Form IL 1120 ST, Small Business Corporation Replacement Tax Return Tax Illinois

What is the Form IL 1120 ST, Small Business Corporation Replacement Tax Return Tax Illinois

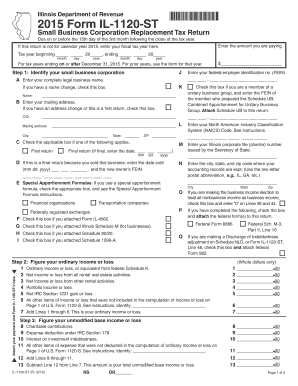

The Form IL 1120 ST is a tax return specifically designed for small business corporations operating in Illinois. This form allows corporations to report their income, deductions, and credits for state tax purposes. It is essential for small businesses to accurately complete this form to ensure compliance with Illinois tax regulations. The form is tailored for corporations that qualify as small businesses under state law, enabling them to take advantage of certain tax benefits and exemptions.

Steps to complete the Form IL 1120 ST, Small Business Corporation Replacement Tax Return Tax Illinois

Completing the Form IL 1120 ST involves several key steps to ensure accuracy and compliance. First, gather all necessary financial documents, including income statements, expense records, and any relevant tax documents. Next, fill out the form by entering your corporation's information, including the business name, address, and federal employer identification number (EIN). Be sure to report all income and applicable deductions accurately. After completing the form, review it thoroughly for any errors or omissions before submitting it to the Illinois Department of Revenue.

How to obtain the Form IL 1120 ST, Small Business Corporation Replacement Tax Return Tax Illinois

The Form IL 1120 ST can be obtained through the Illinois Department of Revenue's official website. It is available for download in PDF format, allowing businesses to print and fill it out manually. Additionally, the form may be accessible through various tax preparation software that supports Illinois state tax filing. Ensure you have the most current version of the form to comply with any recent updates or changes in tax law.

Legal use of the Form IL 1120 ST, Small Business Corporation Replacement Tax Return Tax Illinois

The legal use of the Form IL 1120 ST is critical for small business corporations in Illinois to fulfill their tax obligations. This form serves as an official document submitted to the state, declaring the corporation's financial activities for the tax year. Proper completion and submission of the form are necessary to avoid penalties and ensure that the corporation remains in good standing with state tax authorities. It is important to retain a copy of the submitted form for your records, as it may be required for future reference or audits.

Filing Deadlines / Important Dates

Filing deadlines for the Form IL 1120 ST are crucial for compliance. Typically, the form is due on the 15th day of the third month following the close of the corporation's tax year. For corporations operating on a calendar year, this means the form is due by March 15. If the deadline falls on a weekend or holiday, the due date is extended to the next business day. Corporations should also be aware of any extensions available for filing, which may require additional forms to be submitted.

Penalties for Non-Compliance

Failure to file the Form IL 1120 ST on time can result in significant penalties for small business corporations in Illinois. Penalties may include late filing fees, interest on unpaid taxes, and potential legal action from the Illinois Department of Revenue. It is essential for corporations to adhere to filing deadlines and ensure that all information reported is accurate to avoid these consequences. Maintaining proper records and seeking professional assistance can help mitigate risks associated with non-compliance.

Quick guide on how to complete 2015 form il 1120 st small business corporation replacement tax return tax illinois

Execute Form IL 1120 ST, Small Business Corporation Replacement Tax Return Tax Illinois seamlessly on any gadget

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly substitution for conventional printed and signed agreements, allowing you to access the appropriate form and safely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents swiftly without delays. Handle Form IL 1120 ST, Small Business Corporation Replacement Tax Return Tax Illinois on any device using airSlate SignNow's Android or iOS applications and enhance any document-oriented workflow today.

The easiest way to modify and eSign Form IL 1120 ST, Small Business Corporation Replacement Tax Return Tax Illinois effortlessly

- Obtain Form IL 1120 ST, Small Business Corporation Replacement Tax Return Tax Illinois and click Get Form to commence.

- Utilize the tools we provide to finalize your document.

