Firs Tax Clearance Slip Form

What is the FIRS Tax Clearance Slip

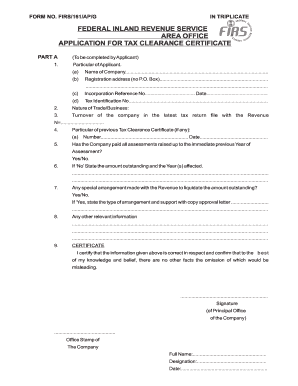

The FIRS Tax Clearance Slip is an official document issued by the Federal Inland Revenue Service (FIRS) in Nigeria. It serves as proof that a taxpayer has fulfilled their tax obligations for a specific period. This slip is essential for individuals and businesses, as it may be required for various transactions, including securing loans, applying for government contracts, or participating in tenders. The slip confirms that the taxpayer is compliant with their tax responsibilities and has no outstanding tax liabilities.

How to Obtain the FIRS Tax Clearance Slip

To obtain the FIRS Tax Clearance Slip, taxpayers must follow a series of steps. First, they need to ensure that all tax returns are filed and any outstanding taxes are paid. Next, they can apply for the slip through the FIRS online portal or by visiting a FIRS office. The application process typically requires the submission of relevant documents, including identification and proof of tax payments. After processing, the FIRS will issue the slip, confirming the taxpayer's compliance.

Steps to Complete the FIRS Tax Clearance Slip

Completing the FIRS Tax Clearance Slip involves several important steps. Initially, gather all necessary documents, such as tax returns and payment receipts. Next, access the FIRS online portal or visit a local office to fill out the application form. It is crucial to provide accurate information to avoid delays. Once the application is submitted, monitor its status and ensure any additional requirements are met. Finally, upon approval, the slip will be issued, indicating tax compliance.

Key Elements of the FIRS Tax Clearance Slip

The FIRS Tax Clearance Slip contains several key elements that validate its authenticity and purpose. These include the taxpayer's name, Tax Identification Number (TIN), the period covered by the clearance, and a unique reference number. Additionally, the slip may feature the FIRS logo and a signature from an authorized official, which further confirms its legitimacy. Understanding these elements is essential for taxpayers to ensure they possess a valid clearance slip.

Legal Use of the FIRS Tax Clearance Slip

The legal use of the FIRS Tax Clearance Slip is critical for various business and personal transactions. It is often required when applying for loans, securing government contracts, or engaging in business with other entities. The slip serves as evidence of tax compliance, which can protect taxpayers from legal repercussions associated with unpaid taxes. Therefore, maintaining an up-to-date clearance slip is essential for individuals and businesses alike.

Required Documents

To apply for the FIRS Tax Clearance Slip, several documents are typically required. These may include:

- Tax Identification Number (TIN)

- Completed tax returns for the relevant periods

- Proof of tax payments

- Identification documents (e.g., national ID, driver's license)

- Any additional documentation requested by FIRS

Having these documents ready can streamline the application process and facilitate the timely issuance of the clearance slip.

Quick guide on how to complete firs tax clearance slip

Complete Firs Tax Clearance Slip effortlessly on any device

Digital document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents quickly and without delays. Manage Firs Tax Clearance Slip on any device using airSlate SignNow Android or iOS applications and enhance any document-driven process today.

How to adjust and eSign Firs Tax Clearance Slip effortlessly

- Obtain Firs Tax Clearance Slip and click on Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize key sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes seconds and holds the same legal significance as a conventional ink signature.

- Review all the information and click on the Done button to save your updates.

- Choose how you would like to send your form, whether by email, SMS, or an invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or errors that require printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from a device of your choice. Adjust and eSign Firs Tax Clearance Slip and guarantee excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the firs tax clearance slip

The best way to create an eSignature for a PDF file in the online mode

The best way to create an eSignature for a PDF file in Chrome

The best way to create an electronic signature for putting it on PDFs in Gmail

The way to generate an electronic signature straight from your smartphone

The way to generate an eSignature for a PDF file on iOS devices

The way to generate an electronic signature for a PDF document on Android

People also ask

-

What is a tax clearance sample and why is it important?

A tax clearance sample is a document obtained from tax authorities that verifies an individual's or business's tax status. It is important because it provides proof that all tax obligations have been met, which is often required for business licenses and loans. Having a clean tax clearance sample can facilitate smoother transactions and enhance credibility.

-

How does airSlate SignNow help in obtaining a tax clearance sample?

airSlate SignNow streamlines the process of signing and sending documents required for obtaining a tax clearance sample. With our eSignature capabilities, you can collect signatures quickly and securely, ensuring that your documents are processed without delays. This efficiency helps you get your tax clearance sample faster.

-

What features does airSlate SignNow offer for managing tax clearance documents?

airSlate SignNow offers features such as document templates, real-time tracking, and automated reminders that make managing tax documents more efficient. With customizable templates for tax clearance samples, you can ensure that your documents are always compliant. Plus, our cloud storage keeps your documents organized and easily accessible.

-

Is there a cost associated with using airSlate SignNow for tax clearance samples?

Yes, there is a cost associated with using airSlate SignNow, but we offer various pricing plans to fit different budgets. Our plans include features specifically designed to facilitate the signing and processing of documents like tax clearance samples. Users can choose a plan that best suits their needs and enjoy a cost-effective solution.

-

Can I integrate airSlate SignNow with other software for tax clearance samples?

Absolutely! airSlate SignNow offers seamless integrations with a wide range of applications, including accounting and tax preparation software. This allows for an efficient workflow when preparing and processing tax clearance samples. Integrating these tools helps you manage your documents in one place and saves time.

-

What are the benefits of using airSlate SignNow for tax clearance samples?

Using airSlate SignNow to manage tax clearance samples provides several benefits, including increased efficiency and reduced paperwork. Our secure, electronic signing process eliminates the need for physical documents, speeding up transaction times. Additionally, you’ll have access to real-time updates and document tracking.

-

How secure is the eSigning process for tax clearance samples?

The eSigning process with airSlate SignNow is highly secure, utilizing encryption and authentication methods to protect your documents. This ensures that your tax clearance sample and any sensitive information contained within are safe from unauthorized access. You can trust our platform to keep your data secure during every transaction.

Get more for Firs Tax Clearance Slip

- Excel cover sheet form

- Data incident reporting form educational agency

- Dma 5157 form

- Application for operator examination maryland department of the form

- Security survey mdlenet dpscs state md form

- Mdewmabwwexm maryland department of the environment form

- Parentguardian information and contact preference form dear

- Fire amp rescue area planning cal oes state of california form

Find out other Firs Tax Clearance Slip

- Can I Sign Alabama Banking PPT

- Electronic signature Washington Sports POA Simple

- How To Electronic signature West Virginia Sports Arbitration Agreement

- Electronic signature Wisconsin Sports Residential Lease Agreement Myself

- Help Me With Sign Arizona Banking Document

- How Do I Sign Arizona Banking Form

- How Can I Sign Arizona Banking Form

- How Can I Sign Arizona Banking Form

- Can I Sign Colorado Banking PPT

- How Do I Sign Idaho Banking Presentation

- Can I Sign Indiana Banking Document

- How Can I Sign Indiana Banking PPT

- How To Sign Maine Banking PPT

- Help Me With Sign Massachusetts Banking Presentation

- Can I Sign Michigan Banking PDF

- Can I Sign Michigan Banking PDF

- Help Me With Sign Minnesota Banking Word

- How To Sign Missouri Banking Form

- Help Me With Sign New Jersey Banking PDF

- How Can I Sign New Jersey Banking Document