CE 5 Petition for Abatement Collectability for Businesses Rev 5 18 Petition for Abatement 2018

What is the CE 5 Petition For Abatement Collectability For Businesses Rev 5 18 Petition For Abatement

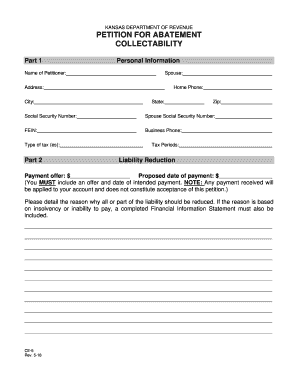

The CE 5 Petition For Abatement Collectability For Businesses Rev 5 18 is a formal request submitted by businesses to seek relief from certain tax liabilities. This petition is specifically designed to address issues related to the collectability of taxes owed, allowing businesses to present their financial circumstances to the tax authority. By doing so, they can potentially reduce or eliminate their tax obligations based on their current financial situation.

Steps to complete the CE 5 Petition For Abatement Collectability For Businesses Rev 5 18 Petition For Abatement

Completing the CE 5 Petition For Abatement requires careful attention to detail. Here are the essential steps:

- Gather necessary financial documents, including income statements and balance sheets.

- Clearly outline the reasons for the petition, detailing why the tax liability is uncollectible.

- Fill out the CE 5 form accurately, ensuring all required fields are completed.

- Review the petition for any errors or omissions before submission.

- Submit the completed form to the appropriate tax authority, either online or via mail.

Key elements of the CE 5 Petition For Abatement Collectability For Businesses Rev 5 18 Petition For Abatement

Understanding the key elements of the CE 5 Petition is crucial for successful submission. Important components include:

- Business Information: Name, address, and tax identification number of the business.

- Tax Liability Details: Specific amounts owed and the tax periods in question.

- Financial Condition: A comprehensive overview of the business's financial status, including income and expenses.

- Supporting Documentation: Attachments that validate the claims made in the petition, such as financial statements.

Legal use of the CE 5 Petition For Abatement Collectability For Businesses Rev 5 18 Petition For Abatement

The legal use of the CE 5 Petition is governed by tax laws and regulations. Businesses must ensure that their petitions comply with relevant state and federal guidelines. This form serves as a legal request for reconsideration of tax liabilities and must be completed with accuracy to be considered valid. Proper legal representation or advice may be beneficial to navigate the complexities of tax law associated with this petition.

Filing Deadlines / Important Dates

Filing deadlines for the CE 5 Petition can vary based on the specific tax authority and the nature of the tax liability. It is essential for businesses to be aware of these deadlines to ensure timely submission. Generally, petitions should be filed as soon as the business becomes aware of its inability to pay the owed taxes. Failure to file within the designated timeframe may result in penalties or denial of the petition.

Eligibility Criteria

To qualify for submitting the CE 5 Petition, businesses must meet certain eligibility criteria. This typically includes demonstrating financial hardship or an inability to pay the tax liabilities in full. Additionally, businesses must be in compliance with all other tax obligations and have filed all required tax returns. Understanding these criteria is crucial for ensuring that the petition stands a strong chance of approval.

Quick guide on how to complete ce 5 petition for abatement collectability for businesses rev 5 18 petition for abatement

Complete CE 5 Petition For Abatement Collectability For Businesses Rev 5 18 Petition For Abatement effortlessly on any device

Digital document management has gained signNow traction among businesses and individuals. It offers an excellent environmentally friendly substitute to conventional printed and signed paperwork, allowing you to access the necessary form and securely keep it online. airSlate SignNow equips you with all the resources you need to create, modify, and eSign your documents quickly without delays. Manage CE 5 Petition For Abatement Collectability For Businesses Rev 5 18 Petition For Abatement on any platform using airSlate SignNow Android or iOS applications and enhance any document-driven process today.

The easiest method to modify and eSign CE 5 Petition For Abatement Collectability For Businesses Rev 5 18 Petition For Abatement seamlessly

- Obtain CE 5 Petition For Abatement Collectability For Businesses Rev 5 18 Petition For Abatement and click on Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize important sections of the documents or redact sensitive information using tools that airSlate SignNow specifically provides for this purpose.

- Generate your eSignature with the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Verify all the information and click on the Done button to save your modifications.

