Kansas Department of Revenue WebFile Kansas Gov Form

Understanding the Kansas CR 108 Form

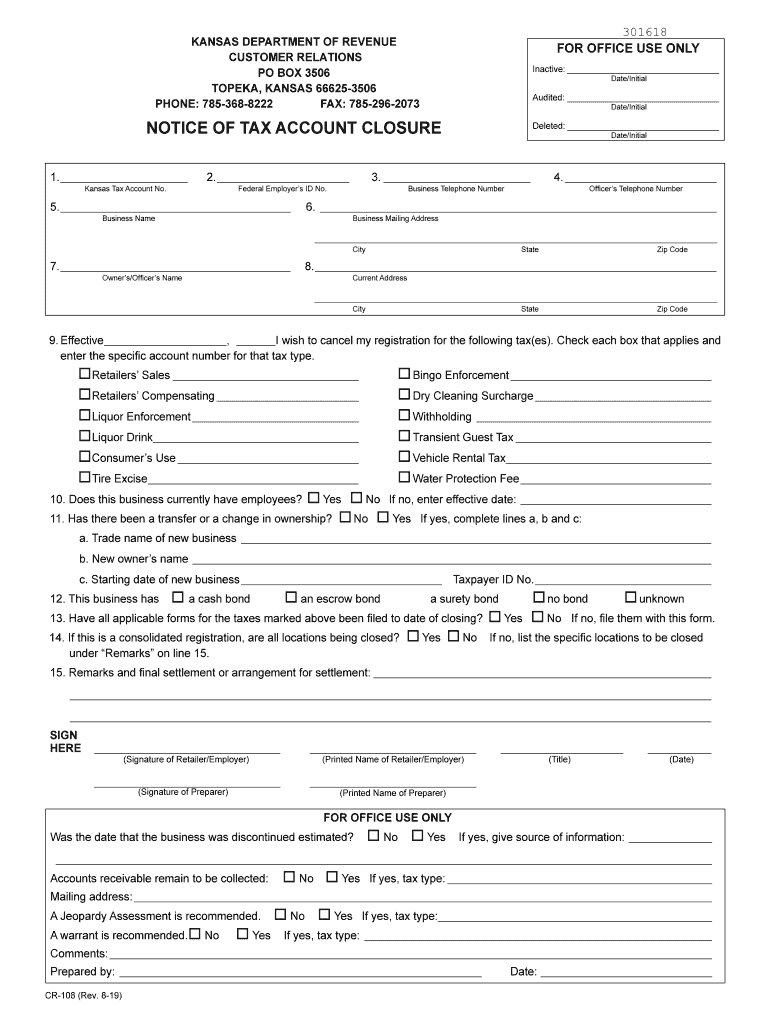

The Kansas CR 108 form, also known as the CR 108 Kansas form, is primarily used for tax closure purposes in the state of Kansas. This form is essential for individuals and businesses looking to formally close their tax accounts with the Kansas Department of Revenue. Proper completion of the CR 108 ensures that all tax obligations are settled and that the individual or business is no longer liable for future taxes related to the closed account.

Steps to Complete the Kansas CR 108 Form

Completing the Kansas CR 108 form involves several key steps to ensure accuracy and compliance. First, gather all necessary information, including your tax identification number and details of the tax periods you are closing. Next, accurately fill out the form, ensuring that all required fields are completed. After filling out the form, review it for any errors or omissions. Finally, submit the completed CR 108 form to the Kansas Department of Revenue through the appropriate submission method, which may include online, mail, or in-person options.

Required Documents for the Kansas CR 108 Form

When submitting the Kansas CR 108 form, certain documents may be required to support your request for tax closure. These documents typically include prior tax returns, payment records, and any correspondence with the Kansas Department of Revenue regarding your tax account. Having these documents ready can streamline the process and help ensure that your closure request is processed without delays.

Legal Use of the Kansas CR 108 Form

The Kansas CR 108 form is legally recognized as a valid document for closing tax accounts in Kansas. When completed correctly and submitted according to state regulations, it serves as formal notification to the Kansas Department of Revenue that the taxpayer wishes to close their account. This legal recognition is crucial, as it protects the taxpayer from future tax liabilities associated with the closed account.

Filing Deadlines for the Kansas CR 108 Form

Filing deadlines for the Kansas CR 108 form can vary based on the specific circumstances of the taxpayer. It is important to check with the Kansas Department of Revenue for any specific deadlines that may apply to your situation. Generally, timely submission of the form can help avoid penalties and ensure a smooth closure process.

Form Submission Methods for the Kansas CR 108

The Kansas CR 108 form can be submitted through various methods. Taxpayers may choose to submit the form online via the Kansas Department of Revenue's official website, or they may opt to mail the completed form to the appropriate address. In some cases, in-person submissions may also be accepted. Choosing the right submission method can depend on personal preference and the urgency of the closure request.

