Loan Variation Form Connective Home Loans

What is the Loan Variation Form Connective Home Loans

The Loan Variation Form Connective Home Loans is a crucial document used to modify the terms of an existing home loan. This form allows borrowers to request changes such as adjustments to interest rates, loan amounts, or repayment terms. By completing this form, borrowers can communicate their needs to lenders effectively, ensuring that any modifications align with their financial goals. It is essential for borrowers to understand the implications of these changes and how they may affect their overall loan agreement.

How to use the Loan Variation Form Connective Home Loans

Using the Loan Variation Form Connective Home Loans involves a straightforward process. First, obtain the form from a reliable source, such as your lender’s website or customer service. Next, fill out the required fields, providing accurate information about your current loan and the desired changes. After completing the form, review it carefully to ensure all details are correct. Finally, submit the form according to your lender's instructions, which may include online submission, mailing, or delivering it in person.

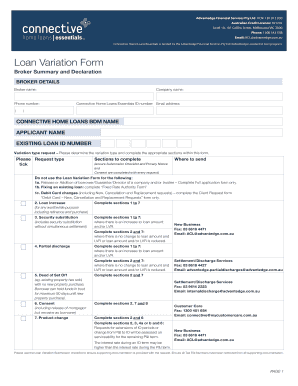

Steps to complete the Loan Variation Form Connective Home Loans

Completing the Loan Variation Form Connective Home Loans requires attention to detail. Follow these steps for a smooth process:

- Gather necessary information, including your loan account number and personal identification.

- Clearly state the changes you wish to make, such as adjusting the repayment period or interest rate.

- Provide any supporting documentation that may be required, such as proof of income or financial hardship.

- Sign and date the form to validate your request.

- Submit the completed form through the designated channel provided by your lender.

Legal use of the Loan Variation Form Connective Home Loans

The legal use of the Loan Variation Form Connective Home Loans is governed by specific regulations to ensure that modifications to loan agreements are valid and enforceable. This form must comply with federal and state laws, including the Truth in Lending Act and other relevant statutes. Proper completion and submission of the form are essential to protect both the borrower’s and lender’s rights. It is advisable to consult with a legal professional if there are uncertainties regarding the implications of the requested changes.

Key elements of the Loan Variation Form Connective Home Loans

The Loan Variation Form Connective Home Loans contains several key elements that are important for both borrowers and lenders. These include:

- Borrower Information: Personal details of the borrower, including name, address, and contact information.

- Loan Details: Existing loan account number and current terms of the loan.

- Requested Changes: Clear description of the modifications being requested, such as interest rate changes or loan term adjustments.

- Supporting Documentation: Any additional paperwork that may be required to substantiate the request.

- Signature: The borrower’s signature to authorize the request and confirm the accuracy of the information provided.

Examples of using the Loan Variation Form Connective Home Loans

There are various scenarios in which borrowers might use the Loan Variation Form Connective Home Loans. For instance:

- A borrower experiencing financial difficulties may request a temporary reduction in their interest rate to ease monthly payments.

- Homeowners looking to refinance might use the form to request a change in the loan term to secure a lower monthly payment.

- Individuals who have improved their credit score may seek to adjust their loan terms to reflect more favorable interest rates.

Quick guide on how to complete loan variation form connective home loans

Complete Loan Variation Form Connective Home Loans effortlessly on any device

Digital document management has become favored by businesses and individuals alike. It offers an excellent eco-friendly substitute for conventional printed and signed documents, allowing you to locate the necessary form and securely store it online. airSlate SignNow equips you with all the tools needed to create, modify, and eSign your documents quickly without delays. Manage Loan Variation Form Connective Home Loans on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related procedure today.

The easiest method to modify and eSign Loan Variation Form Connective Home Loans without hassle

- Find Loan Variation Form Connective Home Loans and click on Get Form to initiate the process.

- Make use of the tools we offer to fill out your document.

- Mark important sections of your documents or conceal sensitive data with tools that airSlate SignNow provides specifically for that purpose.

