Maine Revenue Services Limited Power of Attorney Form 2011

What is the Maine Revenue Services Limited Power Of Attorney Form

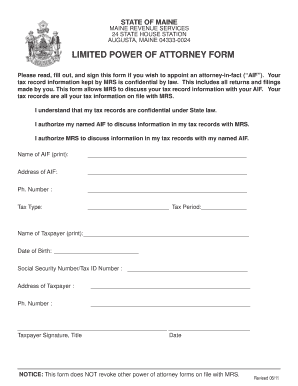

The Maine Revenue Services Limited Power Of Attorney Form is a legal document that allows an individual to designate another person to act on their behalf in specific tax matters with the Maine Revenue Services. This form is particularly useful for taxpayers who may need assistance in managing their tax obligations or representation in dealings with the state tax authority. By completing this form, the taxpayer grants authority to the appointed representative to handle designated tax-related tasks, ensuring compliance with state regulations.

How to use the Maine Revenue Services Limited Power Of Attorney Form

Using the Maine Revenue Services Limited Power Of Attorney Form involves several key steps. First, the taxpayer must fill out the form accurately, providing necessary details such as their name, address, and the specific powers being granted to the representative. It is important to clearly define the scope of authority to avoid any misunderstandings. Once completed, the form must be signed by the taxpayer, and in some cases, notarization may be required. The finalized form should then be submitted to the Maine Revenue Services to ensure that the appointed representative can act on behalf of the taxpayer.

Steps to complete the Maine Revenue Services Limited Power Of Attorney Form

Completing the Maine Revenue Services Limited Power Of Attorney Form requires careful attention to detail. Here are the steps to follow:

- Obtain the form from the Maine Revenue Services website or office.

- Fill in your personal information, including your name, address, and Social Security number.

- Specify the powers you wish to grant to your representative, detailing the tax matters they can handle.

- Sign and date the form, ensuring that your signature matches the name provided.

- If required, have the form notarized to validate your signature.

- Submit the completed form to the Maine Revenue Services via mail or in person.

Legal use of the Maine Revenue Services Limited Power Of Attorney Form

The legal use of the Maine Revenue Services Limited Power Of Attorney Form is governed by state laws regarding power of attorney documents. This form must be executed in accordance with Maine law to ensure its validity. The appointed representative is expected to act in the best interest of the taxpayer and within the limits of authority granted in the form. It is essential for both the taxpayer and the representative to understand their rights and responsibilities under this legal framework to avoid potential disputes.

Key elements of the Maine Revenue Services Limited Power Of Attorney Form

Several key elements define the Maine Revenue Services Limited Power Of Attorney Form. These include:

- Taxpayer Information: Complete details of the individual granting the power of attorney.

- Representative Information: Details of the person being authorized to act on behalf of the taxpayer.

- Scope of Authority: A clear description of the specific tax matters the representative is allowed to handle.

- Signatures: Required signatures from both the taxpayer and, if necessary, a notary public.

- Submission Instructions: Guidelines on how to submit the completed form to the Maine Revenue Services.

Who Issues the Form

The Maine Revenue Services is the official authority that issues the Maine Revenue Services Limited Power Of Attorney Form. This state agency is responsible for administering tax laws and ensuring compliance among taxpayers. The agency provides the necessary forms and guidance for taxpayers to properly designate representatives for tax-related matters. It is advisable to refer to their official resources for the most current version of the form and any specific instructions related to its use.

Quick guide on how to complete maine revenue services limited power of attorney form

Finish Maine Revenue Services Limited Power Of Attorney Form effortlessly on any device

Online document management has gained traction among businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to access the needed form and securely store it online. airSlate SignNow provides all the tools required to create, modify, and eSign your documents promptly without delays. Handle Maine Revenue Services Limited Power Of Attorney Form on any platform with airSlate SignNow Android or iOS applications and enhance any document-centric operation today.

How to modify and eSign Maine Revenue Services Limited Power Of Attorney Form seamlessly

- Find Maine Revenue Services Limited Power Of Attorney Form and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and bears the same legal significance as a standard handwritten signature.

- Review all details and click the Done button to save your changes.