- Choose how you would like to send your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or mistakes that necessitate reprinting document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and eSign CE 5 Petition For Abatement Collectability For Businesses Rev 5 18 Petition For Abatement while ensuring exceptional communication throughout your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct ce 5 petition for abatement collectability for businesses rev 5 18 petition for abatement

Create this form in 5 minutes!

People also ask

-

What is the CE 5 Petition For Abatement Collectability For Businesses Rev 5 18 Petition For Abatement?

The CE 5 Petition For Abatement Collectability For Businesses Rev 5 18 Petition For Abatement is a formal request used by businesses to appeal for an abatement in tax penalties or liabilities. This petition provides a structured format that helps streamline the submission process, ensuring that businesses can effectively present their case to tax authorities.

-

How can airSlate SignNow help with the CE 5 Petition For Abatement Collectability?

airSlate SignNow simplifies the process of completing and submitting the CE 5 Petition For Abatement Collectability For Businesses Rev 5 18 Petition For Abatement. With our eSigning capabilities, you can easily fill out, sign, and share the petition securely, making tax-related processes more efficient for your business.

-

What are the pricing options for using airSlate SignNow in relation to the CE 5 Petition?

airSlate SignNow offers a variety of pricing plans tailored to suit businesses of all sizes. Each plan allows users to create and manage documents, including the CE 5 Petition For Abatement Collectability For Businesses Rev 5 18 Petition For Abatement, at cost-effective rates, making it a budget-friendly solution for eSigning and document management.

-

Are there any features specifically designed for managing the CE 5 Petition For Abatement?

Yes, airSlate SignNow provides features such as template creation, workflow automation, and secure storage that are specifically beneficial for managing the CE 5 Petition For Abatement Collectability For Businesses Rev 5 18 Petition For Abatement. These features enhance productivity and ensure compliance during the petition process.

-

What benefits do businesses gain from using the CE 5 Petition For Abatement Collectability?

Utilizing the CE 5 Petition For Abatement Collectability For Businesses Rev 5 18 Petition For Abatement helps businesses formally address tax issues while potentially reducing penalties. By using airSlate SignNow, companies can expedite their petition submissions, leading to quicker resolutions and less stress during tax season.

-

Can I collaborate with my team on the CE 5 Petition For Abatement using airSlate SignNow?

Absolutely! airSlate SignNow allows for easy collaboration among team members when working on the CE 5 Petition For Abatement Collectability For Businesses Rev 5 18 Petition For Abatement. You can share documents, add comments, and track revisions to ensure everyone is aligned in the petition process.

-

Is airSlate SignNow compatible with other software for managing the CE 5 Petition?

Yes, airSlate SignNow integrates seamlessly with various software applications, enhancing your ability to manage the CE 5 Petition For Abatement Collectability For Businesses Rev 5 18 Petition For Abatement alongside other essential business tools. This integration allows for a fluid workflow, combining document management with existing systems.

Get more for CE 5 Petition For Abatement Collectability For Businesses Rev 5 18 Petition For Abatement

- Lara health professional licensing state of michigan form

- Lara use only form

- Fillable online michigan family home daycare licensing form

- Type of report incident accident illness death michigan michigan form

- Swimming pool contract form

- Versastack solution by cisco and ibm with sql spectrum red form

- Weslaco building permits form

- Temporary restraining order riverside county sheriffamp39s department riversidesheriff form

Find out other CE 5 Petition For Abatement Collectability For Businesses Rev 5 18 Petition For Abatement

- eSignature Kentucky Construction Letter Of Intent Free

- eSignature Kentucky Construction Cease And Desist Letter Easy

- eSignature Business Operations Document Washington Now

- How To eSignature Maine Construction Confidentiality Agreement

- eSignature Maine Construction Quitclaim Deed Secure

- eSignature Louisiana Construction Affidavit Of Heirship Simple

- eSignature Minnesota Construction Last Will And Testament Online

- eSignature Minnesota Construction Last Will And Testament Easy

- How Do I eSignature Montana Construction Claim

- eSignature Construction PPT New Jersey Later

- How Do I eSignature North Carolina Construction LLC Operating Agreement

- eSignature Arkansas Doctors LLC Operating Agreement Later

- eSignature Tennessee Construction Contract Safe

- eSignature West Virginia Construction Lease Agreement Myself

- How To eSignature Alabama Education POA

- How To eSignature California Education Separation Agreement

- eSignature Arizona Education POA Simple

- eSignature Idaho Education Lease Termination Letter Secure

- eSignature Colorado Doctors Business Letter Template Now

- eSignature Iowa Education Last Will And Testament Computer