certain documents may be required to support your claim. These documents can include:

- A copy of your business registration documents.

- Any correspondence related to the identity theft.

- Proof of your identity, such as a driver's license or passport.

- Documentation that shows the fraudulent activity, if available.

Having these documents ready can facilitate the processing of your affidavit and help the IRS take appropriate action against the identity theft.

Legal Use of the Form 14039 B SP Rev 5

The Form 14039 B SP Rev 5 serves a legal purpose in reporting identity theft. By submitting this affidavit, business owners formally notify the IRS of fraudulent activities that may affect their tax filings. This legal recognition is crucial for protecting the business's financial interests and ensuring compliance with tax laws. It also helps establish a record of the identity theft incident, which can be beneficial in any future disputes or investigations.

Submission Methods for the Form 14039 B SP Rev 5

There are multiple ways to submit the Form 14039 B SP Rev 5 to the IRS. Business owners can choose to send the form via mail or submit it electronically, depending on their preferences and the IRS's guidelines. For mail submissions, ensure that you send the form to the correct IRS address designated for identity theft affidavits. If submitting electronically, follow the IRS's online submission process carefully to ensure that your affidavit is received and processed promptly.

IRS Guidelines for the Form 14039 B SP Rev 5

The IRS provides specific guidelines for completing and submitting the Form 14039 B SP Rev 5. It is essential to follow these guidelines closely to avoid delays in processing. The IRS recommends that business owners keep a copy of the completed form for their records. Additionally, if you receive any correspondence from the IRS regarding your affidavit, respond promptly to any requests for additional information or clarification. Staying informed about the IRS's procedures can help ensure a smoother resolution to your identity theft case.

Quick guide on how to complete form 14039 b sp rev 5 2021 business identity theft affidavit spanish version

Complete Form 14039 B SP Rev 5 Business Identity Theft Affidavit Spanish Version seamlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It presents an ideal eco-conscious alternative to traditional printed and signed forms, allowing you to obtain the correct document and securely save it online. airSlate SignNow provides you with all the resources necessary to create, edit, and electronically sign your documents swiftly without delays. Manage Form 14039 B SP Rev 5 Business Identity Theft Affidavit Spanish Version on any device using airSlate SignNow Android or iOS applications and simplify any document-related tasks today.

How to edit and eSign Form 14039 B SP Rev 5 Business Identity Theft Affidavit Spanish Version effortlessly

- Obtain Form 14039 B SP Rev 5 Business Identity Theft Affidavit Spanish Version and then click Get Form to begin.

- Make use of the tools we offer to complete your document.

- Emphasize important parts of your documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature using the Sign tool, which takes only seconds and holds the same legal validity as a conventional wet ink signature.

- Review all information and select the Done button to save your changes.

- Choose how you wish to send your form—via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns over lost or misplaced documents, tedious form searches, or errors that require reprinting. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your selection. Edit and eSign Form 14039 B SP Rev 5 Business Identity Theft Affidavit Spanish Version and ensure excellent communication throughout your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 14039 b sp rev 5 2021 business identity theft affidavit spanish version

Create this form in 5 minutes!

How to create an eSignature for the form 14039 b sp rev 5 2021 business identity theft affidavit spanish version

The best way to make an eSignature for your PDF in the online mode

The best way to make an eSignature for your PDF in Chrome

The way to generate an electronic signature for putting it on PDFs in Gmail

The best way to generate an electronic signature from your smart phone

How to make an electronic signature for a PDF on iOS devices

The best way to generate an electronic signature for a PDF file on Android OS

People also ask

-

What is Form 14039 B and how is it used?

Form 14039 B is a document used to report identity theft related issues to the IRS. This form helps protect your personal information by informing the IRS that your identity has been compromised. By submitting Form 14039 B, individuals can potentially prevent unauthorized tax filings in their name.

-

How can airSlate SignNow assist with Form 14039 B?

airSlate SignNow offers a streamlined process for electronically signing and sharing essential documents like Form 14039 B. With robust features, users can collaborate on the form in real time and ensure that all parties have access. This makes submitting Form 14039 B quicker and more efficient.

-

Are there any costs associated with using airSlate SignNow for Form 14039 B?

Yes, airSlate SignNow offers cost-effective plans to cater to various business needs. Pricing depends on the features and number of users you require, but it is generally designed to be budget-friendly. This makes it an accessible solution for completing Form 14039 B and other essential documents.

-

What features does airSlate SignNow provide for handling Form 14039 B?

airSlate SignNow includes features such as template creation, document sharing, real-time collaboration, and secure eSignature options. These features make managing Form 14039 B hassle-free, ensuring that you can collect signatures quickly and efficiently. Additionally, the platform supports document storage and tracking.

-

Is airSlate SignNow secure for submitting Form 14039 B?

Absolutely! airSlate SignNow utilizes top-notch encryption and security protocols to protect your sensitive information when working on Form 14039 B. Our commitment to data security ensures that your identity and personal details are safeguarded throughout the signing process.

-

Can I integrate airSlate SignNow with other applications when dealing with Form 14039 B?

Yes, airSlate SignNow supports a wide range of integrations, making it easy to connect with your favorite applications. This allows for seamless workflow transitions when handling Form 14039 B with other tools. Integrations can enhance productivity and streamline document management.

-

What are the benefits of using airSlate SignNow for Form 14039 B?

Using airSlate SignNow for Form 14039 B signNowly reduces paperwork and processing time. The platform's user-friendly interface ensures that even those unfamiliar with electronic signing can navigate easily. Ultimately, it empowers users to manage their documents efficiently and with confidence.

Get more for Form 14039 B SP Rev 5 Business Identity Theft Affidavit Spanish Version

- Form type hsc

- Declaration missing receipt form

- Student financial services norco college form

- Facility management certificate planning chart form

- Authorization forms university of oklahoma

- Csu ge breadth certification plan 2020 2021 pierce college form

- Upward bound program application western michigan university wmich form

- Ocd history form age of symptom onset age of ocd

Find out other Form 14039 B SP Rev 5 Business Identity Theft Affidavit Spanish Version

- Can I eSign Wisconsin Last Will and Testament

- eSign Wisconsin Cohabitation Agreement Free

- How To eSign Colorado Living Will

- eSign Maine Living Will Now

- eSign Utah Living Will Now

- eSign Iowa Affidavit of Domicile Now

- eSign Wisconsin Codicil to Will Online

- eSign Hawaii Guaranty Agreement Mobile

- eSign Hawaii Guaranty Agreement Now

- How Can I eSign Kentucky Collateral Agreement

- eSign Louisiana Demand for Payment Letter Simple

- eSign Missouri Gift Affidavit Myself

- eSign Missouri Gift Affidavit Safe

- eSign Nevada Gift Affidavit Easy

- eSign Arizona Mechanic's Lien Online

- eSign Connecticut IOU Online

- How To eSign Florida Mechanic's Lien

- eSign Hawaii Mechanic's Lien Online

- How To eSign Hawaii Mechanic's Lien

- eSign Hawaii IOU Simple