- Choose how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

No more worries about lost or misplaced documents, tiresome form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from your preferred device. Modify and eSign Maine Revenue Services Limited Power Of Attorney Form and ensure optimal communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct maine revenue services limited power of attorney form

Create this form in 5 minutes!

People also ask

-

What is the Maine Revenue Services Limited Power Of Attorney Form?

The Maine Revenue Services Limited Power Of Attorney Form allows you to authorize another person to represent you in matters concerning state tax issues. This form is essential for simplifying communication with Maine's tax authorities, ensuring that your representative can handle specific tasks on your behalf.

-

How can airSlate SignNow help with the Maine Revenue Services Limited Power Of Attorney Form?

AirSlate SignNow provides an easy-to-use platform that allows you to create, send, and eSign the Maine Revenue Services Limited Power Of Attorney Form efficiently. With its intuitive interface, you can complete the form quickly and ensure that it is properly executed and submitted to the relevant authorities.

-

Is there a cost associated with using airSlate SignNow for the Maine Revenue Services Limited Power Of Attorney Form?

Yes, while airSlate SignNow offers various pricing plans, you can access its features starting at a competitive rate. The pricing provides great value, especially for businesses needing to manage documents like the Maine Revenue Services Limited Power Of Attorney Form consistently.

-

What features does airSlate SignNow offer for the Maine Revenue Services Limited Power Of Attorney Form?

AirSlate SignNow includes several features such as customizable templates, real-time tracking, and secure cloud storage. These tools are designed to enhance your experience with the Maine Revenue Services Limited Power Of Attorney Form, making it more efficient and secure.

-

Can I integrate airSlate SignNow with other applications while using the Maine Revenue Services Limited Power Of Attorney Form?

Absolutely! AirSlate SignNow supports various integrations with popular applications, allowing you to streamline your workflow. Whether it's CRM, accounting software, or cloud storage services, using the Maine Revenue Services Limited Power Of Attorney Form alongside these tools enhances your overall productivity.

-

What are the benefits of using airSlate SignNow for the Maine Revenue Services Limited Power Of Attorney Form?

By using airSlate SignNow for the Maine Revenue Services Limited Power Of Attorney Form, you benefit from a fast, secure, and user-friendly solution. This ensures that your documents are handled promptly while maintaining compliance with legal standards, giving you peace of mind.

-

How does airSlate SignNow ensure the security of my Maine Revenue Services Limited Power Of Attorney Form?

AirSlate SignNow takes security seriously; it uses advanced encryption and secure data storage to protect your documents, including the Maine Revenue Services Limited Power Of Attorney Form. You can rest assured that your sensitive information is safe from unauthorized access.

Get more for Maine Revenue Services Limited Power Of Attorney Form

- Spcc1 form

- Agriculture quota certificate format

- Comparing and ordering rational numbers worksheet answer key pdf form

- Tum defer admission form

- Va form 26 1880 100000355

- Where can i get a print for a pre employment physical form

- Request for conviction criminal history record rcw 10 97 r 719 washington state patrol criminal records division form

- Build better form 7 certificate of practical compl

Find out other Maine Revenue Services Limited Power Of Attorney Form

- eSign North Dakota Real Estate Business Letter Template Computer

- eSign North Dakota Real Estate Quitclaim Deed Myself

- eSign Maine Sports Quitclaim Deed Easy

- eSign Ohio Real Estate LLC Operating Agreement Now

- eSign Ohio Real Estate Promissory Note Template Online

- How To eSign Ohio Real Estate Residential Lease Agreement

- Help Me With eSign Arkansas Police Cease And Desist Letter

- How Can I eSign Rhode Island Real Estate Rental Lease Agreement

- How Do I eSign California Police Living Will

- Can I eSign South Dakota Real Estate Quitclaim Deed

- How To eSign Tennessee Real Estate Business Associate Agreement

- eSign Michigan Sports Cease And Desist Letter Free

- How To eSign Wisconsin Real Estate Contract

- How To eSign West Virginia Real Estate Quitclaim Deed

- eSign Hawaii Police Permission Slip Online

- eSign New Hampshire Sports IOU Safe

- eSign Delaware Courts Operating Agreement Easy

- eSign Georgia Courts Bill Of Lading Online

- eSign Hawaii Courts Contract Mobile

- eSign Hawaii Courts RFP Online