Pa 2021

What is the 2021 PA Form?

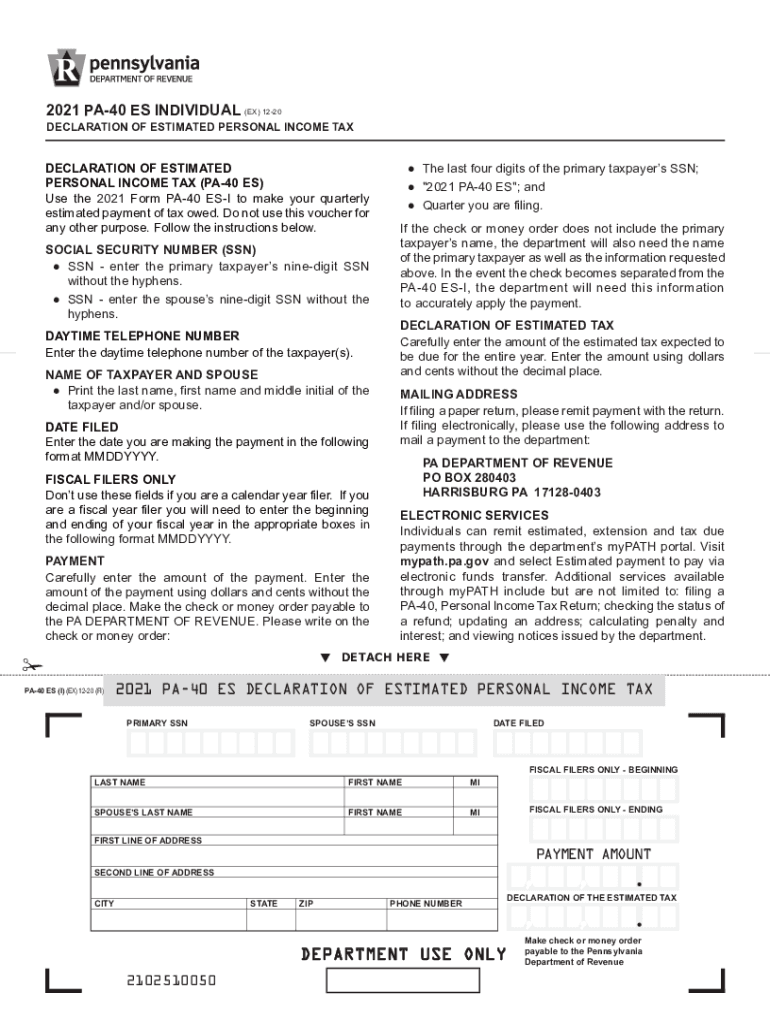

The 2021 PA Form, specifically the PA-40, is the official income tax return used by residents of Pennsylvania to report their income and calculate their state tax liability. This form is essential for individuals and businesses operating within the state, as it ensures compliance with Pennsylvania tax laws. The PA-40 must be completed accurately to reflect all sources of income, deductions, and credits applicable to the taxpayer's situation.

Steps to Complete the 2021 PA Form

Completing the 2021 PA Form involves several key steps:

- Gather necessary documents, including W-2s, 1099s, and any other income statements.

- Fill out personal information, including your name, address, and Social Security number.

- Report all sources of income on the form, ensuring that each entry is accurate and complete.

- Claim any applicable deductions and credits, which can reduce your overall tax liability.

- Calculate your total tax due or refund based on the information provided.

- Review the completed form for accuracy before submission.

Legal Use of the 2021 PA Form

The 2021 PA Form is legally binding when completed and submitted according to Pennsylvania state regulations. To ensure its legal validity, taxpayers must provide accurate information and sign the form. Electronic signatures are accepted, provided they comply with the legal standards set forth by the state. Utilizing a trusted eSignature platform can enhance the security and authenticity of the submission.

Filing Deadlines / Important Dates

For the 2021 tax year, the filing deadline for the PA-40 is typically April 15 of the following year. However, if this date falls on a weekend or holiday, the deadline may be extended. It is crucial for taxpayers to be aware of these dates to avoid penalties and interest on late submissions. Extensions may be available, but they must be requested properly to ensure compliance.

Required Documents for the 2021 PA Form

To accurately complete the 2021 PA Form, taxpayers should prepare the following documents:

- W-2 forms from employers showing wages earned.

- 1099 forms for any freelance or contract work.

- Records of other income sources, such as rental income or dividends.

- Documentation for any deductions or credits claimed, such as receipts for business expenses.

