Attorney Occupational Form

What is the Attorney Occupational Tax Return?

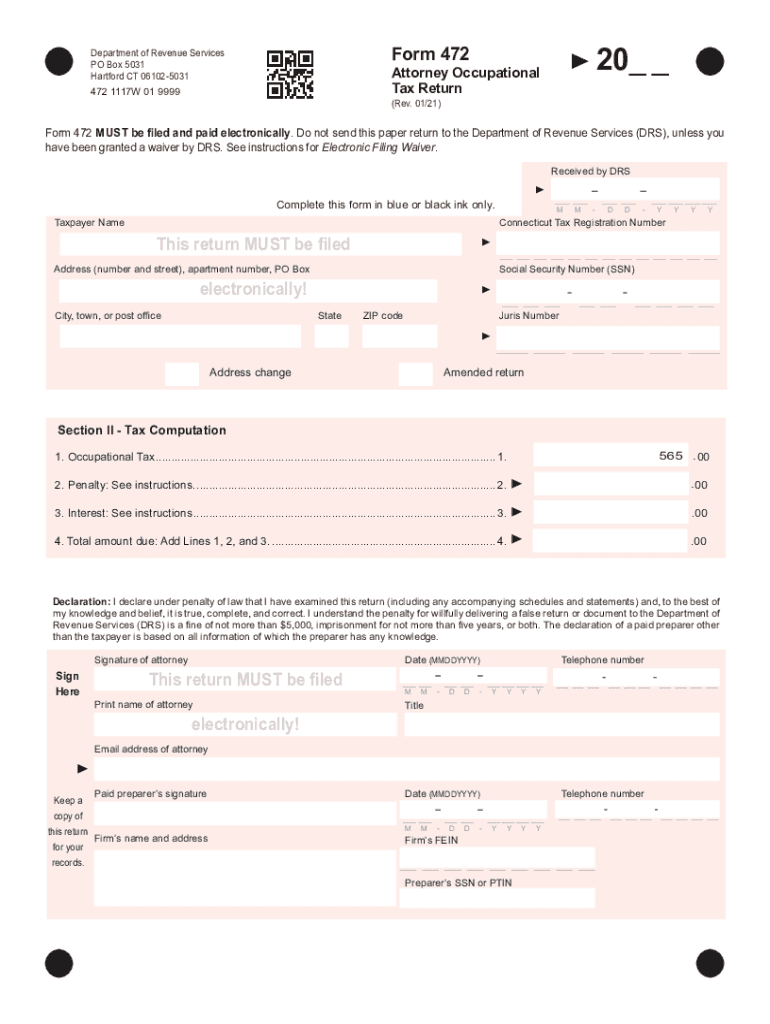

The Attorney Occupational Tax Return, often referred to as the 472 return, is a specific tax form required for attorneys practicing in Connecticut. This form is used to report and pay the occupational tax imposed on attorneys. The tax is calculated based on the attorney's gross income derived from practicing law in the state. Understanding the purpose and requirements of the 472 return is essential for compliance with state tax laws.

Steps to Complete the Attorney Occupational Tax Return

Completing the Connecticut 472 return involves several key steps to ensure accuracy and compliance. First, gather all necessary financial documents, including income statements and expense records. Next, fill out the form by entering your gross income and any applicable deductions. It is crucial to double-check all entries for accuracy. Once completed, the form can be submitted either electronically or via mail, depending on your preference. Ensure that you retain a copy of the submitted form for your records.

Filing Deadlines / Important Dates

Timely filing of the Connecticut 472 return is critical to avoid penalties. The due date for filing is typically April fifteenth of each year, aligning with the federal tax filing deadline. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. Attorneys should also be aware of any changes to the filing schedule that may occur due to state regulations or other factors.

Required Documents for Filing

When preparing to file the Connecticut 472 return, specific documents are necessary to ensure a complete and accurate submission. These documents typically include:

- Income statements detailing gross earnings from legal services

- Records of any deductions or credits applicable to your tax situation

- Previous year's tax return for reference

- Identification information, such as your Social Security Number or Employer Identification Number

Having these documents ready will facilitate a smoother filing process.

Form Submission Methods

The Connecticut 472 return can be submitted through various methods to accommodate different preferences. Attorneys have the option to file the form online through the Connecticut Department of Revenue Services website, which offers a secure and efficient process. Alternatively, the form can be printed and mailed to the appropriate state office. In-person submissions may also be available, providing another avenue for those who prefer direct interaction.

Penalties for Non-Compliance

Failure to file the Connecticut 472 return on time can result in significant penalties. These may include late fees, interest on unpaid taxes, and potential legal repercussions. It is essential for attorneys to stay informed about their filing obligations and ensure timely submission to avoid these consequences. Understanding the penalties associated with non-compliance can motivate timely and accurate filing.

