Form 1100 Ext 2008-2026

What is the Form 1100 Ext

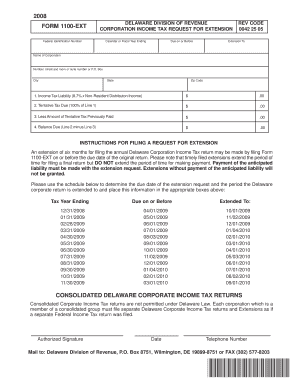

The Form 1100 Ext is an extension request used by businesses to apply for additional time to file their corporate income tax returns. This form is particularly relevant for corporations that need extra time beyond the standard filing deadline. By submitting this form, businesses can secure an automatic extension, allowing them to prepare their tax returns more thoroughly without facing immediate penalties for late filing.

How to use the Form 1100 Ext

Using the Form 1100 Ext involves several straightforward steps. First, ensure that you have the correct version of the form, which can typically be obtained from the IRS website or through tax software. Next, fill out the required information, including your business name, address, and Employer Identification Number (EIN). After completing the form, it should be submitted by the original filing deadline for your corporate tax return. This can be done electronically or via mail, depending on your preference and the IRS guidelines.

Steps to complete the Form 1100 Ext

Completing the Form 1100 Ext requires careful attention to detail. Follow these steps:

- Gather necessary information, including your business name, address, and EIN.

- Indicate the type of return for which you are requesting an extension.

- Provide the estimated tax liability, if applicable.

- Sign and date the form to validate your request.

- Submit the completed form by the original due date of your tax return.

Legal use of the Form 1100 Ext

The legal use of the Form 1100 Ext is governed by IRS regulations. It is essential to submit the form accurately and on time to avoid penalties. The extension granted by this form is automatic, meaning that no further action is needed once the form is filed. However, it is crucial to note that this extension only applies to the filing of the return and does not extend the time to pay any taxes owed.

Filing Deadlines / Important Dates

Filing deadlines for the Form 1100 Ext are critical for compliance. Typically, the form must be submitted by the original due date of the corporate tax return, which is usually the fifteenth day of the fourth month after the end of the corporation's tax year. For corporations operating on a calendar year, this means the deadline is April 15. Keeping track of these dates ensures that businesses remain compliant and avoid penalties.

Who Issues the Form

The Form 1100 Ext is issued by the Internal Revenue Service (IRS), which is the federal agency responsible for tax collection and tax law enforcement in the United States. It is essential for businesses to use the official form provided by the IRS to ensure compliance with federal tax regulations.

Quick guide on how to complete form 1100 ext

Prepare Form 1100 Ext effortlessly on any device

Digital document management has gained traction with companies and individuals alike. It offers an ideal environmentally friendly alternative to conventional printed and signed documents, as you can locate the correct form and securely archive it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage Form 1100 Ext on any device with airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to modify and eSign Form 1100 Ext with ease

- Locate Form 1100 Ext and click Get Form to initiate.

- Utilize the tools we offer to complete your form.

- Highlight pertinent sections of your documents or redact sensitive information using tools specifically provided by airSlate SignNow for that purpose.

- Generate your signature with the Sign tool, which takes just moments and holds the same legal validity as a conventional wet ink signature.

- Verify all the details and click on the Done button to save your modifications.

- Select your preferred method to submit your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or errors necessitating the printing of new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your choice. Edit and eSign Form 1100 Ext and ensure seamless communication at every phase of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is form 1100 ext and how can airSlate SignNow help?

Form 1100 ext is a specific document used for filing extensions. With airSlate SignNow, you can easily create, send, and eSign form 1100 ext, streamlining your extension process and ensuring compliance.

-

What features does airSlate SignNow offer for managing form 1100 ext?

AirSlate SignNow offers features such as customizable templates, secure eSigning, and automated workflows specifically tailored for form 1100 ext. These features help you manage your documents efficiently, reducing time spent on paperwork.

-

Is airSlate SignNow cost-effective for handling form 1100 ext?

Yes, airSlate SignNow offers a cost-effective solution for managing form 1100 ext. Our pricing plans are designed to accommodate businesses of all sizes, allowing you to save money while streamlining your documentation process.

-

Can I integrate airSlate SignNow with other applications for form 1100 ext?

Absolutely! AirSlate SignNow supports integration with various applications, making it easy to incorporate form 1100 ext into your existing workflow. This integration enhances productivity and ensures seamless document management.

-

What are the benefits of using airSlate SignNow for form 1100 ext?

Using airSlate SignNow for form 1100 ext offers benefits such as increased efficiency, reduced paper usage, and improved accuracy. By digitizing your documents, you enhance accessibility and reduce processing time.

-

How secure is airSlate SignNow when handling form 1100 ext?

AirSlate SignNow prioritizes security, providing robust encryption and compliance measures for form 1100 ext. Our platform ensures that your sensitive information is protected, giving you peace of mind while managing your documents.

-

Can multiple users collaborate on form 1100 ext within airSlate SignNow?

Yes, airSlate SignNow allows multiple users to collaborate on form 1100 ext. This collaborative feature enables teams to work together efficiently, ensuring that all necessary signatures and approvals are obtained promptly.

Get more for Form 1100 Ext

- Forms divorce_or_separation_selfhelp california courts

- Fa 4128vb order to show cause with minor children form

- Dv 140 response to request to modify extend dissolve protective order form

- Homesuperior court of californiacounty of napa form

- Hhs income withholding for support fill and sign form

- Fillable online fl 303 declaration regarding notice and form

- Wwwtemplaterollercomgroup11029form fl 235 ampquotadvisement and waiver of rights re

- Fc d no form

Find out other Form 1100 Ext

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document

- How Can I eSignature New Jersey Real Estate Word

- Can I eSignature Tennessee Police Form

- How Can I eSignature Vermont Police Presentation

- How Do I eSignature Pennsylvania Real Estate Document

- How Do I eSignature Texas Real Estate Document

- How Can I eSignature Colorado Courts PDF

- Can I eSignature Louisiana Courts Document

- How To Electronic signature Arkansas Banking Document

- How Do I Electronic signature California Banking Form

- How Do I eSignature Michigan Courts Document

- Can I eSignature Missouri Courts Document

- How Can I Electronic signature Delaware Banking PDF

- Can I Electronic signature Hawaii Banking Document

- Can I eSignature North Carolina Courts Presentation

- Can I eSignature Oklahoma Courts Word

- How To Electronic signature Alabama Business Operations Form

- Help Me With Electronic signature Alabama Car Dealer Presentation