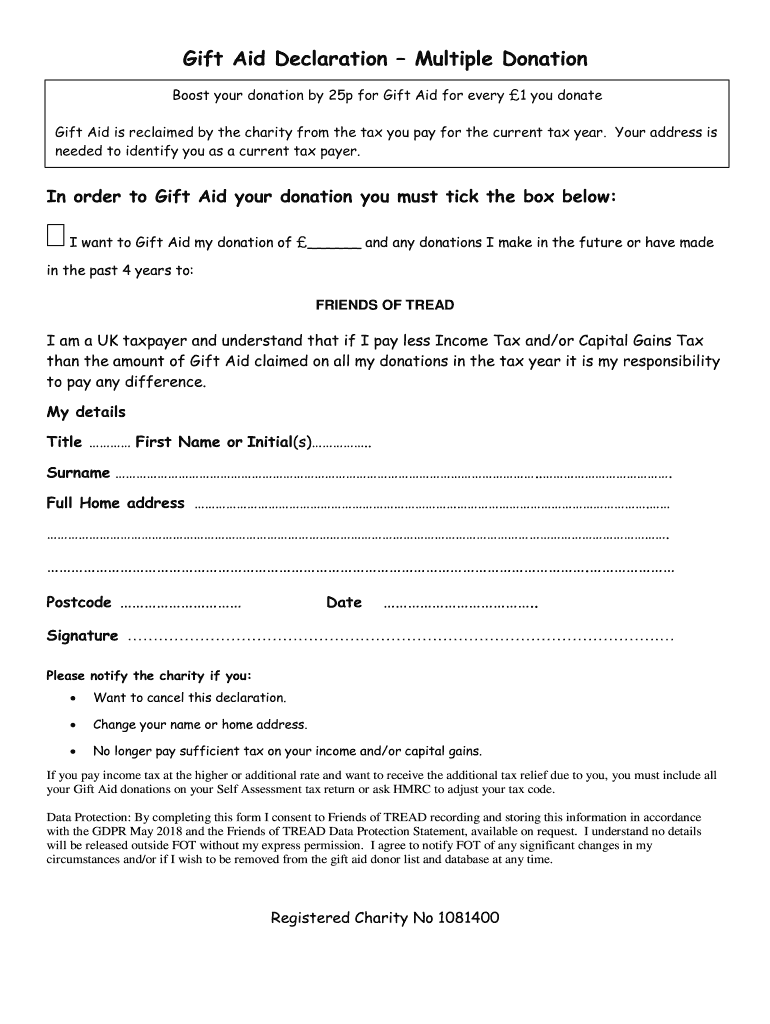

Gift Aid Declaration Multiple Donation Friends of TREAD Form

Understanding the Gift Aid Declaration Multiple Donation

The Gift Aid Declaration Multiple Donation is a crucial document for charities and donors in the United States. It allows charities to claim back tax on donations made by individuals who are taxpayers. This declaration ensures that for every dollar donated, the charity can receive an additional amount from the government, enhancing the impact of each contribution. The declaration must be completed accurately to ensure compliance with IRS regulations, making it essential for both donors and charities to understand its significance.

Steps to Complete the Gift Aid Declaration Multiple Donation

Completing the Gift Aid Declaration Multiple Donation involves several key steps:

- Gather necessary information, including your name, address, and taxpayer identification number.

- Confirm that you are a UK taxpayer and eligible to make the declaration.

- Fill out the declaration form, ensuring all details are accurate and complete.

- Sign and date the form to validate your declaration.

- Submit the form to the charity to enable them to claim the tax back on your donations.

Following these steps carefully will help ensure that your donations maximize their impact and comply with legal requirements.

Legal Use of the Gift Aid Declaration Multiple Donation

The legal use of the Gift Aid Declaration Multiple Donation is governed by IRS guidelines, which stipulate that the donor must be a taxpayer and that the charity must be recognized as a tax-exempt organization. The declaration must clearly state that the donor is willing for the charity to claim back tax on their donations. Failure to comply with these regulations can result in penalties for both the donor and the charity, making it vital to understand the legal implications before completing the form.

Key Elements of the Gift Aid Declaration Multiple Donation

When completing the Gift Aid Declaration Multiple Donation, several key elements must be included:

- Donor Information: Full name, address, and taxpayer identification number.

- Charity Information: Name and registration number of the charity.

- Declaration Statement: A statement confirming the donor's taxpayer status and consent for the charity to claim tax relief.

- Date: The date on which the declaration is signed.

Inclusion of these elements ensures that the form is valid and can be processed by the charity for tax claims.

Examples of Using the Gift Aid Declaration Multiple Donation

Examples of using the Gift Aid Declaration Multiple Donation can vary widely. For instance, a donor who contributes regularly to a local charity can complete a single declaration that covers all future donations. This simplifies the process for both the donor and the charity, allowing for streamlined tax claims. Additionally, one-time donors can also utilize the declaration to enhance the impact of their contributions, ensuring that their donations are maximized through tax relief.

