Acd 31102 Tax Information Authorization 1997

What is the ACD 31075 Tax Information Authorization?

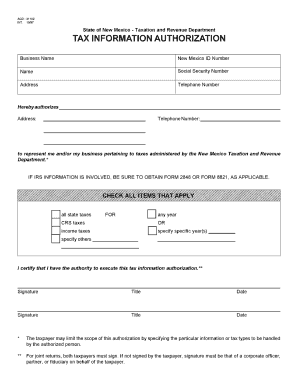

The ACD 31075 Tax Information Authorization is a crucial form used in New Mexico that allows taxpayers to authorize a third party to receive confidential tax information from the New Mexico Taxation and Revenue Department. This form is essential for individuals or businesses who need assistance with their tax matters and wish to grant permission for another party, such as a tax professional, to access their tax records. The authorization ensures that the designated individual can act on behalf of the taxpayer regarding specific tax issues, making it easier to manage tax-related communications and filings.

Steps to Complete the ACD 31075 Tax Information Authorization

Completing the ACD 31075 form involves several straightforward steps:

- Download the form: Obtain the ACD 31075 form from the New Mexico Taxation and Revenue Department's website or other official sources.

- Fill in taxpayer information: Provide the necessary details, including your name, address, and Social Security number or taxpayer identification number.

- Designate the third party: Enter the name and contact information of the individual or organization you are authorizing to receive your tax information.

- Specify the tax matters: Clearly indicate which tax matters the authorization covers, ensuring that it aligns with your needs.

- Sign and date the form: Your signature is required to validate the authorization, along with the date of signing.

- Submit the form: Send the completed ACD 31075 to the New Mexico Taxation and Revenue Department as instructed on the form.

Legal Use of the ACD 31075 Tax Information Authorization

The ACD 31075 Tax Information Authorization is legally binding, provided that it is completed correctly and signed by the taxpayer. This form complies with the relevant state laws governing tax information disclosure. By using this form, taxpayers can ensure that their sensitive tax information is shared only with authorized individuals, protecting their privacy while allowing for necessary assistance in tax matters. It is important to keep a copy of the signed form for your records and to ensure that the authorized party understands the scope of their access to your tax information.

Who Issues the ACD 31075 Form?

The ACD 31075 Tax Information Authorization form is issued by the New Mexico Taxation and Revenue Department. This department is responsible for managing tax collection and ensuring compliance with state tax laws. By providing this form, the department facilitates the process of granting third-party access to taxpayer information, which can help streamline communications and tax-related processes for individuals and businesses in New Mexico.

Required Documents for the ACD 31075 Tax Information Authorization

When completing the ACD 31075 form, you will need to provide specific information to ensure its validity. The required documents and information typically include:

- Your full name and address.

- Your Social Security number or taxpayer identification number.

- The name and contact information of the authorized third party.

- A description of the tax matters for which authorization is granted.

- Your signature and the date of signing.

Form Submission Methods for the ACD 31075

The ACD 31075 Tax Information Authorization can be submitted to the New Mexico Taxation and Revenue Department through various methods. Taxpayers can choose to:

- Submit online: If available, use the department's online portal for electronic submission.

- Mail the form: Send the completed form via postal service to the address specified on the form.

- In-person submission: Deliver the form directly to a local Taxation and Revenue Department office.

Quick guide on how to complete acd 31102 tax information authorization

Effortlessly Prepare Acd 31102 Tax Information Authorization on Any Device

Managing documents online has gained popularity among businesses and individuals alike. It serves as an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to swiftly create, modify, and eSign your documents without any delays. Handle Acd 31102 Tax Information Authorization on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to Alter and eSign Acd 31102 Tax Information Authorization with Ease

- Locate Acd 31102 Tax Information Authorization and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize relevant sections of your documents or obscure sensitive information with the tools that airSlate SignNow specifically provides for that purpose.

- Create your signature using the Sign tool, which takes only seconds and carries the same legal validity as a conventional ink signature.

- Review the details and then click on the Done button to save your changes.

