Surrender Request Form Super Suraksha Dhanaraksha RinnRaksha

What is the Surrender Request Form Super Suraksha Dhanaraksha RinnRaksha

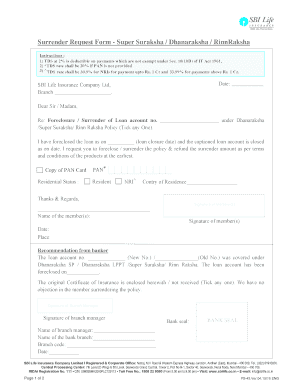

The Surrender Request Form for Super Suraksha Dhanaraksha RinnRaksha is a crucial document for policyholders wishing to terminate their insurance policy. This form allows individuals to formally request the surrender of their policy, enabling them to receive any applicable refund. Understanding the purpose of this form is essential for anyone considering surrendering their Super Suraksha policy, as it outlines the necessary steps and requirements to initiate the process.

How to use the Surrender Request Form Super Suraksha Dhanaraksha RinnRaksha

Using the Surrender Request Form is straightforward. First, ensure that you have all relevant information at hand, including your policy number and personal identification details. Fill out the form accurately, providing all requested information to avoid delays. Once completed, the form can be submitted through various methods, such as online submission, mailing, or in-person delivery, depending on your preference and the options provided by the insurance company.

Steps to complete the Surrender Request Form Super Suraksha Dhanaraksha RinnRaksha

Completing the Surrender Request Form involves several key steps:

- Gather necessary documents, including your policy details and identification.

- Fill out the form with accurate information, ensuring all sections are completed.

- Review the form for any errors or missing information.

- Choose your submission method: online, by mail, or in person.

- Submit the form and retain a copy for your records.

Key elements of the Surrender Request Form Super Suraksha Dhanaraksha RinnRaksha

Important elements of the Surrender Request Form include:

- Policyholder Information: Your name, address, and contact details.

- Policy Details: Your policy number and type of policy.

- Reason for Surrender: A brief explanation for your decision.

- Signature: Your signature to authorize the surrender request.

Legal use of the Surrender Request Form Super Suraksha Dhanaraksha RinnRaksha

The Surrender Request Form is legally binding once submitted, provided it is filled out correctly. It serves as a formal request to the insurance provider, indicating your intention to surrender the policy. Compliance with all legal requirements is essential to ensure that the surrender is processed without complications. This includes adhering to any specific state regulations that may apply.

Form Submission Methods (Online / Mail / In-Person)

Submitting the Surrender Request Form can be done through various methods, each with its advantages:

- Online Submission: Quick and convenient, often allowing for immediate processing.

- Mail: Provides a physical record of your submission but may take longer for processing.

- In-Person: Allows for direct communication with representatives, ensuring all questions are answered.

Quick guide on how to complete surrender request form super suraksha dhanaraksha rinnraksha

Complete Surrender Request Form Super Suraksha Dhanaraksha RinnRaksha effortlessly on any device

Managing documents online has gained popularity among businesses and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to obtain the proper form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your files quickly and seamlessly. Manage Surrender Request Form Super Suraksha Dhanaraksha RinnRaksha on any device using airSlate SignNow Android or iOS applications and enhance any document-centric process today.

The easiest way to modify and electronically sign Surrender Request Form Super Suraksha Dhanaraksha RinnRaksha with ease

- Locate Surrender Request Form Super Suraksha Dhanaraksha RinnRaksha and click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize key sections of your documents or obscure sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature with the Sign tool, which takes mere seconds and carries the same legal validity as a customary wet ink signature.

- Review the details and click the Done button to store your modifications.

- Select your preferred method to send your form, whether by email, text message (SMS), invite link, or download it to your computer.

Put an end to lost or misplaced documents, tiresome form searches, or mistakes that necessitate the printing of new copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device of your choosing. Edit and eSign Surrender Request Form Super Suraksha Dhanaraksha RinnRaksha and guarantee exceptional communication at every stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the SBI Life Super Suraksha refund policy?