- Emphasize pertinent sections of the documents or redact sensitive information with tools that airSlate SignNow offers for that specific use.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review the details and click the Done button to save your modifications.

- Choose your preferred delivery method for your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form navigation, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from your chosen device. Alter and eSign Form IL 1120 ST, Small Business Corporation Replacement Tax Return Tax Illinois and guarantee exceptional communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is Form IL 1120 ST, Small Business Corporation Replacement Tax Return Tax Illinois?

Form IL 1120 ST is a tax return form specifically designed for small business corporations in Illinois. It is utilized to report the Replacement Tax owed by these corporations, ensuring compliance with state tax regulations. Properly filing this form is crucial for maintaining good standing with the Illinois Department of Revenue.

-

How can airSlate SignNow help with completing Form IL 1120 ST?

With airSlate SignNow, you can easily create, send, and eSign Form IL 1120 ST, Small Business Corporation Replacement Tax Return Tax Illinois. Our platform offers user-friendly templates and collaborative features to simplify your filing process. This efficiency helps businesses avoid errors and ensures timely submission of crucial tax documents.

-

Is airSlate SignNow affordable for small businesses looking to manage Form IL 1120 ST?

Yes, airSlate SignNow is a cost-effective solution for small businesses needing to manage Form IL 1120 ST, Small Business Corporation Replacement Tax Return Tax Illinois. We offer competitive pricing plans tailored to meet the needs of various business sizes, allowing you to stay compliant without overspending on administrative tasks.

-

What features does airSlate SignNow offer for tax form management?

airSlate SignNow provides features tailored for efficient document management, including customizable templates, secure eSignatures, and automatic reminders. These tools streamline the process of completing Form IL 1120 ST, Small Business Corporation Replacement Tax Return Tax Illinois, ensuring that you can manage your tax obligations efficiently and effectively.

-

Can I integrate airSlate SignNow with my existing accounting software for Form IL 1120 ST?

Absolutely! airSlate SignNow offers seamless integrations with popular accounting software to enhance your workflow for Form IL 1120 ST, Small Business Corporation Replacement Tax Return Tax Illinois. This integration allows for better data management and reduces the risk of errors when transferring information between systems.

-

What benefits does eSigning provide for completing Form IL 1120 ST?

eSigning with airSlate SignNow for Form IL 1120 ST, Small Business Corporation Replacement Tax Return Tax Illinois offers numerous benefits, including expedited document turnaround and enhanced security. This method eliminates the need for physical signatures, reduces paperwork, and ensures that your forms are safely stored in the cloud for easy access at any time.

-

What support does airSlate SignNow offer for users filing Form IL 1120 ST?

airSlate SignNow provides comprehensive customer support to assist you with filing Form IL 1120 ST, Small Business Corporation Replacement Tax Return Tax Illinois. Our dedicated support team is available via chat, email, or phone to answer any questions you may have and guide you through the document preparation process.

Get more for Form IL 1120 ST, Small Business Corporation Replacement Tax Return Tax Illinois

Find out other Form IL 1120 ST, Small Business Corporation Replacement Tax Return Tax Illinois

- Can I eSign South Dakota Banking PPT

- How Can I eSign South Dakota Banking PPT

- How Do I eSign Alaska Car Dealer Form

- How To eSign California Car Dealer Form

- Can I eSign Colorado Car Dealer Document

- How Can I eSign Colorado Car Dealer Document

- Can I eSign Hawaii Car Dealer Word

- How To eSign Hawaii Car Dealer PPT

- How To eSign Hawaii Car Dealer PPT

- How Do I eSign Hawaii Car Dealer PPT

- Help Me With eSign Hawaii Car Dealer PPT

- How Can I eSign Hawaii Car Dealer Presentation

- How Do I eSign Hawaii Business Operations PDF

- How Can I eSign Hawaii Business Operations PDF

- How To eSign Hawaii Business Operations Form

- How Do I eSign Hawaii Business Operations Form

- Help Me With eSign Hawaii Business Operations Presentation

- How Do I eSign Idaho Car Dealer Document

- How Do I eSign Indiana Car Dealer Document

- How To eSign Michigan Car Dealer Document