Homestead or Property Tax Refund for Homeowners Forms 2020

What is the Kansas Homestead Refund?

The Kansas homestead refund is a program designed to provide financial relief to homeowners who meet specific eligibility criteria. This refund aims to assist individuals and families by returning a portion of property taxes paid on their primary residence. The program is particularly beneficial for low-income households, seniors, and disabled individuals, allowing them to maintain homeownership while alleviating some of the financial burdens associated with property taxes.

Eligibility Criteria for the Kansas Homestead Refund

To qualify for the Kansas homestead refund, applicants must meet certain requirements. These include:

- Being a resident of Kansas and owning a home that serves as their primary residence.

- Meeting income limits set by the state, which can vary based on household size.

- Being at least 55 years old, disabled, or a surviving spouse of a qualified individual.

It is essential to review the specific income thresholds and other eligibility factors to determine if you qualify for the refund.

Steps to Complete the Kansas Homestead Refund Form

Filling out the Kansas homestead refund form involves several key steps:

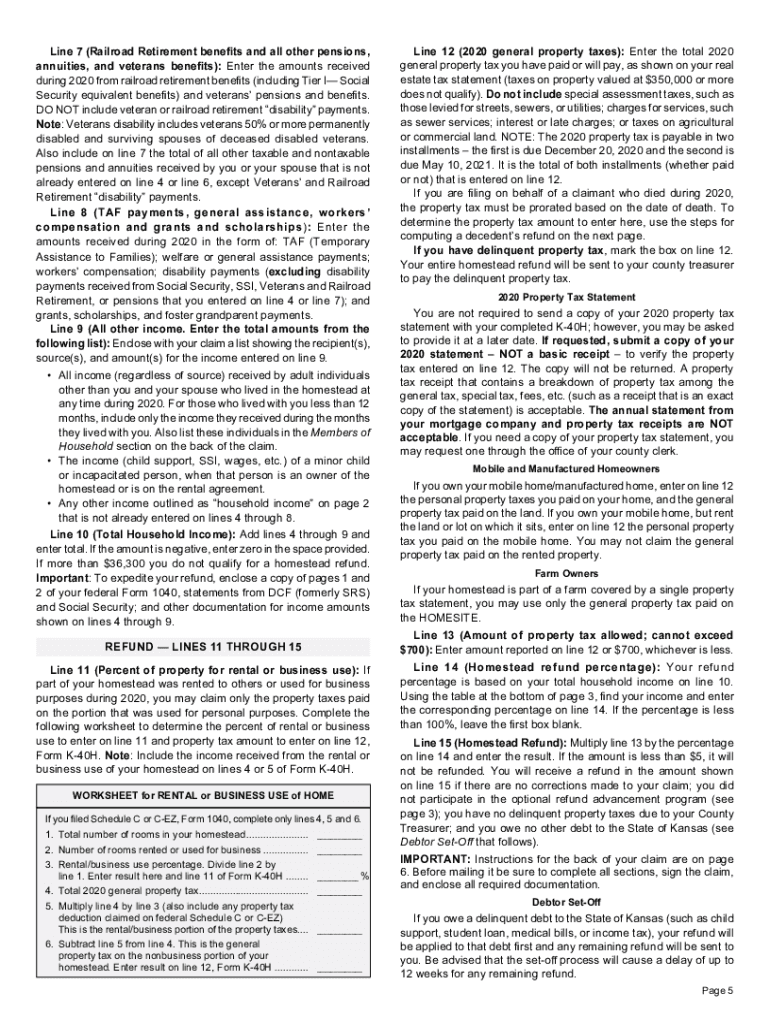

- Gather necessary documentation, including proof of income and property tax statements.

- Obtain the homestead refund application form, which can be downloaded or requested from the appropriate state agency.

- Carefully fill out the form, ensuring all required information is accurate and complete.

- Sign and date the form to certify the information provided.

- Submit the completed form by the specified deadline, either online or via mail.

Following these steps will help ensure that your application is processed smoothly and efficiently.

Form Submission Methods for the Kansas Homestead Refund

Applicants can submit the Kansas homestead refund form through various methods:

- Online Submission: Some applicants may have the option to complete and submit the form electronically through the state’s official website.

- Mail: Completed forms can be printed and sent via postal mail to the designated agency.

- In-Person: Individuals may also choose to submit their applications in person at local government offices.

Each submission method has its own advantages, so applicants should choose the one that best suits their needs.

Required Documents for the Kansas Homestead Refund

When applying for the Kansas homestead refund, certain documents are essential to support your application:

- Proof of income, such as tax returns or pay stubs.

- Property tax statements showing the amount paid for the previous year.

- Identification documents, which may include a driver’s license or Social Security card.

Having these documents ready will facilitate a smoother application process and help ensure that all necessary information is provided.

Filing Deadlines for the Kansas Homestead Refund

It is crucial to be aware of the filing deadlines for the Kansas homestead refund to ensure your application is considered. Typically, applications must be submitted by April 15 of the year following the tax year for which the refund is being claimed. However, it is advisable to check for any updates or changes to these deadlines each year, as they can vary.

