Individual Tax Forms City of Kettering

What is the Individual Tax Forms City Of Kettering

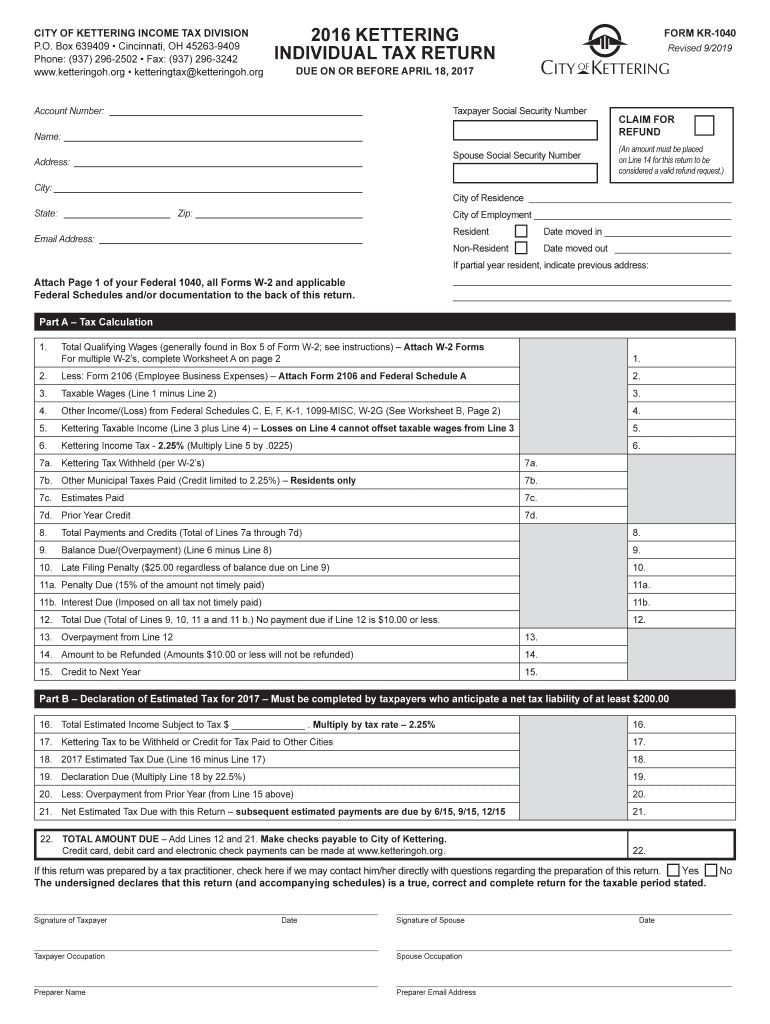

The Individual Tax Forms City Of Kettering are specific documents required for residents to report their income and calculate their tax obligations to the city. These forms are designed to ensure compliance with local tax laws and regulations. They typically include information about income sources, deductions, and credits applicable to the taxpayer's situation. Understanding these forms is crucial for accurate tax filing and to avoid potential penalties.

How to use the Individual Tax Forms City Of Kettering

Using the Individual Tax Forms City Of Kettering involves several key steps. First, gather all necessary financial documents, including W-2s, 1099s, and any relevant receipts for deductions. Next, carefully fill out the forms, ensuring all information is accurate and complete. After completing the forms, review them for any errors. Finally, submit the forms according to the specified methods, which may include online submission, mailing, or in-person delivery at designated locations.

Steps to complete the Individual Tax Forms City Of Kettering

Completing the Individual Tax Forms City Of Kettering requires a systematic approach:

- Gather Documentation: Collect all necessary income and deduction documents.

- Fill Out the Forms: Enter your personal information, income details, and applicable deductions.

- Review for Accuracy: Double-check all entries to ensure they are correct.

- Sign and Date: Ensure you sign and date the forms as required.

- Submit the Forms: Choose your preferred submission method and send the forms accordingly.

Legal use of the Individual Tax Forms City Of Kettering

The legal use of the Individual Tax Forms City Of Kettering is essential for compliance with local tax laws. These forms must be completed accurately and submitted by the designated deadlines to avoid penalties. Electronic signatures are recognized as legally binding, provided they comply with relevant regulations such as ESIGN and UETA. Using a secure platform for eSigning can enhance the validity of your submission.

Filing Deadlines / Important Dates

Filing deadlines for the Individual Tax Forms City Of Kettering are critical to ensure timely compliance. Typically, the deadline aligns with the federal tax filing date, which is usually April 15. However, local regulations may specify different dates or extensions. It is important to check for any updates or changes to these deadlines each tax year to avoid late fees or penalties.

