Tr 99 Form

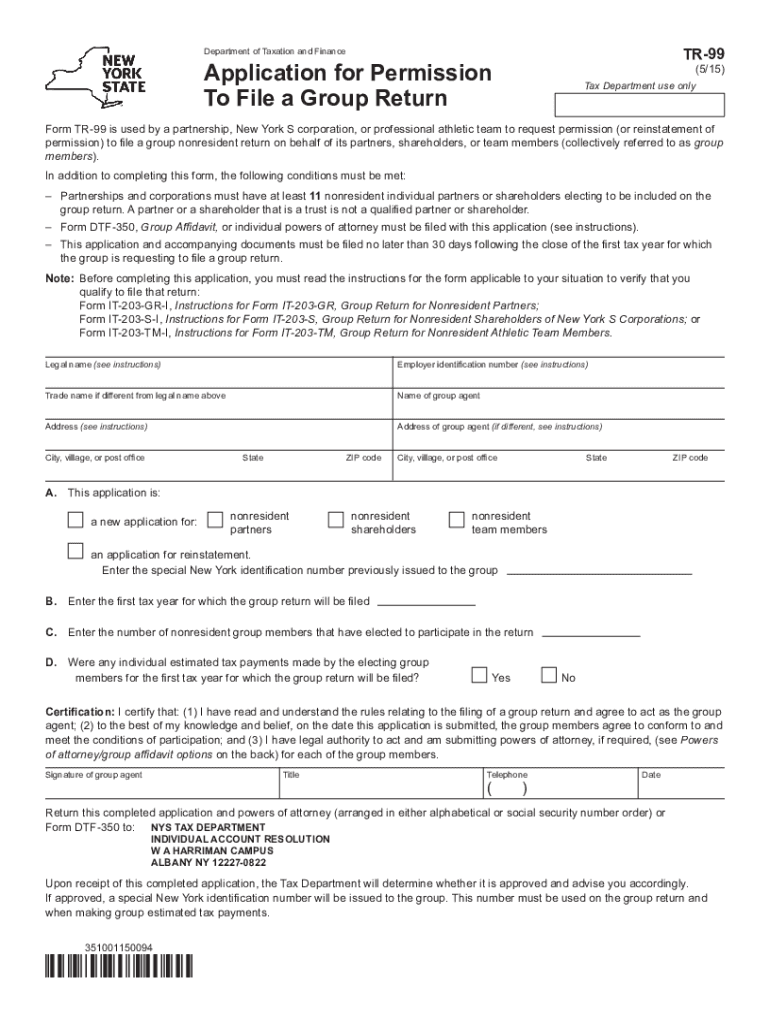

What is the TR-99?

The TR-99 form is a tax-related document used in the United States, specifically for reporting certain financial information to the Internal Revenue Service (IRS). It is essential for individuals and businesses to accurately complete this form to ensure compliance with federal tax regulations. The TR-99 serves as a declaration of income and expenses, allowing taxpayers to report their earnings and claim eligible deductions. Understanding the purpose and requirements of the TR-99 is crucial for maintaining proper tax records and avoiding potential penalties.

How to Obtain the TR-99

To obtain the TR-99 form, individuals can visit the official IRS website, where the form is available for download in PDF format. Alternatively, taxpayers can request a physical copy by contacting the IRS directly or visiting a local IRS office. It is important to ensure that you are using the most current version of the form, as tax regulations may change from year to year. Keeping a printed copy of the form handy can facilitate easier completion during tax season.

Steps to Complete the TR-99

Completing the TR-99 form involves several key steps to ensure accuracy and compliance with IRS guidelines. First, gather all necessary documentation, including income statements, receipts for deductions, and any relevant financial records. Next, fill out the form by entering your personal information, income details, and applicable deductions. It is advisable to double-check all entries for accuracy before submission. Finally, sign and date the form, and choose your preferred submission method, whether online, by mail, or in person.

Legal Use of the TR-99

The TR-99 form is legally binding when completed and submitted according to IRS regulations. To ensure its validity, taxpayers must adhere to the guidelines set forth by the IRS, including accurate reporting of income and expenses. Electronic submission of the TR-99 is permitted, provided that it meets the requirements of the Electronic Signatures in Global and National Commerce (ESIGN) Act. This ensures that eSignatures are legally recognized, making the electronic version of the form just as valid as a paper submission.

Filing Deadlines / Important Dates

Filing deadlines for the TR-99 are crucial for compliance with tax regulations. Typically, the form must be submitted by April 15 of each year for individual taxpayers. However, extensions may be available under certain circumstances. It is important to stay informed about any changes to filing deadlines, as the IRS may adjust dates due to various factors, including natural disasters or legislative changes. Marking these dates on a calendar can help ensure timely submission and avoid penalties.

Required Documents

When preparing to complete the TR-99 form, it is essential to gather all required documents. This includes W-2 forms from employers, 1099 forms for freelance or contract work, and any documentation related to deductible expenses, such as receipts for business-related purchases. Having all necessary information readily available will streamline the completion process and help ensure that the form is filled out accurately, reducing the risk of errors that could lead to delays or penalties.

