Discretionary Sales Surtax Information DR 15DSS R 1114 2021

Understanding the Florida Discretionary Sales Surtax Information DR 15DSS R 1114

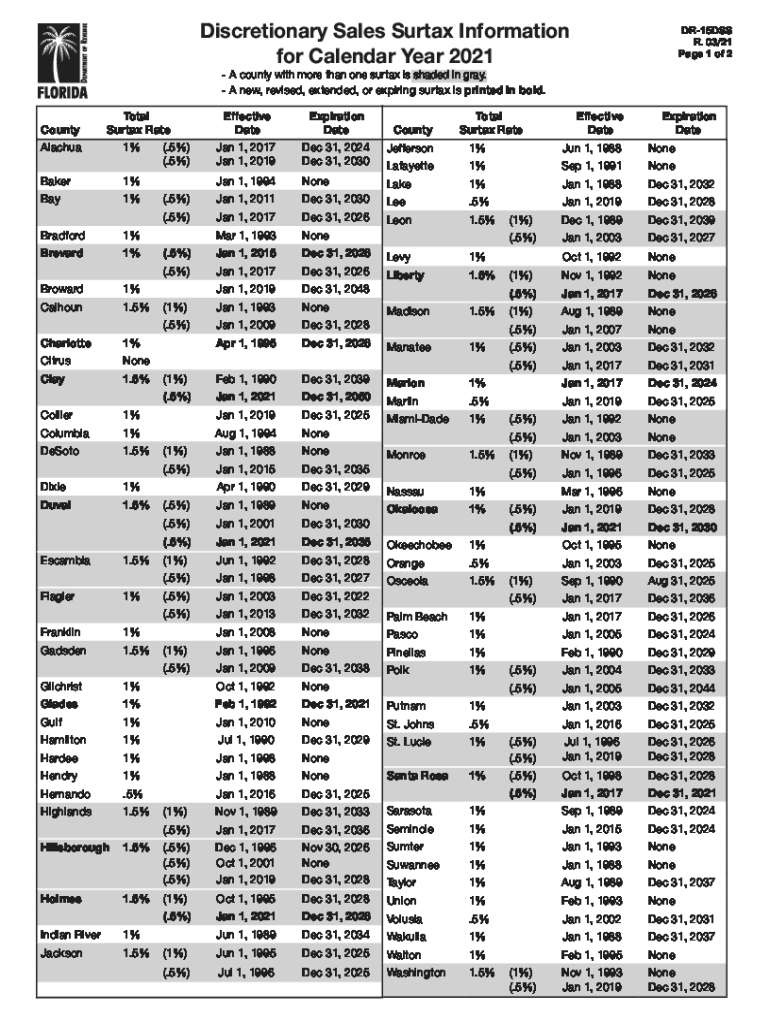

The Florida Discretionary Sales Surtax Information DR 15DSS R 1114 is a crucial form used by businesses to report and remit discretionary sales surtax collected on taxable transactions. This form is essential for ensuring compliance with state tax regulations and helps local governments fund various services. It is important for businesses to understand the specific requirements and implications of this form to avoid penalties and ensure proper reporting.

Steps to Complete the Discretionary Sales Surtax Information DR 15DSS R 1114

Completing the DR 15DSS form involves several key steps:

- Gather necessary sales records and documentation.

- Calculate the total discretionary sales surtax collected during the reporting period.

- Fill out the form accurately, ensuring all sections are completed.

- Review the form for any errors or omissions.

- Submit the completed form to the appropriate state department.

Each step is vital to ensure compliance and accurate reporting of the surtax.

Legal Use of the Discretionary Sales Surtax Information DR 15DSS R 1114

The legal use of the DR 15DSS form is governed by Florida state tax laws. Businesses must use this form to report the discretionary sales surtax they have collected from customers. Failure to use the correct form or to report accurately can lead to legal ramifications, including fines and penalties. Understanding the legal framework surrounding this form is essential for businesses operating in Florida.

Filing Deadlines and Important Dates

Timely filing of the DR 15DSS form is crucial for compliance. The form must be submitted by the specified deadlines, which typically align with the state’s tax reporting periods. Businesses should be aware of these deadlines to avoid late fees and ensure they remain in good standing with tax authorities. Keeping a calendar of important dates related to tax filings can help manage these responsibilities effectively.

Required Documents for the Discretionary Sales Surtax Information DR 15DSS R 1114

To complete the DR 15DSS form, businesses need to gather several key documents:

- Sales records that detail the transactions subject to surtax.

- Previous tax returns for reference.

- Any correspondence from the Florida Department of Revenue regarding surtax obligations.

Having these documents ready will facilitate a smoother completion process and ensure accuracy in reporting.

Who Issues the Discretionary Sales Surtax Information DR 15DSS R 1114

The Florida Department of Revenue is responsible for issuing the Discretionary Sales Surtax Information DR 15DSS R 1114. This department oversees the collection and distribution of sales tax revenues, including discretionary surtax funds. Businesses should refer to the Department of Revenue for any updates or changes to the form or its requirements.

Quick guide on how to complete discretionary sales surtax information dr 15dss r 1114

Set up Discretionary Sales Surtax Information DR 15DSS R 1114 effortlessly on any device

Web-based document management has become increasingly favored by businesses and individuals alike. It serves as an excellent eco-friendly alternative to conventional printed and signed documents, allowing you to access the right form and safely store it online. airSlate SignNow equips you with all the resources necessary to create, modify, and eSign your paperwork swiftly and without complications. Handle Discretionary Sales Surtax Information DR 15DSS R 1114 on any device with the airSlate SignNow Android or iOS applications and enhance any document-related process today.

