Ct Drs Penalty Waiver Form" Keyword Found Websites Listing 2021-2026

What is the Connecticut Drs Penalty Waiver Form?

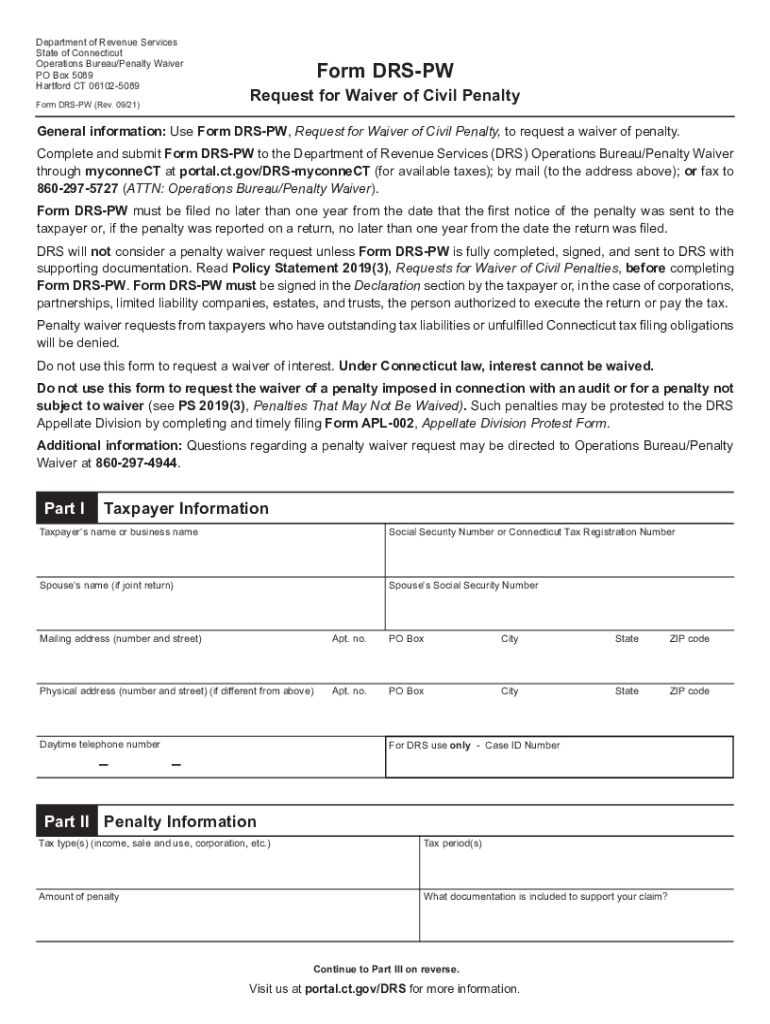

The Connecticut Drs penalty waiver form, often referred to as the drs pw form, is a legal document that allows taxpayers to request a waiver for penalties imposed by the Connecticut Department of Revenue Services. This form is typically used by individuals or businesses that have incurred penalties due to late payments or filings. By submitting this form, taxpayers can explain their circumstances and potentially have their penalties reduced or eliminated. Understanding the purpose and implications of this form is crucial for anyone looking to navigate the complexities of Connecticut tax regulations.

Key Elements of the Connecticut Drs Penalty Waiver Form

The drs pw form includes several key elements that must be completed accurately for it to be considered valid. These elements typically include:

- Taxpayer Information: This section requires the taxpayer's name, address, and identification number.

- Details of the Penalty: Taxpayers must specify the type of penalty being contested and provide any relevant dates.

- Reason for Waiver Request: A clear explanation of the circumstances that led to the penalty is essential. This may include unforeseen events or errors beyond the taxpayer's control.

- Supporting Documentation: Any additional documents that support the waiver request should be included, such as payment receipts or correspondence with the Department of Revenue Services.

Steps to Complete the Connecticut Drs Penalty Waiver Form

Completing the drs pw form involves several important steps to ensure accuracy and compliance:

- Gather Necessary Information: Collect all relevant personal and tax information, including details about the penalties incurred.

- Fill Out the Form: Carefully complete each section of the form, ensuring that all required fields are filled in accurately.

- Attach Supporting Documents: Include any documentation that supports your request for a penalty waiver.

- Review the Form: Double-check all information for accuracy and completeness before submission.

- Submit the Form: Follow the specified submission methods, which may include online submission, mailing, or in-person delivery to the appropriate office.

Legal Use of the Connecticut Drs Penalty Waiver Form

The drs pw form is legally recognized under Connecticut tax law, provided it is completed and submitted in accordance with the state's regulations. It is important for taxpayers to understand that submitting this form does not guarantee the waiver of penalties; rather, it initiates a review process by the Department of Revenue Services. Taxpayers must be prepared to provide a compelling case for their request, as the decision ultimately rests with the state authorities.

Eligibility Criteria for the Connecticut Drs Penalty Waiver Form

To be eligible for a penalty waiver using the drs pw form, taxpayers must meet certain criteria. Generally, these may include:

- Having a valid reason for the late payment or filing, such as medical emergencies or natural disasters.

- Demonstrating a history of compliance with tax obligations prior to the incident that led to the penalty.

- Submitting the waiver request within the time frame specified by the Department of Revenue Services.

