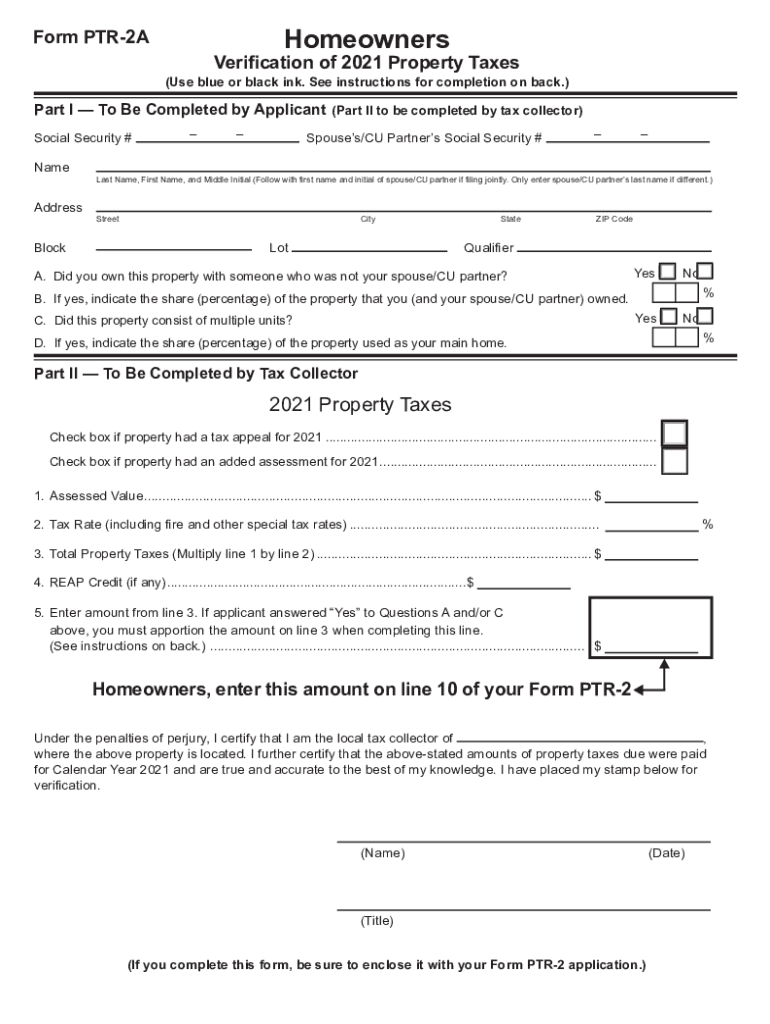

Homeowners Verification of Property Taxes for Use with Form 2021-2026

Understanding Homeowners Verification Of Property Taxes

The Homeowners Verification Of Property Taxes is a crucial document that serves to confirm the property tax status of a homeowner in New Jersey. This verification is often required for various applications, including financial assistance programs, tax exemptions, and mortgage applications. It provides essential information about the property’s assessed value, tax rate, and payment status. Understanding this form is vital for homeowners who wish to ensure they are compliant with state regulations and can take advantage of available benefits.

Steps to Complete the Homeowners Verification Of Property Taxes

Completing the Homeowners Verification Of Property Taxes involves several key steps:

- Gather necessary documentation, including proof of ownership and previous tax statements.

- Obtain the Homeowners Verification Of Property Taxes form from the appropriate local government office or online.

- Fill out the form with accurate information, ensuring all required fields are completed.

- Review the form for any errors or omissions before submission.

- Submit the completed form to the designated authority, either online or via mail.

Legal Use of the Homeowners Verification Of Property Taxes

The Homeowners Verification Of Property Taxes is legally recognized and must be completed accurately to ensure its validity. This document can be used in various legal contexts, such as proving eligibility for tax relief programs or verifying property ownership during financial transactions. Adhering to state regulations when filling out this form is essential to avoid potential legal issues.

Eligibility Criteria for Homeowners Verification Of Property Taxes

To qualify for the Homeowners Verification Of Property Taxes, applicants typically must meet specific eligibility criteria. These may include:

- Ownership of the property in question.

- Current residency in the property.

- Compliance with local tax payment requirements.

It is important for homeowners to check with their local tax authority to ensure they meet all necessary criteria before applying.

Obtaining the Homeowners Verification Of Property Taxes

Homeowners can obtain the Homeowners Verification Of Property Taxes through various means. The most common methods include:

- Visiting the local tax assessor's office in person.

- Accessing the form online through the official state or county website.

- Requesting a copy via mail or email, depending on the local office's policies.

Ensuring that the correct version of the form is obtained is crucial for proper submission.

Form Submission Methods

Once the Homeowners Verification Of Property Taxes form is completed, it can be submitted through several methods:

- Online submission via the local tax authority's website, if available.

- Mailing the completed form to the appropriate office.

- In-person delivery at the local tax assessor's office.

Each submission method may have different processing times, so homeowners should choose the option that best suits their needs.

