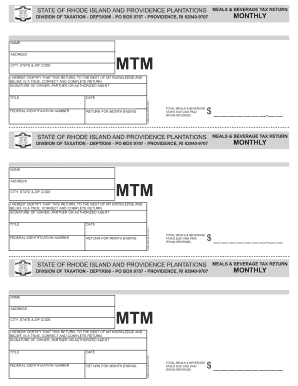

State of Rhode Island Division of TaxationSales and Excise 1 Form

What is the State Of Rhode Island Division Of Taxation Sales And Excise 1?

The State Of Rhode Island Division Of Taxation Sales And Excise 1 form is a crucial document used for reporting sales and excise taxes in the state of Rhode Island. This form is essential for businesses and individuals who engage in taxable sales or activities subject to excise tax. It serves to inform the state about the taxable transactions that have occurred within a specific period, ensuring compliance with state tax laws.

How to use the State Of Rhode Island Division Of Taxation Sales And Excise 1

Using the State Of Rhode Island Division Of Taxation Sales And Excise 1 form involves several steps. First, gather all necessary information regarding your sales and excise transactions. This includes sales amounts, tax rates, and any exemptions that may apply. Next, accurately fill out the form, ensuring that all fields are completed to avoid delays. Finally, submit the form through the appropriate channels, which may include online submission, mailing, or in-person delivery, depending on your preference and the guidelines provided by the Rhode Island Division of Taxation.

Steps to complete the State Of Rhode Island Division Of Taxation Sales And Excise 1

Completing the State Of Rhode Island Division Of Taxation Sales And Excise 1 form requires careful attention to detail. Follow these steps to ensure accuracy:

- Gather all relevant sales data for the reporting period.

- Access the form through the Rhode Island Division of Taxation website or obtain a physical copy.

- Fill in your business information, including name, address, and tax identification number.

- Report total sales and calculate the excise tax owed based on applicable rates.

- Review the form for completeness and accuracy.

- Submit the form by the designated deadline to avoid penalties.

Legal use of the State Of Rhode Island Division Of Taxation Sales And Excise 1

The State Of Rhode Island Division Of Taxation Sales And Excise 1 form is legally binding when completed and submitted according to state regulations. To ensure its legal standing, the form must be filled out accurately, reflecting true and correct information regarding sales and excise tax obligations. Compliance with the submission deadlines and payment requirements is also essential to maintain the form's validity.

Required Documents for the State Of Rhode Island Division Of Taxation Sales And Excise 1

When preparing to complete the State Of Rhode Island Division Of Taxation Sales And Excise 1 form, it is important to have the following documents ready:

- Sales records for the reporting period.

- Previous tax returns, if applicable.

- Documentation of any tax exemptions claimed.

- Business identification documents, such as your tax ID number.

Penalties for Non-Compliance with the State Of Rhode Island Division Of Taxation Sales And Excise 1

Failure to comply with the requirements of the State Of Rhode Island Division Of Taxation Sales And Excise 1 form can lead to significant penalties. These may include fines, interest on unpaid taxes, and potential legal action. It is crucial for individuals and businesses to adhere to filing deadlines and accurately report their tax obligations to avoid these repercussions.

Quick guide on how to complete state of rhode island division of taxationsales and excise 1

Prepare State Of Rhode Island Division Of TaxationSales And Excise 1 effortlessly on any device

Online document management has become increasingly popular among organizations and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, enabling you to locate the correct form and securely save it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents promptly without delays. Manage State Of Rhode Island Division Of TaxationSales And Excise 1 on any device with airSlate SignNow's Android or iOS applications and enhance any document-centered process today.

The easiest way to modify and eSign State Of Rhode Island Division Of TaxationSales And Excise 1 effortlessly

- Obtain State Of Rhode Island Division Of TaxationSales And Excise 1 and click Get Form to begin.

- Use the tools we provide to fill out your form.

- Emphasize pertinent sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your eSignature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional ink signature.

- Verify all the details and click on the Done button to save your changes.

- Choose how you'd like to send your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow addresses your document management needs with just a few clicks from any device you prefer. Modify and eSign State Of Rhode Island Division Of TaxationSales And Excise 1 to ensure effective communication at every step of the form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the State Of Rhode Island Division Of TaxationSales And Excise 1?