Penalties for Non-Compliance

Failure to file the TR-99 form on time or inaccurately reporting information can result in significant penalties. The IRS may impose fines for late submissions, which can accumulate over time. Additionally, incorrect information may trigger audits or further scrutiny, leading to additional financial liability. Understanding the importance of compliance with TR-99 filing requirements can help taxpayers avoid these potential issues and maintain good standing with the IRS.

Quick guide on how to complete tr 99

Complete Tr 99 effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents swiftly without delays. Handle Tr 99 on any device using airSlate SignNow's Android or iOS applications and enhance any document-focused process today.

How to modify and electronically sign Tr 99 with ease

- Locate Tr 99 and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of the documents or redact sensitive information with tools that airSlate SignNow specifically provides for this purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and holds the same legal significance as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose your preferred method for submitting your form, whether via email, text message (SMS), invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Tr 99 to ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is airSlate SignNow and how does it relate to ny tr?

airSlate SignNow is a powerful eSignature and document management solution that streamlines the process of sending and signing documents online. Its user-friendly interface makes it an ideal choice for businesses looking for a cost-effective option. With airSlate SignNow, you can efficiently manage your documents related to ny tr, ensuring a smooth workflow.

-

What are the key features of airSlate SignNow for ny tr?

airSlate SignNow offers a range of features perfect for managing ny tr, including customizable templates, automated workflows, and advanced security protocols. These tools not only enhance user experience but also ensure compliance with legal and industry regulations. Additionally, users can track document status in real-time, adding to the overall efficiency.

-

How does pricing work for airSlate SignNow in relation to ny tr?

airSlate SignNow provides flexible pricing plans tailored to the specific needs of your business, including options ideal for handling ny tr. You can choose between monthly and annual subscriptions with varying access to features. This ensures that you get the best value for your investment while managing your document workflows effectively.

-

What are the benefits of using airSlate SignNow for businesses dealing with ny tr?

Using airSlate SignNow for ny tr brings numerous benefits, including improved document turnaround times and enhanced collaboration among team members. The platform's intuitive design simplifies the process of creating and signing documents, boosting productivity. Moreover, it reduces the reliance on paper, contributing to a more sustainable business practice.

-

Can airSlate SignNow integrate with other tools for managing ny tr?

Yes, airSlate SignNow offers integrations with various third-party applications, making it easier to incorporate into your existing tech stack for managing ny tr. Whether you use CRM systems, cloud storage solutions, or project management tools, airSlate SignNow can seamlessly connect to enhance your workflow. This flexibility helps you maximize efficiency in document handling.

-

Is airSlate SignNow secure for handling sensitive documents related to ny tr?

Absolutely! airSlate SignNow prioritizes security, employing top-tier encryption and compliance measures to protect sensitive documents, including those associated with ny tr. The platform also offers features like two-factor authentication and audit trails, ensuring that your information remains safe throughout the document signing process. Trust is key, and airSlate SignNow delivers.

-

What type of customer support does airSlate SignNow offer for ny tr users?

airSlate SignNow provides comprehensive customer support for ny tr users, including access to a dedicated help center, live chat, and email support. This ensures that you receive prompt assistance whenever you encounter challenges or have questions about using the platform. The support team is friendly and knowledgeable, making it easy for users to solve issues efficiently.

Get more for Tr 99

- My teaching strategies interrater reliability test answers form

- Lic life certificate form

- Bank certificate for confirmation of bank details form

- United states postal service retail quick tip sheet 2021 form

- Stroke risk assessment form thompsonhealthcom

- Fiscal sponsorship agreement template form

- Bank appointment for currency exchange instructions ning form

- Dichiarazioni sostitutive dellatto di notoriet form

Find out other Tr 99

- eSignature West Virginia Construction Lease Agreement Myself

- How To eSignature Alabama Education POA

- How To eSignature California Education Separation Agreement

- eSignature Arizona Education POA Simple

- eSignature Idaho Education Lease Termination Letter Secure

- eSignature Colorado Doctors Business Letter Template Now

- eSignature Iowa Education Last Will And Testament Computer

- How To eSignature Iowa Doctors Business Letter Template

- Help Me With eSignature Indiana Doctors Notice To Quit

- eSignature Ohio Education Purchase Order Template Easy

- eSignature South Dakota Education Confidentiality Agreement Later

- eSignature South Carolina Education Executive Summary Template Easy

- eSignature Michigan Doctors Living Will Simple

- How Do I eSignature Michigan Doctors LLC Operating Agreement

- How To eSignature Vermont Education Residential Lease Agreement

- eSignature Alabama Finance & Tax Accounting Quitclaim Deed Easy

- eSignature West Virginia Education Quitclaim Deed Fast

- eSignature Washington Education Lease Agreement Form Later

- eSignature Missouri Doctors Residential Lease Agreement Fast

- eSignature Wyoming Education Quitclaim Deed Easy