Schedule B Stocks & Bonds REV 1503 FormsPublications 2015-2026

Understanding the Schedule B for Stocks & Bonds on the PA 1503 Inheritance Form

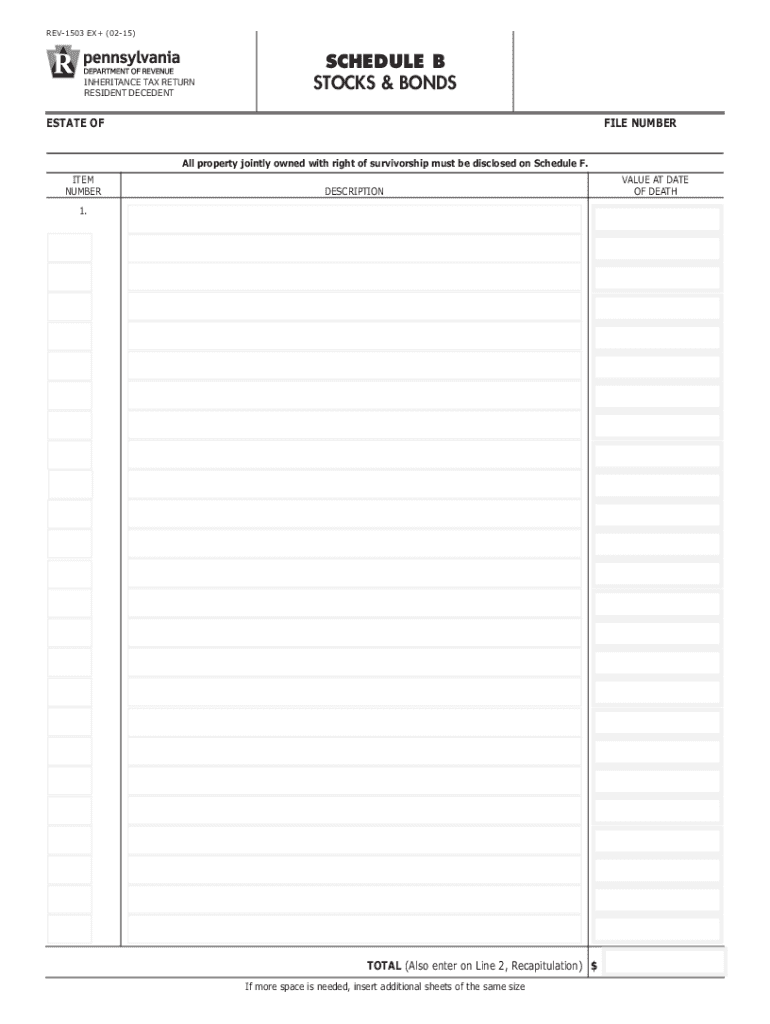

The Schedule B for Stocks & Bonds is an essential component of the PA 1503 inheritance tax form. This schedule is specifically designed to report the value of stocks and bonds that are part of the estate. Accurately completing this section is crucial for ensuring compliance with Pennsylvania inheritance tax regulations. The information provided in Schedule B helps determine the overall tax liability of the estate, making it vital for executors and heirs alike.

Steps to Complete the Schedule B for Stocks & Bonds

Completing the Schedule B for Stocks & Bonds on the PA 1503 form involves several key steps:

- Gather all necessary documents related to the stocks and bonds, including statements and certificates.

- Determine the fair market value of each stock and bond as of the date of death of the decedent.

- List each asset on the Schedule B, including the name of the issuer, number of shares or bonds, and their respective values.

- Ensure that all entries are accurate and reflect the current market conditions to avoid discrepancies.

Legal Use of the Schedule B for Stocks & Bonds

The Schedule B for Stocks & Bonds serves a legal purpose in the context of Pennsylvania inheritance tax. It provides the state with a clear picture of the assets held by the decedent. This documentation is necessary for the proper assessment of taxes owed. Failure to accurately report these assets can lead to penalties, making it essential for executors to understand the legal implications of this schedule.

Filing Deadlines for the PA 1503 Inheritance Tax Form

Timely filing of the PA 1503 inheritance tax form, including Schedule B, is critical. The form must typically be filed within nine months of the decedent's date of death to avoid additional penalties. If the form is filed late, interest may accrue on any taxes owed, increasing the financial burden on the estate. Executors should mark their calendars to ensure compliance with these important deadlines.

Required Documents for Completing the Schedule B

To complete the Schedule B for Stocks & Bonds, certain documents are necessary:

- Death certificate of the decedent.

- Financial statements showing the value of stocks and bonds at the time of death.

- Any documentation related to the ownership of the assets, such as brokerage statements or transfer documents.

Examples of Using the Schedule B for Stocks & Bonds

When filling out the Schedule B, it can be helpful to consider examples of how to report various assets:

- If the decedent owned 100 shares of Company A valued at $50 per share, the total value reported would be $5,000.

- For bonds, if the decedent held a bond with a face value of $1,000 and it was valued at $1,200 at the time of death, the $1,200 should be reported.

