Ir433 Form 2011

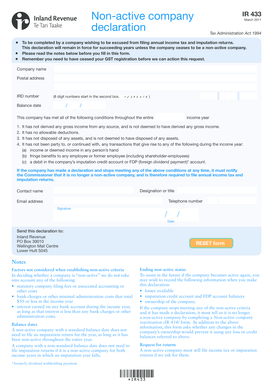

What is the ir433 Form

The ir433 form, also known as the non-active company declaration, is a document used by businesses to declare their status as non-active for tax purposes. This form is essential for entities that have not engaged in any business activities during a specific tax period. By submitting the ir433, companies can ensure compliance with tax regulations while minimizing their obligations. It is particularly relevant for limited liability companies (LLCs), corporations, and partnerships that have temporarily ceased operations.

How to use the ir433 Form

Using the ir433 form involves several straightforward steps. First, businesses must gather relevant information about their entity, including the legal name, tax identification number, and the period during which the company was non-active. Next, the form should be filled out accurately, ensuring all required fields are completed. Once the form is filled, it can be submitted either electronically or via mail, depending on the preferences of the business and the requirements of the tax authority. It is crucial to keep a copy of the submitted form for record-keeping purposes.

Steps to complete the ir433 Form

Completing the ir433 form requires careful attention to detail. Follow these steps for a smooth process:

- Gather necessary information, including your business's legal name and tax ID.

- Indicate the specific period during which the business was non-active.

- Fill out all required fields on the form, ensuring accuracy.

- Review the completed form for any errors or omissions.

- Submit the form electronically through a secure platform or mail it to the appropriate tax authority.

Legal use of the ir433 Form

The legal use of the ir433 form hinges on compliance with federal and state tax regulations. When properly completed and submitted, the form serves as a declaration that the business has not conducted any taxable activities during the specified period. This declaration can protect the business from unnecessary tax liabilities and penalties. Additionally, maintaining accurate records of the submission is vital in case of future inquiries from tax authorities.

Filing Deadlines / Important Dates

Filing deadlines for the ir433 form vary based on the tax year and the specific requirements of the state in which the business operates. Generally, businesses should submit the form by the tax filing deadline for the year in which they declare non-activity. It is essential to check with the local tax authority for specific dates to avoid potential penalties for late submissions. Marking these deadlines on a calendar can help ensure timely compliance.

Required Documents

To complete the ir433 form, certain documents may be required. These typically include:

- The business's legal name and tax identification number.

- Records indicating the period of non-activity.

- Any previous tax filings that may support the declaration of non-activity.

Having these documents ready can streamline the completion and submission process.

Who Issues the Form

The ir433 form is typically issued by the relevant tax authority at the state or federal level. In the United States, businesses may need to refer to the Internal Revenue Service (IRS) or their state’s tax agency to obtain the official version of the form. It is crucial to ensure that the correct version is used to maintain compliance with tax regulations.

Quick guide on how to complete ir433 form

Effortlessly prepare Ir433 Form on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the tools needed to create, modify, and electronically sign your documents quickly and without interruptions. Manage Ir433 Form on any platform using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to modify and electronically sign Ir433 Form with ease

- Obtain Ir433 Form and then click Get Form to begin.

- Use the tools we provide to complete your form.

- Emphasize important sections of your documents or redact confidential information with tools specifically designed by airSlate SignNow for that purpose.

- Create your electronic signature with the Sign tool, which takes only seconds and carries the same legal validity as a conventional hand-written signature.

- Review all the details and then click on the Done button to save your modifications.

- Select your preferred method to share your form, whether by email, SMS, an invitation link, or download it to your computer.

Eliminate the anxiety of lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from your chosen device. Alter and electronically sign Ir433 Form to ensure clear communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct ir433 form

Create this form in 5 minutes!

People also ask

-

What is the ir433 feature in airSlate SignNow?

The ir433 feature in airSlate SignNow allows users to seamlessly create, send, and eSign documents securely. This feature streamlines document workflows, making it easy for businesses to manage their agreements electronically. By incorporating ir433, users can enhance their efficiency and ensure compliance with industry standards.

-

How does pricing work for the ir433 service in airSlate SignNow?

airSlate SignNow offers flexible pricing plans that cater to different business needs, including access to the ir433 capabilities. Customers can choose from various subscription options, ensuring they only pay for the features they use. Additionally, there are often discounts available for annual subscriptions.

-

Can I integrate the ir433 feature with other software applications?

Yes, the ir433 feature in airSlate SignNow supports integrations with popular software applications like Salesforce, Google Drive, and more. This allows businesses to automate their workflows and data management, enhancing productivity. Users can quickly connect their existing tools to leverage the full benefits of the ir433 functionalities.

-

What benefits does the ir433 provide for signing documents?

The ir433 feature offers numerous benefits, including ease of use, enhanced security, and faster turnaround times for document signing. By using airSlate SignNow's ir433 capabilities, businesses can signNowly reduce the time spent on document management, ensuring quicker response times. It also helps in maintaining an organized and legally binding record of agreements.

-

Is the ir433 feature user-friendly for non-technical users?

Absolutely! The ir433 feature in airSlate SignNow is designed to be intuitive, allowing even non-technical users to navigate it with ease. Comprehensive guides and customer support are also available to assist users in maximizing the functionality of ir433. This helps businesses adopt digital signing solutions without technical barriers.

-

What types of documents can be signed using the ir433 feature?

The ir433 feature allows users to sign a wide range of documents, including contracts, agreements, and forms. Users can upload any type of document they need to be signed electronically, ensuring a versatile solution for all business needs. This flexibility makes airSlate SignNow an ideal choice for various industries.

-

Does airSlate SignNow provide mobile access to the ir433 feature?

Yes, airSlate SignNow enables users to access the ir433 feature from mobile devices, facilitating document signing on-the-go. This mobile accessibility ensures that you can send, sign, and manage documents anytime, anywhere. This is especially useful for businesses with remote teams or frequent travelers.

Get more for Ir433 Form

Find out other Ir433 Form

- How To Sign Wyoming Plumbing Form

- Help Me With Sign Idaho Real Estate PDF

- Help Me With Sign Idaho Real Estate PDF

- Can I Sign Idaho Real Estate PDF

- How To Sign Idaho Real Estate PDF

- How Do I Sign Hawaii Sports Presentation

- How Do I Sign Kentucky Sports Presentation

- Can I Sign North Carolina Orthodontists Presentation

- How Do I Sign Rhode Island Real Estate Form

- Can I Sign Vermont Real Estate Document

- How To Sign Wyoming Orthodontists Document

- Help Me With Sign Alabama Courts Form

- Help Me With Sign Virginia Police PPT

- How To Sign Colorado Courts Document

- Can I eSign Alabama Banking PPT

- How Can I eSign California Banking PDF

- How To eSign Hawaii Banking PDF

- How Can I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document