Form Submission Methods

Taxpayers can submit the 2021 PA Form through various methods, including:

- Online submission via the Pennsylvania Department of Revenue's e-filing system.

- Mailing a paper copy of the form to the appropriate address provided by the state.

- In-person submission at designated tax offices or events.

Penalties for Non-Compliance

Failure to file the 2021 PA Form on time or submitting inaccurate information can result in penalties. These may include fines, interest on unpaid taxes, and potential legal action. It is essential for taxpayers to adhere to all filing requirements and deadlines to avoid these consequences. Keeping accurate records and seeking assistance when needed can help mitigate the risk of non-compliance.

Quick guide on how to complete 2021 pa

Execute Pa effortlessly on any device

Digital document management has become increasingly popular among companies and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed papers, allowing you to access the correct format and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and electronically sign your documents swiftly without interruptions. Manage Pa on any device using airSlate SignNow Android or iOS applications and simplify any document-related task today.

The simplest way to modify and electronically sign Pa with ease

- Obtain Pa and then click Get Form to begin.

- Utilize the tools we offer to finalize your document.

- Emphasize important sections of your documents or redact sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Generate your signature using the Sign feature, which takes seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the details and then click on the Done button to save your edits.

- Select your preferred method to send your form, via email, SMS, invite link, or download it to your PC.

Eliminate issues with lost or misplaced documents, tedious form searches, or inaccuracies that require printing new document copies. airSlate SignNow addresses your document management needs with just a few clicks from any device of your choice. Modify and electronically sign Pa and ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2021 pa

Create this form in 5 minutes!

People also ask

-

Can a 14 year old refuse mental health treatment in PA?

The MHPA provides that a minor who is at least 14 years old can consent to voluntary inpatient treatment.

-

How long does a 302 stay on your record in PA?

How Long Does a 302 Stay on Your Record? Generally, a 302 commitment stays on your record for the rest of your life. Your attorney can petition the court to have it removed from your record in some cases.

-

What is Act 67 in PA?

Under Act 67, school entities and non-public schools may only authorize school employees or contractors who meet the definition of "school security personnel"—SPOs, SROs, and school security guards—to carry firearms while performing their school duties.

-

What is the 2021 PA income tax rate?

Overview. Pennsylvania personal income tax is levied at the rate of 3.07 percent against taxable income of resident and nonresident individuals, estates, trusts, partnerships, S corporations, business trusts and limited liability companies not federally taxed as corporations.

-

What is Act 65 in PA?

Act 65 - ALLOWING MINORS TO CONSENT TO MEDICAL CARE - MENTAL HEALTH TREATMENT AND RELEASE OF MEDICAL RECORDS.

-

What is the Pennsylvania Property Rights Protection Act?

These sections of the new Eminent Domain Code have been called the Property Rights Protection Act. Pennsylvania Government entities are severely restricted in any effort which would take private property to transfer that ownership to a different private entity.

Get more for Pa

- Phone 650 372 6200 fax 650 627 8244 form

- Introduction to avatar san mateo county health form

- Change name form

- Body art practitioner registration application form san

- Office of small business assistance home palm beach county form

- Housing discrimination complaint questionnaire palm form

- Housing discrimination complaint questionnaire form

- Homeschool completion affidavit form

Find out other Pa

- Help Me With Electronic signature Indiana Direct Deposit Enrollment Form

- Electronic signature Iowa Overtime Authorization Form Online

- Electronic signature Illinois Employee Appraisal Form Simple

- Electronic signature West Virginia Business Ethics and Conduct Disclosure Statement Free

- Electronic signature Alabama Disclosure Notice Simple

- Electronic signature Massachusetts Disclosure Notice Free

- Electronic signature Delaware Drug Testing Consent Agreement Easy

- Electronic signature North Dakota Disclosure Notice Simple

- Electronic signature California Car Lease Agreement Template Free

- How Can I Electronic signature Florida Car Lease Agreement Template

- Electronic signature Kentucky Car Lease Agreement Template Myself

- Electronic signature Texas Car Lease Agreement Template Easy

- Electronic signature New Mexico Articles of Incorporation Template Free

- Electronic signature New Mexico Articles of Incorporation Template Easy

- Electronic signature Oregon Articles of Incorporation Template Simple

- eSignature Montana Direct Deposit Enrollment Form Easy

- How To Electronic signature Nevada Acknowledgement Letter

- Electronic signature New Jersey Acknowledgement Letter Free

- Can I eSignature Oregon Direct Deposit Enrollment Form

- Electronic signature Colorado Attorney Approval Later