Solved I Am Being Asked to Fill Out Form 511ef I Think I May

Understanding the 511ef Form

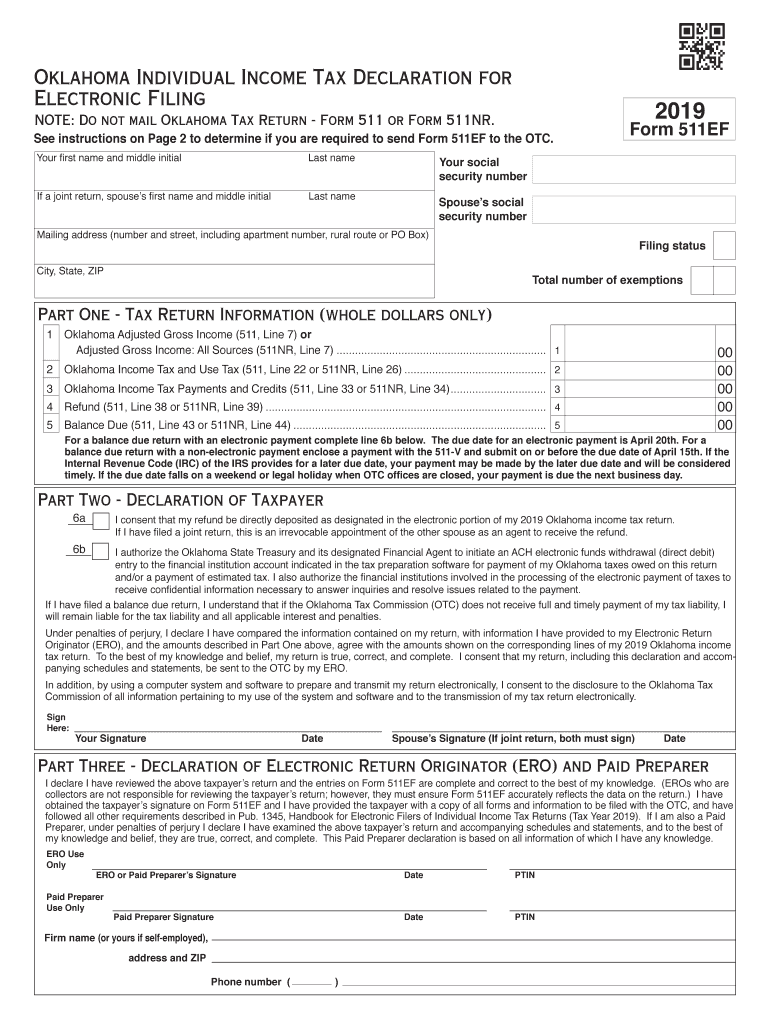

The 511ef form is an individual tax form used in Oklahoma for reporting income and calculating tax liability. It is essential for residents and those earning income in the state to ensure compliance with state tax laws. The form requires personal information, income details, and deductions applicable to the taxpayer's situation. Understanding its purpose is crucial for accurate filing and avoiding potential penalties.

Steps to Complete the 511ef Form

Completing the 511ef form involves several key steps:

- Gather Required Information: Collect personal identification details, income statements, and any relevant deductions.

- Fill Out Personal Information: Enter your name, address, and Social Security number accurately.

- Report Income: Include all sources of income, such as wages, self-employment earnings, and interest.

- Claim Deductions: Identify and apply any eligible deductions to reduce your taxable income.

- Calculate Tax Liability: Use the provided tax tables or formulas to determine your tax owed.

- Review and Sign: Ensure all information is correct, then sign and date the form.

Legal Use of the 511ef Form

The 511ef form is legally binding when completed and submitted according to Oklahoma state tax regulations. It must be filled out truthfully and accurately to ensure compliance. Any fraudulent information can lead to penalties, including fines or legal action. Utilizing secure electronic tools for submission can enhance the legal validity of the document.

Filing Deadlines for the 511ef Form

Timely submission of the 511ef form is crucial to avoid penalties. The filing deadline typically aligns with the federal tax deadline, which is usually April 15. If the deadline falls on a weekend or holiday, it may be extended to the next business day. Taxpayers should stay informed about any changes to these deadlines, especially in light of potential extensions or adjustments by state authorities.

Required Documents for the 511ef Form

To successfully complete the 511ef form, certain documents are necessary:

- W-2 forms from employers

- 1099 forms for self-employment or other income

- Receipts for deductible expenses

- Previous year’s tax return for reference

Having these documents ready can streamline the filing process and help ensure accuracy.

Form Submission Methods

The 511ef form can be submitted in several ways to accommodate different preferences:

- Online: Utilize electronic filing through authorized platforms for a quick and secure submission.