Quick guide on how to complete homeowners verification of 2021 property taxes for use with form

Complete Homeowners Verification Of Property Taxes For Use With Form effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documentation, allowing you to easily locate the appropriate form and securely keep it online. airSlate SignNow provides you with all the resources necessary to create, modify, and eSign your documents quickly without delays. Manage Homeowners Verification Of Property Taxes For Use With Form on any device using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to modify and eSign Homeowners Verification Of Property Taxes For Use With Form with ease

- Obtain Homeowners Verification Of Property Taxes For Use With Form and select Get Form to begin.

- Utilize the tools we provide to finalize your form.

- Select important sections of the documents or redact sensitive information using tools that airSlate SignNow specifically offers for that purpose.

- Create your eSignature with the Sign feature, which takes just seconds and holds the same legal validity as a conventional handwritten signature.

- Review all the details and click on the Done button to save your edits.

- Decide how you wish to send your form, whether by email, text message (SMS), or invite link, or download it to your computer.

Eliminate the worry of lost or misplaced files, tedious form searching, or errors that require printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from a device of your choice. Edit and eSign Homeowners Verification Of Property Taxes For Use With Form and ensure exceptional communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct homeowners verification of 2021 property taxes for use with form

Create this form in 5 minutes!

People also ask

-

What is nj ptr 2a and how does it relate to airSlate SignNow?

The nj ptr 2a is a specific form utilized in New Jersey for property tax appeals. With airSlate SignNow, users can easily fill out and eSign the nj ptr 2a form, simplifying the process for property owners looking to appeal their tax assessments.

-

How can airSlate SignNow facilitate the completion of nj ptr 2a forms?

airSlate SignNow offers an intuitive platform that allows users to complete nj ptr 2a forms digitally. This means you can quickly fill out required fields, gather signatures, and send the document for review, all from one convenient system.

-

What are the pricing options for airSlate SignNow when using nj ptr 2a?

airSlate SignNow provides various pricing plans to cater to different business needs. Whether you're an individual needing to submit a nj ptr 2a form or a large organization managing multiple documents, you can choose a plan that fits your usage and budget effectively.

-

What features does airSlate SignNow offer for managing nj ptr 2a forms?

AirSlate SignNow offers features like document templates, customizable workflows, and real-time tracking, making it easy to manage nj ptr 2a forms. These tools streamline the eSigning process, ensuring all necessary steps are completed efficiently.

-

What are the benefits of using airSlate SignNow for nj ptr 2a submissions?

Using airSlate SignNow for nj ptr 2a submissions means faster processing times and reduced paperwork. The digital nature of the solution enhances security, mitigates risks of lost documents, and allows for effortless collaboration among users.

-

Can I integrate airSlate SignNow with other platforms to handle nj ptr 2a forms?

Yes, airSlate SignNow offers integration capabilities with numerous other platforms. This ensures that users can seamlessly connect their existing systems to efficiently manage nj ptr 2a forms without disrupting their workflow.

-

Is airSlate SignNow compliant with regulations for nj ptr 2a documents?

Absolutely, airSlate SignNow complies with all relevant regulations for handling nj ptr 2a documents. With its secure electronic signature solutions, users can trust that their submissions meet legal standards required by New Jersey authorities.

Get more for Homeowners Verification Of Property Taxes For Use With Form

- Brick mason contractor package mississippi form

- Roofing contractor package mississippi form

- Electrical contractor package mississippi form

- Sheetrock drywall contractor package mississippi form

- Flooring contractor package mississippi form

- Trim carpentry contractor package mississippi form

- Fencing contractor package mississippi form

- Hvac contractor package mississippi form

Find out other Homeowners Verification Of Property Taxes For Use With Form

- Electronic signature Vermont Stock Purchase Agreement Template Safe

- Electronic signature California Stock Transfer Form Template Mobile

- How To Electronic signature Colorado Stock Transfer Form Template

- Electronic signature Georgia Stock Transfer Form Template Fast

- Electronic signature Michigan Stock Transfer Form Template Myself

- Electronic signature Montana Stock Transfer Form Template Computer

- Help Me With Electronic signature Texas Debt Settlement Agreement Template

- How Do I Electronic signature Nevada Stock Transfer Form Template

- Electronic signature Virginia Stock Transfer Form Template Secure

- How Do I Electronic signature Colorado Promissory Note Template

- Can I Electronic signature Florida Promissory Note Template

- How To Electronic signature Hawaii Promissory Note Template

- Electronic signature Indiana Promissory Note Template Now

- Electronic signature Kansas Promissory Note Template Online

- Can I Electronic signature Louisiana Promissory Note Template

- Electronic signature Rhode Island Promissory Note Template Safe

- How To Electronic signature Texas Promissory Note Template

- Electronic signature Wyoming Indemnity Agreement Template Free

- Electronic signature Iowa Bookkeeping Contract Safe

- Electronic signature New York Bookkeeping Contract Myself