Quick guide on how to complete schedule b stocks amp bonds rev 1503 formspublications

Effortlessly prepare Schedule B Stocks & Bonds REV 1503 FormsPublications on any device

The popularity of online document management has surged among businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed papers, allowing you to access the appropriate forms and securely store them online. airSlate SignNow equips you with all the tools necessary to create, edit, and electronically sign your documents quickly without delays. Manage Schedule B Stocks & Bonds REV 1503 FormsPublications on any device using the airSlate SignNow applications for Android or iOS and simplify your document-related tasks today.

How to modify and electronically sign Schedule B Stocks & Bonds REV 1503 FormsPublications with ease

- Obtain Schedule B Stocks & Bonds REV 1503 FormsPublications and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize pertinent sections of the documents or conceal sensitive data with tools that airSlate SignNow provides specifically for that purpose.

- Generate your electronic signature with the Sign feature, which takes moments and carries the same legal validity as a conventional handwritten signature.

- Review the information and click on the Done button to save your modifications.

- Choose your preferred method for sending your form, whether by email, SMS, invite link, or downloading it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs with just a few clicks from any device. Edit and electronically sign Schedule B Stocks & Bonds REV 1503 FormsPublications to ensure effective communication at every stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct schedule b stocks amp bonds rev 1503 formspublications

Create this form in 5 minutes!

People also ask

-

What is the pa 1503 inheritance form?

The pa 1503 inheritance form is a crucial document for reporting inherited assets in Pennsylvania. It helps clarify any inheritance tax obligations associated with the estate. Understanding the requirements of the pa 1503 inheritance can simplify the legal process for executors.

-

How can airSlate SignNow assist with completing the pa 1503 inheritance form?

AirSlate SignNow provides a user-friendly platform to complete the pa 1503 inheritance form efficiently. Our electronic signing capabilities help you gather necessary signatures quickly. With our solution, you can streamline the document management process, making inheritance transactions simpler.

-

Is there a cost associated with using airSlate SignNow for the pa 1503 inheritance?

Yes, there is a subscription cost for using airSlate SignNow, but it remains an affordable solution compared to traditional methods. You gain access to unlimited eSigning, document storage, and collaboration features. Investing in airSlate SignNow for managing the pa 1503 inheritance will ultimately save you time and reduce paperwork hassle.

-

What features does airSlate SignNow offer for managing the pa 1503 inheritance process?

AirSlate SignNow includes features like customizable templates, secure document storage, and cloud-based collaboration that enhance the management of the pa 1503 inheritance process. Users can track document status in real-time, enabling better communication among involved parties. Our platform simplifies the workflow for inheritance-related documentation.

-

Can I integrate airSlate SignNow with other software for the pa 1503 inheritance documentation?

Yes, airSlate SignNow supports integrations with various applications and CRM systems, making it easier to manage the pa 1503 inheritance documentation alongside other tools. This interoperability enhances your overall productivity and efficiency. By integrating airSlate SignNow, you can streamline your entire inheritance documentation process.

-

What benefits does airSlate SignNow provide for managing inheritance documents like the pa 1503?

Using airSlate SignNow for managing the pa 1503 inheritance documents offers numerous benefits, including reduced processing time and increased accuracy. The platform’s electronic signing capabilities enhance compliance and security. By utilizing airSlate SignNow, you ensure a smoother inheritance management experience.

-

How secure is airSlate SignNow when handling sensitive documents like the pa 1503 inheritance form?

AirSlate SignNow prioritizes security with features like data encryption and secure access controls. Handling sensitive documents, such as the pa 1503 inheritance form, is safe within our platform. Our robust security measures ensure that your confidential information remains protected throughout the process.

Get more for Schedule B Stocks & Bonds REV 1503 FormsPublications

Find out other Schedule B Stocks & Bonds REV 1503 FormsPublications

- Electronic signature Wisconsin Car Dealer Contract Simple

- Electronic signature Wyoming Car Dealer Lease Agreement Template Computer

- How Do I Electronic signature Mississippi Business Operations Rental Application

- Electronic signature Missouri Business Operations Business Plan Template Easy

- Electronic signature Missouri Business Operations Stock Certificate Now

- Electronic signature Alabama Charity Promissory Note Template Computer

- Electronic signature Colorado Charity Promissory Note Template Simple

- Electronic signature Alabama Construction Quitclaim Deed Free

- Electronic signature Alaska Construction Lease Agreement Template Simple

- Electronic signature Construction Form Arizona Safe

- Electronic signature Kentucky Charity Living Will Safe

- Electronic signature Construction Form California Fast

- Help Me With Electronic signature Colorado Construction Rental Application

- Electronic signature Connecticut Construction Business Plan Template Fast

- Electronic signature Delaware Construction Business Letter Template Safe

- Electronic signature Oklahoma Business Operations Stock Certificate Mobile

- Electronic signature Pennsylvania Business Operations Promissory Note Template Later

- Help Me With Electronic signature North Dakota Charity Resignation Letter

- Electronic signature Indiana Construction Business Plan Template Simple

- Electronic signature Wisconsin Charity Lease Agreement Mobile