Pa Rev 516 2019-2026

What is the Pa Rev 516?

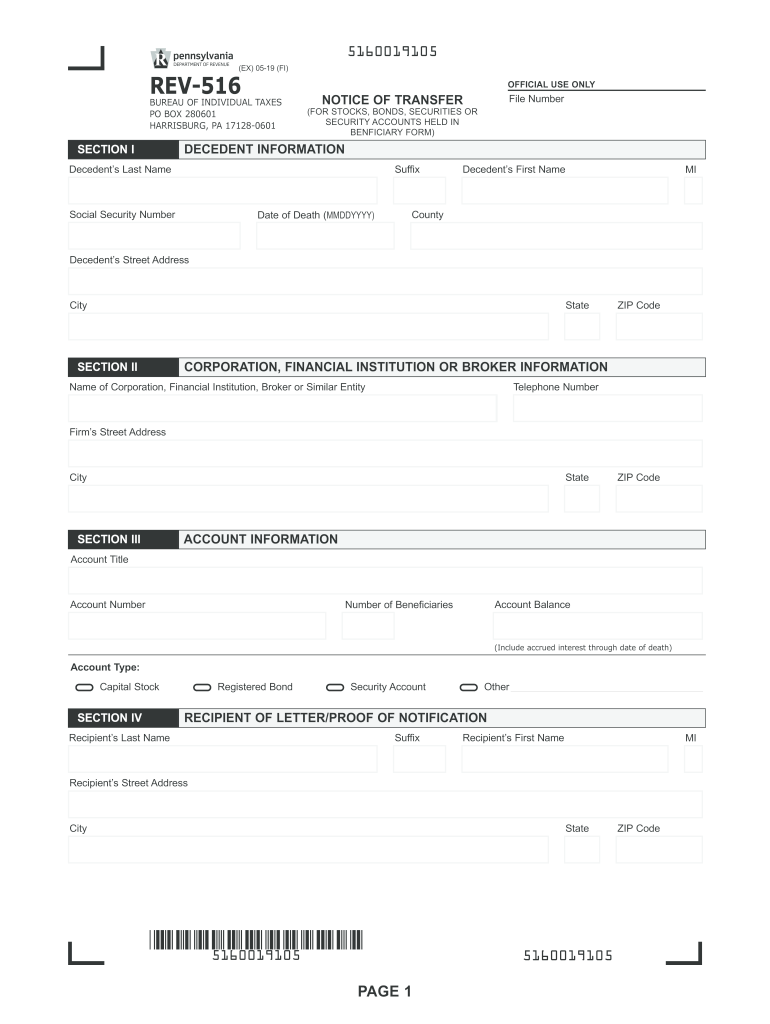

The Pa Rev 516, also known as the Pennsylvania Inheritance Tax Waiver Form, is a crucial document used to request a waiver of the inheritance tax in Pennsylvania. This form is typically required when an estate is being settled and the heirs wish to claim their inheritance without the burden of tax obligations. The rev 516 form serves as an official declaration that the inheritance tax has been addressed, allowing for a smoother transfer of assets to beneficiaries.

How to use the Pa Rev 516

Using the Pa Rev 516 involves several steps to ensure compliance with state regulations. First, gather all necessary information regarding the estate and its beneficiaries. Next, fill out the form accurately, providing details such as the decedent's information and the relationship of the heirs to the decedent. Once completed, the form must be submitted to the appropriate county office or tax authority for processing. It is essential to retain copies of the submitted form for personal records.

Steps to complete the Pa Rev 516

Completing the Pa Rev 516 requires careful attention to detail. Follow these steps:

- Obtain the latest version of the form from an official source.

- Fill in the decedent's name, date of death, and Social Security number.

- List the names, addresses, and relationships of all beneficiaries.

- Indicate the value of the estate and any deductions applicable.

- Sign and date the form to certify its accuracy.

- Submit the completed form to the appropriate tax authority.

Legal use of the Pa Rev 516

The legal validity of the Pa Rev 516 is anchored in Pennsylvania state law, which allows for the electronic submission of tax waiver forms under specific conditions. To ensure the form is legally binding, it must be completed with accurate information and submitted to the relevant authorities. Compliance with the Electronic Signatures in Global and National Commerce (ESIGN) Act and the Uniform Electronic Transactions Act (UETA) is crucial when submitting the form electronically.

Eligibility Criteria

To be eligible to use the Pa Rev 516, the individual must be an heir or beneficiary of the estate in question. The estate must be subject to Pennsylvania inheritance tax, and the waiver is typically applicable when the estate's value falls below a certain threshold. Additionally, all required documentation must be provided to support the waiver request, including proof of relationship to the decedent and any relevant estate valuations.