- Choose your preferred method to send your form, via email, text message (SMS), or an invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow takes care of all your document management needs with just a few clicks from your chosen device. Modify and eSign Acd 31102 Tax Information Authorization and ensure outstanding communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct acd 31102 tax information authorization

Create this form in 5 minutes!

People also ask

-

What is NM ACD 31075 and how does it relate to airSlate SignNow?

NM ACD 31075 is a designation often associated with electronic signature solutions, highlighting a standard for efficient document management. With airSlate SignNow, businesses can leverage this standard to easily send and eSign documents, streamlining their workflows and ensuring compliance.

-

What features does airSlate SignNow offer for NM ACD 31075?

airSlate SignNow includes a range of features designed to meet the NM ACD 31075 standards, such as customizable templates, advanced signing options, and robust security measures. These features simplify document workflows while ensuring that businesses remain compliant with industry regulations.

-

How can airSlate SignNow help businesses save money related to NM ACD 31075 compliance?

By using airSlate SignNow, businesses can reduce costs associated with paper documents and manual signing processes. Our platform offers a cost-effective solution to meet NM ACD 31075 standards, minimizing overhead and improving efficiency with electronic signatures.

-

Is airSlate SignNow suitable for small businesses needing NM ACD 31075 solutions?

Absolutely! airSlate SignNow is designed to be user-friendly and cost-effective, making it an ideal choice for small businesses looking to comply with NM ACD 31075. Our platform allows smaller enterprises to manage their document workflows effortlessly, enhancing productivity without breaking the bank.

-

What integrations does airSlate SignNow provide for NM ACD 31075 users?

airSlate SignNow offers seamless integrations with various applications that help meet NM ACD 31075 compliance. Users can connect with popular tools such as CRM systems, cloud storage services, and collaboration platforms to create a comprehensive document management solution.

-

How does the electronic signing process work with airSlate SignNow for NM ACD 31075?

The electronic signing process with airSlate SignNow is straightforward and compliant with NM ACD 31075 guidelines. Users can send documents for eSignature, track their status, and receive notifications, making it easy to manage documents from start to finish.

-

What are the security features of airSlate SignNow regarding NM ACD 31075?

airSlate SignNow prioritizes security, implementing features that align with NM ACD 31075 requirements. The platform utilizes encryption, secure data storage, and detailed access controls to protect sensitive information throughout the signing process.

Get more for Acd 31102 Tax Information Authorization

- 2020 form va personal history questionnaire pdffiller

- Texas fin507 fill out and sign printable pdf template form

- Dental board of california consumer complaint form dental board of california consumer complaint form

- Department of buildings guide to new york city form

- Scaling the response to climate changerequest pdf form

- Dtsc hazardous waste generator requirements fact sheet department of toxic substances control form

- Et 0547 report of transfermultiple enrollment form

- Alabama application competency form

Find out other Acd 31102 Tax Information Authorization

- Can I eSignature Iowa Standstill Agreement

- How To Electronic signature Tennessee Standard residential lease agreement

- How To Electronic signature Alabama Tenant lease agreement

- Electronic signature Maine Contract for work Secure

- Electronic signature Utah Contract Myself

- How Can I Electronic signature Texas Electronic Contract

- How Do I Electronic signature Michigan General contract template

- Electronic signature Maine Email Contracts Later

- Electronic signature New Mexico General contract template Free

- Can I Electronic signature Rhode Island Email Contracts

- How Do I Electronic signature California Personal loan contract template

- Electronic signature Hawaii Personal loan contract template Free

- How To Electronic signature Hawaii Personal loan contract template

- Electronic signature New Hampshire Managed services contract template Computer

- Electronic signature Alabama Real estate sales contract template Easy

- Electronic signature Georgia Real estate purchase contract template Secure

- Electronic signature South Carolina Real estate sales contract template Mobile

- Can I Electronic signature Kentucky Residential lease contract

- Can I Electronic signature Nebraska Residential lease contract

- Electronic signature Utah New hire forms Now