Pa Estimated Tax Form Fill Out and Sign Printable PDF 2022

What is the Pennsylvania Estimated Tax Form?

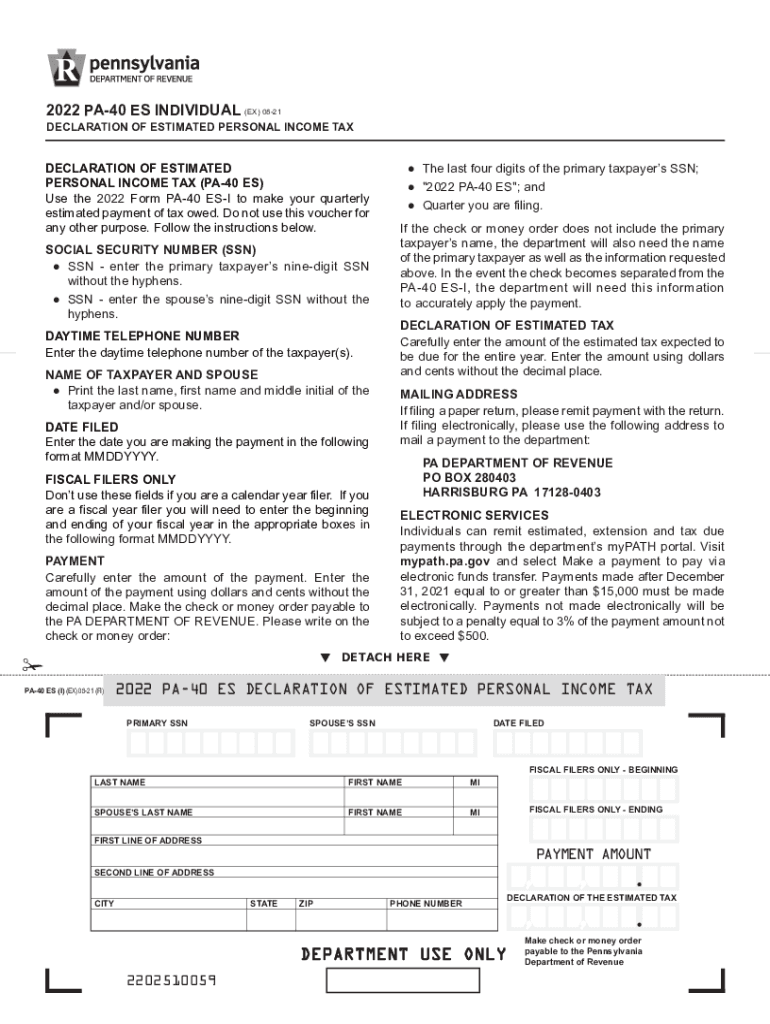

The Pennsylvania estimated tax form is a document used by individuals and businesses to report and pay estimated income tax to the state. This form is essential for taxpayers who expect to owe tax of $500 or more when they file their annual return. The form allows taxpayers to make quarterly payments based on their expected income, ensuring they meet their tax obligations throughout the year. The form is officially known as the PA-40 ES and is specifically designed for estimated tax payments.

Steps to Complete the Pennsylvania Estimated Tax Form

Completing the Pennsylvania estimated tax form involves several key steps:

- Gather necessary financial information, including income sources and deductions.

- Calculate your expected annual income and tax liability.

- Determine the amount of estimated tax you need to pay for each quarter.

- Fill out the PA-40 ES form with your calculated figures.

- Review the form for accuracy before submission.

Following these steps will help ensure that you accurately report your estimated tax payments and avoid penalties for underpayment.

Filing Deadlines / Important Dates

It is crucial to be aware of the filing deadlines for the Pennsylvania estimated tax form to avoid penalties. The estimated tax payments are typically due on the following dates:

- April 15 for the first quarter

- June 15 for the second quarter

- September 15 for the third quarter

- January 15 of the following year for the fourth quarter

Taxpayers should ensure that payments are made on or before these dates to remain compliant with state tax regulations.

Legal Use of the Pennsylvania Estimated Tax Form

The Pennsylvania estimated tax form is legally binding when completed accurately and submitted on time. Compliance with state tax laws requires taxpayers to make estimated payments if they expect to owe a certain amount when filing their annual return. Failure to submit the form or make the required payments can result in penalties and interest charges. Therefore, it is essential to understand the legal implications of using the PA-40 ES form and to ensure all information provided is truthful and accurate.

Who Issues the Pennsylvania Estimated Tax Form?

The Pennsylvania Department of Revenue is responsible for issuing the estimated tax form. This state agency oversees the collection of taxes and ensures compliance with tax laws. Taxpayers can obtain the PA-40 ES form directly from the Department of Revenue's website or through authorized tax preparation services. Understanding the issuing authority helps taxpayers know where to seek assistance or clarification regarding the form.

Examples of Using the Pennsylvania Estimated Tax Form

There are various scenarios in which individuals or businesses may need to use the Pennsylvania estimated tax form:

- Self-employed individuals who do not have taxes withheld from their income.

- Freelancers who earn income from multiple clients throughout the year.

- Investors who receive significant dividends or capital gains.

- Small business owners who anticipate owing state taxes based on their business income.