How to modify and eSign Discretionary Sales Surtax Information DR 15DSS R 1114 with ease

- Find Discretionary Sales Surtax Information DR 15DSS R 1114 and click on Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Highlight signNow sections of your documents or redact sensitive information with tools specifically provided by airSlate SignNow for this purpose.

- Create your eSignature using the Sign feature, which takes mere moments and carries the same legal validity as a conventional wet ink signature.

- Review the details and hit the Done button to store your changes.

- Choose how you wish to share your form, via email, SMS, invite link, or download it to your device.

Eliminate the stress of lost or misplaced files, tedious form searching, and errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign Discretionary Sales Surtax Information DR 15DSS R 1114 and ensure excellent communication at every step of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct discretionary sales surtax information dr 15dss r 1114

Create this form in 5 minutes!

How to create an eSignature for the discretionary sales surtax information dr 15dss r 1114

How to generate an electronic signature for your PDF online

How to generate an electronic signature for your PDF in Google Chrome

The way to generate an electronic signature for signing PDFs in Gmail

The best way to generate an electronic signature from your smartphone

How to make an electronic signature for a PDF on iOS

The best way to generate an electronic signature for a PDF file on Android

People also ask

-

What is the Florida sales surtax and how does it affect my business?

The Florida sales surtax is an additional tax imposed on certain sales transactions in the state. Understanding this tax is crucial for businesses as it directly impacts pricing and profitability in Florida. By correctly calculating the Florida sales surtax, your business can ensure compliance and avoid potential penalties.

-

How can airSlate SignNow help with managing Florida sales surtax documentation?

airSlate SignNow simplifies the process of managing documentation related to the Florida sales surtax. Our platform allows businesses to easily create, send, and eSign documents that include pertinent tax information, ensuring that all records are accurate and up to date. This user-friendly approach saves time and enhances compliance with Florida sales surtax regulations.

-

Are there any fees associated with using airSlate SignNow for handling Florida sales surtax documents?

While airSlate SignNow offers a cost-effective solution for document management, there may be associated fees depending on the selected plan. Each plan is designed to cater to different business needs, providing value for managing Florida sales surtax documentation efficiently. It's advisable to review our pricing page for detailed information on fees.

-

What features does airSlate SignNow offer to support Florida sales surtax compliance?

airSlate SignNow offers features like customizable templates, eSignature capabilities, and automated workflows that streamline compliance with the Florida sales surtax requirements. These tools make it easier to collect necessary signatures and store important documents securely. Staying compliant with sales tax rules has never been more efficient.

-

Can airSlate SignNow integrate with my existing accounting software to manage Florida sales surtax?

Yes, airSlate SignNow offers integrations with various accounting software solutions, making it easier to manage your Florida sales surtax calculations and documentation. This functionality helps ensure that your business’s financial records are synchronized and reduce errors related to tax compliance. Check our integrations list to see if your software is supported.

-

What are the benefits of using airSlate SignNow for Florida sales surtax management?

Utilizing airSlate SignNow for Florida sales surtax management provides several benefits, such as increased efficiency and reduced administrative burdens. Companies can also ensure legal compliance while enhancing their ability to manage documents securely and conveniently. Overall, airSlate SignNow offers a scalable solution tailored to meet unique business needs.

-

Is airSlate SignNow suitable for small businesses dealing with Florida sales surtax?

Absolutely! airSlate SignNow is designed to cater to businesses of all sizes, including small businesses that may be navigating Florida sales surtax for the first time. Our platform is user-friendly and offers various pricing plans, ensuring that small businesses can efficiently manage their documentation without breaking the bank.

Get more for Discretionary Sales Surtax Information DR 15DSS R 1114

- Change name minor 481379805 form

- Massachusetts note 481379806 form

- Massachusetts massachusetts installments fixed rate promissory note secured by residential real estate form

- Massachusetts revocation of health care proxy form

- Md deed form

- Subcontractors agreement contract form

- Md agreement form

- Maryland maryland articles of incorporation for close corporation form

Find out other Discretionary Sales Surtax Information DR 15DSS R 1114

- eSignature North Dakota Real Estate Quitclaim Deed Later

- eSignature Minnesota Sports Rental Lease Agreement Free

- eSignature Minnesota Sports Promissory Note Template Fast

- eSignature Minnesota Sports Forbearance Agreement Online

- eSignature Oklahoma Real Estate Business Plan Template Free

- eSignature South Dakota Police Limited Power Of Attorney Online

- How To eSignature West Virginia Police POA

- eSignature Rhode Island Real Estate Letter Of Intent Free

- eSignature Rhode Island Real Estate Business Letter Template Later

- eSignature South Dakota Real Estate Lease Termination Letter Simple

- eSignature Tennessee Real Estate Cease And Desist Letter Myself

- How To eSignature New Mexico Sports Executive Summary Template

- Can I eSignature Utah Real Estate Operating Agreement

- eSignature Vermont Real Estate Warranty Deed Online

- eSignature Vermont Real Estate Operating Agreement Online

- eSignature Utah Real Estate Emergency Contact Form Safe

- eSignature Washington Real Estate Lease Agreement Form Mobile

- How Can I eSignature New York Sports Executive Summary Template

- eSignature Arkansas Courts LLC Operating Agreement Now

- How Do I eSignature Arizona Courts Moving Checklist