Form Submission Methods for the Connecticut Drs Penalty Waiver Form

Taxpayers have several options for submitting the drs pw form. These methods may include:

- Online Submission: Many taxpayers prefer to complete and submit the form electronically through the Connecticut Department of Revenue Services website.

- Mail: Taxpayers can print the completed form and send it via postal mail to the designated address provided by the state.

- In-Person Submission: For those who prefer face-to-face communication, visiting a local Department of Revenue Services office is an option.

Quick guide on how to complete ct drs penalty waiver formampquot keyword found websites listing

Effortlessly Prepare Ct Drs Penalty Waiver Form" Keyword Found Websites Listing on Any Device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to access the right template and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents quickly and without delays. Handle Ct Drs Penalty Waiver Form" Keyword Found Websites Listing on any platform using airSlate SignNow Android or iOS applications and enhance any document-related process today.

The Easiest Way to Modify and eSign Ct Drs Penalty Waiver Form" Keyword Found Websites Listing Without Stress

- Locate Ct Drs Penalty Waiver Form" Keyword Found Websites Listing and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight important sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select how you wish to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Modify and eSign Ct Drs Penalty Waiver Form" Keyword Found Websites Listing and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct ct drs penalty waiver formampquot keyword found websites listing

Create this form in 5 minutes!

How to create an eSignature for the ct drs penalty waiver formampquot keyword found websites listing

The best way to generate an electronic signature for a PDF online

The best way to generate an electronic signature for a PDF in Google Chrome

The way to create an e-signature for signing PDFs in Gmail

The way to make an e-signature straight from your smartphone

The way to make an e-signature for a PDF on iOS

The way to make an e-signature for a PDF document on Android

People also ask

-

What are the key features of airSlate SignNow for drs ct?

airSlate SignNow offers a range of features tailored for drs ct users, including customizable templates, multi-party signing, and secure cloud storage. These features simplify the document signing process and enhance workflow efficiency. With the intuitive interface, businesses can easily manage and send documents for eSigning.

-

How does airSlate SignNow support business needs related to drs ct?

By utilizing airSlate SignNow for drs ct, businesses can ensure a faster and more reliable document signing process. The platform effectively addresses common pain points such as lengthy turnaround times and lost paperwork. This leads to improved productivity and reduced operational costs.

-

What pricing plans are available for airSlate SignNow focused on drs ct?

AirSlate SignNow offers flexible pricing plans designed to suit various business sizes engaged in drs ct. From basic to premium plans, businesses can choose according to their signing volume and required features. Each plan includes access to essential tools that streamline document management.

-

Is it easy to integrate airSlate SignNow with existing systems for drs ct?

Yes, integrating airSlate SignNow with existing systems for drs ct is straightforward and user-friendly. The platform supports various integrations with popular applications such as CRM and ERP systems, enhancing overall workflow. This ensures that businesses can keep their operations seamless without requiring extensive IT resources.

-

What security measures does airSlate SignNow implement for drs ct?

AirSlate SignNow prioritizes security for drs ct, implementing advanced encryption and compliance measures. All documents are securely stored, ensuring confidentiality and integrity. Additionally, users benefit from features like audit trails and user authentication to prevent unauthorized access.

-

How can airSlate SignNow improve collaboration in drs ct?

AirSlate SignNow enhances collaboration in drs ct by allowing multiple users to sign and comment on documents simultaneously. This feature promotes real-time feedback and faster decision-making, reducing bottlenecks in workflow. Teams can work together efficiently, regardless of location.

-

Can airSlate SignNow assist with compliance for drs ct businesses?

Yes, airSlate SignNow helps businesses in drs ct maintain compliance with various regulations and standards. The platform offers eSigning solutions that meet legal requirements, ensuring documents are valid and enforceable. This reduces the risk of legal issues associated with document handling.

Get more for Ct Drs Penalty Waiver Form" Keyword Found Websites Listing

- Alaska legal life form

- Essential legal life documents for new parents alaska form

- General power of attorney for care and custody of child or children alaska form

- Small business accounting package alaska form

- Company employment policies and procedures package alaska form

- Ak power attorney form

- Newly divorced individuals package alaska form

- Disposition document form

Find out other Ct Drs Penalty Waiver Form" Keyword Found Websites Listing

- Sign Indiana Software Development Proposal Template Easy

- Sign South Dakota Working Time Control Form Now

- Sign Hawaii IT Project Proposal Template Online

- Sign Nebraska Operating Agreement Now

- Can I Sign Montana IT Project Proposal Template

- Sign Delaware Software Development Agreement Template Now

- How To Sign Delaware Software Development Agreement Template

- How Can I Sign Illinois Software Development Agreement Template

- Sign Arkansas IT Consulting Agreement Computer

- Can I Sign Arkansas IT Consulting Agreement

- Sign Iowa Agile Software Development Contract Template Free

- How To Sign Oregon IT Consulting Agreement

- Sign Arizona Web Hosting Agreement Easy

- How Can I Sign Arizona Web Hosting Agreement

- Help Me With Sign Alaska Web Hosting Agreement

- Sign Alaska Web Hosting Agreement Easy

- Sign Arkansas Web Hosting Agreement Simple

- Sign Indiana Web Hosting Agreement Online

- Sign Indiana Web Hosting Agreement Easy

- How To Sign Louisiana Web Hosting Agreement