Annual Report on Revenues and Expenditures of Foreign Fire Insurance Premiums Fire Companies, Fire Departments and Benevolent as Form

Understanding the Annual Report on Revenues and Expenditures of Foreign Fire Insurance Premiums

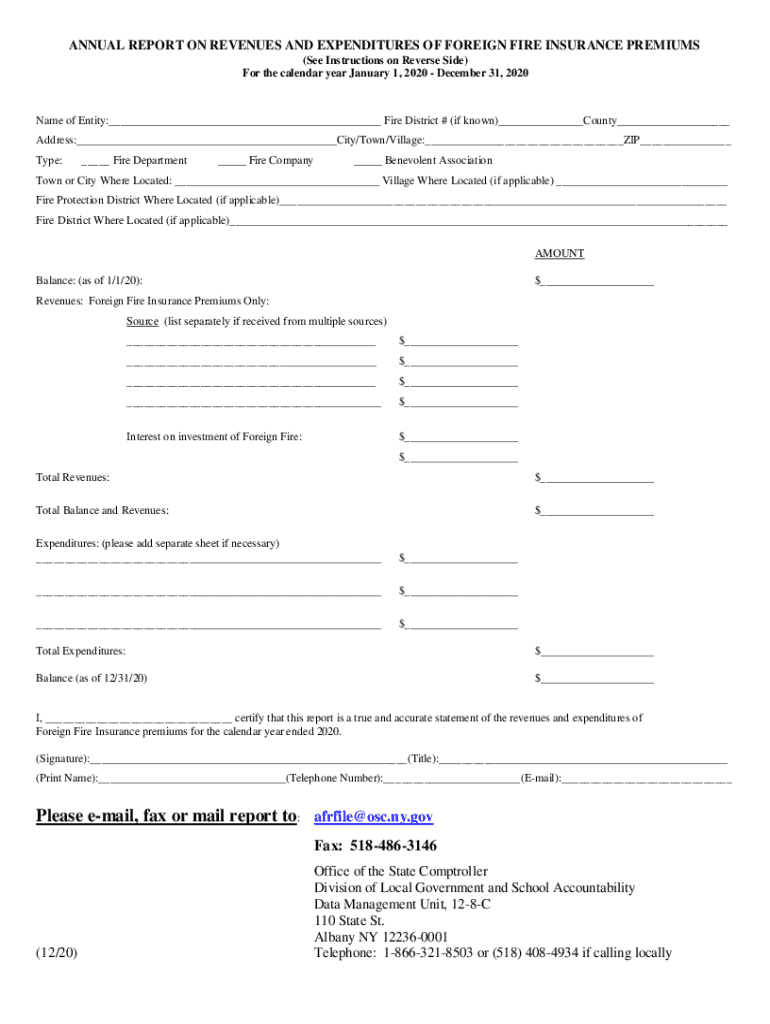

The annual report on revenues and expenditures of foreign fire insurance premiums is a vital document for fire companies, fire departments, and benevolent associations that receive and utilize foreign fire insurance tax proceeds. Commonly referred to as the 'two percent tax', this report outlines how funds are allocated and spent, ensuring transparency and accountability in the use of these tax proceeds. It is essential for organizations to accurately report their financial activities to comply with state regulations and maintain their eligibility for these funds.

Steps to Complete the Annual Report

Completing the annual report involves several key steps to ensure accuracy and compliance. Organizations should begin by gathering all relevant financial documents, including income statements and expenditure records. Next, they should fill out the required sections of the report, detailing revenues received from foreign fire insurance premiums and how these funds were expended. It is crucial to review the report for completeness and accuracy before submission. Finally, organizations should submit the report by the designated deadline to avoid penalties.

Key Elements of the Report

The annual report must include specific key elements to be considered complete. These elements typically consist of:

- Total revenues received from foreign fire insurance premiums.

- Detailed expenditures, categorized by purpose (e.g., equipment purchases, training, community programs).

- Any remaining balance of funds at the end of the reporting period.

- Signatures from authorized representatives of the organization, confirming the accuracy of the reported information.

Legal Use of the Annual Report

The legal use of the annual report is crucial for compliance with state laws regarding foreign fire insurance tax proceeds. Organizations must ensure that their reports are filed accurately and on time to avoid potential legal repercussions. Failure to comply with reporting requirements can lead to penalties, including the loss of funding or legal action. Therefore, understanding the legal implications of the report is essential for all organizations involved.

Filing Deadlines and Important Dates

Organizations must adhere to specific filing deadlines for the annual report on revenues and expenditures of foreign fire insurance premiums. These deadlines can vary by state, so it is important for organizations to be aware of their specific requirements. Typically, the report is due annually, and organizations should mark their calendars to ensure timely submission. Missing the deadline can result in penalties or loss of funding.

Form Submission Methods

The annual report can be submitted through various methods, including online submission, mail, or in-person delivery. Many states offer online portals for easy and efficient filing, which can streamline the process. Organizations should check their state’s requirements to determine the preferred submission method and ensure they follow all guidelines to avoid complications.

Quick guide on how to complete annual report on revenues and expenditures of foreign fire insurance premiums fire companies fire departments and benevolent

Complete Annual Report On Revenues And Expenditures Of Foreign Fire Insurance Premiums Fire Companies, Fire Departments And Benevolent As effortlessly on any device

Online document management has gained immense traction among organizations and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed papers, as you can locate the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents swiftly without delays. Manage Annual Report On Revenues And Expenditures Of Foreign Fire Insurance Premiums Fire Companies, Fire Departments And Benevolent As on any platform with airSlate SignNow Android or iOS applications and simplify any document-related task today.