Each of these examples illustrates the importance of accurately estimating tax liabilities to avoid penalties and ensure compliance with state regulations.

Quick guide on how to complete pa estimated tax form fill out and sign printable pdf

Effortlessly prepare Pa Estimated Tax Form Fill Out And Sign Printable PDF on any device

Digital document management has gained tremendous popularity among organizations and individuals alike. It offers a perfect eco-conscious alternative to traditional printed forms, as you can easily find the appropriate template and securely store it online. airSlate SignNow furnishes you with all the tools required to create, modify, and electronically sign your documents swiftly without any holdups. Manage Pa Estimated Tax Form Fill Out And Sign Printable PDF on any device using airSlate SignNow’s Android or iOS applications and enhance any document-related process today.

The easiest way to alter and electronically sign Pa Estimated Tax Form Fill Out And Sign Printable PDF with ease

- Find Pa Estimated Tax Form Fill Out And Sign Printable PDF and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize important sections of the documents or redact sensitive information with tools specifically provided by airSlate SignNow.

- Generate your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Verify all details and click on the Done button to save your revisions.

- Choose how you wish to distribute your form, via email, SMS, or invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form hunting, or errors that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Pa Estimated Tax Form Fill Out And Sign Printable PDF to ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct pa estimated tax form fill out and sign printable pdf

Create this form in 5 minutes!

People also ask

-

What is the Pennsylvania estimated tax form?

The Pennsylvania estimated tax form is used by individuals and businesses to estimate and pay state income taxes throughout the year. This form is essential for those who earn income not subject to withholding, ensuring compliance with Pennsylvania tax regulations.

-

How can airSlate SignNow help with Pennsylvania estimated tax forms?

AirSlate SignNow streamlines the process of filling out and signing Pennsylvania estimated tax forms by providing a user-friendly interface for electronic signatures. This makes it easy to complete and submit your forms accurately and on time, enhancing your overall filing experience.

-

Are there any costs associated with using airSlate SignNow for Pennsylvania estimated tax forms?

AirSlate SignNow offers a cost-effective solution for managing Pennsylvania estimated tax forms, with various pricing plans to suit different business needs. You can choose from flexible subscriptions that provide access to all the essential features needed for efficient document management.

-

What features does airSlate SignNow offer for Pennsylvania estimated tax form submissions?

AirSlate SignNow offers features like customizable templates, secure eSignatures, and automated reminders for Pennsylvania estimated tax form submissions. These tools help you maintain organization and ensure you never miss a deadline for your tax payments.

-

Can I integrate airSlate SignNow with other tools for managing Pennsylvania estimated tax forms?

Yes, airSlate SignNow offers integration with various third-party applications and services that enhance document management. This functionality allows you to streamline your workflow and connect with your existing financial tools when working with Pennsylvania estimated tax forms.

-

Is it safe to use airSlate SignNow for sensitive tax documents like Pennsylvania estimated tax forms?

Absolutely! AirSlate SignNow prioritizes security, utilizing encryption and compliance with industry standards to protect your sensitive information. When you use airSlate SignNow for your Pennsylvania estimated tax forms, you can be confident that your data is safe and secure.

-

How can airSlate SignNow improve my efficiency in filing Pennsylvania estimated tax forms?

By leveraging airSlate SignNow’s automated features and easy-to-navigate interface, you can signNowly reduce the time spent on filing Pennsylvania estimated tax forms. This efficiency allows you to focus on other important business tasks while ensuring that your tax obligations are met promptly.

Get more for Pa Estimated Tax Form Fill Out And Sign Printable PDF

- Final decree of dissolution of marriage with children new mexico form

- Petition establish form

- New mexico decree 497320108 form

- Nm withholding form

- Mutual wills containing last will and testaments for unmarried persons living together with no children new mexico form

- Mutual wills package of last wills and testaments for unmarried persons living together with adult children new mexico form

- Mutual wills or last will and testaments for unmarried persons living together with minor children new mexico form

- Non marital cohabitation living together agreement new mexico form

Find out other Pa Estimated Tax Form Fill Out And Sign Printable PDF

- Electronic signature Texas Time Off Policy Later

- Electronic signature Texas Time Off Policy Free

- eSignature Delaware Time Off Policy Online

- Help Me With Electronic signature Indiana Direct Deposit Enrollment Form

- Electronic signature Iowa Overtime Authorization Form Online

- Electronic signature Illinois Employee Appraisal Form Simple

- Electronic signature West Virginia Business Ethics and Conduct Disclosure Statement Free

- Electronic signature Alabama Disclosure Notice Simple

- Electronic signature Massachusetts Disclosure Notice Free

- Electronic signature Delaware Drug Testing Consent Agreement Easy

- Electronic signature North Dakota Disclosure Notice Simple

- Electronic signature California Car Lease Agreement Template Free

- How Can I Electronic signature Florida Car Lease Agreement Template

- Electronic signature Kentucky Car Lease Agreement Template Myself

- Electronic signature Texas Car Lease Agreement Template Easy

- Electronic signature New Mexico Articles of Incorporation Template Free

- Electronic signature New Mexico Articles of Incorporation Template Easy

- Electronic signature Oregon Articles of Incorporation Template Simple

- eSignature Montana Direct Deposit Enrollment Form Easy

- How To Electronic signature Nevada Acknowledgement Letter