Charitable Form

What is the Charitable Organizations Form?

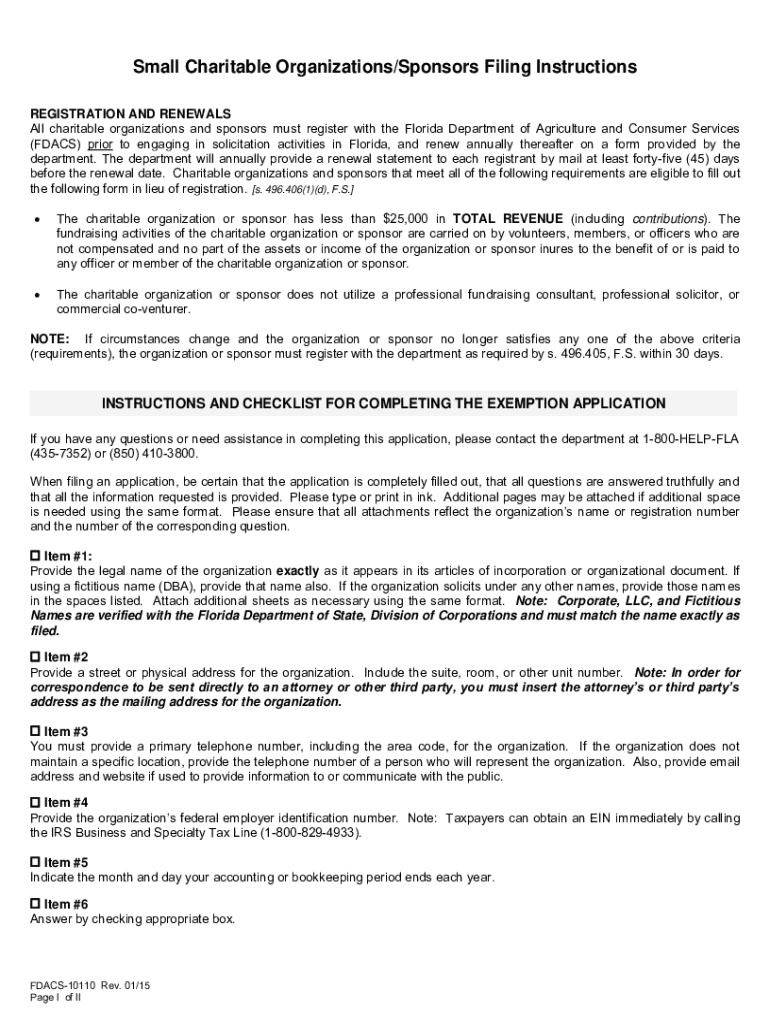

The Charitable Organizations Form is a critical document used by nonprofit entities to apply for tax-exempt status under Internal Revenue Code Section 501(c)(3). This form helps organizations demonstrate their purpose, structure, and compliance with federal regulations. Understanding this form is essential for any charitable organization aiming to operate legally and effectively within the United States.

Steps to Complete the Charitable Organizations Form

Completing the Charitable Organizations Form requires careful attention to detail. Here are the key steps:

- Gather necessary information about your organization, including its mission, structure, and financial data.

- Fill out the form accurately, ensuring all sections are completed, including the purpose of the organization and its planned activities.

- Provide supporting documentation, such as bylaws and articles of incorporation, to demonstrate compliance with state and federal laws.

- Review the completed form for accuracy and completeness before submission.

Legal Use of the Charitable Organizations Form

The legal use of the Charitable Organizations Form is governed by various federal and state regulations. To ensure compliance, organizations must adhere to the guidelines set forth by the IRS and relevant state authorities. This includes meeting specific criteria for charitable purposes and maintaining accurate records of financial activities. Failure to comply with these regulations can result in penalties or loss of tax-exempt status.

Eligibility Criteria for Charitable Organizations

To qualify as a charitable organization, entities must meet certain eligibility criteria. These include:

- Operating exclusively for charitable, religious, educational, or scientific purposes.

- Not engaging in substantial lobbying or political activities.

- Ensuring that no part of the organization's net earnings benefits any private individual or shareholder.

Organizations must provide evidence of their compliance with these criteria when submitting the Charitable Organizations Form.

Required Documents for Submission

When submitting the Charitable Organizations Form, several documents are typically required to support the application. These may include:

- Articles of incorporation or organization.

- Bylaws governing the organization.

- Financial statements or budgets outlining projected expenses and revenues.

- Detailed descriptions of the organization's programs and activities.

Having these documents ready can streamline the application process and enhance the likelihood of approval.

Form Submission Methods

The Charitable Organizations Form can be submitted through various methods, including:

- Online submission via the IRS website, which allows for quicker processing times.

- Mailing a paper copy of the form to the appropriate IRS address.

- In-person submission at designated IRS offices, although this method is less common.

