Il 2848 Form

What is the IL-2848?

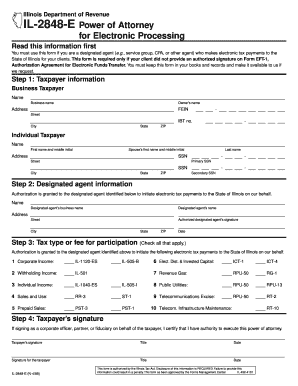

The IL-2848 is a Power of Attorney form used in Illinois, allowing individuals to authorize another person to represent them before the Illinois Department of Revenue. This form is essential for taxpayers who need assistance with their tax matters, enabling their designated representative to act on their behalf regarding tax filings and inquiries. The IL-2848 is particularly useful for those who may not be familiar with tax regulations or who prefer to have a professional handle their tax affairs.

How to Use the IL-2848

To use the IL-2848 effectively, taxpayers must complete the form by providing necessary information such as the taxpayer's name, address, and Social Security number, along with the representative's details. Once filled out, the form must be signed and dated by the taxpayer. This authorizes the designated representative to communicate with the Illinois Department of Revenue, allowing them to receive confidential tax information and represent the taxpayer in any tax-related matters.

Steps to Complete the IL-2848

Completing the IL-2848 involves several key steps:

- Obtain the IL-2848 form from the Illinois Department of Revenue website or another reliable source.

- Fill in the taxpayer's information, including name, address, and Social Security number.

- Enter the representative's details, including their name, address, and any relevant identification numbers.

- Specify the tax matters for which the representative is authorized to act.

- Sign and date the form to validate it.

After completing these steps, the form can be submitted to the appropriate tax authority as needed.

Legal Use of the IL-2848

The IL-2848 is legally binding as long as it is filled out correctly and signed by the taxpayer. This form complies with the necessary legal requirements set forth by the Illinois Department of Revenue. It is crucial for taxpayers to ensure that the designated representative is trusted and capable of handling their tax matters, as the representative will have access to sensitive financial information.

Filing Deadlines / Important Dates

When using the IL-2848, it is important to be aware of relevant filing deadlines and important dates. Taxpayers should ensure that the form is submitted in a timely manner to avoid delays in processing their tax matters. Specific deadlines may vary based on the type of tax issue being addressed, so consulting the Illinois Department of Revenue's guidelines can provide clarity on any pressing timelines.

Form Submission Methods

The IL-2848 can be submitted through various methods, including:

- Online submission through the Illinois Department of Revenue's electronic filing system.

- Mailing a printed copy of the completed form to the appropriate tax office.

- In-person delivery at designated tax offices, if preferred.

Choosing the right submission method can help ensure that the form is processed efficiently.

Quick guide on how to complete il 2848

Effortlessly Prepare Il 2848 on Any Device

Digital document management has gained traction among businesses and individuals. It offers a fantastic eco-friendly substitute for traditional printed and signed papers, as you can locate the right template and securely keep it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents promptly without any hold-ups. Manage Il 2848 on any device using airSlate SignNow’s Android or iOS applications and enhance any document-focused procedure today.

The easiest way to modify and eSign Il 2848 effortlessly

- Locate Il 2848 and click Get Form to begin.

- Make use of the tools we offer to complete your document.

- Emphasize pertinent sections of your documents or conceal sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature using the Sign function, which takes mere seconds and carries the same legal standing as a conventional wet ink signature.

- Review all the details and then click the Done button to preserve your modifications.

- Choose your preferred method to send your form, whether by email, SMS, or invite link, or download it directly to your computer.

Eliminate concerns about lost or misplaced documents, tiring form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Modify and eSign Il 2848 to ensure outstanding communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is airSlate SignNow's role in managing my Illinois tax file?

airSlate SignNow simplifies the process of handling your Illinois tax file by allowing you to securely send and electronically sign tax documents. With its user-friendly interface, you can manage your tax filings efficiently without the hassle of physical paperwork.

-

How does airSlate SignNow ensure the security of my Illinois tax file?

Security is a top priority at airSlate SignNow. We use advanced encryption methods and comply with data protection regulations to ensure your Illinois tax file is safe from unauthorized access, ensuring your sensitive information remains confidential.

-

What features does airSlate SignNow offer for my Illinois tax file?

airSlate SignNow provides features like customizable templates, automated workflows, and real-time tracking of document status that specifically cater to your Illinois tax file handling needs. These tools streamline the process, making it faster and more efficient.

-

Is airSlate SignNow affordable for small businesses managing their Illinois tax file?

Yes, airSlate SignNow offers competitively priced plans designed to fit the budgets of small businesses needing to manage their Illinois tax file. With various pricing options, you can select a plan that suits your needs without compromising on features.

-

Can I integrate airSlate SignNow with other software for my Illinois tax file?

Absolutely! airSlate SignNow offers seamless integrations with popular accounting and tax software, allowing you to easily manage your Illinois tax file alongside your existing tools. This integration enhances your productivity by streamlining workflows.

-

What are the benefits of using airSlate SignNow for my Illinois tax file?

Using airSlate SignNow for your Illinois tax file allows for faster document turnaround, reduced errors, and improved compliance with filing requirements. It empowers your business to focus on growth while we take care of your document management needs.

-

Does airSlate SignNow provide customer support for issues related to my Illinois tax file?

Yes, airSlate SignNow offers dedicated customer support to assist with any issues related to your Illinois tax file. Our support team is available to help you through any challenges, ensuring you can effectively manage your tax documents.

Get more for Il 2848

- Part i employers statement needed for both life or accidental death claims form

- Board of regents of the university system of georgia form

- Download the international patient form fox chase cancer center

- Skin script consent form rejuvalase

- Electronic medical record authorization 12 to 17 years of age form

- Oov exercise sheet form

- Er university of massachusetts medical school policy umassmed form

- Pdf forms for web aflac

Find out other Il 2848

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors