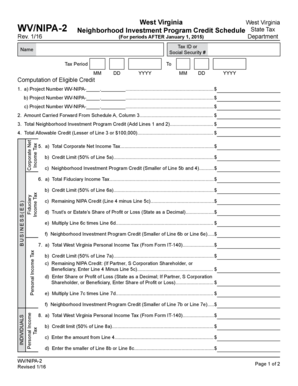

Neighborhood Investment Program Credit Schedule State Tax Form

What is the Neighborhood Investment Program Credit Schedule State Tax

The Neighborhood Investment Program Credit Schedule State Tax is a form used in West Virginia that allows taxpayers to claim a credit for contributions made to eligible neighborhood investment projects. This program is designed to encourage investment in economically distressed areas, promoting community development and revitalization. By completing the wv wvnipa2 form, individuals and businesses can receive tax credits based on their contributions, which can significantly reduce their state tax liability.

Steps to complete the Neighborhood Investment Program Credit Schedule State Tax

Completing the Neighborhood Investment Program Credit Schedule involves several key steps to ensure accuracy and compliance. First, gather all necessary documentation related to your contributions, including receipts and proof of payment. Next, fill out the wv wvnipa2 form with your personal information and the details of your contributions. Be sure to include the amounts donated and the specific projects supported. After completing the form, review it for any errors before submitting it with your state tax return. This careful approach will help ensure that you receive the appropriate credits.

Eligibility Criteria

To qualify for the Neighborhood Investment Program Credit, taxpayers must meet specific eligibility criteria. Contributions must be made to projects that are certified by the West Virginia Development Office. Additionally, the contributions should be directed toward initiatives that benefit low-income communities or support community development efforts. Both individuals and businesses can apply, but the amount of credit available may vary based on the type of entity and the total contributions made.

Required Documents

When completing the wv wvnipa2 form, certain documents are required to substantiate your claim for the tax credit. These documents typically include:

- Proof of contributions, such as receipts or bank statements.

- Documentation from the project or organization receiving the contributions, confirming their eligibility.

- Your completed wv wvnipa2 form detailing the amounts and projects supported.

Having these documents ready will facilitate a smoother filing process and help ensure compliance with state requirements.

Legal use of the Neighborhood Investment Program Credit Schedule State Tax

The legal use of the Neighborhood Investment Program Credit Schedule State Tax is governed by West Virginia state laws and regulations. It is essential for taxpayers to adhere to these guidelines to ensure that their claims for credits are valid. This includes making contributions to approved projects and accurately reporting all relevant information on the wv wvnipa2 form. Failure to comply with these legal requirements may result in penalties or disqualification from receiving the tax credits.

Form Submission Methods

The wv wvnipa2 form can be submitted through various methods, allowing flexibility for taxpayers. The primary submission methods include:

- Online submission through the West Virginia Department of Revenue's e-filing system.

- Mailing the completed form along with your state tax return to the designated address.

- In-person submission at local tax offices, where assistance may be available.

Choosing the method that best suits your needs can enhance the efficiency of the filing process.

Quick guide on how to complete neighborhood investment program credit schedule state tax

Complete Neighborhood Investment Program Credit Schedule State Tax effortlessly on any device

Digital document management has become a favorite among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed papers, allowing you to find the right form and securely save it online. airSlate SignNow provides all the necessary tools to create, modify, and eSign your documents quickly without delays. Manage Neighborhood Investment Program Credit Schedule State Tax on any device with airSlate SignNow's Android or iOS applications and streamline any document-based operation today.

How to modify and eSign Neighborhood Investment Program Credit Schedule State Tax with ease

- Obtain Neighborhood Investment Program Credit Schedule State Tax and then click Get Form to begin.

- Make use of the tools we offer to fill out your document.

- Emphasize relevant sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and bears the same legal validity as a conventional wet ink signature.

- Review all the information and then click on the Done button to save your changes.