Required Documents

To complete the Individual Tax Forms City Of Kettering, several documents are generally required:

- W-2 forms from employers

- 1099 forms for any freelance or contract work

- Receipts for deductible expenses

- Previous year’s tax return for reference

- Any other documentation relevant to income or deductions

Quick guide on how to complete individual tax forms city of kettering

Effortlessly Prepare Individual Tax Forms City Of Kettering on Any Device

Online document management has become popular among businesses and individuals. It provides an ideal eco-friendly substitute for traditional printed and signed documents, as you can acquire the appropriate form and securely save it online. airSlate SignNow offers all the tools you require to create, amend, and eSign your documents quickly without delays. Manage Individual Tax Forms City Of Kettering on any device using airSlate SignNow's Android or iOS applications and streamline any document-related task today.

The Easiest Way to Edit and eSign Individual Tax Forms City Of Kettering Seamlessly

- Obtain Individual Tax Forms City Of Kettering and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight essential sections of the documents or redact sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your signature with the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click the Done button to save your changes.

- Choose your preferred method to send your form, whether by email, SMS, or an invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Modify and eSign Individual Tax Forms City Of Kettering and guarantee outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What are Individual Tax Forms City Of Kettering?

Individual Tax Forms City Of Kettering refer to the specific forms required by residents to file their local income taxes. These forms are essential for compliance with Kettering’s tax regulations and help ensure that residents contribute to local services. Understanding these documents is crucial for accurate tax reporting and possible deductions.

-

How can airSlate SignNow help with Individual Tax Forms City Of Kettering?

airSlate SignNow streamlines the process of completing and eSigning Individual Tax Forms City Of Kettering. Our platform allows users to fill out these forms digitally, ensuring that all necessary fields are completed efficiently. With user-friendly features, you can easily send your completed forms directly to the appropriate city office.

-

Are there any fees associated with filing Individual Tax Forms City Of Kettering using airSlate SignNow?

Yes, while airSlate SignNow offers a cost-effective solution, there may be fees associated with the service depending on the plan you choose. These fees provide access to essential tools for managing and submitting Individual Tax Forms City Of Kettering. Review our pricing plans to find an option that fits your budget.

-

What features does airSlate SignNow offer for Individual Tax Forms City Of Kettering?

airSlate SignNow provides several features tailored for completing Individual Tax Forms City Of Kettering, including secure eSignature capabilities, customizable templates, and easy file sharing. These features enhance user experience by making the form-filling process swift and compliant with local tax regulations.

-

Is it safe to use airSlate SignNow for Individual Tax Forms City Of Kettering?

Absolutely, airSlate SignNow prioritizes the security of your data. Our platform uses advanced encryption and complies with industry standards to protect sensitive information related to Individual Tax Forms City Of Kettering. You can confidently submit your forms knowing your personal data is secure.

-

Can I access Individual Tax Forms City Of Kettering on mobile devices?

Yes, airSlate SignNow is accessible on both desktop and mobile devices, making it easy to manage Individual Tax Forms City Of Kettering anywhere, anytime. Our mobile-friendly interface ensures you can complete and eSign your forms on the go, providing flexibility and convenience to users.

-

What integrations does airSlate SignNow offer for Individual Tax Forms City Of Kettering?

airSlate SignNow integrates with various applications and services to enhance the process of managing Individual Tax Forms City Of Kettering. These integrations enable users to import and export data seamlessly, synchronize documents with cloud storage, and connect with accounting software for easier tax management.

Get more for Individual Tax Forms City Of Kettering

Find out other Individual Tax Forms City Of Kettering

- How Can I eSign Illinois Healthcare / Medical Presentation

- Can I eSign Hawaii High Tech Document

- How Can I eSign Hawaii High Tech Document

- How Do I eSign Hawaii High Tech Document

- Can I eSign Hawaii High Tech Word

- How Can I eSign Hawaii High Tech Form

- How Do I eSign New Mexico Healthcare / Medical Word

- How To eSign Washington High Tech Presentation

- Help Me With eSign Vermont Healthcare / Medical PPT

- How To eSign Arizona Lawers PDF

- How To eSign Utah Government Word

- How Can I eSign Connecticut Lawers Presentation

- Help Me With eSign Hawaii Lawers Word

- How Can I eSign Hawaii Lawers Document

- How To eSign Hawaii Lawers PPT

- Help Me With eSign Hawaii Insurance PPT

- Help Me With eSign Idaho Insurance Presentation

- Can I eSign Indiana Insurance Form

- How To eSign Maryland Insurance PPT

- Can I eSign Arkansas Life Sciences PDF