Quick guide on how to complete 2017 homestead or property tax refund for homeowners forms

Complete Homestead Or Property Tax Refund For Homeowners Forms effortlessly on any device

Online document management has gained immense traction among companies and individuals. It offers an ideal eco-friendly substitute to traditional printed and signed agreements, as you can easily find the necessary form and securely store it online. airSlate SignNow provides you with all the tools you need to create, modify, and eSign your documents quickly without interruptions. Manage Homestead Or Property Tax Refund For Homeowners Forms on any platform with airSlate SignNow's Android or iOS applications and enhance any document-based task today.

How to modify and eSign Homestead Or Property Tax Refund For Homeowners Forms without any hassle

- Find Homestead Or Property Tax Refund For Homeowners Forms and click on Get Form to begin.

- Use the tools we provide to fill out your form.

- Highlight important sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and has the same legal validity as a traditional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose your preferred method of sending your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choosing. Modify and eSign Homestead Or Property Tax Refund For Homeowners Forms and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2017 homestead or property tax refund for homeowners forms

Create this form in 5 minutes!

People also ask

-

What is the Kansas homestead refund program?

The Kansas homestead refund program provides financial assistance to eligible homeowners, allowing them to recover a portion of their property taxes. This program is designed to support low-income residents and is crucial for those looking to ease their financial burden. Understanding the details can help you determine if you qualify for a Kansas homestead refund.

-

How do I apply for the Kansas homestead refund?

To apply for the Kansas homestead refund, you need to fill out the appropriate form available from the Kansas Department of Revenue. Make sure to gather all necessary documentation regarding your home's value and income status. Submitting your application accurately can optimize your chances of receiving the Kansas homestead refund.

-

What are the eligibility requirements for the Kansas homestead refund?

Eligibility for the Kansas homestead refund generally includes being a homeowner, having an adjusted gross income below a certain threshold, and living in the home as your primary residence. Different factors may affect individual eligibility, so it's essential to review the criteria thoroughly. Meeting these requirements is crucial for accessing the Kansas homestead refund.

-

How long does it take to receive the Kansas homestead refund?

The time it takes to receive your Kansas homestead refund can vary based on processing times and individual circumstances. Typically, once your application is approved, funds may be issued within a few weeks to a couple of months. Keeping your contact information updated can help facilitate a faster response regarding your Kansas homestead refund.

-

Is there a cost associated with applying for the Kansas homestead refund?

There is no application fee for the Kansas homestead refund; however, ensuring that all the required documents are correctly submitted may require some time and effort. It's a free service provided by the state of Kansas aimed at alleviating property tax burdens. Taking advantage of the Kansas homestead refund can signNowly benefit eligible homeowners.

-

Can I receive assistance with the application process for the Kansas homestead refund?

Yes, various local organizations and government offices offer assistance to individuals applying for the Kansas homestead refund. They can provide guidance on filling out your application and ensure that you meet all eligibility criteria. Seeking help can streamline your experience and increase the chances of a successful application for the Kansas homestead refund.

-

Are there benefits to the Kansas homestead refund aside from financial relief?

In addition to financial relief, the Kansas homestead refund can provide peace of mind and security for homeowners struggling with property taxes. This support can help you focus on other financial responsibilities, reduce stress, and improve overall quality of life. Understanding these benefits can enhance your appreciation for the Kansas homestead refund.

Get more for Homestead Or Property Tax Refund For Homeowners Forms

- Apd 29 form

- Application for license to carry a concealed umatilla county form

- Reston teen center participant registration form life ticket church

- Netl f 1421 1a form

- Netl f 142 1 1a form

- Cpuc form pl739b

- The california solar mandate rolls out in 2020 heres how form

- Cec nrcc sra 01 e revised 0815 energy ca form

Find out other Homestead Or Property Tax Refund For Homeowners Forms

- Sign Delaware High Tech Rental Lease Agreement Online

- Sign Connecticut High Tech Lease Template Easy

- How Can I Sign Louisiana High Tech LLC Operating Agreement

- Sign Louisiana High Tech Month To Month Lease Myself

- How To Sign Alaska Insurance Promissory Note Template

- Sign Arizona Insurance Moving Checklist Secure

- Sign New Mexico High Tech Limited Power Of Attorney Simple

- Sign Oregon High Tech POA Free

- Sign South Carolina High Tech Moving Checklist Now

- Sign South Carolina High Tech Limited Power Of Attorney Free

- Sign West Virginia High Tech Quitclaim Deed Myself

- Sign Delaware Insurance Claim Online

- Sign Delaware Insurance Contract Later

- Sign Hawaii Insurance NDA Safe

- Sign Georgia Insurance POA Later

- How Can I Sign Alabama Lawers Lease Agreement

- How Can I Sign California Lawers Lease Agreement

- Sign Colorado Lawers Operating Agreement Later

- Sign Connecticut Lawers Limited Power Of Attorney Online

- Sign Hawaii Lawers Cease And Desist Letter Easy