Quick guide on how to complete kansas department of revenue webfile kansasgov

Complete Kansas Department Of Revenue WebFile Kansas gov effortlessly on any device

Online document management has gained signNow traction among businesses and individuals. It offers a perfect eco-friendly substitute for traditional printed and signed documentation, as you can easily locate the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents quickly without delays. Manage Kansas Department Of Revenue WebFile Kansas gov on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

The easiest way to edit and eSign Kansas Department Of Revenue WebFile Kansas gov without any hassle

- Locate Kansas Department Of Revenue WebFile Kansas gov and then click Get Form to begin.

- Use the tools we provide to complete your form submission.

- Highlight key sections of the documents or redact sensitive information using tools that airSlate SignNow specifically offers for that purpose.

- Create your signature with the Sign feature, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Verify the information and click on the Done button to finalize your changes.

- Select how you would prefer to send your form—via email, SMS, invite link, or download it to your computer.

Wave goodbye to lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Edit and eSign Kansas Department Of Revenue WebFile Kansas gov while ensuring clear communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the cr 108 kansas form, and how does it work with airSlate SignNow?

The cr 108 kansas form is an essential document used for motor vehicle sales in the state of Kansas. With airSlate SignNow, you can easily eSign and send this document to ensure a smooth transaction process. Our platform simplifies the entire process to save you time and reduce paperwork.

-

How much does it cost to use airSlate SignNow for cr 108 kansas forms?

airSlate SignNow offers competitive pricing plans that cater to all types of businesses, making it affordable to eSign cr 108 kansas forms. You can choose from monthly or annual subscriptions, with various features included, ensuring you get the best value for your investment. Check our pricing page for detailed information on our plans.

-

What are the key features of airSlate SignNow for cr 108 kansas transactions?

airSlate SignNow provides a range of features that enhance the signing experience for cr 108 kansas documents. Key features include easy document upload, customizable templates, secure storage, and real-time tracking of document status. These functionalities help streamline your business operations.

-

Are there any benefits to using airSlate SignNow for cr 108 kansas forms?

Using airSlate SignNow for cr 108 kansas forms allows for faster processing and improved efficiency. You can reduce the time spent on paperwork, mitigate errors, and enhance the overall customer experience with our user-friendly interface. Plus, the electronic signing process is legally binding and secure.

-

Can I integrate airSlate SignNow with other software for handling cr 108 kansas documents?

Yes, airSlate SignNow integrates seamlessly with various software applications, enhancing your workflow for cr 108 kansas documents. Whether you're using CRM systems, document management software, or payment processors, our integrations facilitate a smooth experience. Explore our integration options to see how it can benefit your business.

-

Is airSlate SignNow secure for signing cr 108 kansas forms?

Absolutely! airSlate SignNow prioritizes security and compliance, ensuring your cr 108 kansas forms are protected. Our platform uses industry-standard encryption and authentication measures, making it a reliable choice for eSigning sensitive documents. You can trust us to keep your information safe.

-

What devices can I use to access airSlate SignNow for cr 108 kansas forms?

You can access airSlate SignNow on various devices, including desktops, tablets, and smartphones, making it convenient for signing cr 108 kansas forms anytime, anywhere. Our responsive design ensures that you'll have a consistent and user-friendly experience across all devices. Stay connected and manage your documents on the go!

Get more for Kansas Department Of Revenue WebFile Kansas gov

- Policy ampampamp procedure pampampampp approval request form

- Iowa ebt report changes form

- In the superior court of washington county of pierce form

- Pierce county superior court docket form

- Form 3 application state jobs alabama

- Who may enter a pillar 3 medical student of the university of form

- 2019 wiche and mn dental application form

- Application for the certificate of eligibility i 20 brooklyn form

Find out other Kansas Department Of Revenue WebFile Kansas gov

- Can I Electronic signature Wyoming Legal Limited Power Of Attorney

- How Do I Electronic signature Wyoming Legal POA

- How To Electronic signature Florida Real Estate Contract

- Electronic signature Florida Real Estate NDA Secure

- Can I Electronic signature Florida Real Estate Cease And Desist Letter

- How Can I Electronic signature Hawaii Real Estate LLC Operating Agreement

- Electronic signature Georgia Real Estate Letter Of Intent Myself

- Can I Electronic signature Nevada Plumbing Agreement

- Electronic signature Illinois Real Estate Affidavit Of Heirship Easy

- How To Electronic signature Indiana Real Estate Quitclaim Deed

- Electronic signature North Carolina Plumbing Business Letter Template Easy

- Electronic signature Kansas Real Estate Residential Lease Agreement Simple

- How Can I Electronic signature North Carolina Plumbing Promissory Note Template

- Electronic signature North Dakota Plumbing Emergency Contact Form Mobile

- Electronic signature North Dakota Plumbing Emergency Contact Form Easy

- Electronic signature Rhode Island Plumbing Business Plan Template Later

- Electronic signature Louisiana Real Estate Quitclaim Deed Now

- Electronic signature Louisiana Real Estate Quitclaim Deed Secure

- How Can I Electronic signature South Dakota Plumbing Emergency Contact Form

- Electronic signature South Dakota Plumbing Emergency Contact Form Myself