How to modify and eSign Annual Report On Revenues And Expenditures Of Foreign Fire Insurance Premiums Fire Companies, Fire Departments And Benevolent As seamlessly

- Obtain Annual Report On Revenues And Expenditures Of Foreign Fire Insurance Premiums Fire Companies, Fire Departments And Benevolent As and click on Get Form to begin.

- Utilize the tools we provide to finalize your document.

- Highlight pertinent sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign feature, which takes moments and carries the same legal validity as a conventional wet ink signature.

- Review the details and then click the Done button to save your changes.

- Select your preferred method to deliver your form, whether by email, SMS, invitation link, or download it to your PC.

Eliminate concerns about missing or misplaced documents, tedious form navigation, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choosing. Edit and eSign Annual Report On Revenues And Expenditures Of Foreign Fire Insurance Premiums Fire Companies, Fire Departments And Benevolent As to ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is an annual report on revenues and expenditures of foreign fire insurance premiums?

An annual report on revenues and expenditures of foreign fire insurance premiums is a comprehensive document that provides insights into the financial performance and spending related to foreign fire insurance. It helps stakeholders understand trends, compliance, and fiscal responsibilities. By using airSlate SignNow, you can easily generate, sign, and manage such reports securely.

-

How does airSlate SignNow assist in creating an annual report on revenues and expenditures of foreign fire insurance premiums?

With airSlate SignNow, preparing an annual report on revenues and expenditures of foreign fire insurance premiums becomes seamless. The platform allows for easy document creation, editing, and e-signing, ensuring accuracy and compliance. This streamlines the reporting process, allowing businesses to focus on what matters most.

-

What features of airSlate SignNow enhance the management of annual reports?

airSlate SignNow offers features like templates, automated workflows, and real-time tracking, which are essential for managing an annual report on revenues and expenditures of foreign fire insurance premiums. These tools simplify document handling, facilitate collaboration, and ensure prompt execution. Enhanced security features also protect sensitive financial data.

-

Is airSlate SignNow cost-effective for producing annual reports?

Yes, airSlate SignNow is a cost-effective solution for producing an annual report on revenues and expenditures of foreign fire insurance premiums. It eliminates the need for physical document storage and reduces paper costs. Additionally, the platform’s pricing plans scale with your business needs, making it accessible for all company sizes.

-

Can airSlate SignNow integrate with other software for financial reporting?

Absolutely! airSlate SignNow integrates seamlessly with various accounting and financial software, enhancing the efficiency of preparing an annual report on revenues and expenditures of foreign fire insurance premiums. This integration allows for data import/export, reducing manual entry and ensuring accuracy in financial reporting.

-

How secure is airSlate SignNow for handling sensitive annual report data?

Security is a top priority for airSlate SignNow, especially when it comes to documents like the annual report on revenues and expenditures of foreign fire insurance premiums. The platform employs bank-level encryption, secure access controls, and compliance with industry standards to ensure that your data remains confidential and protected from unauthorized access.

-

What benefits can businesses expect from using airSlate SignNow for their reports?

By leveraging airSlate SignNow for an annual report on revenues and expenditures of foreign fire insurance premiums, businesses can expect improved efficiency, lower costs, and enhanced compliance. The ease of e-signatures accelerates the approval process, while automated workflows reduce administrative burdens. Overall, it fosters a more productive financial reporting environment.

Get more for Annual Report On Revenues And Expenditures Of Foreign Fire Insurance Premiums Fire Companies, Fire Departments And Benevolent As

- Wwwuslegalformscomform library135465 uspsusps form 3624 fill and sign printable template onlineus

- Form 941 pr rev march 2022 employers quarterly federal tax return puerto rican version

- Wwwirsgovpubirs priorinstructions for department of the treasury internal revenue form

- Irs 13844 2020 2022 fill out tax template onlineus form

- Form 944 x rev february 2022 adjusted employers annual federal tax return or claim for refund

- Instructions for form 941 ss internal revenue service

- Wwwirsgovpubirs pdfinstrucciones para el anexo b formulario 941 pr rev marzo

- Instrucciones para irs tax forms

Find out other Annual Report On Revenues And Expenditures Of Foreign Fire Insurance Premiums Fire Companies, Fire Departments And Benevolent As

- eSignature Michigan Courts Affidavit Of Heirship Simple

- eSignature Courts Word Mississippi Later

- eSignature Tennessee Sports Last Will And Testament Mobile

- How Can I eSignature Nevada Courts Medical History

- eSignature Nebraska Courts Lease Agreement Online

- eSignature Nebraska Courts LLC Operating Agreement Easy

- Can I eSignature New Mexico Courts Business Letter Template

- eSignature New Mexico Courts Lease Agreement Template Mobile

- eSignature Courts Word Oregon Secure

- Electronic signature Indiana Banking Contract Safe

- Electronic signature Banking Document Iowa Online

- Can I eSignature West Virginia Sports Warranty Deed

- eSignature Utah Courts Contract Safe

- Electronic signature Maine Banking Permission Slip Fast

- eSignature Wyoming Sports LLC Operating Agreement Later

- Electronic signature Banking Word Massachusetts Free

- eSignature Wyoming Courts Quitclaim Deed Later

- Electronic signature Michigan Banking Lease Agreement Computer

- Electronic signature Michigan Banking Affidavit Of Heirship Fast

- Electronic signature Arizona Business Operations Job Offer Free