Portal Ct Gov Media2021 Form CT 706 NT Instructions Connecticut Estate Tax 2021

Understanding the CT 706 NT Form

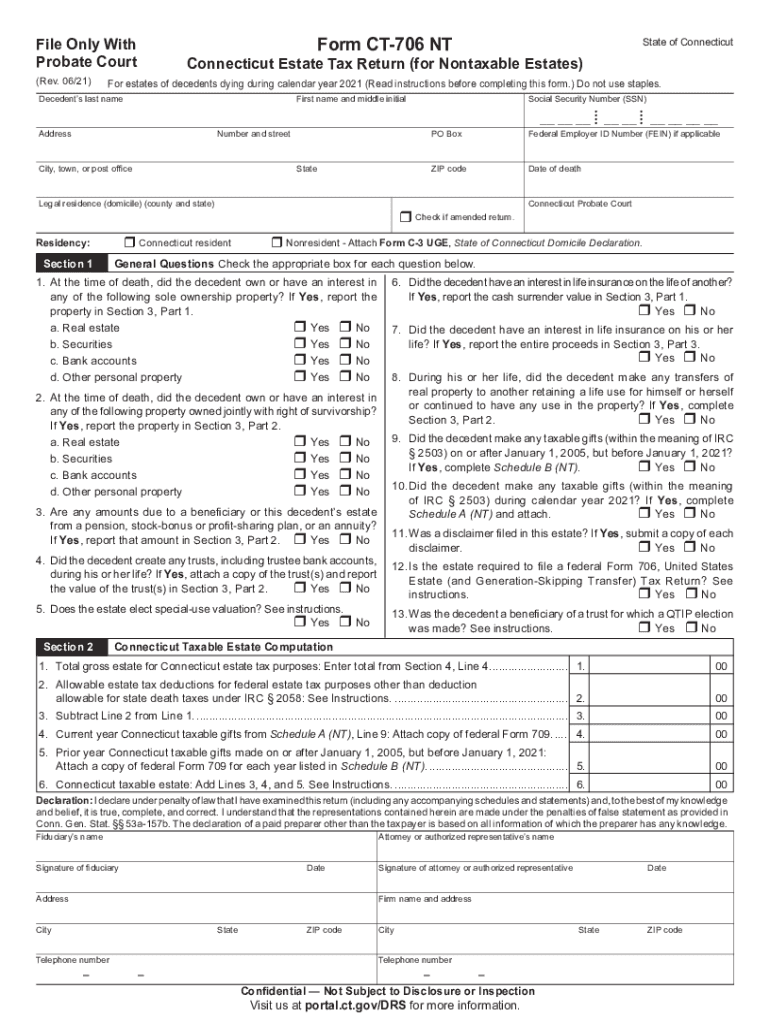

The CT 706 NT form is a crucial document used for reporting estate taxes in Connecticut. It is specifically designed for estates that do not exceed the state's exemption threshold. This form is essential for ensuring compliance with Connecticut estate tax laws and is used to calculate the tax owed based on the value of the estate. Proper completion of the CT 706 NT is necessary to avoid penalties and ensure that the estate is settled in accordance with state regulations.

Steps to Complete the CT 706 NT Form

Completing the CT 706 NT form involves several key steps to ensure accuracy and compliance. First, gather all necessary financial documents related to the estate, including asset valuations and liabilities. Next, fill out the form with detailed information about the deceased, including their name, date of death, and the total value of the estate. It is important to carefully follow the instructions provided with the form to ensure all sections are completed correctly. After filling out the form, review it for any errors before submission.

Required Documents for the CT 706 NT Form

When preparing to file the CT 706 NT form, certain documents are required to support the information provided. These documents typically include:

- Death certificate of the deceased

- Asset appraisals and valuations

- Liabilities and debts of the estate

- Prior tax returns, if applicable

Having these documents readily available will facilitate a smoother filing process and help ensure that the information reported is accurate and complete.

Filing Deadlines for the CT 706 NT Form

Timely submission of the CT 706 NT form is critical to avoid penalties. The form must be filed within nine months following the date of death of the decedent. If additional time is needed, an extension can be requested, but it is essential to adhere to the original deadline to prevent any potential late fees or interest charges on unpaid taxes.

Legal Use of the CT 706 NT Form

The CT 706 NT form is legally binding and must be completed in accordance with Connecticut estate tax laws. It is important to ensure that all information is truthful and accurate, as any discrepancies could lead to audits or penalties. Utilizing reliable eSignature solutions can enhance the legal validity of the form when filing electronically, ensuring compliance with state regulations.

Digital vs. Paper Version of the CT 706 NT Form

Filing the CT 706 NT form can be done either digitally or via paper submission. The digital version offers advantages such as faster processing times and reduced risk of errors. Additionally, electronic filing can provide immediate confirmation of submission. Conversely, the paper version may be preferred by those who are more comfortable with traditional methods. Regardless of the method chosen, it is essential to ensure that all required information is accurately reported.

