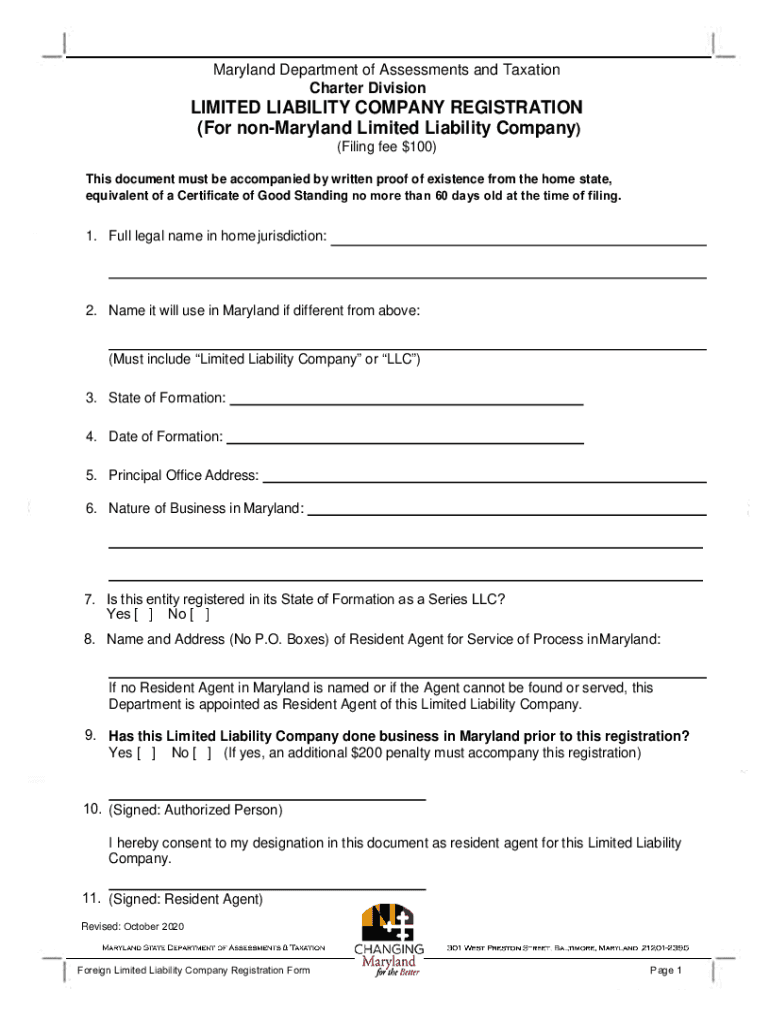

State Department of Assessments and Taxation Form

What is the State Department of Assessments and Taxation?

The State Department of Assessments and Taxation (SDAT) is a governmental body responsible for overseeing property assessments and taxation in various states across the U.S. This department plays a critical role in ensuring that property taxes are assessed fairly and accurately, which helps fund essential public services. The SDAT manages the valuation of real property, maintains property records, and provides resources for property owners to understand their rights and responsibilities regarding taxation.

Steps to Complete the State Department of Assessments and Taxation Form

Completing the State Department of Assessments and Taxation form involves several key steps to ensure accuracy and compliance. First, gather all necessary information, including property details and ownership documentation. Next, carefully fill out the form, ensuring that each section is completed accurately. After filling out the form, review it for any errors or omissions. Once confirmed, submit the form through the designated method, whether online, by mail, or in person, depending on your state’s requirements.

Legal Use of the State Department of Assessments and Taxation

The legal use of the State Department of Assessments and Taxation form is crucial for maintaining compliance with state tax laws. Properly completing and submitting this form ensures that property assessments are conducted according to legal standards, which protects both the property owner and the state. It is important to understand that failure to comply with the requirements may lead to penalties or disputes regarding property valuations.

Required Documents for the State Department of Assessments and Taxation

When preparing to submit the State Department of Assessments and Taxation form, specific documents may be required. Commonly needed documents include proof of ownership, previous property tax statements, and any relevant property appraisals. Depending on the state, additional documentation may be necessary, such as identification or financial statements. Ensuring that all required documents are submitted can facilitate a smoother assessment process.

Form Submission Methods

The State Department of Assessments and Taxation form can typically be submitted through various methods, including online, by mail, or in person. Online submission is often the most efficient option, allowing for quick processing and confirmation. If opting for mail, ensure that the form is sent to the correct address and consider using a trackable mailing service. In-person submissions may be available at local offices, providing an opportunity to ask questions or clarify any uncertainties.

State-Specific Rules for the State Department of Assessments and Taxation

Each state has its own specific rules and regulations governing the State Department of Assessments and Taxation. These rules can affect how property is assessed, the deadlines for submissions, and the penalties for non-compliance. It is essential for property owners to familiarize themselves with their state's guidelines to ensure that they are adhering to the correct procedures and timelines.

Examples of Using the State Department of Assessments and Taxation

Examples of using the State Department of Assessments and Taxation form include scenarios such as applying for a property tax exemption, reporting changes in property ownership, or contesting an assessment. Each of these situations requires the completion of the appropriate form and may involve additional documentation to support the request. Understanding these examples can help property owners navigate their responsibilities effectively.