Quick guide on how to complete attorney occupational

Effortlessly Prepare Attorney Occupational on Any Device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal environmentally friendly substitute for conventional printed and signed documents, enabling you to locate the right form and securely keep it online. airSlate SignNow equips you with all the resources necessary to generate, alter, and eSign your documents quickly without delays. Manage Attorney Occupational on any device with the airSlate SignNow apps for Android or iOS and streamline any document-related task today.

The Easiest Way to Modify and eSign Attorney Occupational Without Stress

- Obtain Attorney Occupational and click on Get Form to begin.

- Use the tools we offer to complete your form.

- Emphasize important sections of the documents or obscure sensitive details with tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature with the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review the information and click on the Done button to save your updates.

- Choose how you want to send your form, via email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or mislaid documents, laborious form searches, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management requirements in just a few clicks from the device of your choice. Modify and eSign Attorney Occupational and ensure exceptional communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the Connecticut 472 return?

The Connecticut 472 return is a document that needs to be filed by certain businesses in Connecticut as part of their tax compliance. It reports income and deductions specific to the state's regulations. Understanding this form is crucial for ensuring compliance and avoiding penalties.

-

How can airSlate SignNow assist with filing the Connecticut 472 return?

With airSlate SignNow, businesses can easily prepare and eSign their Connecticut 472 return documents online. Our platform streamlines the process, allowing users to quickly fill out forms and obtain signatures digitally, thereby saving time and reducing errors.

-

What are the pricing options for airSlate SignNow when filing the Connecticut 472 return?

Pricing for airSlate SignNow varies based on subscription plans, which are designed to fit the needs of different businesses. The service offers competitive rates, ensuring that submitting a Connecticut 472 return is both cost-effective and efficient for users.

-

Are there any integrations available with airSlate SignNow for Connecticut 472 return filings?

Yes, airSlate SignNow offers integrations with various accounting and tax preparation software, making it easier to manage your Connecticut 472 return filings. These integrations enhance workflow efficiency and ensure that your documents are seamlessly connected.

-

What features of airSlate SignNow enhance the eSigning process for the Connecticut 472 return?

AirSlate SignNow provides advanced features such as real-time tracking, reminders, and multiple signing options that make the eSigning process for the Connecticut 472 return straightforward and user-friendly. These features help expedite the submission process and increase compliance.

-

Is airSlate SignNow secure for filing the Connecticut 472 return?

Absolutely! AirSlate SignNow employs industry-standard security measures, including encryption and secure cloud storage, to protect your sensitive information when filing the Connecticut 472 return. You can trust that your data is safe throughout the eSigning process.

-

Can I use airSlate SignNow for other state tax returns besides the Connecticut 472 return?

Yes, airSlate SignNow can be used for a variety of state tax returns, not just the Connecticut 472 return. Our platform is flexible and designed to accommodate different types of documents, making it a versatile tool for your tax filing needs.

Get more for Attorney Occupational

- Dbpr bcaib 1 application for initial certification by examination or endorsement inspectors and plans examiners form

- 2019 2021 form wy amended annual report for profit and

- Foreign corporation annual report illinois secretary of state form

- Falconry license renewal application fg360 california form

- Penalty amp interest applied starting march 1 2021 form

- Credit card fax cover sheetpdf form

- Fillable online no submitter found fax email print pdffiller form

- Full rate mailing statement guide australia post form

Find out other Attorney Occupational

- eSign Missouri Construction Rental Lease Agreement Easy

- How To eSign Washington Doctors Confidentiality Agreement

- Help Me With eSign Kansas Education LLC Operating Agreement

- Help Me With eSign West Virginia Doctors Lease Agreement Template

- eSign Wyoming Doctors Living Will Mobile

- eSign Wyoming Doctors Quitclaim Deed Free

- How To eSign New Hampshire Construction Rental Lease Agreement

- eSign Massachusetts Education Rental Lease Agreement Easy

- eSign New York Construction Lease Agreement Online

- Help Me With eSign North Carolina Construction LLC Operating Agreement

- eSign Education Presentation Montana Easy

- How To eSign Missouri Education Permission Slip

- How To eSign New Mexico Education Promissory Note Template

- eSign New Mexico Education Affidavit Of Heirship Online

- eSign California Finance & Tax Accounting IOU Free

- How To eSign North Dakota Education Rental Application

- How To eSign South Dakota Construction Promissory Note Template

- eSign Education Word Oregon Secure

- How Do I eSign Hawaii Finance & Tax Accounting NDA

- eSign Georgia Finance & Tax Accounting POA Fast