Quick guide on how to complete portalctgov media2021 form ct 706 nt instructions connecticut estate tax

Prepare Portal ct gov media2021 Form CT 706 NT Instructions Connecticut Estate Tax effortlessly on any device

Digital document management has gained popularity among organizations and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the correct format and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents promptly without complications. Handle Portal ct gov media2021 Form CT 706 NT Instructions Connecticut Estate Tax on any device using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

Effortlessly edit and electronically sign Portal ct gov media2021 Form CT 706 NT Instructions Connecticut Estate Tax

- Find Portal ct gov media2021 Form CT 706 NT Instructions Connecticut Estate Tax and click Get Form to begin.

- Use the tools we provide to fill out your document.

- Mark important sections of the documents or redact sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your signature using the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select how you would like to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, exhausting document searches, or errors that necessitate printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choice. Modify and electronically sign Portal ct gov media2021 Form CT 706 NT Instructions Connecticut Estate Tax while ensuring outstanding communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct portalctgov media2021 form ct 706 nt instructions connecticut estate tax

Create this form in 5 minutes!

How to create an eSignature for the portalctgov media2021 form ct 706 nt instructions connecticut estate tax

The best way to generate an electronic signature for a PDF in the online mode

The best way to generate an electronic signature for a PDF in Chrome

The way to create an e-signature for putting it on PDFs in Gmail

The way to make an e-signature straight from your smart phone

The way to make an e-signature for a PDF on iOS devices

The way to make an e-signature for a PDF document on Android OS

People also ask

-

What is ct 706 nt and how does it work with airSlate SignNow?

The ct 706 nt is an essential form for Connecticut businesses, and airSlate SignNow simplifies its completion and e-signing process. By seamlessly integrating this form into our platform, users can quickly fill, sign, and send it to relevant parties, ensuring compliance and efficiency in their operations.

-

How can airSlate SignNow help with the ct 706 nt form submissions?

airSlate SignNow offers features specifically designed for handling ct 706 nt forms, enabling users to send, track, and manage submissions effortlessly. Users can utilize templates and automated workflows that ensure all necessary information is captured accurately and that submissions meet regulatory requirements.

-

What are the pricing options for using airSlate SignNow for ct 706 nt forms?

airSlate SignNow provides flexible pricing plans that cater to different business needs when dealing with ct 706 nt forms. Our plans are cost-effective and include options for individual users to teams, ensuring that everyone can benefit from our e-signature solutions without overspending.

-

Can I integrate airSlate SignNow with other software while using the ct 706 nt?

Yes! airSlate SignNow easily integrates with various business applications, allowing seamless management of ct 706 nt forms. This means you can connect with CRM systems, document storage solutions, and more, streamlining your workflow and enhancing productivity.

-

What features does airSlate SignNow offer for managing the ct 706 nt forms?

airSlate SignNow provides robust features for managing the ct 706 nt forms, including customizable templates, real-time tracking, and secure storage. With our intuitive platform, users can create efficient workflows that simplify the e-signature process and ensure legal compliance.

-

How does airSlate SignNow enhance the e-signing experience for the ct 706 nt?

AirSlate SignNow enhances the e-signing experience for the ct 706 nt by providing an intuitive user interface and mobile-friendly options. Stakeholders can sign documents anytime and anywhere, making the process faster and more convenient.

-

What benefits do I gain by using airSlate SignNow for the ct 706 nt?

By using airSlate SignNow for the ct 706 nt, businesses benefit from time-saving automation and improved accuracy in form submissions. Additionally, our platform reduces the need for physical paperwork, allowing for a more eco-friendly approach while ensuring secure and compliant transactions.

Get more for Portal ct gov media2021 Form CT 706 NT Instructions Connecticut Estate Tax

- Contractors forms package alaska

- Power of attorney for sale of motor vehicle alaska form

- Ak power attorney 497294252 form

- Wedding planning or consultant package alaska form

- Alaska power attorney 497294267 form

- Hunting forms package alaska

- Identity theft recovery package alaska form

- Aging parent package alaska form

Find out other Portal ct gov media2021 Form CT 706 NT Instructions Connecticut Estate Tax

- Electronic signature West Virginia Education Contract Safe

- Help Me With Electronic signature West Virginia Education Business Letter Template

- Electronic signature West Virginia Education Cease And Desist Letter Easy

- Electronic signature Missouri Insurance Stock Certificate Free

- Electronic signature Idaho High Tech Profit And Loss Statement Computer

- How Do I Electronic signature Nevada Insurance Executive Summary Template

- Electronic signature Wisconsin Education POA Free

- Electronic signature Wyoming Education Moving Checklist Secure

- Electronic signature North Carolina Insurance Profit And Loss Statement Secure

- Help Me With Electronic signature Oklahoma Insurance Contract

- Electronic signature Pennsylvania Insurance Letter Of Intent Later

- Electronic signature Pennsylvania Insurance Quitclaim Deed Now

- Electronic signature Maine High Tech Living Will Later

- Electronic signature Maine High Tech Quitclaim Deed Online

- Can I Electronic signature Maryland High Tech RFP

- Electronic signature Vermont Insurance Arbitration Agreement Safe

- Electronic signature Massachusetts High Tech Quitclaim Deed Fast

- Electronic signature Vermont Insurance Limited Power Of Attorney Easy

- Electronic signature Washington Insurance Last Will And Testament Later

- Electronic signature Washington Insurance Last Will And Testament Secure