the TAX COMMISSION of the CITY of NEW NYC Gov 2020

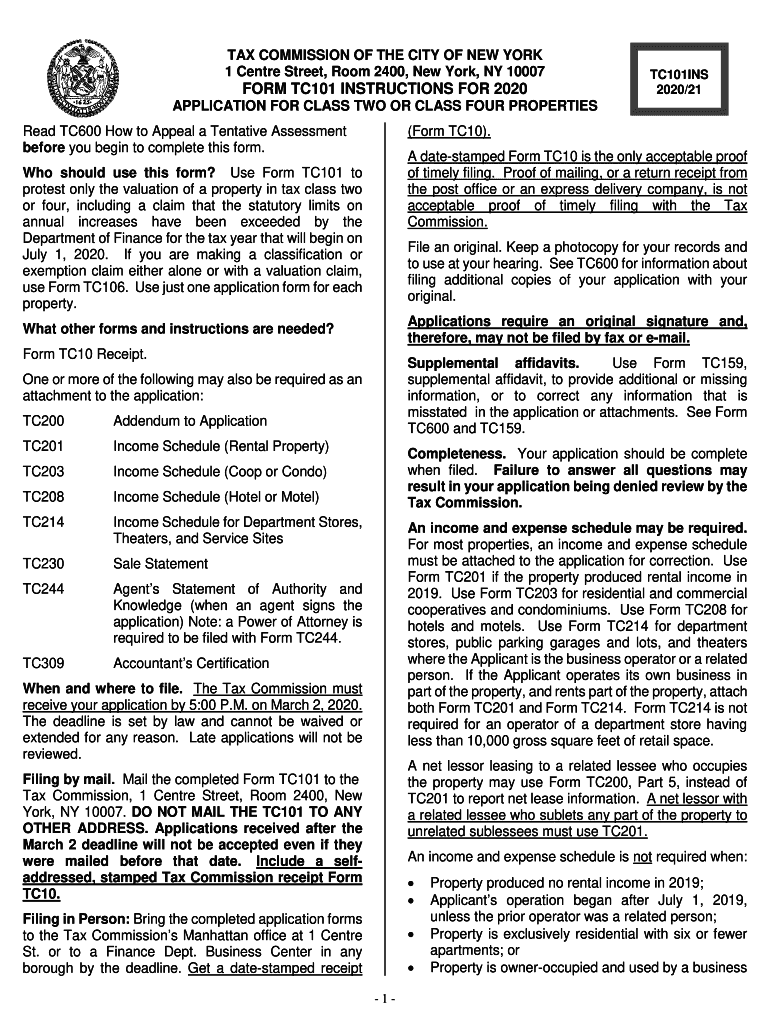

What is the New York 101 Form?

The New York 101 form, also known as TC-101, is a crucial document used by taxpayers in New York City to report their income and calculate their tax liabilities. This form is specifically tailored for individuals and businesses operating within the city limits, ensuring compliance with local tax regulations. It captures essential information regarding income sources, deductions, and credits that may apply to the taxpayer's situation.

Steps to Complete the New York 101 Form

Completing the New York 101 form involves several key steps to ensure accuracy and compliance. First, gather all necessary financial documents, such as W-2s, 1099s, and any other income statements. Next, carefully fill out each section of the form, providing accurate information about your income, deductions, and credits. It's important to double-check your entries for any errors. Finally, sign and date the form before submitting it to the appropriate tax authority.

Legal Use of the New York 101 Form

The New York 101 form is legally binding and must be filled out in accordance with state and local tax laws. To ensure its validity, taxpayers should adhere to guidelines set forth by the New York City Department of Finance. This includes maintaining accurate records and ensuring that all information reported is truthful and complete. Failure to comply with these regulations can result in penalties or audits.

Form Submission Methods

Taxpayers have several options for submitting the New York 101 form. The form can be submitted online through the New York City Department of Finance website, allowing for a quick and efficient filing process. Alternatively, individuals may choose to mail the completed form to the designated tax office or deliver it in person. Each method has its own processing times, so it's advisable to choose the one that best fits your needs.

Required Documents

To accurately complete the New York 101 form, certain documents are required. These typically include:

- W-2 forms from employers

- 1099 forms for any freelance or contract work

- Records of any other income sources

- Documentation for deductions and credits claimed

Having these documents on hand will streamline the completion process and help ensure accurate reporting.

Filing Deadlines / Important Dates

Understanding the filing deadlines for the New York 101 form is essential for compliance. Typically, the deadline for submission aligns with the federal tax deadline, which is usually April fifteenth. However, it is important to verify any specific dates or extensions that may apply, as they can vary from year to year. Keeping track of these deadlines can help avoid penalties and ensure timely processing of your tax return.