Quick guide on how to complete state department of assessments and taxation

Effortlessly Prepare State Department Of Assessments And Taxation on Any Device

Digital document management has gained traction among businesses and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed documents, allowing you to easily locate the appropriate form and securely save it online. airSlate SignNow provides all the resources necessary to create, edit, and electronically sign your documents quickly without delays. Manage State Department Of Assessments And Taxation on any platform with airSlate SignNow apps for Android or iOS and enhance any document-centric workflow today.

How to Modify and eSign State Department Of Assessments And Taxation Effortlessly

- Obtain State Department Of Assessments And Taxation and click on Get Form to begin.

- Make use of the tools we provide to complete your form.

- Mark pertinent sections of your documents or conceal sensitive details using tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature using the Sign feature, which only takes seconds and carries the same legal validity as a conventional handwritten signature.

- Review all the details and click on the Done button to finalize your changes.

- Choose how you would like to share your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from a device of your choice. Edit and eSign State Department Of Assessments And Taxation to ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the State Department Of Assessments And Taxation?

The State Department Of Assessments And Taxation is a governmental agency responsible for the assessment of property values and the collection of taxes in the state. They ensure accurate property valuation, supporting fair taxation. Understanding their processes can help businesses streamline their compliance strategies.

-

How can airSlate SignNow assist with documents related to the State Department Of Assessments And Taxation?

airSlate SignNow provides a seamless way to eSign and send documents required by the State Department Of Assessments And Taxation. Our platform simplifies the documentation process, allowing businesses to manage their tax-related paperwork efficiently. This aids in faster submissions and compliance with state regulations.

-

What are the pricing plans for airSlate SignNow's services?

airSlate SignNow offers a variety of pricing plans tailored to meet diverse needs, including options for small businesses and larger enterprises. Our cost-effective solutions ensure that you can manage your document signing needs without overspending. For more details, visit our pricing page to find the best fit for your business related to the State Department Of Assessments And Taxation.

-

What features does airSlate SignNow offer that are beneficial for working with the State Department Of Assessments And Taxation?

airSlate SignNow includes features such as customizable templates, real-time tracking, and secure cloud storage, specifically tailored for compliance with the State Department Of Assessments And Taxation. These tools enhance efficiency by reducing the time spent on document handling. Our easy-to-use interface further supports quick and convenient document management.

-

How can airSlate SignNow improve compliance with the State Department Of Assessments And Taxation?

By using airSlate SignNow, businesses can ensure all documents are eSigned and submitted in accordance with the requirements of the State Department Of Assessments And Taxation. Our solution enhances compliance through automatic reminders and secure document storage. This reduces the risks of late submissions and penalties.

-

Are there integrations available with other services for the State Department Of Assessments And Taxation?

Yes, airSlate SignNow offers integrations with a variety of popular services that can help streamline workflows related to the State Department Of Assessments And Taxation. Our platform is compatible with CRM systems, cloud storage solutions, and more, allowing for improved efficiency. These integrations facilitate the easy transfer of data and documents.

-

What benefits does airSlate SignNow offer businesses dealing with the State Department Of Assessments And Taxation?

Businesses using airSlate SignNow benefit from increased efficiency, reduced paperwork, and enhanced compliance with the State Department Of Assessments And Taxation. Our easy-to-use platform saves time and reduces errors in document handling. This allows businesses to focus more on their core operations and ensures tax-related documents are managed effectively.

Get more for State Department Of Assessments And Taxation

- Limited scope x ray operators form

- Fill in buy the adopted persons minnesota department of health form

- Opwdd ddro manual form

- State disability review unit fill out and sign printable pdf form

- Sealed file form

- Application to add a father on michigan birth record form

- Dmv tm 1odometerdisclosurestatement 571310421 form

- Obl337 occupational license salesperson packet form

Find out other State Department Of Assessments And Taxation

- Can I Electronic signature Utah Non-Profit PPT

- How Do I Electronic signature Nebraska Legal Form

- Help Me With Electronic signature Nevada Legal Word

- How Do I Electronic signature Nevada Life Sciences PDF

- How Can I Electronic signature New York Life Sciences Word

- How Can I Electronic signature North Dakota Legal Word

- How To Electronic signature Ohio Legal PDF

- How To Electronic signature Ohio Legal Document

- How To Electronic signature Oklahoma Legal Document

- How To Electronic signature Oregon Legal Document

- Can I Electronic signature South Carolina Life Sciences PDF

- How Can I Electronic signature Rhode Island Legal Document

- Can I Electronic signature South Carolina Legal Presentation

- How Can I Electronic signature Wyoming Life Sciences Word

- How To Electronic signature Utah Legal PDF

- How Do I Electronic signature Arkansas Real Estate Word

- How Do I Electronic signature Colorado Real Estate Document

- Help Me With Electronic signature Wisconsin Legal Presentation

- Can I Electronic signature Hawaii Real Estate PPT

- How Can I Electronic signature Illinois Real Estate Document