- Mail: Print the completed form and send it to the designated state tax office address.

- In-Person: Deliver the form directly to a local tax office for immediate processing.

Choosing the right submission method can impact processing times and ease of completion.

Quick guide on how to complete solved i am being asked to fill out form 511ef i think i may

Complete Solved I Am Being Asked To Fill Out Form 511ef I Think I May effortlessly on any device

Online document management has become increasingly favored by businesses and individuals alike. It offers a convenient eco-friendly alternative to traditional printed and signed documents, allowing you to access the appropriate form and securely store it online. airSlate SignNow provides all the features you need to create, modify, and electronically sign your documents swiftly without delays. Manage Solved I Am Being Asked To Fill Out Form 511ef I Think I May on any platform with airSlate SignNow's Android or iOS applications, and streamline any document-centric process today.

The simplest way to modify and electronically sign Solved I Am Being Asked To Fill Out Form 511ef I Think I May effortlessly

- Locate Solved I Am Being Asked To Fill Out Form 511ef I Think I May and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize pertinent sections of your documents or redact sensitive information using tools specifically provided by airSlate SignNow for that purpose.

- Generate your signature with the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Select how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to missing or lost files, tedious form hunting, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device you prefer. Modify and eSign Solved I Am Being Asked To Fill Out Form 511ef I Think I May and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is 511ef and how does it relate to airSlate SignNow?

511ef is a key term associated with airSlate SignNow, which empowers businesses to manage document signing and eSigning seamlessly. It serves as a representation of our efficient and user-friendly solution for document workflow. By understanding 511ef, users can grasp the full capabilities of our platform.

-

What are the main features of airSlate SignNow?

airSlate SignNow offers a range of features including document management, eSigning, and automated workflows. Enhanced by the concept of 511ef, our platform ensures that users enjoy a comprehensive solution to streamline their document processes. It integrates seamlessly into existing workflows, making it an ideal choice for various business needs.

-

How much does airSlate SignNow cost?

airSlate SignNow provides flexible pricing plans that cater to different business sizes and needs. Prices are designed to provide excellent value, especially for users looking to implement the efficiencies of 511ef in their operations. You can choose a plan that fits your budget while still benefiting from our robust features.

-

Can airSlate SignNow integrate with other tools?

Yes, airSlate SignNow offers extensive integration capabilities, allowing businesses to connect with a variety of applications. Whether you're using CRM systems, project management tools, or others, the principles of 511ef ensure smooth interoperability. This enhances your workflow and improves efficiency across platforms.

-

What are the benefits of using airSlate SignNow for eSigning?

Utilizing airSlate SignNow allows for quick and secure eSigning of documents, saving you time and enhancing compliance. With the efficiency of 511ef at its core, our solution simplifies the signing process, making it accessible for users anytime, anywhere. This translates into improved productivity for your business.

-

Is airSlate SignNow user-friendly?

Absolutely! airSlate SignNow prioritizes user experience with an intuitive interface designed for all levels of tech proficiency. By embodying the concept of 511ef, we make it easy for users to navigate the platform and start leveraging its features without extensive training. Ease of use is a signNow benefit of our service.

-

What industries can benefit from airSlate SignNow?

Various industries including finance, real estate, and healthcare can benefit signNowly from airSlate SignNow. The principles of 511ef allow our platform to be versatile, addressing unique document needs across different sectors. Businesses in these industries can streamline their processes and enhance operational efficiency.

Get more for Solved I Am Being Asked To Fill Out Form 511ef I Think I May

Find out other Solved I Am Being Asked To Fill Out Form 511ef I Think I May

- Can I eSignature Kentucky Performance Contract

- eSignature Nevada Performance Contract Safe

- eSignature California Franchise Contract Secure

- How To eSignature Colorado Sponsorship Proposal Template

- eSignature Alabama Distributor Agreement Template Secure

- eSignature California Distributor Agreement Template Later

- eSignature Vermont General Power of Attorney Template Easy

- eSignature Michigan Startup Cost Estimate Simple

- eSignature New Hampshire Invoice for Services (Standard Format) Computer

- eSignature Arkansas Non-Compete Agreement Later

- Can I eSignature Arizona Non-Compete Agreement

- How Do I eSignature New Jersey Non-Compete Agreement

- eSignature Tennessee Non-Compete Agreement Myself

- How To eSignature Colorado LLC Operating Agreement

- Help Me With eSignature North Carolina LLC Operating Agreement

- eSignature Oregon LLC Operating Agreement Online

- eSignature Wyoming LLC Operating Agreement Online

- eSignature Wyoming LLC Operating Agreement Computer

- eSignature Wyoming LLC Operating Agreement Later

- eSignature Wyoming LLC Operating Agreement Free