Pa Inheritance Tax Waiver Form 2013

What is the Pennsylvania Inheritance Tax Waiver Form?

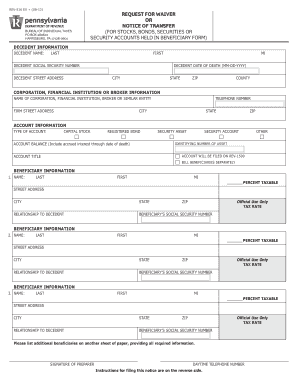

The Pennsylvania inheritance tax waiver form, commonly referred to as the PA inheritance tax waiver form or form 516, is a legal document used to request a waiver of inheritance tax obligations. This form is essential for beneficiaries who inherit property or assets in Pennsylvania and wish to ensure that the transfer occurs without the immediate burden of tax payments. The waiver is particularly relevant when the estate's value falls below a certain threshold, allowing heirs to receive their inheritance without tax implications.

How to Use the Pennsylvania Inheritance Tax Waiver Form

Using the Pennsylvania inheritance tax waiver form involves several steps to ensure compliance with state regulations. First, beneficiaries must complete the form accurately, providing all necessary information about the deceased and the assets involved. Once completed, the form should be submitted to the Pennsylvania Department of Revenue. It is important to keep a copy of the submitted form for personal records. Additionally, the waiver can help expedite the transfer of assets, making it crucial for timely estate settlements.

Steps to Complete the Pennsylvania Inheritance Tax Waiver Form

Completing the Pennsylvania inheritance tax waiver form requires careful attention to detail. Here are the steps:

- Gather all necessary information about the deceased, including their full name, date of death, and Social Security number.

- Collect details about the assets being inherited, such as property descriptions and values.

- Fill out the form accurately, ensuring that all sections are completed and that the information matches official documents.

- Sign the form, as required, to authenticate the request.

- Submit the completed form to the appropriate state department, either online or via mail.

Legal Use of the Pennsylvania Inheritance Tax Waiver Form

The legal use of the Pennsylvania inheritance tax waiver form is governed by state laws regarding inheritance and taxation. It is crucial for beneficiaries to understand that submitting this form does not eliminate tax obligations entirely but rather requests a waiver under specific conditions. The form must be filed correctly to be considered valid, and any discrepancies may lead to delays or rejections by the state. Legal counsel may be advisable for complex estates or if there are uncertainties regarding tax liabilities.

Required Documents for the Pennsylvania Inheritance Tax Waiver Form

When submitting the Pennsylvania inheritance tax waiver form, several supporting documents may be required to validate the request. These documents typically include:

- The death certificate of the deceased.

- Proof of identity for the beneficiary.

- Documentation detailing the assets being inherited.

- Any previous tax returns related to the estate, if applicable.

Ensuring that all required documents accompany the waiver form can facilitate a smoother processing experience.

Form Submission Methods for the Pennsylvania Inheritance Tax Waiver Form

The Pennsylvania inheritance tax waiver form can be submitted through various methods, providing flexibility for beneficiaries. The available submission methods include:

- Online submission via the Pennsylvania Department of Revenue's official website.

- Mailing the completed form to the designated address provided by the state.

- In-person submission at local revenue offices, if preferred.

Each method has its own processing times, so it is advisable to choose the one that best suits the urgency of the request.

Quick guide on how to complete pa inheritance tax waiver form

Effortlessly prepare Pa Inheritance Tax Waiver Form on any device

Digital document management has become increasingly popular among businesses and individuals. It serves as an excellent eco-friendly alternative to traditional printed and signed documents, allowing you to obtain the appropriate form and safely store it online. airSlate SignNow provides all the tools necessary to quickly create, modify, and eSign your documents without delays. Manage Pa Inheritance Tax Waiver Form using the airSlate SignNow Android or iOS applications and simplify any document-related task today.

How to edit and eSign Pa Inheritance Tax Waiver Form with ease

- Locate Pa Inheritance Tax Waiver Form and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your signature using the Sign feature, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your modifications.

- Choose your preferred method to share your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced files, tiring document searches, or errors that necessitate reprinting new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Edit and eSign Pa Inheritance Tax Waiver Form and ensure excellent communication at every step of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct pa inheritance tax waiver form

Create this form in 5 minutes!

How to create an eSignature for the pa inheritance tax waiver form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a PA inheritance tax waiver form?

The PA inheritance tax waiver form is a document required in Pennsylvania to officially waive or exempt certain estates from inheritance tax. This form is crucial for beneficiaries to ensure they receive their inheritance without unexpected tax liabilities. airSlate SignNow simplifies the process of filling out and signing this form electronically, making it more convenient.

-

How can I access the PA inheritance tax waiver form through airSlate SignNow?

You can easily access the PA inheritance tax waiver form by signing up for an airSlate SignNow account. Once logged in, you will find templates for various legal forms, including the PA inheritance tax waiver form, ready for you to complete and sign electronically.

-

What features does airSlate SignNow offer for managing PA inheritance tax waiver forms?

airSlate SignNow offers features that include electronic signatures, document storage, and templates specifically for the PA inheritance tax waiver form. These features ensure that you can create, send, and manage the form efficiently, while also maintaining compliance with state requirements.

-

Is there a cost associated with using airSlate SignNow for the PA inheritance tax waiver form?

Yes, there is a subscription fee for using airSlate SignNow, which grants access to all features including the creation and management of the PA inheritance tax waiver form. However, the pricing is competitive compared to traditional methods of document signing and management, providing great value for the services offered.

-

Can I integrate airSlate SignNow with other software to manage PA inheritance tax waiver forms?

Absolutely! airSlate SignNow offers integrations with various popular software tools which allow you to streamline the process of managing PA inheritance tax waiver forms. This includes options to connect with CRMs, cloud storage services, and more, enhancing your workflow and productivity.

-

What are the benefits of using airSlate SignNow for my PA inheritance tax waiver form needs?

Using airSlate SignNow for your PA inheritance tax waiver form needs offers several benefits such as increased efficiency, reduced paperwork, and compliance with state regulations. The user-friendly interface allows users to complete forms quickly, ensuring timely submissions and a smoother process overall.

-

How secure is my information when using airSlate SignNow for the PA inheritance tax waiver form?

airSlate SignNow prioritizes the security of your information by employing advanced encryption and compliance with industry standards. This ensures that your PA inheritance tax waiver form and any personal information are protected, providing peace of mind while you manage important documents.

Get more for Pa Inheritance Tax Waiver Form

Find out other Pa Inheritance Tax Waiver Form

- eSignature Nebraska Rental lease agreement forms Fast

- eSignature Delaware Rental lease agreement template Fast

- eSignature West Virginia Rental lease agreement forms Myself

- eSignature Michigan Rental property lease agreement Online

- Can I eSignature North Carolina Rental lease contract

- eSignature Vermont Rental lease agreement template Online

- eSignature Vermont Rental lease agreement template Now

- eSignature Vermont Rental lease agreement template Free

- eSignature Nebraska Rental property lease agreement Later

- eSignature Tennessee Residential lease agreement Easy

- Can I eSignature Washington Residential lease agreement

- How To eSignature Vermont Residential lease agreement form

- How To eSignature Rhode Island Standard residential lease agreement

- eSignature Mississippi Commercial real estate contract Fast

- eSignature Arizona Contract of employment Online

- eSignature Texas Contract of employment Online

- eSignature Florida Email Contracts Free

- eSignature Hawaii Managed services contract template Online

- How Can I eSignature Colorado Real estate purchase contract template

- How To eSignature Mississippi Real estate purchase contract template