Sales Tax Refund Request Utah State Tax Commission Form

What is the Sales Tax Refund Request for Utah State Tax Commission

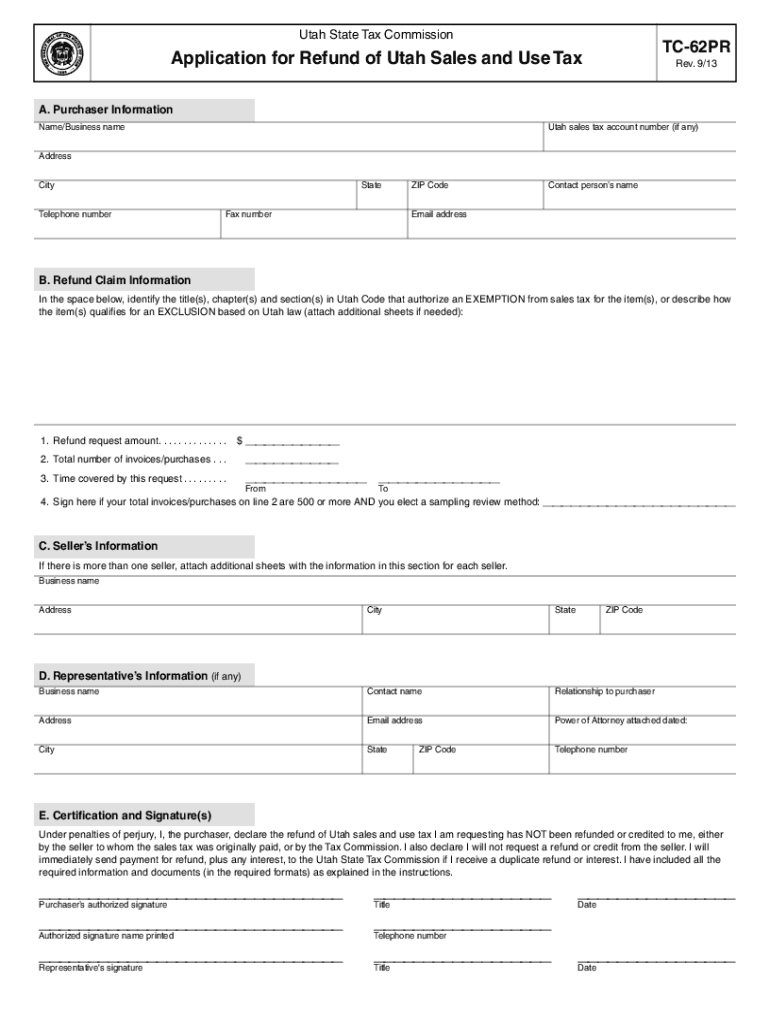

The Sales Tax Refund Request is a specific form used by taxpayers in Utah to claim refunds for sales tax overpayments. This form is essential for individuals and businesses who believe they have paid more sales tax than required. The Utah State Tax Commission oversees the processing of these requests, ensuring compliance with state tax laws. Understanding the purpose of this form is crucial for anyone seeking to recover excess sales tax payments.

How to Use the Sales Tax Refund Request for Utah State Tax Commission

To effectively use the Sales Tax Refund Request, taxpayers must first obtain the form from the Utah State Tax Commission's website or their local tax office. After acquiring the form, fill it out with accurate information, including personal details and specifics about the sales tax overpayment. It is important to provide supporting documentation, such as receipts or invoices, to substantiate the claim. Once completed, the form can be submitted either online or via mail, depending on the preferred method of the taxpayer.

Steps to Complete the Sales Tax Refund Request for Utah State Tax Commission

Completing the Sales Tax Refund Request involves several key steps:

- Obtain the Sales Tax Refund Request form from the Utah State Tax Commission.

- Fill in your personal information, including name, address, and contact details.

- Detail the sales tax overpayment, specifying the amounts and dates of transactions.

- Attach any necessary documentation, such as receipts or proof of payment.

- Review the form for accuracy before submission.

- Submit the form online or mail it to the designated address provided by the Tax Commission.

Key Elements of the Sales Tax Refund Request for Utah State Tax Commission

The key elements of the Sales Tax Refund Request include:

- Taxpayer Information: Essential personal details of the taxpayer submitting the request.

- Transaction Details: Specifics of the sales transactions for which the refund is being requested.

- Supporting Documentation: Evidence of overpayment, such as receipts or invoices.

- Signature: The taxpayer's signature is required to validate the request.

Required Documents for the Sales Tax Refund Request

When submitting the Sales Tax Refund Request, certain documents must accompany the form to ensure a smooth processing experience. Required documents typically include:

- Receipts or invoices showing the sales tax overpayment.

- Any prior correspondence with the Tax Commission regarding the overpayment.

- Proof of identity, if necessary, to verify the taxpayer's information.

Eligibility Criteria for the Sales Tax Refund Request

To be eligible for a refund through the Sales Tax Refund Request, taxpayers must meet specific criteria. Generally, eligibility includes:

- Having paid sales tax on purchases that qualify for a refund.