The SBI Life Super Suraksha refund policy allows policyholders to receive a portion of their premium back under certain conditions. This is designed to enhance the affordability of the policy while providing financial security. Understanding the refund policy can help you maximize the benefits of your investment in the SBI Life Super Suraksha plan.

-

How does the SBI Life Super Suraksha refund work?

The SBI Life Super Suraksha refund operates by refunding a percentage of the total premiums paid if the policyholder surrenders their policy after completing a certain tenure. This feature ensures that customers can receive value even if they decide to exit the policy early. It's important to review the specific terms and conditions associated with the refund to make informed decisions.

-

What benefits does the SBI Life Super Suraksha policy offer?

The SBI Life Super Suraksha policy offers several benefits, including life coverage, savings options, and the potential for a refund on premiums. These advantages make it an attractive choice for individuals seeking both protection and financial returns. By choosing this policy, you can ensure financial security for your loved ones along with a systematic saving plan.

-

Is the SBI Life Super Suraksha refund applicable for all policyholders?

Not all policyholders may be eligible for the SBI Life Super Suraksha refund; eligibility typically depends on the specifics of the policy and how long premiums have been paid. It's essential to consult the policy documentation or speak with an insurance advisor to determine your refund eligibility. This way, you can understand how the refund impacts your overall financial planning.

-

What is the cost of an SBI Life Super Suraksha policy?

The cost of an SBI Life Super Suraksha policy varies based on factors such as age, coverage amount, and duration of the plan. It is crucial to assess how the premium fits into your financial goals, especially if you plan to take advantage of the SBI Life Super Suraksha refund feature. A personalized quote can help you understand your payment options and potential benefits.

-

Can I integrate an SBI Life Super Suraksha policy with other financial products?

Yes, you can integrate the SBI Life Super Suraksha policy with other financial products to enhance your overall financial strategy. For instance, combining it with investment plans can provide a balanced approach to savings and insurance. Such integrations may allow you to further benefit from the SBI Life Super Suraksha refund over time.

-

How do I claim the SBI Life Super Suraksha refund?

To claim the SBI Life Super Suraksha refund, you typically need to submit a written request to your insurer along with relevant documents, such as policy details and identification. The refund process may vary, so it's best to contact customer service for precise guidance. Ensuring that all requirements are met can facilitate a smoother claim experience.

Get more for Surrender Request Form Super Suraksha Dhanaraksha RinnRaksha

- Time card change sign off form ritricted access

- Renovation notice letter to tenant form

- Rental application resident center century 21 oviedo realty form

- How to write a landlord tenant lease agreement 5 form

- Vendor space rental agreement luxury house turkeylht form

- Move in move out landlord tenant checklist formdocx

- Letter of intent for lease form

- Fda prior notice form fedex

Find out other Surrender Request Form Super Suraksha Dhanaraksha RinnRaksha

- Electronic signature Mississippi Redemption Agreement Online

- eSignature West Virginia Distribution Agreement Safe

- Electronic signature Nevada Equipment Rental Agreement Template Myself

- Can I Electronic signature Louisiana Construction Contract Template

- Can I eSignature Washington Engineering Proposal Template

- eSignature California Proforma Invoice Template Simple

- eSignature Georgia Proforma Invoice Template Myself

- eSignature Mississippi Proforma Invoice Template Safe

- eSignature Missouri Proforma Invoice Template Free

- Can I eSignature Mississippi Proforma Invoice Template

- eSignature Missouri Proforma Invoice Template Simple

- eSignature Missouri Proforma Invoice Template Safe

- eSignature New Hampshire Proforma Invoice Template Mobile

- eSignature North Carolina Proforma Invoice Template Easy

- Electronic signature Connecticut Award Nomination Form Fast

- eSignature South Dakota Apartment lease agreement template Free

- eSignature Maine Business purchase agreement Simple

- eSignature Arizona Generic lease agreement Free

- eSignature Illinois House rental agreement Free

- How To eSignature Indiana House rental agreement