Quick guide on how to complete the tax commission of the city of new nycgov

Complete THE TAX COMMISSION OF THE CITY OF NEW NYC gov easily on any device

Online document administration has become favored by businesses and individuals alike. It serves as a perfect environmentally-friendly alternative to traditional printed and signed documents, allowing you to locate the right form and securely preserve it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage THE TAX COMMISSION OF THE CITY OF NEW NYC gov on any platform using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The simplest way to modify and eSign THE TAX COMMISSION OF THE CITY OF NEW NYC gov effortlessly

- Locate THE TAX COMMISSION OF THE CITY OF NEW NYC gov and click Get Form to commence.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of your documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and has the same legal validity as a conventional wet ink signature.

- Verify the details and click on the Done button to preserve your modifications.

- Select your preferred method of sending your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or mislaid files, tedious form searches, or errors that require printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Alter and eSign THE TAX COMMISSION OF THE CITY OF NEW NYC gov and ensure outstanding communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct the tax commission of the city of new nycgov

Create this form in 5 minutes!

People also ask

-

What is the New York 101 form?

The New York 101 form is a legal document used in the state of New York for various business purposes. It is essential for ensuring compliance with state regulations, and using airSlate SignNow, you can easily create, send, and eSign this form. Our platform simplifies the process, making it efficient for all users.

-

How can airSlate SignNow help with the New York 101 form?

airSlate SignNow streamlines the process of handling the New York 101 form by providing an easy-to-use interface for document preparation and eSigning. This ensures that you can quickly complete the form without hassle. Plus, all signatures are legally binding and secure.

-

Is there a cost associated with using airSlate SignNow for the New York 101 form?

Yes, there is a cost for utilizing airSlate SignNow, but it is designed to be cost-effective for businesses of all sizes. Our pricing plans offer flexibility and vary based on features and usage, making it economical to manage documents like the New York 101 form.

-

What features does airSlate SignNow offer for processing the New York 101 form?

With airSlate SignNow, you can take advantage of features such as customizable templates, real-time tracking, and secure cloud storage when processing the New York 101 form. These functionalities enhance productivity and ensure you never lose track of your important documents.

-

Can I integrate airSlate SignNow with other applications for the New York 101 form?

Absolutely! airSlate SignNow supports integrations with various applications, making it easier to manage the New York 101 form alongside your existing workflows. This integration capability improves efficiency and ensures that your document processes are seamless.

-

What are the benefits of using airSlate SignNow for the New York 101 form?

The main benefits of using airSlate SignNow for the New York 101 form include enhanced security, faster turnaround times, and the ability to track document status easily. This allows businesses to focus more on their core activities while ensuring compliance with regulatory requirements.

-

Is airSlate SignNow compliant with New York state regulations for the 101 form?

Yes, airSlate SignNow is compliant with New York state regulations, ensuring that your completed New York 101 form meets all legal requirements. We prioritize compliance so that you can confidently send and eSign documents without worrying about legal issues.

Get more for THE TAX COMMISSION OF THE CITY OF NEW NYC gov

- Illinois certification for hearing impaired license plates form

- Illinois korean war veteran license plates request form

- Connecticut department of motor vehicles ct business one form

- Pdf request pertaining to military records niagara county form

- Wwwdmvvirginiagovwebdocpdffor hire intrastate operating authority certificate license form

- Out of state vin verification form department of

- Ilovepdfcom ilovepdf online pdf tools for pdf lovers iloveimg api reference for developersiloveimg api reference for form

- Bulletin department of revenue motor vehicle form

Find out other THE TAX COMMISSION OF THE CITY OF NEW NYC gov

- Sign South Dakota Doctors LLC Operating Agreement Safe

- Sign Texas Doctors Moving Checklist Now

- Sign Texas Doctors Residential Lease Agreement Fast

- Sign Texas Doctors Emergency Contact Form Free

- Sign Utah Doctors Lease Agreement Form Mobile

- Sign Virginia Doctors Contract Safe

- Sign West Virginia Doctors Rental Lease Agreement Free

- Sign Alabama Education Quitclaim Deed Online

- Sign Georgia Education Business Plan Template Now

- Sign Louisiana Education Business Plan Template Mobile

- Sign Kansas Education Rental Lease Agreement Easy

- Sign Maine Education Residential Lease Agreement Later

- How To Sign Michigan Education LLC Operating Agreement

- Sign Mississippi Education Business Plan Template Free

- Help Me With Sign Minnesota Education Residential Lease Agreement

- Sign Nevada Education LLC Operating Agreement Now

- Sign New York Education Business Plan Template Free

- Sign Education Form North Carolina Safe

- Sign North Carolina Education Purchase Order Template Safe

- Sign North Dakota Education Promissory Note Template Now