Homestead or Property Tax Refund for Homeowners Instruction Booklet and Forms Rev 8 21 the Homestead Claim K 40H Allows a Rebate 2021

Understanding the Kansas Homestead Refund

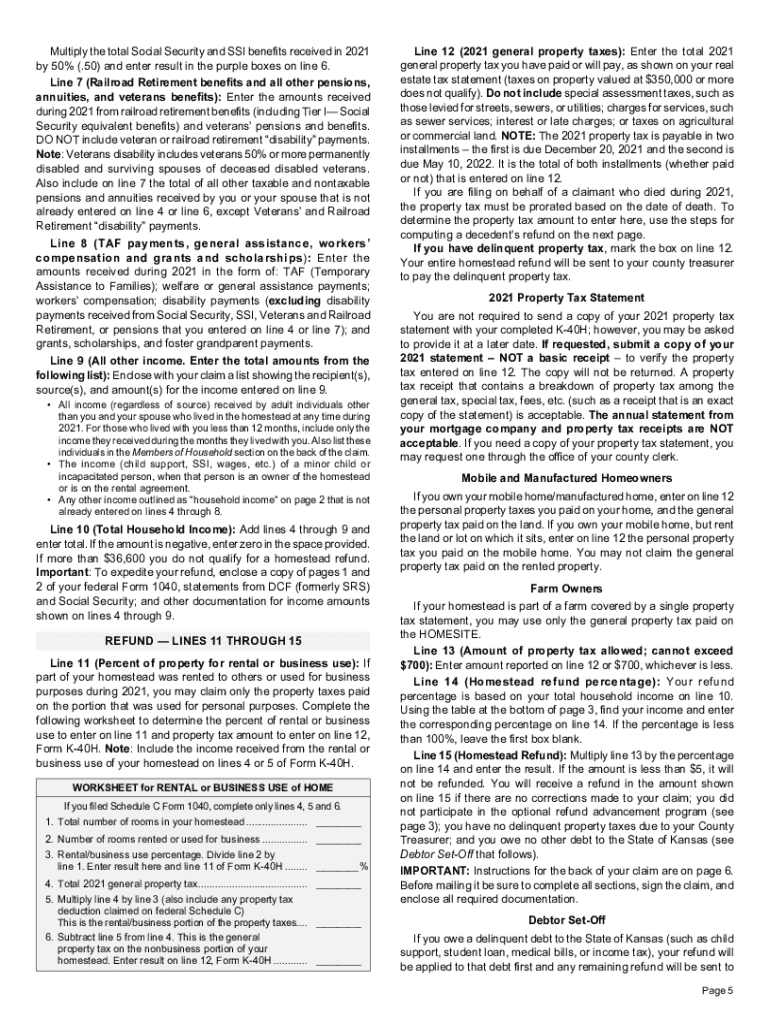

The Kansas Homestead Refund, formally known as the Homestead Claim K-40H, is designed to provide financial relief to homeowners by offering a rebate on a portion of the property taxes they have paid. This program is especially beneficial for low-income residents, seniors, and individuals with disabilities who own their homes. A homestead is defined as the primary residence of an individual, which can include houses, mobile homes, or manufactured homes. The goal of this refund is to alleviate the financial burden of property taxes, making homeownership more accessible for Kansas residents.

Eligibility Criteria for the Kansas Homestead Refund

To qualify for the Kansas Homestead Refund, applicants must meet specific eligibility requirements. These include:

- Being a resident of Kansas and owning a homestead.

- Meeting income thresholds set by the state, which may vary based on household size.

- Filing the appropriate Homestead Claim K-40H form by the designated deadline.

- Providing necessary documentation, such as proof of income and property tax payments.

It is essential for applicants to review the latest guidelines to ensure they meet all criteria before submitting their claims.

Steps to Complete the Homestead Claim K-40H

Filling out the Homestead Claim K-40H form involves several steps to ensure accurate submission and processing. Here’s a simplified guide:

- Gather necessary documents, including proof of income and property tax statements.

- Obtain the Homestead Claim K-40H form from the Kansas Department of Revenue website or local tax office.

- Complete the form, ensuring all sections are filled out accurately.

- Submit the completed form by mail or in person to the appropriate county appraiser's office.

Following these steps carefully can help avoid delays in processing your refund.

Required Documents for Submission

When applying for the Kansas Homestead Refund, certain documents must be included to support your claim. These documents typically include:

- Proof of income, such as tax returns or pay stubs.

- Property tax statements showing the amount paid.

- Identification documents, which may include a driver's license or state ID.

Ensuring that all required documents are submitted can streamline the approval process and enhance the likelihood of receiving the refund.

Filing Deadlines for the Kansas Homestead Refund

Timely submission of the Homestead Claim K-40H is critical for receiving the refund. The filing deadlines are generally set by the Kansas Department of Revenue. Typically, the deadline for submitting the claim is April 15 of the year following the tax year for which the refund is being claimed. It is advisable to check the official guidelines for any updates or changes to these dates.

Digital vs. Paper Submission of the Homestead Claim

Applicants have the option to submit their Homestead Claim K-40H form either digitally or via paper. Digital submission may offer benefits such as faster processing times and ease of tracking. However, some individuals may prefer paper submission for various reasons, including familiarity with the process or lack of access to digital tools. Regardless of the method chosen, ensuring that the form is completed accurately is essential for a successful claim.