The State Of Rhode Island Division Of TaxationSales And Excise 1 refers to the regulatory framework governing the taxation of sales and excise in Rhode Island. It encompasses various tax policies and processes that businesses must adhere to when selling products or services in the state. Understanding this framework is crucial for compliance and financial planning.

-

How can airSlate SignNow assist with the State Of Rhode Island Division Of TaxationSales And Excise 1 documentation?

airSlate SignNow streamlines the documentation process required for compliance with the State Of Rhode Island Division Of TaxationSales And Excise 1. Our eSigning solution allows you to easily create, send, and sign necessary tax documents, ensuring you stay organized and compliant. This eliminates paperwork hassles and speeds up the filing process.

-

What features does airSlate SignNow offer for handling tax-related documents?

airSlate SignNow provides a range of features designed to simplify the management of tax-related documents, especially in relation to the State Of Rhode Island Division Of TaxationSales And Excise 1. Users can utilize templates, automated reminders, and cloud storage for easy access. The platform ensures that all documents are securely signed and stored, promoting efficient workflows.

-

How much does airSlate SignNow cost for businesses dealing with the State Of Rhode Island Division Of TaxationSales And Excise 1?

airSlate SignNow offers competitive pricing tailored to businesses, including those focused on the State Of Rhode Island Division Of TaxationSales And Excise 1. There are various plans available, ensuring you can choose one that fits your budget and needs. Each plan includes essential features to manage tax documentation effectively.

-

Can airSlate SignNow integrate with other accounting software regarding tax compliance?

Yes, airSlate SignNow integrates seamlessly with various accounting and financial software solutions, enhancing efficiency for businesses addressing the State Of Rhode Island Division Of TaxationSales And Excise 1. This integration allows for better synchronization of tax documents and financial records, facilitating compliance and accurate reporting.

-

What are the benefits of using airSlate SignNow for tax documentation?

Using airSlate SignNow for your tax documentation needs, particularly for the State Of Rhode Island Division Of TaxationSales And Excise 1, offers numerous benefits. It enhances document accuracy, reduces processing time, and helps ensure compliance with state regulations. This efficient approach ultimately saves you time and reduces the risk of costly errors.

-

Is airSlate SignNow secure for sensitive tax documents?

Absolutely, airSlate SignNow prioritizes the security of your documents, especially when dealing with sensitive information related to the State Of Rhode Island Division Of TaxationSales And Excise 1. The platform employs advanced encryption protocols and compliance measures to protect your data, ensuring that your confidential tax information remains secure throughout the entire process.

Get more for State Of Rhode Island Division Of TaxationSales And Excise 1

- P 142r rev form

- Instructions to certified examiner for conducting article 19 a biennial oralwritten examinations instructions for conducting form

- Individual vehicle approval iva inspection manual form

- Interlock kansas financial aid online application form

- Event registration number application ern form

- Canada new brunswick employment insurance nb ei connect form

- Certificate authority transact fill out and sign form

- Illinois enhanced skills driving school application for form

Find out other State Of Rhode Island Division Of TaxationSales And Excise 1

- eSign Texas Construction POA Mobile

- eSign Kansas Finance & Tax Accounting Stock Certificate Now

- eSign Tennessee Education Warranty Deed Online

- eSign Tennessee Education Warranty Deed Now

- eSign Texas Education LLC Operating Agreement Fast

- eSign Utah Education Warranty Deed Online

- eSign Utah Education Warranty Deed Later

- eSign West Virginia Construction Lease Agreement Online

- How To eSign West Virginia Construction Job Offer

- eSign West Virginia Construction Letter Of Intent Online

- eSign West Virginia Construction Arbitration Agreement Myself

- eSign West Virginia Education Resignation Letter Secure

- eSign Education PDF Wyoming Mobile

- Can I eSign Nebraska Finance & Tax Accounting Business Plan Template

- eSign Nebraska Finance & Tax Accounting Business Letter Template Online

- eSign Nevada Finance & Tax Accounting Resignation Letter Simple

- eSign Arkansas Government Affidavit Of Heirship Easy

- eSign California Government LLC Operating Agreement Computer

- eSign Oklahoma Finance & Tax Accounting Executive Summary Template Computer

- eSign Tennessee Finance & Tax Accounting Cease And Desist Letter Myself