Nm Acd 2020-2026

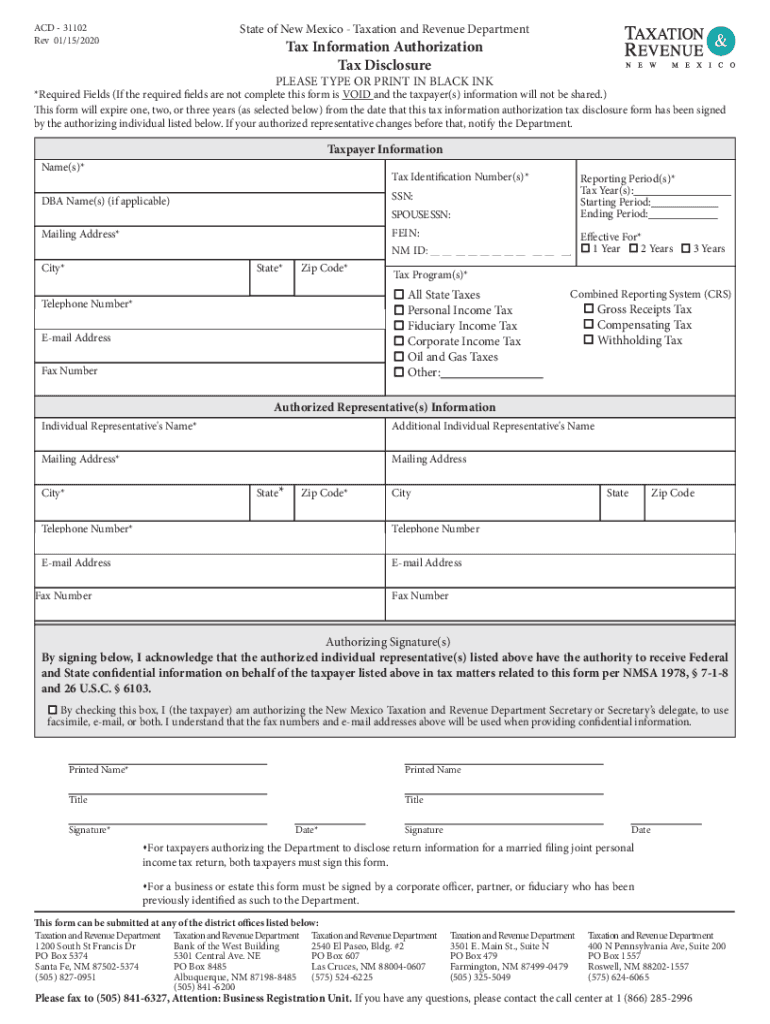

What is the NM ACD?

The NM ACD, or New Mexico Authorization for Collection of Delinquent Taxes, is a form used by the New Mexico Taxation and Revenue Department. It allows taxpayers to authorize the state to collect unpaid taxes directly from their accounts. This form is essential for those who may be facing tax delinquencies and need to formalize the process of tax collection.

How to Use the NM ACD

Using the NM ACD involves a straightforward process. Taxpayers must fill out the form accurately, providing necessary personal and financial information. This includes details such as the taxpayer's name, address, and the specific tax obligations being addressed. Once completed, the form must be submitted to the appropriate state authority for processing.

Steps to Complete the NM ACD

Completing the NM ACD requires careful attention to detail. Follow these steps to ensure proper submission:

- Gather necessary personal information, including your Social Security Number or Tax Identification Number.

- Clearly state the tax type and amount owed.

- Review the form for accuracy, ensuring all fields are filled out correctly.

- Sign and date the form to validate your authorization.

- Submit the completed form to the New Mexico Taxation and Revenue Department via mail or electronically, if available.

Legal Use of the NM ACD

The NM ACD is legally binding once submitted and accepted by the state. It complies with state regulations governing tax collection and authorization. This means that taxpayers must ensure all information provided is truthful and complete to avoid potential legal repercussions.

Required Documents

When submitting the NM ACD, certain documents may be required to support the information provided. These could include:

- Proof of identity, such as a driver's license or state ID.

- Documentation of tax obligations, including previous tax returns or notices from the tax department.

