Penalty & Interest Applied Starting March 1, 2020

What is the Penalty & Interest Applied Starting March 1

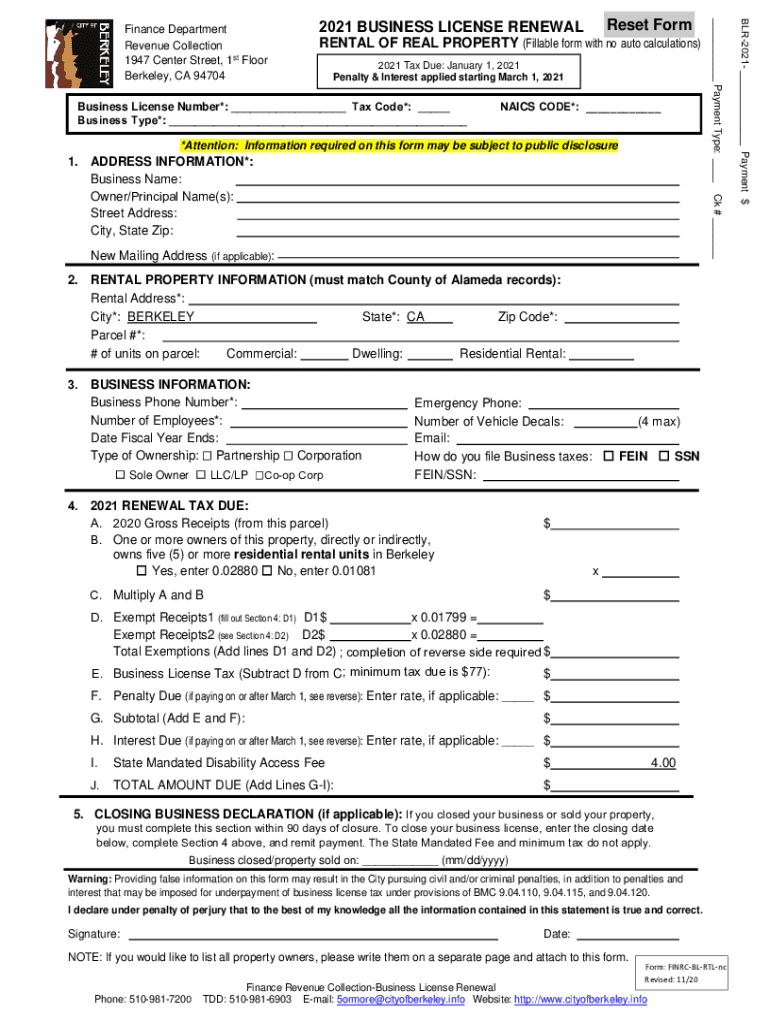

The "Penalty & Interest Applied Starting March 1" refers to specific financial consequences that may be imposed on taxpayers who fail to meet certain obligations by the designated date. This can include late payments or failure to file required forms. Understanding these penalties is crucial for individuals and businesses to avoid unexpected financial burdens and ensure compliance with tax regulations.

Steps to complete the Penalty & Interest Applied Starting March 1

Completing the "Penalty & Interest Applied Starting March 1" form involves several key steps to ensure accuracy and compliance. First, gather all necessary financial documents, including income statements and previous tax returns. Next, carefully fill out the form, ensuring all information is correct and complete. It is essential to review the form for any errors before submission. Finally, submit the form through the appropriate channels, whether online, by mail, or in person, depending on the requirements set forth by the issuing authority.

Legal use of the Penalty & Interest Applied Starting March 1

The legal use of the "Penalty & Interest Applied Starting March 1" form is governed by federal and state tax laws. This form must be completed accurately to be considered valid in any legal proceedings or audits. Compliance with the relevant regulations ensures that the penalties and interest assessed are enforceable. It is advisable to consult with a tax professional to ensure that all legal requirements are met when using this form.

Filing Deadlines / Important Dates

Filing deadlines for the "Penalty & Interest Applied Starting March 1" form are critical to avoid incurring additional penalties. Typically, the form must be submitted by the specified date to prevent interest from accruing on unpaid balances. It is important to stay informed about any changes in deadlines that may occur due to legislative updates or other factors. Marking these dates on a calendar can help ensure timely compliance.

IRS Guidelines

The Internal Revenue Service (IRS) provides specific guidelines regarding the "Penalty & Interest Applied Starting March 1" form. These guidelines outline the conditions under which penalties and interest may be assessed, as well as the procedures for disputing any charges. Familiarizing oneself with these guidelines is essential for understanding potential liabilities and ensuring proper compliance with tax obligations.

Examples of using the Penalty & Interest Applied Starting March 1

Examples of situations where the "Penalty & Interest Applied Starting March 1" form may be applicable include cases where taxpayers fail to pay their taxes by the due date or do not file required forms on time. For instance, a self-employed individual who misses the tax payment deadline may incur penalties and interest, necessitating the use of this form to address the issue. Understanding these scenarios can help taxpayers recognize the importance of timely compliance.

Quick guide on how to complete penalty amp interest applied starting march 1 2021

Execute Penalty & Interest Applied Starting March 1, effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed documents, as you can access the necessary form and securely archive it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents quickly and without delays. Manage Penalty & Interest Applied Starting March 1, on any platform with the airSlate SignNow apps available for Android or iOS, and simplify any document-related task today.