Quick guide on how to complete 2021 homestead or property tax refund for homeowners instruction booklet and forms rev 8 21 the homestead claim k 40h allows a

Complete Homestead Or Property Tax Refund For Homeowners Instruction Booklet And Forms Rev 8 21 The Homestead Claim K 40H Allows A Rebate effortlessly on any device

Online document management has become increasingly favored by businesses and individuals. It offers an ideal environmentally friendly substitute for traditional printed and signed documents, enabling you to find the appropriate form and securely keep it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your files swiftly without interruptions. Manage Homestead Or Property Tax Refund For Homeowners Instruction Booklet And Forms Rev 8 21 The Homestead Claim K 40H Allows A Rebate from any device using airSlate SignNow Android or iOS applications and streamline any document-related process today.

The easiest way to adjust and eSign Homestead Or Property Tax Refund For Homeowners Instruction Booklet And Forms Rev 8 21 The Homestead Claim K 40H Allows A Rebate with ease

- Find Homestead Or Property Tax Refund For Homeowners Instruction Booklet And Forms Rev 8 21 The Homestead Claim K 40H Allows A Rebate and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature with the Sign feature, which takes just moments and carries the same legal validity as a conventional wet ink signature.

- Review the information and then click the Done button to save your modifications.

- Choose your delivery method for your form: via email, SMS, invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from your preferred device. Modify and eSign Homestead Or Property Tax Refund For Homeowners Instruction Booklet And Forms Rev 8 21 The Homestead Claim K 40H Allows A Rebate and ensure excellent communication at any stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2021 homestead or property tax refund for homeowners instruction booklet and forms rev 8 21 the homestead claim k 40h allows a

Create this form in 5 minutes!

How to create an eSignature for the 2021 homestead or property tax refund for homeowners instruction booklet and forms rev 8 21 the homestead claim k 40h allows a

The best way to make an electronic signature for a PDF document online

The best way to make an electronic signature for a PDF document in Google Chrome

The best way to generate an e-signature for signing PDFs in Gmail

The way to create an electronic signature straight from your smart phone

How to generate an e-signature for a PDF document on iOS

The way to create an electronic signature for a PDF document on Android OS

People also ask

-

What is the kansas homestead refund?

The Kansas homestead refund is a program designed to provide financial relief to homeowners in Kansas. It allows eligible residents to receive a refund of property taxes based on income and home value, helping to alleviate housing costs.

-

How do I qualify for the kansas homestead refund?

To qualify for the Kansas homestead refund, you must meet certain criteria, including being a resident of Kansas, meeting income limits, and owning or renting your home. It's important to review the specific guidelines to determine your eligibility.

-

How can airSlate SignNow help with the kansas homestead refund process?

airSlate SignNow streamlines the process of submitting documents for the Kansas homestead refund. With its easy-to-use eSign features, you can quickly sign and send required forms without the hassle of printing and mailing.

-

What documents are needed for the kansas homestead refund?

For the Kansas homestead refund, you typically need to provide proof of income, property tax statements, and identification. Using airSlate SignNow, you can securely manage and send these documents electronically.

-

Is there a fee to apply for the kansas homestead refund?

There is no application fee to apply for the Kansas homestead refund, but you may incur standard costs related to document submission. airSlate SignNow offers a cost-effective solution for managing and sending your application securely.

-

How long does it take to receive the kansas homestead refund?

The processing time for the Kansas homestead refund can vary based on several factors, but it generally takes a few weeks after your application is processed. Ensuring your documents are submitted correctly using airSlate SignNow can help expedite the process.

-

Can I track my kansas homestead refund application status?

While tracking your Kansas homestead refund application status may vary by county, you can typically confirm your application through the local housing office. airSlate SignNow's audit trail feature helps you keep track of when your documents were signed and sent.

Get more for Homestead Or Property Tax Refund For Homeowners Instruction Booklet And Forms Rev 8 21 The Homestead Claim K 40H Allows A Rebate

Find out other Homestead Or Property Tax Refund For Homeowners Instruction Booklet And Forms Rev 8 21 The Homestead Claim K 40H Allows A Rebate

- Sign New York Plumbing Cease And Desist Letter Free

- Sign Alabama Real Estate Quitclaim Deed Free

- How Can I Sign Alabama Real Estate Affidavit Of Heirship

- Can I Sign Arizona Real Estate Confidentiality Agreement

- How Do I Sign Arizona Real Estate Memorandum Of Understanding

- Sign South Dakota Plumbing Job Offer Later

- Sign Tennessee Plumbing Business Letter Template Secure

- Sign South Dakota Plumbing Emergency Contact Form Later

- Sign South Dakota Plumbing Emergency Contact Form Myself

- Help Me With Sign South Dakota Plumbing Emergency Contact Form

- How To Sign Arkansas Real Estate Confidentiality Agreement

- Sign Arkansas Real Estate Promissory Note Template Free

- How Can I Sign Arkansas Real Estate Operating Agreement

- Sign Arkansas Real Estate Stock Certificate Myself

- Sign California Real Estate IOU Safe

- Sign Connecticut Real Estate Business Plan Template Simple

- How To Sign Wisconsin Plumbing Cease And Desist Letter

- Sign Colorado Real Estate LLC Operating Agreement Simple

- How Do I Sign Connecticut Real Estate Operating Agreement

- Sign Delaware Real Estate Quitclaim Deed Secure