499r4 Form

What is the 499 R-4?

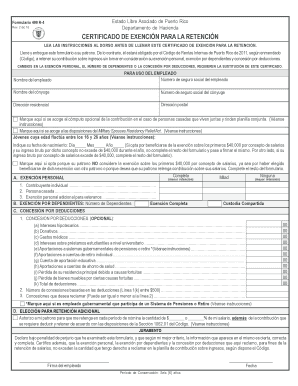

The 499 R-4 is a tax form used in Puerto Rico, specifically designed for individuals and businesses to report exempt income from certain sources. This form is essential for claiming a certificate of exemption from withholding taxes, allowing eligible entities to avoid unnecessary tax deductions on income that is not subject to withholding. Understanding the purpose and requirements of the formulario 499 R-4 is crucial for compliance with Puerto Rican tax laws.

How to Use the 499 R-4

Using the formulario 499 R-4 involves several steps to ensure accurate reporting and compliance. First, gather all necessary documentation that supports your claim for exemption. This may include proof of income sources and any relevant financial statements. Next, fill out the form carefully, ensuring all information is complete and accurate. Once completed, submit the form to the appropriate tax authority in Puerto Rico, either electronically or via mail, depending on your preference and the guidelines provided by the local tax office.

Steps to Complete the 499 R-4

Completing the formulario 499 R-4 requires attention to detail. Follow these steps for a smooth process:

- Gather Documentation: Collect all necessary documents that verify your income and eligibility for exemption.

- Fill Out the Form: Provide accurate information in each section of the form, ensuring that all fields are completed.

- Review for Accuracy: Double-check all entries for errors or omissions to avoid delays or rejections.

- Submit the Form: Send the completed form to the appropriate tax authority, following the submission guidelines.

Legal Use of the 499 R-4

The legal use of the formulario 499 R-4 is governed by tax regulations in Puerto Rico. To be considered valid, the form must be filled out correctly and submitted on time. It is important to understand the legal implications of submitting this form, as providing false information can lead to penalties or legal repercussions. Compliance with local tax laws ensures that individuals and businesses can benefit from the exemptions intended by the form.

Key Elements of the 499 R-4

Several key elements define the formulario 499 R-4, making it essential for tax reporting in Puerto Rico:

- Identification Information: Include personal or business identification details, such as name, address, and tax identification number.

- Income Sources: Clearly outline the sources of income that qualify for exemption.

- Signature: The form must be signed by the individual or authorized representative to validate the information provided.

- Submission Date: Ensure the form is submitted by the designated deadlines to avoid penalties.

Filing Deadlines / Important Dates

Filing deadlines for the formulario 499 R-4 are critical for compliance. Typically, the form must be submitted by a specific date each tax year, often coinciding with the general tax filing deadline in Puerto Rico. It is essential to stay informed about any changes to these dates, as late submissions can result in penalties or loss of exemption status. Keeping a calendar of important tax dates can help ensure timely filing.

Quick guide on how to complete 499r4

Complete 499r4 seamlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal environmentally friendly alternative to traditional printed and signed papers, as you can easily access the correct form and securely store it online. airSlate SignNow provides you with all the resources necessary to generate, modify, and electronically sign your documents quickly without delays. Manage 499r4 on any device using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The easiest way to alter and electronically sign 499r4 effortlessly

- Find 499r4 and click on Get Form to begin.

- Utilize the resources we provide to complete your form.

- Highlight pertinent sections of the documents or obscure sensitive information with tools specifically designed by airSlate SignNow for this purpose.

- Create your eSignature using the Sign feature, which takes seconds and has the same legal validity as a conventional ink signature.

- Review all details and click on the Done button to save your changes.

- Choose how you wish to deliver your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Modify and electronically sign 499r4 and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a certificado de exencion para la retencion?

A certificado de exencion para la retencion is a document that certifies an entity's exemption from certain withholding taxes. This document is crucial for individuals and businesses to manage their tax liabilities effectively, enabling them to retain more of their revenue.

-

How can airSlate SignNow help me obtain a certificado de exencion para la retencion?

With airSlate SignNow, you can effortlessly create and manage the necessary documents required for your certificado de exencion para la retencion. Our platform streamlines the eSigning process, making it easy to send, sign, and store your documents securely.

-

What features does airSlate SignNow offer for document management?

airSlate SignNow offers a variety of features that facilitate efficient document management, including customizable templates, secure eSignatures, and cloud storage. These tools simplify the creation and tracking of documents like the certificado de exencion para la retencion, enhancing your workflow.

-

Is airSlate SignNow cost-effective for businesses looking to manage a certificado de exencion para la retencion?

Yes, airSlate SignNow is designed to be a cost-effective solution for businesses of all sizes. With flexible pricing plans, it provides affordable access to essential document management tools, making it easier for you to handle your certificado de exencion para la retencion without breaking the bank.

-

What integrations does airSlate SignNow offer to enhance document workflows?

airSlate SignNow offers numerous integrations with popular business applications such as Google Drive, Dropbox, and Salesforce. These integrations help streamline your processes when dealing with documents like the certificado de exencion para la retencion, allowing for seamless data flow across platforms.

-

Can I track the status of my certificado de exencion para la retencion documents?

Absolutely! airSlate SignNow provides real-time tracking for all your documents, including the certificado de exencion para la retencion. You can easily check who has signed, view the signing progress, and receive notifications, ensuring you stay informed throughout the process.

-

How does airSlate SignNow ensure the security of my documents?

airSlate SignNow takes document security seriously, employing advanced encryption standards and secure cloud storage. This ensures that your sensitive information, including your certificado de exencion para la retencion, is protected against unauthorized access and data bsignNowes.

Get more for 499r4

- Certificate of origin korea us trade agreement fill form

- Certifying official documents for foreign use form

- Private bird hunting area application pwd 348 texas form

- Discovering family and local history form

- Monitoring device driving permit mddp terms ampamp conditions form

- Calvcb in home supportive services billing form

- Pdf pharmacy form ph210 office of the professions new york state

- Inclusion form for sole proprietors and partners election c15r 92019 election pursuant listed laws version september 2019

Find out other 499r4

- Can I Electronic signature Minnesota Insurance PDF

- How Do I Electronic signature Minnesota Insurance Document

- How To Electronic signature Missouri Insurance Form

- How Can I Electronic signature New Jersey Insurance Document

- How To Electronic signature Indiana High Tech Document

- How Do I Electronic signature Indiana High Tech Document

- How Can I Electronic signature Ohio Insurance Document

- Can I Electronic signature South Dakota Insurance PPT

- How Can I Electronic signature Maine Lawers PPT

- How To Electronic signature Maine Lawers PPT

- Help Me With Electronic signature Minnesota Lawers PDF

- How To Electronic signature Ohio High Tech Presentation

- How Can I Electronic signature Alabama Legal PDF

- How To Electronic signature Alaska Legal Document

- Help Me With Electronic signature Arkansas Legal PDF

- How Can I Electronic signature Arkansas Legal Document

- How Can I Electronic signature California Legal PDF

- Can I Electronic signature Utah High Tech PDF

- How Do I Electronic signature Connecticut Legal Document

- How To Electronic signature Delaware Legal Document