The simplest way to modify and eSign Penalty & Interest Applied Starting March 1, with ease

- Access Penalty & Interest Applied Starting March 1, and click Get Form to commence.

- Utilize the tools we offer to complete your form.

- Emphasize key sections of your documents or obscure sensitive data with tools specifically provided by airSlate SignNow for that purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review the information and then click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate issues of lost or misplaced files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any chosen device. Modify and eSign Penalty & Interest Applied Starting March 1, to ensure outstanding communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct penalty amp interest applied starting march 1 2021

Create this form in 5 minutes!

How to create an eSignature for the penalty amp interest applied starting march 1 2021

The best way to create an electronic signature for a PDF document in the online mode

The best way to create an electronic signature for a PDF document in Chrome

How to generate an e-signature for putting it on PDFs in Gmail

How to generate an e-signature from your mobile device

The way to create an e-signature for a PDF document on iOS devices

How to generate an e-signature for a PDF file on Android devices

People also ask

-

What does 'Penalty & Interest Applied Starting March 1,' mean for my business?

'Penalty & Interest Applied Starting March 1,' refers to a new regulation impacting businesses that might result in additional costs if certain compliance measures are not met. It is essential for companies to understand these changes to avoid unexpected fees. airSlate SignNow can help streamline your documentation process to ensure compliance and minimize risks.

-

How can airSlate SignNow help me manage documents related to 'Penalty & Interest Applied Starting March 1,'?

airSlate SignNow provides a user-friendly platform to manage and eSign documents efficiently, especially those related to compliance with 'Penalty & Interest Applied Starting March 1,'. With our software, you can quickly send, receive, and track important documents, ensuring you stay on top of deadlines and avoid penalties.

-

Are there any costs associated with using airSlate SignNow for 'Penalty & Interest Applied Starting March 1,' compliance?

While using airSlate SignNow involves subscription fees, it can ultimately save you money by helping to avoid penalties related to 'Penalty & Interest Applied Starting March 1,'. Our pricing plans are designed to be cost-effective, enabling businesses of all sizes to comply without breaking the bank.

-

What features does airSlate SignNow offer to assist with 'Penalty & Interest Applied Starting March 1,' regulations?

airSlate SignNow offers various features such as electronic signatures, document templates, and audit trails, all of which are crucial for navigating 'Penalty & Interest Applied Starting March 1,' regulations successfully. These features help ensure that your documents are legally binding and properly managed.

-

Can I integrate airSlate SignNow with other software for better management of 'Penalty & Interest Applied Starting March 1,' documents?

Yes, airSlate SignNow offers seamless integrations with numerous software applications, enhancing your ability to manage documents relating to 'Penalty & Interest Applied Starting March 1,'. This integration capability helps centralize your workflow, making it easier to keep track of compliance-related documents.

-

What are the benefits of using airSlate SignNow in relation to 'Penalty & Interest Applied Starting March 1,'?

Using airSlate SignNow in the context of 'Penalty & Interest Applied Starting March 1,' provides several benefits, including reduced processing time, improved compliance, and enhanced security for sensitive documents. Our platform equips your team with the tools needed to navigate these regulations effectively and efficiently.

-

Is airSlate SignNow suitable for businesses of all sizes when addressing 'Penalty & Interest Applied Starting March 1,' requirements?

Absolutely! airSlate SignNow is designed to cater to businesses of all sizes, providing essential tools to manage 'Penalty & Interest Applied Starting March 1,' documentation. Whether you are a small business or a large enterprise, our platform offers scalable solutions to meet your unique needs.

Get more for Penalty & Interest Applied Starting March 1,

- 5 401 pretrial release new mexico legislature form

- For use with district court rule 5 401 form

- For use with magistrate court rule 6 401 form

- Fillable online order setting aside bond forfeiture fax email print form

- Fillable online default judgment judgment of default on bond fax form

- For use with district court rule 5 406 nmra form

- Courts in new mexico ballotpedia form

- To be used only if upon conviction the form

Find out other Penalty & Interest Applied Starting March 1,

- How Can I Sign Ohio Car Dealer Cease And Desist Letter

- How To Sign Ohio Car Dealer Arbitration Agreement

- How To Sign Oregon Car Dealer Limited Power Of Attorney

- How To Sign Pennsylvania Car Dealer Quitclaim Deed

- How Can I Sign Pennsylvania Car Dealer Quitclaim Deed

- Sign Rhode Island Car Dealer Agreement Safe

- Sign South Dakota Car Dealer Limited Power Of Attorney Now

- Sign Wisconsin Car Dealer Quitclaim Deed Myself

- Sign Wisconsin Car Dealer Quitclaim Deed Free

- Sign Virginia Car Dealer POA Safe

- Sign Wisconsin Car Dealer Quitclaim Deed Fast

- How To Sign Wisconsin Car Dealer Rental Lease Agreement

- How To Sign Wisconsin Car Dealer Quitclaim Deed

- How Do I Sign Wisconsin Car Dealer Quitclaim Deed

- Sign Wyoming Car Dealer Purchase Order Template Mobile

- Sign Arizona Charity Business Plan Template Easy

- Can I Sign Georgia Charity Warranty Deed

- How To Sign Iowa Charity LLC Operating Agreement

- Sign Kentucky Charity Quitclaim Deed Myself

- Sign Michigan Charity Rental Application Later