India Life Insurance Questionnaire Form

What is the India Life Insurance Questionnaire

The India Life Insurance Questionnaire is a comprehensive document designed to gather essential information from individuals applying for life insurance policies. This form is crucial for insurance companies to assess the risk associated with insuring an applicant. It typically includes questions about the applicant's health history, lifestyle choices, and financial situation. By providing accurate and complete information, applicants can ensure that their insurance coverage is tailored to their specific needs.

How to obtain the India Life Insurance Questionnaire

To obtain the India Life Insurance Questionnaire, individuals can visit the official website of the insurance provider or contact their customer service. Many insurance companies also offer downloadable versions of the questionnaire in PDF format. It is advisable to check for any specific requirements or updates related to the questionnaire to ensure that applicants have the most current version. Additionally, some insurance agents may provide the questionnaire directly during consultations.

Steps to complete the India Life Insurance Questionnaire

Completing the India Life Insurance Questionnaire involves several key steps:

- Gather necessary personal information, including identification details and contact information.

- Review health history, including any pre-existing conditions, medications, and past medical treatments.

- Consider lifestyle factors such as smoking, alcohol consumption, and exercise habits.

- Provide financial information, including income and any existing insurance policies.

- Double-check all answers for accuracy before submission.

Taking the time to thoroughly complete the questionnaire can help ensure a smoother application process and better coverage options.

Legal use of the India Life Insurance Questionnaire

The India Life Insurance Questionnaire is legally binding when completed accurately and submitted to the insurance provider. It serves as a formal declaration of the applicant's health and lifestyle, which can impact the terms of the policy. Misrepresentation or omission of critical information may lead to complications in claims processing or policy approval. Therefore, it is important to understand the legal implications of the information provided in the questionnaire.

Key elements of the India Life Insurance Questionnaire

Key elements of the India Life Insurance Questionnaire typically include:

- Personal Information: Name, address, date of birth, and contact details.

- Health History: Questions regarding past illnesses, surgeries, and current health status.

- Lifestyle Choices: Information about smoking, drinking, and exercise habits.

- Financial Information: Details about income, existing insurance policies, and beneficiaries.

These elements are essential for the insurance provider to evaluate the applicant's risk profile and determine appropriate coverage and premiums.

Examples of using the India Life Insurance Questionnaire

Examples of using the India Life Insurance Questionnaire can vary based on individual circumstances. For instance:

- A young professional applying for their first life insurance policy may focus on health and lifestyle questions to secure lower premiums.

- A parent seeking additional coverage for their family may emphasize financial information to ensure adequate protection.

- An individual with a complex medical history may need to provide detailed health information to facilitate a thorough risk assessment.

Each scenario highlights the importance of tailoring responses to reflect personal circumstances accurately.

Quick guide on how to complete india life insurance questionnaire

Effortlessly Prepare India Life Insurance Questionnaire on Any Device

Digital document management has gained traction among businesses and individuals. It serves as an ideal eco-friendly substitute for conventional printed and signed documents, as you can easily access the right form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly and without delays. Manage India Life Insurance Questionnaire on any device with airSlate SignNow's Android or iOS applications and enhance any document-related task today.

The Simplest Way to Edit and eSign India Life Insurance Questionnaire with Ease

- Locate India Life Insurance Questionnaire and click on Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize important sections of the document or obscure sensitive information with tools designed specifically for that purpose by airSlate SignNow.

- Generate your eSignature using the Sign tool, which takes only seconds and carries the same legal validity as a conventional handwritten signature.

- Review all the details and click on the Done button to save your changes.

- Choose your preferred method of sending your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searching, or errors that require printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Modify and eSign India Life Insurance Questionnaire and ensure exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

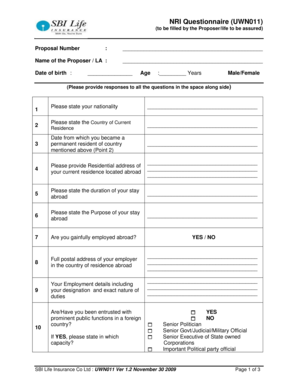

What is SBI Life Insurance NRI and how does it work?

