Printable Connecticut Income Tax Forms for Tax Year 2019Contact DRS CT GOV Connecticut's Official State WebsiteOnline Registrati 2020

Steps to complete the Connecticut Schedule

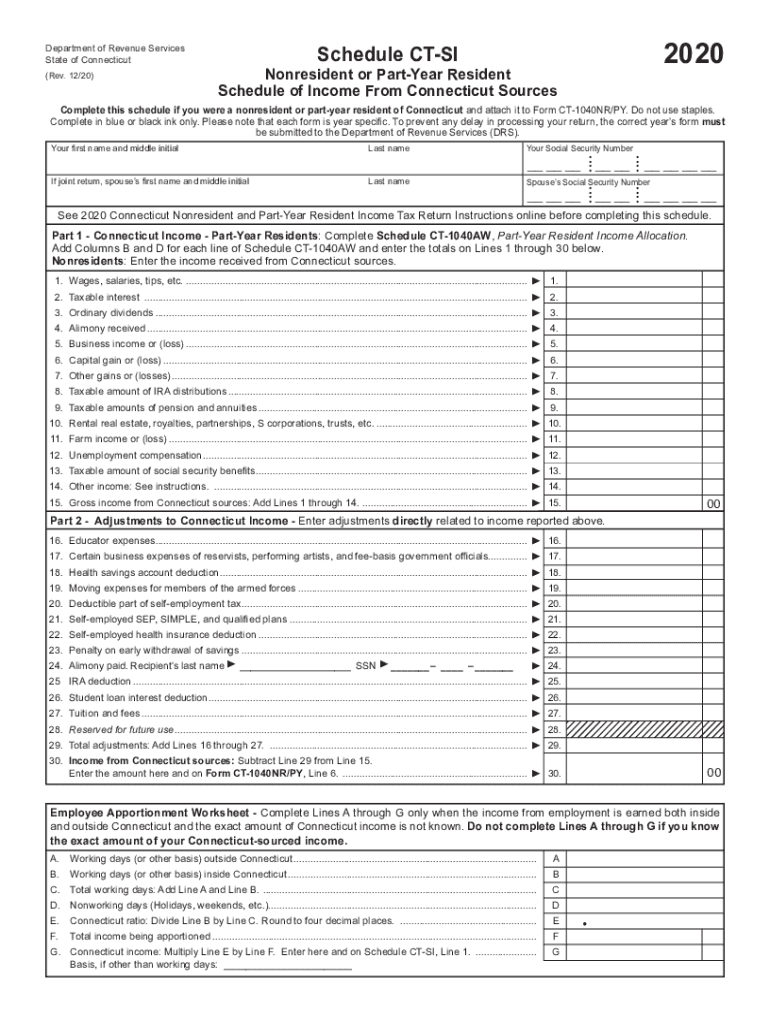

Completing the Connecticut Schedule involves several key steps to ensure accuracy and compliance with state tax regulations. Begin by gathering all necessary documents, including your W-2 forms, 1099s, and any other income statements. Next, download the appropriate Connecticut Schedule form for the tax year you are filing. Ensure you are using the correct version, as tax laws may change annually.

Once you have the form, carefully follow the instructions provided. Fill out your personal information, including your name, address, and Social Security number. Report your income accurately, ensuring that you include all relevant sources of income. After completing the form, review it for any errors or omissions. It may be helpful to have a trusted individual review your completed form as well.

Finally, submit your Connecticut Schedule by the designated deadline. You can file electronically through an approved e-filing service or send your completed form via mail to the Connecticut Department of Revenue Services. Ensure you keep a copy of your submitted form for your records.

Legal use of the Connecticut Schedule

The Connecticut Schedule is a legally binding document that must be completed accurately to comply with state tax laws. When filled out correctly, it serves as an official record of your income and tax obligations. It is essential to understand that any misrepresentation or errors may lead to penalties or audits by the Connecticut Department of Revenue Services.

To ensure the legal validity of your Connecticut Schedule, consider using a reliable eSignature solution. This can provide you with a digital certificate that enhances the legitimacy of your submission. Additionally, be aware of the legal frameworks governing eSignatures, such as the ESIGN Act and UETA, which affirm the enforceability of electronic signatures in the United States.