- Submitting the request within the designated time frame set by the Utah State Tax Commission.

- Providing accurate and complete information on the form.

Quick guide on how to complete sales tax refund request utah state tax commission

Complete Sales Tax Refund Request Utah State Tax Commission easily on any device

Digital document management has gained signNow traction among organizations and individuals. It offers an ideal environmentally friendly substitute for conventional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow provides all the resources necessary to create, edit, and eSign your documents quickly without delays. Handle Sales Tax Refund Request Utah State Tax Commission on any device with the airSlate SignNow Android or iOS applications and streamline any document-related process today.

The most efficient way to edit and eSign Sales Tax Refund Request Utah State Tax Commission with ease

- Locate Sales Tax Refund Request Utah State Tax Commission and then click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize important sections of your documents or redact sensitive information with tools provided by airSlate SignNow specifically for that purpose.

- Create your signature using the Sign tool, which takes just seconds and carries the same legal validity as a traditional wet ink signature.

- Review the details and then click on the Done button to save your updates.

- Choose how you wish to share your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs with just a few clicks from any device you choose. Edit and eSign Sales Tax Refund Request Utah State Tax Commission while ensuring exceptional communication at every stage of your form preparation process using airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is tc 62pr in the context of airSlate SignNow?

The tc 62pr refers to a specific plan or feature set within airSlate SignNow that enhances document signing capabilities. It enables businesses to streamline their eSigning processes while ensuring high security and compliance standards. By utilizing tc 62pr, users can improve operational efficiency and reduce turnaround times for document approval.

-

How does pricing for tc 62pr compare to other plans?

Pricing for the tc 62pr plan is highly competitive, especially when compared to other eSigning solutions on the market. It offers various tiered options that cater to different business sizes and needs. The cost-effectiveness of tc 62pr allows organizations to save signNowly while enjoying comprehensive features that enhance productivity.

-

What are the key features of the tc 62pr plan?

The tc 62pr plan includes robust features such as customizable templates, automated workflows, and advanced security measures. This plan ensures that documents are signed quickly and securely, accommodating various business processes. Additionally, users benefit from an intuitive interface that simplifies document management and tracking.

-

Can I integrate tc 62pr with other tools and platforms?

Absolutely! The tc 62pr plan supports seamless integrations with numerous applications, including CRM and project management tools. This flexibility allows businesses to enhance their workflows by connecting airSlate SignNow with the software they already use, increasing efficiency and effectiveness in document handling.

-

What benefits does the tc 62pr plan provide to businesses?

Businesses using the tc 62pr plan experience accelerated document turnaround times and improved compliance. The plan's cost-effective pricing and powerful features help organizations reduce overhead while maintaining high-quality standards. Moreover, teams enjoy a collaborative environment that enhances communication during the signing process.

-

Is tc 62pr suitable for small businesses?

Yes, the tc 62pr plan is designed to be scalable, making it a perfect fit for small businesses. It provides essential features without overwhelming costs, allowing smaller organizations to leverage the power of eSigning. Small businesses can benefit from improved efficiency and reduced delays in document processing through this plan.

-

How secure is the tc 62pr plan for document transactions?

The tc 62pr plan employs advanced security measures to ensure that all document transactions are secure. Features such as encryption, multi-factor authentication, and audit trails are standard, providing users with peace of mind. By utilizing tc 62pr, businesses can have confidence in the safety and integrity of their important documents.

Get more for Sales Tax Refund Request Utah State Tax Commission

- Pump installation and production equipment test report form

- Alaska unified certification program aucp form

- Get wa state business licenseampquot keyword found websites form

- Csclcd 518 rev 921 michigan department of licensing form

- 17 printable mechanic repair forms templates fillable

- New service installation requirementsnew peoples gas form

- Application for mediation or hearing form a

- Accessory dwelling unit application accessory dwelling unit application form

Find out other Sales Tax Refund Request Utah State Tax Commission

- How Do I Electronic signature Nevada Life Sciences PDF

- How Can I Electronic signature New York Life Sciences Word

- How Can I Electronic signature North Dakota Legal Word

- How To Electronic signature Ohio Legal PDF

- How To Electronic signature Ohio Legal Document

- How To Electronic signature Oklahoma Legal Document

- How To Electronic signature Oregon Legal Document

- Can I Electronic signature South Carolina Life Sciences PDF

- How Can I Electronic signature Rhode Island Legal Document

- Can I Electronic signature South Carolina Legal Presentation

- How Can I Electronic signature Wyoming Life Sciences Word

- How To Electronic signature Utah Legal PDF

- How Do I Electronic signature Arkansas Real Estate Word

- How Do I Electronic signature Colorado Real Estate Document

- Help Me With Electronic signature Wisconsin Legal Presentation

- Can I Electronic signature Hawaii Real Estate PPT

- How Can I Electronic signature Illinois Real Estate Document

- How Do I Electronic signature Indiana Real Estate Presentation

- How Can I Electronic signature Ohio Plumbing PPT

- Can I Electronic signature Texas Plumbing Document