Choosing the right submission method can impact the efficiency and speed of the application process.

Quick guide on how to complete charitable

Set Up Charitable effortlessly on any device

Managing documents online has gained traction among businesses and individuals. It serves as an ideal environmentally friendly substitute for traditional printed and signed documents, allowing you to acquire the necessary form and securely store it online. airSlate SignNow equips you with all the resources needed to create, modify, and electronically sign your documents quickly without delays. Handle Charitable on any platform using the airSlate SignNow Android or iOS applications and enhance any document-related process today.

The easiest method to adjust and electronically sign Charitable without difficulty

- Obtain Charitable and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Mark important sections of the documents or obscure sensitive information with tools provided by airSlate SignNow specifically for that purpose.

- Generate your eSignature using the Sign tool, which takes moments and holds the same legal significance as a conventional wet ink signature.

- Review all the details and click the Done button to save your changes.

- Select your preferred method of sharing your form, whether by email, SMS, or invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or errors that require printing new copies. airSlate SignNow addresses your needs in document management in just a few clicks, from any device you choose. Modify and electronically sign Charitable and ensure excellent communication at any step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

How can airSlate SignNow benefit charitable organizations?

airSlate SignNow provides charitable organizations with an efficient and cost-effective way to manage documents electronically. By streamlining the signing process, nonprofits can save time and resources, allowing them to focus more on their mission and community impact.

-

What features does airSlate SignNow offer for charitable organizations?

airSlate SignNow offers key features that are valuable to charitable organizations, including customizable templates, document tracking, and real-time collaboration. These tools enhance the efficiency of signature collection and help organizations maintain compliance with legal requirements.

-

Is airSlate SignNow affordable for charitable organizations?

Yes, airSlate SignNow is designed to be cost-effective, making it accessible for charitable organizations with varying budgets. We offer pricing plans that cater specifically to nonprofits, ensuring they can use our services without breaking the bank.

-

How does airSlate SignNow ensure data security for charitable organizations?

Data security is a top priority for airSlate SignNow. We employ advanced encryption measures and follow industry standards to protect sensitive information, ensuring that charitable organizations can securely sign and store their documents without concern.

-

Can charitable organizations integrate airSlate SignNow with other software?

Absolutely! airSlate SignNow offers seamless integrations with popular software platforms such as Google Drive, Salesforce, and Microsoft Office. This flexibility makes it easy for charitable organizations to incorporate our eSigning solutions into their existing workflows.

-

What types of documents can charitable organizations send with airSlate SignNow?

Charitable organizations can use airSlate SignNow to send a wide range of documents, including donation agreements, contracts, and volunteer applications. Our platform supports various document formats, making it a versatile tool for any nonprofit.

-

Is airSlate SignNow easy to use for charitable organizations?

Yes, airSlate SignNow is designed with user-friendliness in mind. Charitable organizations can easily navigate the platform to send and manage documents, ensuring that even those with limited technical skills can benefit from our eSigning solution.

Get more for Charitable

- Wwwformsworkflowcomformdetailsorder after hearing on motion to cancel set aside judgment

- Pretrial alcohol education program application form

- Wwwformsworkflowcomformdetailspetition for custody and support of minor children fl 260

- Get the free pdf attorney or party without attorney name form

- Summary process execution for possesion eviction nonresidential form

- De facto parent pamphlet judicial council forms

- Jv 330 form

- In the circuit court of the state of oregon for the county of petition for form

Find out other Charitable

- How To Sign Texas Education Profit And Loss Statement

- Sign Vermont Education Residential Lease Agreement Secure

- How Can I Sign Washington Education NDA

- Sign Wisconsin Education LLC Operating Agreement Computer

- Sign Alaska Finance & Tax Accounting Purchase Order Template Computer

- Sign Alaska Finance & Tax Accounting Lease Termination Letter Free

- Can I Sign California Finance & Tax Accounting Profit And Loss Statement

- Sign Indiana Finance & Tax Accounting Confidentiality Agreement Later

- Sign Iowa Finance & Tax Accounting Last Will And Testament Mobile

- Sign Maine Finance & Tax Accounting Living Will Computer

- Sign Montana Finance & Tax Accounting LLC Operating Agreement Computer

- How Can I Sign Montana Finance & Tax Accounting Residential Lease Agreement

- Sign Montana Finance & Tax Accounting Residential Lease Agreement Safe

- How To Sign Nebraska Finance & Tax Accounting Letter Of Intent

- Help Me With Sign Nebraska Finance & Tax Accounting Letter Of Intent

- Sign Nebraska Finance & Tax Accounting Business Letter Template Online

- Sign Rhode Island Finance & Tax Accounting Cease And Desist Letter Computer

- Sign Vermont Finance & Tax Accounting RFP Later

- Can I Sign Wyoming Finance & Tax Accounting Cease And Desist Letter

- Sign California Government Job Offer Now