Required Documents for the Connecticut Schedule

To complete the Connecticut Schedule accurately, you will need several key documents. These typically include:

- Your W-2 forms from employers, which report your annual wages and tax withholdings.

- 1099 forms for any freelance or contract work, detailing other income sources.

- Records of any deductions or credits you plan to claim, such as receipts for charitable donations or medical expenses.

- Any additional income statements, such as interest or dividends from investments.

Having these documents readily available will streamline the process and help ensure that your Connecticut Schedule is completed accurately.

Filing Deadlines for the Connecticut Schedule

Filing deadlines for the Connecticut Schedule are crucial to avoid penalties and ensure compliance with state tax laws. Typically, the deadline for filing your state income tax return, including the Connecticut Schedule, is April fifteenth. If this date falls on a weekend or holiday, the deadline may be extended to the next business day.

It is advisable to check for any updates or changes to deadlines each tax year, as they can vary. Additionally, if you require more time to file, you may request an extension, but it is important to note that this does not extend the time to pay any taxes owed.

Form Submission Methods for the Connecticut Schedule

There are several methods available for submitting your Connecticut Schedule. You can choose to file electronically through an approved e-filing service, which is often the fastest and most efficient method. Electronic filing allows for immediate confirmation of receipt and can expedite any potential refunds.

If you prefer to file by mail, ensure that you send your completed Connecticut Schedule to the correct address provided by the Connecticut Department of Revenue Services. It is advisable to use a secure mailing method, such as certified mail, to track your submission. Regardless of the method chosen, keeping a copy of your submitted form is essential for your records.

Key elements of the Connecticut Schedule

Understanding the key elements of the Connecticut Schedule is essential for accurate completion. The form typically includes sections for personal information, income reporting, deductions, and tax calculations. Each section is designed to capture specific financial details that contribute to your overall tax liability.

Be sure to familiarize yourself with any specific instructions related to each section, as they can vary based on your individual tax situation. Additionally, some forms may include worksheets or additional schedules that need to be completed based on the complexity of your financial circumstances.

Quick guide on how to complete printable connecticut income tax forms for tax year 2019contact drs ctgov connecticuts official state websiteonline

Effortlessly prepare Printable Connecticut Income Tax Forms For Tax Year 2019Contact DRS CT GOV Connecticut's Official State WebsiteOnline Registrati on any device

Managing documents online has become increasingly favored by companies and individuals alike. It offers an ideal environmentally-friendly substitute for traditional printed and signed documents, allowing you to locate the correct form and securely store it in the cloud. airSlate SignNow equips you with all the necessary tools to swiftly create, modify, and electronically sign your documents without delays. Handle Printable Connecticut Income Tax Forms For Tax Year 2019Contact DRS CT GOV Connecticut's Official State WebsiteOnline Registrati on any platform using airSlate SignNow's Android or iOS applications and simplify your document-related tasks today.

The simplest way to modify and electronically sign Printable Connecticut Income Tax Forms For Tax Year 2019Contact DRS CT GOV Connecticut's Official State WebsiteOnline Registrati with ease

- Obtain Printable Connecticut Income Tax Forms For Tax Year 2019Contact DRS CT GOV Connecticut's Official State WebsiteOnline Registrati and click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Highlight important sections of your documents or redact sensitive information using tools specifically designed by airSlate SignNow for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to save your changes.

- Choose how you want to send your form, whether via email, text message (SMS), invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow takes care of all your document management needs with just a few clicks from any device you prefer. Edit and electronically sign Printable Connecticut Income Tax Forms For Tax Year 2019Contact DRS CT GOV Connecticut's Official State WebsiteOnline Registrati to ensure smooth communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct printable connecticut income tax forms for tax year 2019contact drs ctgov connecticuts official state websiteonline

Create this form in 5 minutes!

How to create an eSignature for the printable connecticut income tax forms for tax year 2019contact drs ctgov connecticuts official state websiteonline

The best way to create an e-signature for your PDF file online

The best way to create an e-signature for your PDF file in Google Chrome

The best way to make an e-signature for signing PDFs in Gmail

The way to make an e-signature right from your mobile device

The way to generate an electronic signature for a PDF file on iOS

The way to make an e-signature for a PDF on Android devices

People also ask

-

What is CT Schedule in airSlate SignNow?