Filing Deadlines / Important Dates

Filing deadlines for the Gift Aid Declaration Multiple Donation are essential for both donors and charities to consider. While there is no specific deadline for submitting the declaration, it is recommended that donors complete the form at the time of their donation. Charities must claim the tax back within four years of the donation date to ensure compliance with IRS regulations. Keeping track of these timelines helps maintain the integrity of the donation process.

Quick guide on how to complete gift aid declaration multiple donation friends of tread

Effortlessly Prepare Gift Aid Declaration Multiple Donation Friends Of TREAD on Any Device

Online document handling has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed papers, allowing you to find the right form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and electronically sign your documents swiftly without delays. Manage Gift Aid Declaration Multiple Donation Friends Of TREAD on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

The Easiest Way to Edit and Electronically Sign Gift Aid Declaration Multiple Donation Friends Of TREAD

- Find Gift Aid Declaration Multiple Donation Friends Of TREAD and click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Highlight relevant sections of your documents or redact sensitive information with tools specifically provided by airSlate SignNow for this purpose.

- Create your electronic signature using the Sign tool, which takes just seconds and carries the same legal validity as a traditional handwritten signature.

- Verify the details and click the Done button to save your modifications.

- Select how you wish to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, and errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Gift Aid Declaration Multiple Donation Friends Of TREAD and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a declaration form filled sample?

A declaration form filled sample is a pre-completed document that outlines specific information required for declarations in various contexts. It serves as a template for users to understand how to properly fill out their own declaration forms, ensuring all necessary details are included.

-

How can airSlate SignNow help in creating a declaration form filled sample?

airSlate SignNow makes it easy to create a declaration form filled sample by providing customizable templates that cater to different needs. Users can fill out the form digitally, ensuring accuracy and simplicity in the preparation process, and save time compared to traditional methods.

-

What features does airSlate SignNow offer for managing declaration forms?

AirSlate SignNow offers a range of features for managing declaration forms, including document editing, eSigning capabilities, and automated workflows. These features help streamline the process, making it easier to create, manage, and send declaration forms filled samples securely and efficiently.

-

Is airSlate SignNow cost-effective for small businesses needing declaration form filled samples?

Yes, airSlate SignNow is a cost-effective solution for small businesses. It provides flexible pricing plans tailored to different budget needs while delivering valuable tools to create, send, and eSign declaration form filled samples without breaking the bank.

-

Can I integrate airSlate SignNow with other applications for my declaration forms?

Absolutely! airSlate SignNow offers seamless integrations with popular applications like Google Drive, Salesforce, and Microsoft Office. This allows users to easily manage and access their declaration form filled samples alongside other essential business tools.

-

What are the security features of airSlate SignNow for declaration forms?

AirSlate SignNow places a high priority on security, employing robust encryption and compliance measures to protect your declaration forms filled samples. With secure cloud storage and strict access controls, users can trust that their sensitive information is safe.

-

How easy is it to edit a declaration form filled sample in airSlate SignNow?

Editing a declaration form filled sample in airSlate SignNow is very straightforward. Users can quickly make changes directly in the document using the intuitive interface, ensuring that updates can be made efficiently without requiring any complicated processes.

Get more for Gift Aid Declaration Multiple Donation Friends Of TREAD

- 3587 e file form fillable payment voucher for lp llp and

- 2021 form 100 california corporation franchise or income tax return 2021 form 100 california corporation franchise or income

- Form 540 california resident income tax returnpdf

- Franchise tax board change of address formdaily catalog

- Get the free arkansas state withholding form pdffiller

- Instructions for form 2210 internal revenue service fill

- Fillable form ar1075 deduction for tuition paid to post

- 2021 form 3832 limited liability company nonresident members consent california 2021 form 3832 limited liability company

Find out other Gift Aid Declaration Multiple Donation Friends Of TREAD

- eSign Delaware Software Development Proposal Template Free

- eSign Nevada Software Development Proposal Template Mobile

- Can I eSign Colorado Mobile App Design Proposal Template

- How Can I eSignature California Cohabitation Agreement

- How Do I eSignature Colorado Cohabitation Agreement

- How Do I eSignature New Jersey Cohabitation Agreement

- Can I eSign Utah Mobile App Design Proposal Template

- eSign Arkansas IT Project Proposal Template Online

- eSign North Dakota IT Project Proposal Template Online

- eSignature New Jersey Last Will and Testament Online

- eSignature Pennsylvania Last Will and Testament Now

- eSign Arkansas Software Development Agreement Template Easy

- eSign Michigan Operating Agreement Free

- Help Me With eSign Nevada Software Development Agreement Template

- eSign Arkansas IT Consulting Agreement Computer

- How To eSignature Connecticut Living Will

- eSign Alaska Web Hosting Agreement Computer

- eSign Alaska Web Hosting Agreement Now

- eSign Colorado Web Hosting Agreement Simple

- How Do I eSign Colorado Joint Venture Agreement Template