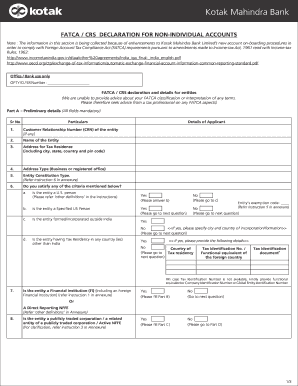

Bank Fatca Non Individual Form

What is the Bank Fatca Non Individual Form

The Bank Fatca Non Individual Form is a crucial document designed for non-individual entities, such as corporations, partnerships, and trusts, to comply with the Foreign Account Tax Compliance Act (FATCA). This form is essential for financial institutions to report information about foreign financial accounts held by U.S. taxpayers. By completing this form, non-individual entities disclose their tax status and ensure compliance with U.S. tax regulations, helping to prevent tax evasion.

How to use the Bank Fatca Non Individual Form

Using the Bank Fatca Non Individual Form involves several key steps. First, gather all necessary information regarding the entity's financial accounts and tax status. Next, accurately fill out the form, ensuring that all details are correct and complete. Once the form is filled out, it should be submitted to the relevant financial institution or tax authority as required. It is important to keep a copy of the completed form for your records, as it may be needed for future reference or audits.

Steps to complete the Bank Fatca Non Individual Form

Completing the Bank Fatca Non Individual Form requires careful attention to detail. Follow these steps for successful completion:

- Gather necessary documentation, including the entity's tax identification number and financial account details.

- Provide accurate information about the entity's ownership structure and tax classification.

- Review the form for accuracy, ensuring all fields are filled out correctly.

- Sign and date the form, confirming that the information provided is true and complete.

- Submit the form to the appropriate financial institution or regulatory body.

Legal use of the Bank Fatca Non Individual Form

The legal use of the Bank Fatca Non Individual Form is governed by U.S. tax laws and international agreements. This form must be completed accurately to ensure compliance with FATCA regulations. Failure to provide accurate information can lead to penalties, including withholding taxes on certain payments. It is essential to understand the legal implications of the information provided and to maintain compliance with all applicable laws.

Required Documents

When completing the Bank Fatca Non Individual Form, several documents may be required to ensure accurate reporting. These documents typically include:

- The entity's tax identification number (TIN).

- Financial account statements from foreign financial institutions.

- Proof of the entity's formation and tax classification.

- Any relevant agreements or contracts that may affect the entity's tax status.

Form Submission Methods

The Bank Fatca Non Individual Form can be submitted through various methods, depending on the requirements of the financial institution or tax authority. Common submission methods include:

- Online submission through the financial institution's secure portal.

- Mailing a physical copy of the form to the designated address.

- In-person submission at a local branch or office of the financial institution.

Quick guide on how to complete bank fatca non individual form

Effortlessly Prepare Bank Fatca Non Individual Form on Any Device

Digital document management has gained traction among companies and individuals. It presents an excellent eco-friendly substitute for traditional printed and signed documents, as you can find the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents swiftly without delays. Manage Bank Fatca Non Individual Form on any platform with airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to Edit and eSign Bank Fatca Non Individual Form with Ease

- Find Bank Fatca Non Individual Form and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight important sections of your documents or obscure sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a standard wet ink signature.

- Review all the information and then click on the Done button to preserve your changes.

- Select your preferred method to submit your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or errors that necessitate reprinting new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you choose. Edit and eSign Bank Fatca Non Individual Form to ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the bank FATCA declaration non individual form?

The bank FATCA declaration non individual form is a document required for non-individual entities to report their foreign financial accounts under the Foreign Account Tax Compliance Act (FATCA). This form is crucial for ensuring compliance with international tax regulations and helps prevent tax evasion by providing transparency about foreign assets.

-

How can airSlate SignNow help with the bank FATCA declaration non individual form?

airSlate SignNow simplifies the process of completing the bank FATCA declaration non individual form by providing a user-friendly platform for document creation and e-signature. Our solution ensures that all your forms are completed accurately and securely, making compliance effortless and efficient.

-

What are the costs associated with using airSlate SignNow for the bank FATCA declaration non individual form?

airSlate SignNow offers competitive pricing plans designed to suit businesses of all sizes, making it affordable to manage your bank FATCA declaration non individual form efficiently. We also offer a free trial, allowing you to explore our features and see the value before committing.

-

Is there any integration support for the bank FATCA declaration non individual form?

Yes, airSlate SignNow seamlessly integrates with various platforms, enhancing your workflow for handling the bank FATCA declaration non individual form. Whether you're using CRM systems, Cloud storage, or bookkeeping software, our integrations ensure that your processes stay connected and efficient.

-

What are the benefits of using airSlate SignNow for the bank FATCA declaration non individual form?

By using airSlate SignNow for the bank FATCA declaration non individual form, you gain efficiency, security, and compliance assurance in your document management. Our platform helps you save time by automating workflows and ensures that your documents are signed electronically, promoting a paperless office environment.

-

Is it safe to use airSlate SignNow for the bank FATCA declaration non individual form?

Absolutely! airSlate SignNow prioritizes the security of your documents, including the bank FATCA declaration non individual form. Our platform employs advanced encryption and compliance with international security standards to ensure that your sensitive information is protected.

-

Can I edit the bank FATCA declaration non individual form after sending it through airSlate SignNow?

Yes, you can edit the bank FATCA declaration non individual form even after initiating the sending process. airSlate SignNow offers features that allow you to manage your documents flexibly, ensuring any necessary changes can be made without hassle.

Get more for Bank Fatca Non Individual Form

- Disclosure of ownership form texas clia

- Medical marijuana identification card cdph form 9042

- An initial application cdph 283b california department of form

- Please complete this form fully incomplete applications will be returned cdph ca

- Dmh rendering provider form

- Vending machine license form

- A0448 live scan form

- Aries client sharenon share consent form cdph 8693 pdf cdph ca

Find out other Bank Fatca Non Individual Form

- How To Sign Alabama Construction PDF

- How To Sign Connecticut Construction Document

- How To Sign Iowa Construction Presentation

- How To Sign Arkansas Doctors Document

- How Do I Sign Florida Doctors Word

- Can I Sign Florida Doctors Word

- How Can I Sign Illinois Doctors PPT

- How To Sign Texas Doctors PDF

- Help Me With Sign Arizona Education PDF

- How To Sign Georgia Education Form

- How To Sign Iowa Education PDF

- Help Me With Sign Michigan Education Document

- How Can I Sign Michigan Education Document

- How Do I Sign South Carolina Education Form

- Can I Sign South Carolina Education Presentation

- How Do I Sign Texas Education Form

- How Do I Sign Utah Education Presentation

- How Can I Sign New York Finance & Tax Accounting Document

- How Can I Sign Ohio Finance & Tax Accounting Word

- Can I Sign Oklahoma Finance & Tax Accounting PPT