The CT Schedule in airSlate SignNow refers to a comprehensive timeline for getting your documents signed and executed efficiently. This feature allows businesses to set deadlines, ensuring that all parties are aware of when signatures are needed. With a CT Schedule, users can enhance their workflow and improve document turnaround times.

-

How much does airSlate SignNow cost for using CT Schedule features?

The pricing for airSlate SignNow varies based on the plan you choose, but all plans include access to the CT Schedule feature. We offer flexible pricing options tailored for small businesses and enterprises alike. For detailed pricing information, please visit our pricing page or contact our sales team for a quote.

-

What are the key features of the CT Schedule in airSlate SignNow?

Key features of the CT Schedule include customizable deadlines, automated reminders, and the ability to track the signing status of documents. This ensures a streamlined process where users can manage their signing timelines effectively. Additionally, the CT Schedule integrates seamlessly with existing workflows to enhance productivity.

-

How can the CT Schedule benefit my business?

The CT Schedule can signNowly increase your business's efficiency by reducing the time spent tracking document signatures. It provides clarity and accountability throughout the signing process, allowing you to predict completion times more accurately. This leads to improved operational efficiency and enhanced customer satisfaction.

-

Is it easy to integrate airSlate SignNow’s CT Schedule with other tools?

Yes, airSlate SignNow offers robust integrations with various platforms, making it easy to incorporate the CT Schedule feature into your existing workflows. Whether you use CRM systems, project management tools, or cloud storage solutions, our platform supports seamless integration. This capability allows for a smoother user experience across multiple applications.

-

Can I customize the CT Schedule settings for my specific needs?

Absolutely! The CT Schedule in airSlate SignNow is designed to be customizable so you can set it according to your business requirements. You can define deadlines, tailor reminder notifications, and adjust signing roles to fit your workflow. This level of customization helps ensure that your signing processes align perfectly with your organizational goals.

-

What kind of customer support does airSlate SignNow offer for the CT Schedule feature?

airSlate SignNow provides comprehensive customer support to help users navigate the CT Schedule feature effectively. Our support team is available through multiple channels, including chat, email, and phone. Additionally, we offer extensive resources such as tutorials and FAQs to ensure you make the most of your signing experience.

Get more for Printable Connecticut Income Tax Forms For Tax Year 2019Contact DRS CT GOV Connecticut's Official State WebsiteOnline Registrati

- Alaska personal representative form

- Alaska eviction form

- Ak landlord form

- Real estate home sales package with offer to purchase contract of sale disclosure statements and more for residential house form

- Annual minutes alaska alaska form

- Notices resolutions simple stock ledger and certificate alaska form

- Minutes for organizational meeting alaska alaska form

- Sample transmittal letter to secretary of states office to file articles of incorporation alaska alaska form

Find out other Printable Connecticut Income Tax Forms For Tax Year 2019Contact DRS CT GOV Connecticut's Official State WebsiteOnline Registrati

- Help Me With eSignature Indiana Doctors Notice To Quit

- eSignature Ohio Education Purchase Order Template Easy

- eSignature South Dakota Education Confidentiality Agreement Later

- eSignature South Carolina Education Executive Summary Template Easy

- eSignature Michigan Doctors Living Will Simple

- How Do I eSignature Michigan Doctors LLC Operating Agreement

- How To eSignature Vermont Education Residential Lease Agreement

- eSignature Alabama Finance & Tax Accounting Quitclaim Deed Easy

- eSignature West Virginia Education Quitclaim Deed Fast

- eSignature Washington Education Lease Agreement Form Later

- eSignature Missouri Doctors Residential Lease Agreement Fast

- eSignature Wyoming Education Quitclaim Deed Easy

- eSignature Alaska Government Agreement Fast

- How Can I eSignature Arizona Government POA

- How Do I eSignature Nevada Doctors Lease Agreement Template

- Help Me With eSignature Nevada Doctors Lease Agreement Template

- How Can I eSignature Nevada Doctors Lease Agreement Template

- eSignature Finance & Tax Accounting Presentation Arkansas Secure

- eSignature Arkansas Government Affidavit Of Heirship Online

- eSignature New Jersey Doctors Permission Slip Mobile