States that Don't Tax Social Security Benefits Kiplinger 2018

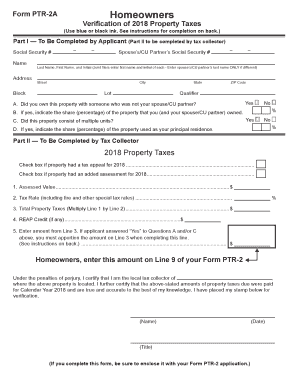

Understanding the nj ptr 2a Form

The nj ptr 2a form is a critical document for individuals seeking to navigate specific tax benefits associated with Social Security. This form is essential for residents in states that do not tax Social Security benefits, allowing them to claim exemptions and ensure compliance with state tax regulations. Understanding the nuances of this form can help taxpayers maximize their benefits and avoid potential pitfalls.

Steps to Complete the nj ptr 2a Form

Completing the nj ptr 2a form involves several key steps to ensure accuracy and compliance. First, gather all necessary personal information, including your Social Security number and details about your income. Next, carefully fill out each section of the form, ensuring that all information is correct and complete. After completing the form, review it for any errors before submission. Finally, submit the form according to the specified guidelines, whether online or via mail.

Legal Use of the nj ptr 2a Form

The nj ptr 2a form is legally binding when completed correctly and submitted in accordance with state regulations. It is essential to understand the legal implications of the information provided on this form. Misrepresentation or errors can lead to penalties or denial of benefits. Therefore, ensuring that all information is accurate and truthful is crucial for maintaining compliance with state tax laws.

Eligibility Criteria for the nj ptr 2a Form

To qualify for the nj ptr 2a form, applicants must meet specific eligibility criteria. Generally, individuals must reside in a state that does not tax Social Security benefits. Additionally, they should provide proof of their Social Security income and any other relevant financial information. Understanding these criteria can help streamline the application process and ensure that all necessary documentation is prepared.

Filing Deadlines for the nj ptr 2a Form

Filing deadlines for the nj ptr 2a form are crucial for ensuring that taxpayers do not miss out on potential benefits. Typically, the form must be submitted by a specific date each tax year, which aligns with state tax filing deadlines. It is important to stay informed about these dates to avoid late submissions, which could result in penalties or loss of benefits.

State-Specific Rules for the nj ptr 2a Form

Each state has unique rules regarding the nj ptr 2a form, particularly concerning eligibility and submission processes. Familiarizing yourself with these state-specific regulations is vital for successful completion and submission. This knowledge helps ensure compliance and maximizes the benefits available to taxpayers residing in states that do not tax Social Security benefits.

Quick guide on how to complete states that dont tax social security benefits kiplinger

Accomplish States That Don't Tax Social Security Benefits Kiplinger effortlessly on any device

Digital document management has gained traction among organizations and individuals alike. It offers an ideal eco-friendly substitute for conventional printed and signed paperwork, as you can access the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents swiftly and without delays. Handle States That Don't Tax Social Security Benefits Kiplinger on any device using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

The easiest method to modify and eSign States That Don't Tax Social Security Benefits Kiplinger with ease

- Locate States That Don't Tax Social Security Benefits Kiplinger and click on Obtain Form to initiate.

- Utilize the features we provide to finalize your document.

- Emphasize important sections of your papers or conceal sensitive details with tools that airSlate SignNow specifically provides for that purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and holds the same legal significance as a traditional wet ink signature.

- Review all the details and press the Done button to save your modifications.

- Select your preferred method for sharing your form, whether by email, text message (SMS), invitation link, or downloading it to your computer.

Eliminate concerns about lost or misplaced files, monotonous form searches, or mistakes that necessitate printing additional copies. airSlate SignNow addresses all your document management needs in just a few clicks from your chosen device. Alter and eSign States That Don't Tax Social Security Benefits Kiplinger while ensuring excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct states that dont tax social security benefits kiplinger

Create this form in 5 minutes!

People also ask

-

What is nj ptr 2a and how can it benefit my business?

NJ PTR 2A refers to a specific document related to property tax relief in New Jersey. By utilizing airSlate SignNow to manage nj ptr 2a forms, businesses can streamline the completion and submission process, ensuring accuracy and compliance while saving time.

-

How does airSlate SignNow handle nj ptr 2a document security?

AirSlate SignNow prioritizes your security, especially for sensitive documents like nj ptr 2a. Our platform uses bank-level encryption and secure cloud storage to ensure that all your documents remain protected and confidential throughout the signing process.

-

Is there a free trial available for the nj ptr 2a document management?

Yes, airSlate SignNow offers a free trial that allows you to explore the features for managing nj ptr 2a documents. This trial period lets you test the tool's effectiveness in eSigning and document handling before committing to a subscription plan.

-

What features does airSlate SignNow offer for nj ptr 2a processing?

AirSlate SignNow offers a variety of features for nj ptr 2a processing, including customizable templates, real-time tracking, and automated reminders for signatures. These functionalities enhance efficiency and ensure that you never miss a submission deadline.

-

Can I integrate airSlate SignNow with other business applications for nj ptr 2a?

Absolutely! AirSlate SignNow seamlessly integrates with various business applications, which means you can connect it with tools you already use for handling nj ptr 2a documents. This integration ensures a smooth workflow and reduces manual data entry.

-

What are the pricing options for airSlate SignNow when dealing with nj ptr 2a?

AirSlate SignNow provides flexible pricing options that cater to different business needs, even when managing nj ptr 2a documents. You can choose from plans that fit your budget and scale as your business grows without sacrificing features.

-

How can airSlate SignNow speed up the nj ptr 2a submission process?

With airSlate SignNow, the nj ptr 2a submission process is expedited through features like electronic signatures and document sharing. This allows you to send and receive completed forms faster, enhancing your overall operational efficiency.

Get more for States That Don't Tax Social Security Benefits Kiplinger

- Bdvr 153 record request for account holders bdvr 153 record request for account holders form

- Make a high quality logo for you by workkruchok7 fiverr form

- Update my address welcome to the state of new york form

- Aish open government form

- Form k 89 vehicle storage rates requirements application

- 83039 adoc form

- Illinois parking program for persons with disabilities law enforcement guide form

- Reg 256 statement of facts california department of form

Find out other States That Don't Tax Social Security Benefits Kiplinger

- Electronic signature Virginia Courts Business Plan Template Fast

- How To Electronic signature Utah Courts Operating Agreement

- Electronic signature West Virginia Courts Quitclaim Deed Computer

- Electronic signature West Virginia Courts Quitclaim Deed Free

- Electronic signature Virginia Courts Limited Power Of Attorney Computer

- Can I Sign Alabama Banking PPT

- Electronic signature Washington Sports POA Simple

- How To Electronic signature West Virginia Sports Arbitration Agreement

- Electronic signature Wisconsin Sports Residential Lease Agreement Myself

- Help Me With Sign Arizona Banking Document

- How Do I Sign Arizona Banking Form

- How Can I Sign Arizona Banking Form

- How Can I Sign Arizona Banking Form

- Can I Sign Colorado Banking PPT

- How Do I Sign Idaho Banking Presentation

- Can I Sign Indiana Banking Document

- How Can I Sign Indiana Banking PPT

- How To Sign Maine Banking PPT

- Help Me With Sign Massachusetts Banking Presentation

- Can I Sign Michigan Banking PDF