SBI Life Insurance NRI is a tailored insurance product designed specifically for Non-Resident Indians. It provides financial security and risk coverage while allowing NRIs to invest in India's insurance market. With a variety of plans, it ensures that NRIs maintain their ties with India while benefiting from comprehensive coverage.

-

What are the key benefits of SBI Life Insurance NRI?

The key benefits of SBI Life Insurance NRI include flexible premium payment options, tax benefits under Section 80C, and attractive returns on investment. Additionally, it offers extensive coverage against life risks, ensuring peace of mind for NRIs and their families. This insurance is a vital step in safeguarding one's financial future.

-

How much does SBI Life Insurance NRI cost?

The cost of SBI Life Insurance NRI varies depending on the chosen plan, the sum assured, and the applicant's age. Generally, the premiums are competitive and affordable for NRIs looking for reliable insurance coverage. It's advisable to compare different plans and their costs to find the one that fits your budget.

-

Are there any special features of SBI Life Insurance NRI?

Yes, SBI Life Insurance NRI includes features such as online policy management, flexible premium payment frequencies, and customizable coverage options. It also provides easy repatriation benefits, allowing NRIs to manage funds easily from abroad. The policy caters specifically to the needs of expatriates, making it a preferred choice.

-

Can SBI Life Insurance NRI policies be renewed online?

Absolutely! SBI Life Insurance NRI policies can be easily renewed online through their user-friendly portal. This convenience makes it hassle-free for NRIs to maintain their policies and ensure continued coverage without interruptions. Online renewal also allows for quick payment processing and instant confirmation.

-

What documents are required to apply for SBI Life Insurance NRI?

To apply for SBI Life Insurance NRI, you typically need to submit identity proof, address proof, income proof, and any previous insurance documents. Specific requirements may vary based on the policy chosen. Proper documentation ensures a smooth application process and quicker policy issuance.

-

Is there a grace period for SBI Life Insurance NRI premium payments?

Yes, SBI Life Insurance NRI provides a grace period for premium payments, typically ranging from 30 to 60 days. This grace period allows NRIs to make payments without losing coverage, ensuring that their insurance remains active despite unforeseen circumstances. It's essential to check the specific terms of your selected policy.

Get more for India Life Insurance Questionnaire

- North dakota judgment form

- North dakota court system eviction for landlords form

- Demand for rent form

- Eviction notice rental lease agreements notice to tenant form

- V residential eviction summons oregon judicial department form

- Form 7 summons eviction claim if your complaint is only

- Jd fm 149 form

- Dd form 2257

Find out other India Life Insurance Questionnaire

- Can I eSign Colorado Car Dealer Document

- How Can I eSign Colorado Car Dealer Document

- Can I eSign Hawaii Car Dealer Word

- How To eSign Hawaii Car Dealer PPT

- How To eSign Hawaii Car Dealer PPT

- How Do I eSign Hawaii Car Dealer PPT

- Help Me With eSign Hawaii Car Dealer PPT

- How Can I eSign Hawaii Car Dealer Presentation

- How Do I eSign Hawaii Business Operations PDF

- How Can I eSign Hawaii Business Operations PDF

- How To eSign Hawaii Business Operations Form

- How Do I eSign Hawaii Business Operations Form

- Help Me With eSign Hawaii Business Operations Presentation

- How Do I eSign Idaho Car Dealer Document

- How Do I eSign Indiana Car Dealer Document

- How To eSign Michigan Car Dealer Document

- Can I eSign Michigan Car Dealer PPT

- How Can I eSign Michigan Car Dealer Form

- Help Me With eSign Kansas Business Operations PPT

- How Can I eSign Mississippi Car Dealer Form