Required Documents

When submitting the Pa Rev 516, several documents may be required to support the application. These typically include:

- A copy of the death certificate of the decedent.

- Proof of relationship to the decedent, such as birth or marriage certificates.

- Documentation of the estate's value, including appraisals or financial statements.

- Any prior tax returns or waivers related to the estate.

Quick guide on how to complete pa rev 516

Complete Pa Rev 516 effortlessly on any device

Managing documents online has become increasingly popular among businesses and individuals. It offers an excellent environmentally friendly alternative to conventional printed and signed documents, as you can easily find the necessary form and securely store it online. airSlate SignNow provides you with all the tools you require to create, modify, and electronically sign your documents quickly and without delays. Handle Pa Rev 516 on any device using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The easiest method to modify and electronically sign Pa Rev 516 effortlessly

- Find Pa Rev 516 and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Highlight important sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for this purpose.

- Create your electronic signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review the information and click on the Done button to save your modifications.

- Choose how you wish to share your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from a device of your choice. Modify and electronically sign Pa Rev 516 and guarantee exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct pa rev 516

Create this form in 5 minutes!

People also ask

-

What is rev 516 and how does it relate to airSlate SignNow?

Rev 516 is a key feature within the airSlate SignNow platform that streamlines the eSigning process for documents. This functionality helps businesses efficiently manage their signatures while enhancing the overall workflow. With rev 516, users can ensure secure and legally binding electronic signatures.

-

What are the pricing options for using rev 516 with airSlate SignNow?

airSlate SignNow offers flexible pricing tiers that include rev 516 in their plans. Customers can choose from various options based on their usage needs, whether for individual users or larger teams. The pricing is designed to be cost-effective, providing great value for the features offered.

-

What benefits does rev 516 provide for businesses?

The rev 516 feature in airSlate SignNow provides multiple benefits, including improved document turnaround time and reduced paper waste. It allows teams to collaborate seamlessly while ensuring compliance with legal standards for eSignatures. This efficiency can lead to enhanced productivity and cost savings.

-

Can rev 516 integrate with other software tools?

Yes, rev 516 offers integration capabilities with various software applications commonly used by businesses. This includes CRM systems, cloud storage solutions, and productivity tools. By integrating these systems, users can enhance their workflow and access documents easily.

-

Is rev 516 secure for handling sensitive documents?

Absolutely, rev 516 comes with robust security features designed to protect sensitive information throughout the signing process. airSlate SignNow utilizes encryption and authentication protocols to ensure that all eSigned documents are secure. Businesses can trust rev 516 for their confidential document handling.

-

How does rev 516 improve the customer experience?

Rev 516 signNowly enhances the customer experience by reducing the time it takes to complete document transactions. Clients can sign documents from anywhere, at any time, using any device. This convenience leads to faster approvals and improved client satisfaction.

-

What types of documents can be handled with rev 516?

Rev 516 can handle a wide variety of document types, including contracts, agreements, and forms. AirSlate SignNow's versatile platform supports multiple file formats, ensuring that users can easily send and eSign all necessary documents. This flexibility simplifies the signing process for users.

Get more for Pa Rev 516

- Tax collectors mailing list flhsmvgov form

- Fillable online form tr 1 application for registration

- Illinois pearl harbor survivor license plates request form

- Cardiology medical report state of connecticut drivers form

- Ol 16 s application for salespersons license california dmv form

- Illinois irp average per vehicle distance chart form

- D ctgov connecticuts official state website form

- Application to issue or replace 45 day form

Find out other Pa Rev 516

- eSignature Arkansas Life Sciences LLC Operating Agreement Mobile

- eSignature California Life Sciences Contract Safe

- eSignature California Non-Profit LLC Operating Agreement Fast

- eSignature Delaware Life Sciences Quitclaim Deed Online

- eSignature Non-Profit Form Colorado Free

- eSignature Mississippi Lawers Residential Lease Agreement Later

- How To eSignature Mississippi Lawers Residential Lease Agreement

- Can I eSignature Indiana Life Sciences Rental Application

- eSignature Indiana Life Sciences LLC Operating Agreement Fast

- eSignature Kentucky Life Sciences Quitclaim Deed Fast

- Help Me With eSignature Georgia Non-Profit NDA

- How Can I eSignature Idaho Non-Profit Business Plan Template

- eSignature Mississippi Life Sciences Lease Agreement Myself

- How Can I eSignature Mississippi Life Sciences Last Will And Testament

- How To eSignature Illinois Non-Profit Contract

- eSignature Louisiana Non-Profit Business Plan Template Now

- How Do I eSignature North Dakota Life Sciences Operating Agreement

- eSignature Oregon Life Sciences Job Offer Myself

- eSignature Oregon Life Sciences Job Offer Fast

- eSignature Oregon Life Sciences Warranty Deed Myself