- Craft your signature using the Sign feature, which takes just moments and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose your preferred method to send your form, whether by email, text message (SMS), or invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, monotonous form searching, or mistakes that necessitate the printing of new document copies. airSlate SignNow meets your document management requirements with just a few clicks from any device of your choosing. Edit and eSign Loan Variation Form Connective Home Loans and guarantee outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What are signNow home loans?

SignNow home loans refer to mortgage solutions that utilize the airSlate SignNow platform for document management and electronic signature capabilities. This allows borrowers and lenders to streamline the process of securing home loans with efficiency and security. The use of signNow helps to minimize paperwork, making it easier to complete applications and agreements.

-

How does signNow enhance the home loan application process?

SignNow enhances the home loan application process by providing an intuitive interface for electronic signatures and document management. Users can easily upload, sign, and send documents from any device, reducing the time spent on paperwork. This not only accelerates the approval process but also ensures that all documents are securely stored and easily accessible.

-

What are the pricing options for using signNow home loans?

AirSlate SignNow offers a variety of pricing plans tailored to different needs, ensuring that signNow home loans are accessible for both individuals and businesses. Plans typically include various features such as document storage, templates, and custom branding. For detailed pricing, visit the airSlate SignNow website to explore options that best fit your requirements.

-

What benefits does signNow provide for home loan transactions?

The benefits of signNow for home loan transactions include increased efficiency, reduced processing times, and enhanced security. By digitizing the entire loan process, users can focus on what truly matters—getting their homes financed. Additionally, signNow provides audit trails and compliance features that help all parties stay informed and protected.

-

Can signNow integrate with other mortgage software?

Yes, signNow can seamlessly integrate with various mortgage software solutions and CRMs, enhancing the workflow for home loan transactions. This integration allows users to access signNow's eSigning and document management features directly within their existing systems. This capability contributes to a more cohesive experience, saving time and reducing errors.

-

Is signNow home loans user-friendly for first-time users?

Absolutely! SignNow is designed with user-friendliness in mind, making it accessible for first-time users navigating the home loan process. The platform offers an easy-to-follow interface and helpful tutorials, ensuring that even those unfamiliar with digital signatures can complete their transactions with confidence and ease.

-

How can I get support if I have questions about signNow home loans?

AirSlate SignNow provides comprehensive customer support for inquiries related to signNow home loans. Users can access an extensive help center, FAQs, and user guides to find answers quickly. Additionally, for more personalized assistance, you can contact their dedicated support team via email or live chat.

Get more for Loan Variation Form Connective Home Loans

- Attorney occupational tax ct form

- Ct ifta quarterly fuel use tax schedule form

- Apply to have your share of the overpayment refunded to you form

- Form ct 8857

- Named below to the authorized persons or organization named below for the tax types specified below form

- De form 8821de

- Form 6401

- State of delaware delaware division of revenue delawaregov form

Find out other Loan Variation Form Connective Home Loans

- Electronic signature Delaware Junior Employment Offer Letter Later

- Electronic signature Texas Time Off Policy Later

- Electronic signature Texas Time Off Policy Free

- eSignature Delaware Time Off Policy Online

- Help Me With Electronic signature Indiana Direct Deposit Enrollment Form

- Electronic signature Iowa Overtime Authorization Form Online

- Electronic signature Illinois Employee Appraisal Form Simple

- Electronic signature West Virginia Business Ethics and Conduct Disclosure Statement Free

- Electronic signature Alabama Disclosure Notice Simple

- Electronic signature Massachusetts Disclosure Notice Free

- Electronic signature Delaware Drug Testing Consent Agreement Easy

- Electronic signature North Dakota Disclosure Notice Simple

- Electronic signature California Car Lease Agreement Template Free

- How Can I Electronic signature Florida Car Lease Agreement Template

- Electronic signature Kentucky Car Lease Agreement Template Myself

- Electronic signature Texas Car Lease Agreement Template Easy

- Electronic signature New Mexico Articles of Incorporation Template Free

- Electronic signature New Mexico Articles of Incorporation Template Easy

- Electronic signature Oregon Articles of Incorporation Template Simple

- eSignature Montana Direct Deposit Enrollment Form Easy