- Select how you would prefer to send your form, via email, SMS, or invitation link, or download it to your computer.

Forget about lost or mishandled documents, tedious form navigation, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from a device of your choice. Alter and eSign Neighborhood Investment Program Credit Schedule State Tax and ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the wv wvnipa2 form and how can I use it with airSlate SignNow?

The wv wvnipa2 form is a specific document format used in West Virginia for various administrative purposes. With airSlate SignNow, you can easily upload, edit, and eSign the wv wvnipa2 form, ensuring compliance and streamlined workflows. Our platform allows you to manage these documents efficiently to save time and avoid errors.

-

Is there a cost associated with using the wv wvnipa2 form on airSlate SignNow?

airSlate SignNow offers a range of pricing plans tailored to your business needs, including plans that facilitate the use of the wv wvnipa2 form. Our competitive pricing ensures that you get the most value for an easy-to-use eSignature solution. Visit our pricing page for detailed information on available plans.

-

What features does airSlate SignNow offer for managing the wv wvnipa2 form?

airSlate SignNow provides a suite of features for managing the wv wvnipa2 form, including customizable templates, secure eSignature capabilities, and seamless document tracking. You can collaborate in real-time, add notes, and ensure all signers are kept in the loop. These features enhance your document management process signNowly.

-

Can I integrate the wv wvnipa2 form with other tools using airSlate SignNow?

Yes, airSlate SignNow supports various integrations that can streamline your workflow involving the wv wvnipa2 form. You can integrate it with popular tools like Google Workspace, Salesforce, and more. This capability helps create a smooth process for eSigning and managing your documents within your existing workflow.

-

How does airSlate SignNow ensure the security of my wv wvnipa2 form?

Security is a top priority at airSlate SignNow. We implement advanced encryption and security measures to protect your wv wvnipa2 form from unauthorized access. Additionally, our platform complies with industry standards and regulations, ensuring that your documents remain safe and confidential.

-

What are the benefits of using airSlate SignNow for the wv wvnipa2 form?

Using airSlate SignNow for the wv wvnipa2 form offers numerous benefits, including improved efficiency, reduced turnaround times, and enhanced collaboration. With our user-friendly interface, you can quickly create and manage forms without any technical expertise. This results in productive workflows tailored to your business's specific needs.

-

Is it easy to get started with the wv wvnipa2 form on airSlate SignNow?

Absolutely! Getting started with the wv wvnipa2 form on airSlate SignNow is simple and user-friendly. You can create an account with just a few clicks, upload your form, and start eSigning immediately. Our platform includes guided tutorials and excellent customer support to help you every step of the way.

Get more for Neighborhood Investment Program Credit Schedule State Tax

Find out other Neighborhood Investment Program Credit Schedule State Tax

- Can I Sign Michigan Home Loan Application

- Sign Arkansas Mortgage Quote Request Online

- Sign Nebraska Mortgage Quote Request Simple

- Can I Sign Indiana Temporary Employment Contract Template

- How Can I Sign Maryland Temporary Employment Contract Template

- How Can I Sign Montana Temporary Employment Contract Template

- How Can I Sign Ohio Temporary Employment Contract Template

- Sign Mississippi Freelance Contract Online

- Sign Missouri Freelance Contract Safe

- How Do I Sign Delaware Email Cover Letter Template

- Can I Sign Wisconsin Freelance Contract

- Sign Hawaii Employee Performance Review Template Simple

- Sign Indiana Termination Letter Template Simple

- Sign Michigan Termination Letter Template Free

- Sign Colorado Independent Contractor Agreement Template Simple

- How Can I Sign Florida Independent Contractor Agreement Template

- Sign Georgia Independent Contractor Agreement Template Fast

- Help Me With Sign Nevada Termination Letter Template

- How Can I Sign Michigan Independent Contractor Agreement Template

- Sign Montana Independent Contractor Agreement Template Simple