F4562 PDF Form 4562 Depreciation and Amortization Attach 2021

What is Form 4562?

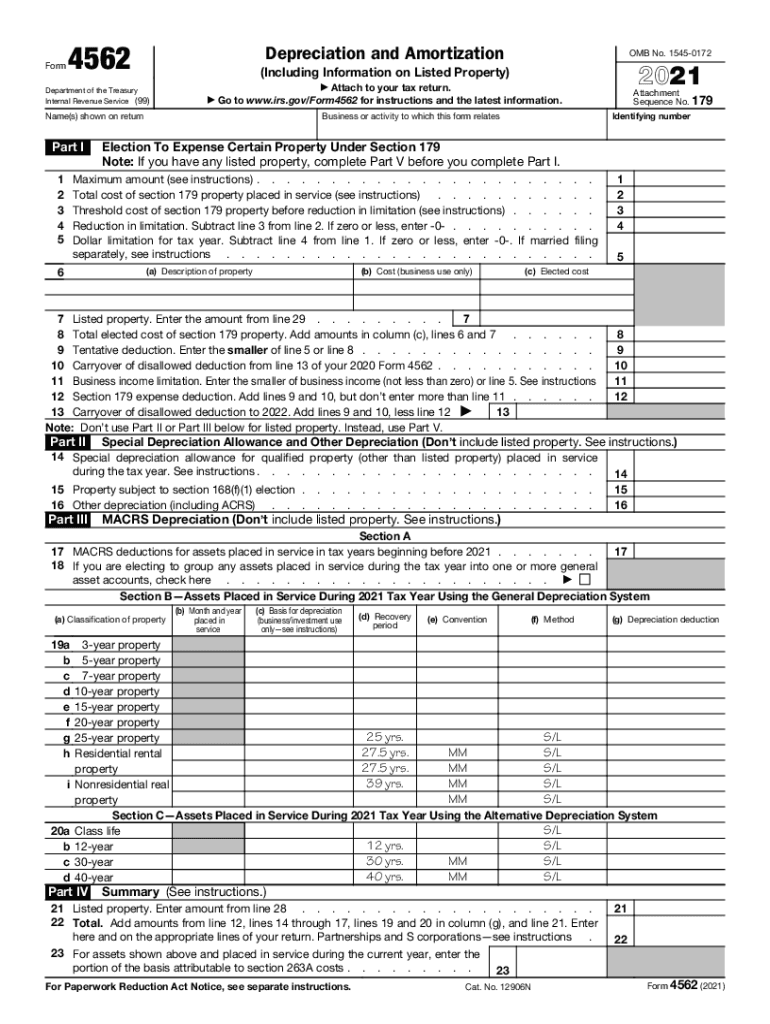

Form 4562, officially known as the Depreciation and Amortization form, is a crucial document used by businesses and individuals to claim depreciation on their assets. This form is essential for reporting the depreciation of property used in a trade or business, as well as for claiming amortization of certain intangible assets. It is typically filed with the Internal Revenue Service (IRS) as part of an annual tax return. Understanding how to properly complete this form is vital for ensuring compliance with IRS regulations and maximizing potential tax benefits.

Key Elements of Form 4562

Form 4562 includes several key sections that taxpayers must complete to provide a comprehensive overview of their depreciation and amortization claims. These sections typically include:

- Part I: Election to Expense Certain Property Under Section 179, allowing taxpayers to deduct the cost of qualifying property.

- Part II: Special Depreciation Allowance, detailing the additional first-year depreciation for qualified property.

- Part III: MACRS Depreciation, which outlines the Modified Accelerated Cost Recovery System for depreciating property.

- Part IV: Summary of Acquisitions, providing a summary of all property placed in service during the tax year.

Steps to Complete Form 4562

Completing Form 4562 requires careful attention to detail. Here are the general steps to follow:

- Gather all necessary documentation related to the assets you are claiming depreciation for, including purchase receipts and prior year tax returns.

- Determine the eligibility of your assets for depreciation or amortization, ensuring they meet IRS criteria.

- Fill out Part I if you are electing to expense property under Section 179, indicating the total amount you wish to deduct.

- Complete Part II for any special depreciation allowances you are claiming.

- Fill out Part III to calculate the MACRS depreciation for your assets, using the appropriate recovery period.

- Summarize all acquisitions in Part IV, listing each asset and its corresponding depreciation method.

IRS Guidelines for Form 4562

The IRS provides specific guidelines for filling out Form 4562 to ensure compliance and accuracy. Taxpayers should refer to the IRS instructions for the form, which detail the eligibility requirements, depreciation methods, and any limitations on deductions. It is essential to stay updated on IRS regulations, as these can change annually, affecting how depreciation is calculated and reported.

Filing Deadlines for Form 4562

Form 4562 must be filed by the due date of your tax return, including extensions. For most taxpayers, this means submitting the form by April 15 of the following year. If you are filing for a business entity, the deadlines may vary based on your entity type and fiscal year. It is crucial to adhere to these deadlines to avoid penalties and ensure that you receive the full benefits of your depreciation claims.

