Ptr 2 Form 2013

What is the Ptr 2 Form

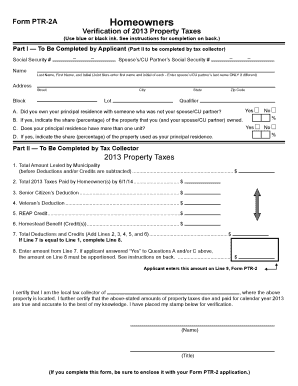

The Ptr 2 form, also known as the New Jersey PTR-2, is a property tax reimbursement application designed for eligible senior citizens and disabled individuals in New Jersey. This form allows qualified applicants to receive a reimbursement for property taxes paid on their primary residence. The purpose of the PTR-2 is to provide financial relief to those who may struggle with the burden of property taxes, ensuring that they can maintain their homes and financial stability.

How to use the Ptr 2 Form

Using the Ptr 2 form involves several key steps. First, ensure that you meet the eligibility criteria, which typically includes age and income requirements. Once eligibility is confirmed, obtain the form through the New Jersey Division of Taxation website or local tax office. Complete the form by providing accurate information regarding your property taxes, income, and personal details. Finally, submit the completed form by the specified deadline to ensure your application is processed in a timely manner.

Steps to complete the Ptr 2 Form

Completing the Ptr 2 form requires careful attention to detail. Follow these steps:

- Gather necessary documentation, including proof of income and property tax statements.

- Fill out your personal information, ensuring accuracy in your name, address, and Social Security number.

- Report your total income for the year, including all sources of income.

- Detail the property taxes you paid, providing the amounts for the relevant tax year.

- Review the completed form for any errors or omissions before submission.

Legal use of the Ptr 2 Form

The Ptr 2 form is legally binding when completed and submitted in accordance with New Jersey state laws. It is essential to provide truthful information, as any discrepancies may lead to penalties or denial of benefits. The form must be signed and dated to validate the application, ensuring compliance with legal requirements. Understanding the legal implications of the form helps applicants navigate the process with confidence.

Key elements of the Ptr 2 Form

Several key elements are crucial when filling out the Ptr 2 form:

- Applicant Information: Personal details, including name, address, and Social Security number.

- Income Reporting: Comprehensive disclosure of all income sources to determine eligibility.

- Property Tax Details: Accurate reporting of property taxes paid during the specified year.

- Signature: A signed declaration confirming the accuracy of the information provided.

Form Submission Methods

The Ptr 2 form can be submitted through various methods to accommodate applicants' preferences. Options include:

- Online Submission: Many applicants choose to submit the form electronically through the New Jersey Division of Taxation's online portal.

- Mail: The completed form can be printed and mailed to the appropriate tax office.

- In-Person: Applicants may also visit local tax offices to submit the form directly.

Quick guide on how to complete ptr 2 form

Manage Ptr 2 Form effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It offers a superb eco-friendly substitute for traditional printed and signed documents, as you can access the right form and securely maintain it online. airSlate SignNow equips you with all the tools necessary to generate, modify, and eSign your documents promptly without delays. Handle Ptr 2 Form on any device using the airSlate SignNow Android or iOS applications and ease any document-related tasks today.

The simplest way to modify and eSign Ptr 2 Form with ease

- Obtain Ptr 2 Form and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight pertinent sections of the documents or obscure sensitive data using the features that airSlate SignNow specifically offers for that purpose.

- Create your signature with the Sign feature, which takes just seconds and carries the same legal validity as a conventional handwritten signature.

- Review the details and click on the Done button to save your changes.

- Choose how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searching, or errors requiring new document copies. airSlate SignNow meets your document management needs in just a few clicks from any preferred device. Modify and eSign Ptr 2 Form and guarantee exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct ptr 2 form

Create this form in 5 minutes!

People also ask

-

What is a ptr 2 form, and how does it work?

The ptr 2 form is a document used for various filing purposes, particularly in tax reporting. With airSlate SignNow, you can easily create, send, and eSign your ptr 2 form online, streamlining the entire process and ensuring compliance with all necessary regulations.

-

What are the benefits of using airSlate SignNow for my ptr 2 form?

Using airSlate SignNow for your ptr 2 form provides a range of benefits including enhanced security, faster processing times, and the ability to track document status in real-time. This makes managing your forms more efficient and reduces the risk of errors.

-

Is there a cost associated with using airSlate SignNow for ptr 2 forms?

Yes, airSlate SignNow offers flexible pricing plans tailored to different business needs. You can choose a plan that suits your volume of ptr 2 form processing, ensuring you only pay for what you need.

-

Can I customize my ptr 2 form using airSlate SignNow?

Absolutely! AirSlate SignNow allows you to customize your ptr 2 form to fit your business requirements. You can add your branding, modify fields, and set personalized signing workflows to ensure a seamless experience for all users.

-

How does airSlate SignNow ensure the security of my ptr 2 form?

AirSlate SignNow employs advanced security measures to protect your ptr 2 form and other documents. This includes encryption, secure data storage, and compliance with industry standards to safeguard all sensitive information.

-

What integrations does airSlate SignNow offer for working with ptr 2 forms?

AirSlate SignNow integrates seamlessly with various applications, such as CRM systems, document management tools, and cloud storage platforms. These integrations facilitate a smoother workflow, allowing you to manage your ptr 2 form alongside your other business processes.

-

Can I track the status of my ptr 2 form with airSlate SignNow?

Yes, airSlate SignNow provides tracking features that allow you to monitor the status of your ptr 2 form in real-time. You'll receive notifications when the document is opened, viewed, or signed, ensuring you stay informed throughout the process.

Get more for Ptr 2 Form

Find out other Ptr 2 Form

- Sign New Jersey Charity Promissory Note Template Secure

- How Do I Sign North Carolina Charity Lease Agreement Form

- How To Sign Oregon Charity Living Will

- Sign South Dakota Charity Residential Lease Agreement Simple

- Sign Vermont Charity Business Plan Template Later

- Sign Arkansas Construction Executive Summary Template Secure

- How To Sign Arkansas Construction Work Order

- Sign Colorado Construction Rental Lease Agreement Mobile

- Sign Maine Construction Business Letter Template Secure

- Can I Sign Louisiana Construction Letter Of Intent

- How Can I Sign Maryland Construction Business Plan Template

- Can I Sign Maryland Construction Quitclaim Deed

- Sign Minnesota Construction Business Plan Template Mobile

- Sign Construction PPT Mississippi Myself

- Sign North Carolina Construction Affidavit Of Heirship Later

- Sign Oregon Construction Emergency Contact Form Easy

- Sign Rhode Island Construction Business Plan Template Myself

- Sign Vermont Construction Rental Lease Agreement Safe

- Sign Utah Construction Cease And Desist Letter Computer

- Help Me With Sign Utah Construction Cease And Desist Letter