- Any relevant financial statements that may support the authorization request.

Form Submission Methods

The NM ACD can be submitted through various methods to accommodate taxpayer preferences. These methods include:

- Online submission via the New Mexico Taxation and Revenue Department's website, if available.

- Mailing the completed form to the designated state office.

- In-person submission at local tax offices, providing an opportunity for immediate assistance.

Penalties for Non-Compliance

Failing to comply with the requirements associated with the NM ACD can lead to serious consequences. Taxpayers may face penalties such as:

- Increased interest on unpaid taxes.

- Additional fines for late submission.

- Potential legal action for continued non-compliance with tax obligations.

Quick guide on how to complete nm acd

Complete Nm Acd effortlessly on any gadget

Web-based document management has become increasingly favored by companies and individuals alike. It serves as an ideal environmentally friendly alternative to traditional printed and signed documents, as it allows you to access the correct form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage Nm Acd on any gadget with airSlate SignNow Android or iOS applications and streamline any document-related process today.

How to adjust and eSign Nm Acd with ease

- Locate Nm Acd and then click Get Form to begin.

- Leverage the tools we offer to fill out your document.

- Select relevant sections of your documents or obscure sensitive details with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal significance as a conventional wet ink signature.

- Review all the information and then click the Done button to save your changes.

- Decide how you wish to share your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to misplaced or lost files, tedious form searches, or errors that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Adjust and eSign Nm Acd and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct nm acd

Create this form in 5 minutes!

How to create an eSignature for the nm acd

The way to create an eSignature for a PDF online

The way to create an eSignature for a PDF in Google Chrome

The best way to create an eSignature for signing PDFs in Gmail

The way to make an electronic signature from your smartphone

The best way to generate an eSignature for a PDF on iOS

The way to make an electronic signature for a PDF file on Android

People also ask

-

What is nm tax information authorization?

NM tax information authorization is a legal document that allows an individual or business to authorize another party to access their tax information in New Mexico. With airSlate SignNow, you can easily create and sign this document online, ensuring compliance with state regulations.

-

How does airSlate SignNow simplify nm tax information authorization?

airSlate SignNow simplifies the nm tax information authorization process by providing an intuitive platform for document creation and e-signature. Users can quickly draft the necessary authorization form, send it for signatures, and securely store it all in one place.

-

What are the costs associated with using airSlate SignNow for nm tax information authorization?

airSlate SignNow offers various pricing plans to meet the needs of different users. You can get started with a free trial, and depending on the features you need for managing nm tax information authorization, you can choose a plan that suits your budget and requirements.

-

Are there templates available for nm tax information authorization in airSlate SignNow?

Yes, airSlate SignNow provides pre-built templates for nm tax information authorization, making it easy to get started. These templates can be customized to fit your specific needs, saving you time and ensuring accuracy in your document preparation.

-

Is airSlate SignNow secure for nm tax information authorization documents?

Absolutely! airSlate SignNow uses advanced encryption and security protocols to ensure that your nm tax information authorization documents are safe and secure. This protects your sensitive data throughout the signing process.

-

What benefits does airSlate SignNow offer for managing nm tax information authorization?

With airSlate SignNow, you gain access to a range of benefits for managing nm tax information authorization, including faster turnaround times, reduced paperwork, and increased efficiency. This user-friendly platform enhances collaboration and streamlines your document workflow.

-

Can I integrate other tools with airSlate SignNow for nm tax information authorization?

Yes, airSlate SignNow supports integrations with various business applications, enabling you to streamline your nm tax information authorization process. By connecting with your CRM, accounting software, and more, you can enhance productivity and maintain a seamless workflow.

Get more for Nm Acd

Find out other Nm Acd

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document

- How Can I eSignature New Jersey Real Estate Word

- Can I eSignature Tennessee Police Form

- How Can I eSignature Vermont Police Presentation

- How Do I eSignature Pennsylvania Real Estate Document

- How Do I eSignature Texas Real Estate Document

- How Can I eSignature Colorado Courts PDF

- Can I eSignature Louisiana Courts Document

- How To Electronic signature Arkansas Banking Document

- How Do I Electronic signature California Banking Form