Digital vs. Paper Version of Form 4562

Taxpayers have the option to file Form 4562 either digitally or on paper. Filing electronically can streamline the process, reduce errors, and provide immediate confirmation of submission. Many tax preparation software programs, such as TurboTax and QuickBooks, support the digital filing of Form 4562, making it easier for users to complete and submit the form accurately. However, some individuals may prefer the traditional paper method, which requires mailing the completed form to the IRS.

Quick guide on how to complete f4562pdf form 4562 depreciation and amortization attach

Complete F4562 pdf Form 4562 Depreciation And Amortization Attach seamlessly on any device

Digital document management has gained popularity among businesses and individuals alike. It serves as an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to access the correct form and securely save it online. airSlate SignNow provides you with the essential tools to create, update, and eSign your documents rapidly without any hindrances. Manage F4562 pdf Form 4562 Depreciation And Amortization Attach on any device using airSlate SignNow Android or iOS applications and streamline any document-centric procedure today.

The easiest way to modify and eSign F4562 pdf Form 4562 Depreciation And Amortization Attach with ease

- Find F4562 pdf Form 4562 Depreciation And Amortization Attach and click Get Form to begin.

- Utilize the tools available to complete your document.

- Select important sections of your documents or redact sensitive information with features that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review the details and click on the Done button to save your alterations.

- Decide how you want to share your form, whether by email, SMS, invitation link, or download it to your PC.

Put aside concerns about lost or misplaced files, tedious form searching, or mistakes requiring new document prints. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Modify and eSign F4562 pdf Form 4562 Depreciation And Amortization Attach and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct f4562pdf form 4562 depreciation and amortization attach

Create this form in 5 minutes!

How to create an eSignature for the f4562pdf form 4562 depreciation and amortization attach

The way to generate an e-signature for a PDF file online

The way to generate an e-signature for a PDF file in Google Chrome

How to create an electronic signature for signing PDFs in Gmail

How to generate an e-signature right from your mobile device

The way to create an e-signature for a PDF file on iOS

How to generate an e-signature for a PDF on Android devices

People also ask

-

What is form 4562 and how is it used?

Form 4562 is used to depreciate property and report your deductions for business assets. It helps businesses calculate the depreciation expense for the tax year. Using airSlate SignNow, you can easily eSign your completed form 4562, ensuring timely submission.

-

How can airSlate SignNow help with filling out form 4562?

airSlate SignNow provides templates and tools to streamline the completion of form 4562. With our platform, users can fill out the form electronically and utilize our validation features to ensure accuracy. This simplifies the process and reduces the chance of errors.

-

What features does airSlate SignNow offer for eSigning form 4562?

With airSlate SignNow, you can eSign form 4562 securely and quickly. Our platform offers features like in-person signing, customizable workflows, and advanced security protocols. This ensures that your important documents are signed and delivered without hassle.

-

Is there a cost associated with using airSlate SignNow for form 4562?

Yes, airSlate SignNow offers various pricing plans to suit different business needs. Each plan allows you to send, sign, and manage documents like form 4562 efficiently. We provide a cost-effective solution that maximizes your budget while ensuring quality service.

-

Can airSlate SignNow integrate with other software for handling form 4562?

Absolutely! airSlate SignNow integrates seamlessly with a variety of business applications such as CRMs and accounting software. This ensures that your form 4562 can be easily accessed and managed alongside your other critical business documents.

-

What are the benefits of using airSlate SignNow for document management, including form 4562?

Using airSlate SignNow for document management provides numerous benefits, including enhanced efficiency and improved compliance. You can easily manage, sign, and share form 4562 directly from our platform, streamlining your workflow and saving valuable time.

-

How does eSigning form 4562 with airSlate SignNow enhance security?

eSigning form 4562 with airSlate SignNow enhances security through encryption, secure access, and audit trails. These features ensure that your signature and data are protected throughout the signing process. Trusting airSlate SignNow means your documents are in safe hands.

Get more for F4562 pdf Form 4562 Depreciation And Amortization Attach

Find out other F4562 pdf Form 4562 Depreciation And Amortization Attach

- eSignature Indiana Unlimited Power of Attorney Safe

- Electronic signature Maine Lease agreement template Later

- Electronic signature Arizona Month to month lease agreement Easy

- Can I Electronic signature Hawaii Loan agreement

- Electronic signature Idaho Loan agreement Now

- Electronic signature South Carolina Loan agreement Online

- Electronic signature Colorado Non disclosure agreement sample Computer

- Can I Electronic signature Illinois Non disclosure agreement sample

- Electronic signature Kentucky Non disclosure agreement sample Myself

- Help Me With Electronic signature Louisiana Non disclosure agreement sample

- How To Electronic signature North Carolina Non disclosure agreement sample

- Electronic signature Ohio Non disclosure agreement sample Online

- How Can I Electronic signature Oklahoma Non disclosure agreement sample

- How To Electronic signature Tennessee Non disclosure agreement sample

- Can I Electronic signature Minnesota Mutual non-disclosure agreement

- Electronic signature Alabama Non-disclosure agreement PDF Safe

- Electronic signature Missouri Non-disclosure agreement PDF Myself

- How To Electronic signature New York Non-disclosure agreement PDF

- Electronic signature South Carolina Partnership agreements Online

- How Can I Electronic signature Florida Rental house lease agreement